jroballo/iStock via Getty Images

RWE Aktiengesellschaft (OTCPK:RWEOY) is well-positioned to benefit from the big push towards green electricity production and to replace Russian gas from the energy-intensive German (and more) industries. I would argue that the company is slightly undervalued, especially compared to the competition, excluding the hydrogen upside since it’s still unknown.

RWE is one of the most prominent worldwide players in the energy production business, and the electricity market will continue to be essential for years to come despite these current market disruptions that are happening. I’m of the opinion that this company is a good way to be exposed to the energy transitioning trend without overpaying for it and still receiving an acceptable 2% dividend yield while we wait.

The Business

RWE has been around for a while now. It began producing electricity at the start of the 20th century with a focus on scale and producing at the cheapest price possible. Now, the company has been through an accelerated renewable process which saw the gradual phase-out of their lignite and nuclear power plants in favor of solar, wind, battery, gas, and more green electricity sources. This move has been compensated by the German government and it’s still ongoing, adding to the uncertainty that we see around the company. There is an ambitious goal to be 100% carbon neutral by 2040.

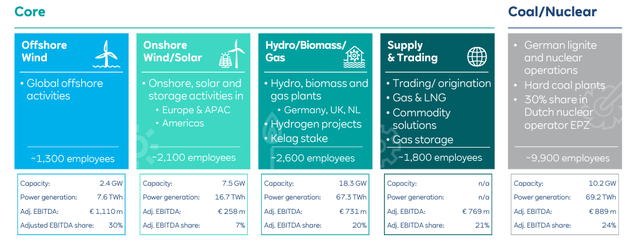

Besides onshore/offshore wind, solar, hydro/biomass/gas (core business), and coal/nuclear (to be phased out), the company also has a “supply & trading” department that is in charge of risk management and electricity negotiations, which has seen its profits increase during this uncertain period.

RWE Business Areas (RWE Factbook 2022)

It’s, at the moment, part of the top 10 biggest renewable electricity producers by capacity, and the second when considering one of the areas with the most significant growth ahead, offshore wind. The most significant geographies are the U.S., Germany, the UK, and the Netherlands.

Electricity, Hydrogen, and the Competition

The current objective is around a proper and sustainable shift away from pollutant sources of electricity. For that, they have come up with an ambitious gross 50B€ investment plan (30B€ net of disinvestment) until 2030, aiming to have over 55 GW of capacity by that date. Despite appearing massive, most of the competition has larger plans for growth (i.e., Orsted (OTCPK:DNNGY) or Iberdrola (OTCPK:IBDSF)). Moreover, RWE provides a clear EBITDA target of 5B€ in 2030, originating only from renewable sources, giving a high single-rate CAGR growth rate for the years to come.

Competition is fierce, and there are several existing players heavily investing and planning to invest to capitalize on the European push toward energy independence. European governments might incentivize investments in the area, but there are no major competitive advantages in electricity besides perhaps scale, so returns are expected to remain very close to the cost of capital, which should caution investors. While excess returns might be low, industry safety is high, with long-term contracts securing revenue and margins, and a product that is essential, basic and durable.

Competitive Advantage – Hydrogen

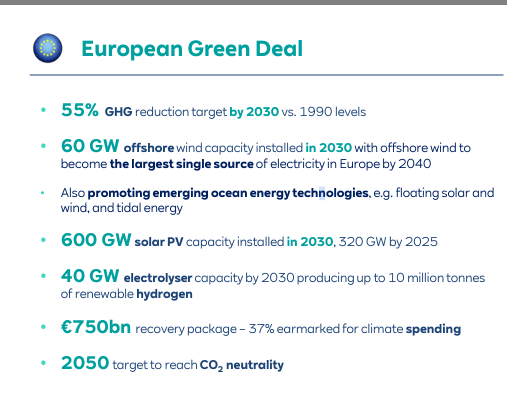

It is with hydrogen where I see the most interesting potential for RWE and its foothold inside the mighty German industry, which is heavily dependent on the, now scarce, Russian natural gas. They are already developing around 30 green H2 projects to deliver energy to industries, mobility solutions, and/or heat. While it’s still now cost viable compared to other solutions, I believe that to be just a matter of time and development, like it was the case with other alternatives before. The new European green deal establishes a 40GW capacity for producing hydrogen.

European Green Deal (RWE Factbook 2022)

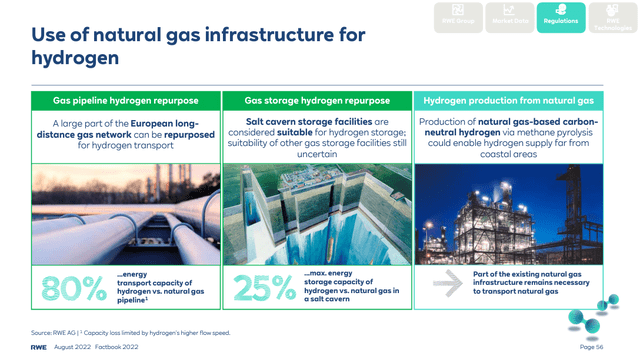

One of the already existent projects, the H2rcules, is planned to use the already existing gas infrastructure to connect industries in the Rhine to provide energy. Projects like this will create large barriers to entry to other competitors, providing a long-term competitive advantage to whoever controls the pipeline.

Hydrogen using natural gas infrastructure (RWE Factbook 2022)

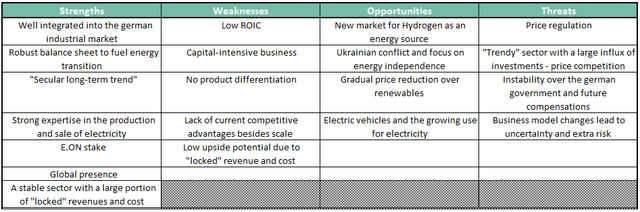

SWOT Analysis

Future Outlook

Electricity is a primary good, essential for the well-being of both families and corporations.

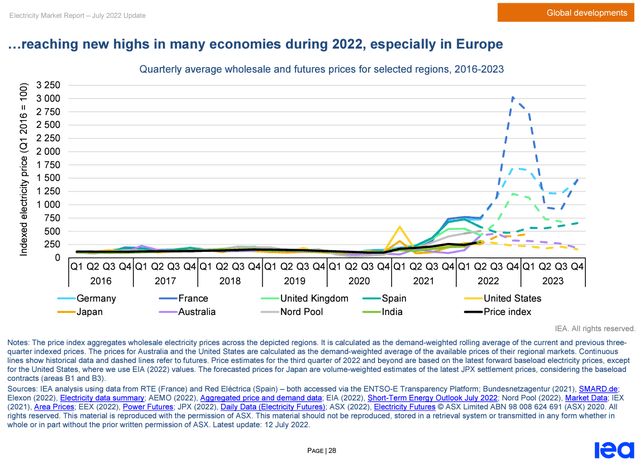

In the short-term, electricity has seen high levels of instability and also elevated prices due to the Ukrainian conflict that forced sanctions on Russian natural gas and oil products, sparking an energy crisis. Electricity demand generally increases alongside GDP and the severity of the winters, but presently has been benefiting from the increasing driver by the growth in electric vehicles.

In the long-term, I think it’s safe to assume a steady demand growth derived from multiple factors like growing digitalization, GDP growth, quality of life improvements, and growing adoption of electric vehicles, among others. Despite recent levels being unsustainable, the International Energy Agency estimates high prices to continue to elevate when compared to historical data, and there is no end in sight for the armed conflict. RWE should benefit since it has relatively high flexibility (>30%) “unsecured” gross margin.

Electricity future and past prices (IEA)

Besides electricity, there is the bright debated (green) hydrogen future that the company is pursuing. There is a multitude of possibilities to use H2 to reduce the carbon footprint, it could be great to fix the intermittency of renewables, power large barges and commercial airplanes or even produce “green” steel. The potential is huge, but the profitability is still unknown despite being already widely discussed.

Valuation

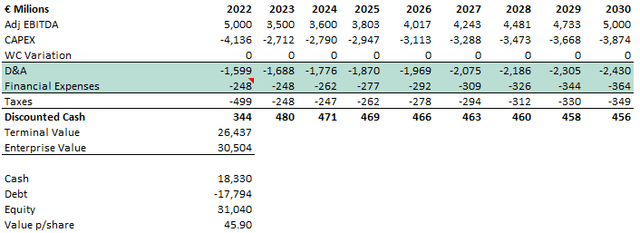

To apply numbers and data support to the investment thesis, I’ve created a simple discounted cash flow model using the final 5B€ of EBITDA at the end of 2030. I’m considering a (small) WACC of 6.10% and a 3% perpetual growth since the CAPEX should decrease once the growth slows down, making the free cash flow higher.

I believe the business to be slightly below fair value because of all the uncertainty around Germany and energy, but the hydrogen potential is not included and can be great upside potential for the stock.

If we then do a relative valuation, comparing industry competitors, the difference is higher since I believe the ESG trend has created a big gap between full renewable companies and mixed ones like RWE. If considering the 2030 GW capacity, RWE is at a 0.47 EV/2030 capacity while EDPR (OTCPK:EDRVF, OTCPK:EDRVY) is at 0.64, Orsted at 0.92, and Iberdrola at 0.99.

Risks

There are always risks in every investment and RWE is no exception. I’ve compiled the main ones for me into three topics.

- Regulatory Risk – energy market can be highly regulated due to its importance. Furthermore, the energy transition plan to renewables done by RWE is supported by future compensations to be paid by the German government. These compensations might change in the future, especially if the governing party changes like it happened recently. The lack of future compensation might jeopardize the investment plan.

- Operational Risk – Besides wind and solar parks and their inherent risks, the company operates sensitive nuclear plants that require extra attention since any accident can be catastrophic. Also, it owns gas plants that need highly unstable commodities to function.

- Market Risk – RWE negotiates future contracts and other types of derivatives to buy and sell commodities/electricity. These contracts require strong financial availability to guarantee margin accounts, especially in these times. Future contracts allow extra security to the business, but it also reduces the flexibility to beneficial price swings.

Summary

The world electricity production market, and especially the European one, faces an increasing effort in adopting cleaner energy sources in response to the climate problem and to grant highly important energy independence. Besides being exposed to this trend, RWE also benefits from future developments of the, yet to be fully discovered, hydrogen.

I see a business with the downside secured by the safe electricity business, but with a very interesting potential upside regarding hydrogen. No less important, I believe that it’s trading at a fair value and it also provides a 2% dividend yield while investors wait for capital appreciation.

Be the first to comment