undefined undefined/iStock via Getty Images

Investment thesis: Official sanctions left out Russia’s energy sector, as well as other exports that are crucial to the wellbeing of the global economy. We are nevertheless faced with a situation where Russia’s oil exports, as well as the exports of other important goods, ranging from fertilizers to palladium, are being curtailed. These shortfalls in supply are leading to price spikes and outright physical shortages for many goods and services throughout the global economy. While the official sanctions may have been thought out in a way that it was assumed that it will not harm the global economy to a great degree, it seems that we failed to account for the growing trend of social pressures causing the private sector to take positions contrary to what used to be their main goal, namely to legally provide the greatest returns possible to shareholders. As they say; “The road to hell is paved with good intentions”, in this case, meaning that the combination of government and corporate decisions on jumping on the bandwagon of righteousness, helped to set us more firmly on the path of an imminent global economic catastrophe than we already were before this latest crisis.

The first wave of disasters will hit when energy demand destruction will commence, with a more tragic episode to follow, where demand destruction will have to occur for food, with the poorest on the planet, including those less fortunate within our own wealthier societies set to be priced out. There is a very real chance that we will enter a period not dissimilar to what was experienced in Eastern Europe in the 1990s, in the aftermath of the collapse of communism. A global stagflationary trend that will feed on a combination of geological realities, worsening geopolitical circumstances, as well as institutional inadequacies, often leading to breakdowns in basic functions of society, will eventually take on a life of its own and it will be very hard to stop it. Investors will struggle to manage to keep their portfolios gaining in value on pace with inflation rates. It is set to become an exercise in wealth preservation, not so much an opportunity to gain wealth in real terms. Even that will only be achieved with much skill, a sharp intuition, cool nerves, and some luck. The crisis will far outlast the Ukraine war and even the sanctions regimes currently in place, which might be lifted at some point in the future, but much too late to prevent the impending stagflationary crisis from taking on a life of its own.

Russia’s commodities exports are being severely disrupted, despite assurances that sanctions were not meant to target those exports that are vital to the global economy.

It has been estimated that coinciding with the financial sanctions that were introduced by the US, together with the EU, UK, and other developed world allies, Russian crude oil exports declined by about 2.5 mb/d. There was some fool’s hope that OPEC countries would quickly respond to fill that void, but the world was rebuffed just recently. The next big hope is for Iran’s crude to come to the rescue, once we will supposedly see a return to the 2015 nuclear deal. US officials even went as far as courting Venezuela’s current government, which it does not even recognize as legitimate in a sign of how desperate the situation has become, less than two weeks into the Ukraine war, and the economic aftermath.

In order to truly understand how serious the gap in the global supply/demand situation has become, we need to realize that even before this crisis erupted, we were likely looking at a potentially sizable supply shortfall by the fourth quarter of this year.

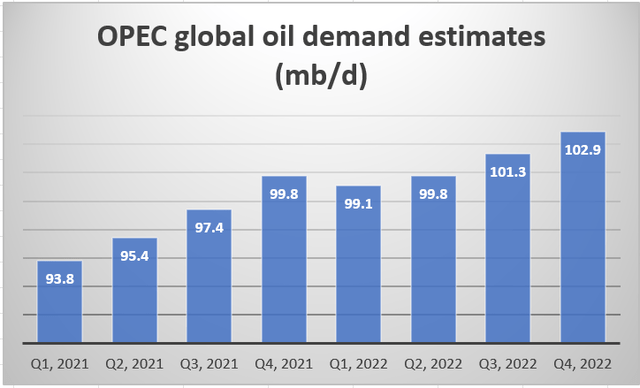

OPEC quarterly global demand (OPEC data)

Based on OPEC’s latest data, normal global economic evolution trends would have brought global demand to 102.9 mb/d by the fourth quarter of this year, which is 3.1 mb/d higher than it was in the fourth quarter of last year. To put things into perspective, global supply did not meet demand in most of the fourth quarter of 2021, based on EIA data. So, to put things into perspective, global supply was supposed to increase by 3.1 mb/d from the fourth quarter of 2021, in addition to the Q4 supply/demand gap that was already in place in order to balance the market. An increase of about 4 mb/d would have been needed. Now, we have an additional gap of 2.5 mb/d, due to Russia’s inability to ship its oil, making for a gap of 6.5 mb/d by the end of the year, if things persist as they are currently.

Assuming that Iran & Venezuela will come through with an increase of about 1.5 mb/d between the two, as well as perhaps Persian Gulf countries providing an extra 2 mb/d in production, we would be more than halfway there to closing the gap. US, Canada, and others may increase production as well, while some other countries, such as Columbia, Mexico, UK could see a decline in oil production. On balance, we could get another 1 mb/d in supply from the rest of the world. Overall, there would still be a roughly 2 mb/d gap in the supply/demand equation in the fourth quarter of this year, within the context of global oil and liquid products inventories already being very tight.

What this means for the global economy in practical terms is that there needs to be enough demand destruction to cover a 2 mb/d gap in the happiest of outcomes, if the current decline in Russian oil exports will persist. The magnitude of economic growth reduction that will be needed, can best be visualized by employing a formula that I came up with a while ago, to express the global economic growth rate to oil demand growth relationship, which I observed to be somewhat reliable over the past years.

The formula goes as follows: Efficiency gains (1.5%) + (% increase in oil supply x 2).

When we input -2% growth in oil supply, we get: 1.5% + (-2% x2) = -2.5%.

In other words, the drag on global GDP growth will be roughly 2.5% for the year as a whole in the event that Russia will continue to see the decline in oil export volumes persist. The IMF was forecasting global economic growth at 4.4% before this crisis. In other words, even before we factor in other effects of the economic confrontation with Russia, we are looking at the global economic growth of roughly 1%-2%.

There are other effects to consider, such as the spike in natural gas prices in the EU, where the spot price was already dangerously high in the past few months, which did lead to many industries ranging from aluminum producers to ceramics manufacturers curtailing output.

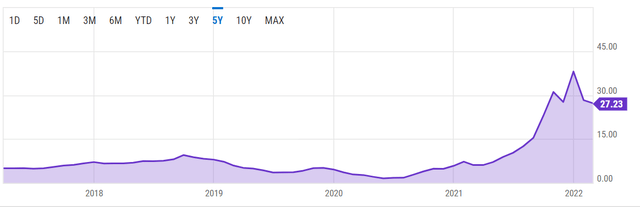

EU natural gas import price (Yahoo)

In February, natural gas imports were costing on average more than five times more than the natural gas spot price in the US. This month it will be far worse.

All these months of high natural gas prices in the EU also affected the fertilizer industry in many countries, where some companies temporarily halted production. It is still unclear to what extent it made a dent in total EU fertilizer output. Now, with new sanctions on Russia and Belarus, we are facing a situation where two of the top three global potash fertilizer producers are unable to sell fertilizer to the world. Russia is also a top producer of nitrogen fertilizer It is unclear at this point to what extent this will hit global food production, but it is likely to have a significant impact. Any attempts to calculate the negative GDP effects of demand destruction for food is an outright disturbing exercise that I would rather not attempt. We will nevertheless most likely experience demand destruction on a global scale for the one commodity that we cannot physically survive without, alongside clean water. Shortfalls in the global food supply could last until 2024 unless we sort the global fertilizer supply situation out.

There are other crucial commodities that Russia exports, which the global economy can hardly do without. There is palladium, where Russia is the largest producer. Along with South Africa, it provides most of the metal that has many industrial uses. There is neon, with 90% of it coming from Russia & Ukraine, which is important in the semiconductor industry. Even coal supplies that are considered ordinary are being affected. More importantly, with perhaps a more immediate impact, Russian wheat exports are being affected, with Ukrainian supplies most likely taking a major hit this year as well. Some of the problems emerging from shortfalls in Russian exports can be remedied, with product substitution, a drawdown of existing stockpiles, and so on, but most of the effects cannot be remedied. The overall picture that is quickly emerging is one where an already robust commodities bull market is now shifting into hyperdrive and may last for a very long time, with more and more commodities prices smashing through old record prices and sometimes leaving those old records in the dust.

I should note that Goldman Sachs just came out with a new oil price prediction for this year and next, with $135/barrel for 2022 and $115 for 2023. I personally think that at this point, the bias has to be to the upside, because the relationship with Russia will not soon return to normal, with both sides deeply entrenched in their positions, and few off-ramps to be had. Even if peace will break out in Ukraine, with some sort of agreement in place, I doubt that we will see a quick return to normal economic ties. In the meantime, whether it will be a destructive hurricane affecting major offshore oil production areas, or a rebel Houthi attack on Saudi Arabia’s oil infrastructure, technical problems in any major fields or transport infrastructure around the world, there is some probability of it happening, putting further upward pressure on prices.

Demand destruction can easily develop into a long-term stagflationary nightmare.

I highlighted back in 2020, in an article entitled “Deflation Will Give Way To Hyperinflation, And An Investment Dilemma “, the fact that the global economy can easily slide into an inflationary mess. Back in 2020, in the middle of the initial drastic COVID shutdowns, and after a decade of deflationary pressures, it was hard for people to fathom any outcome that would lead to a hyperinflation scenario. Recent trends, before Russia’s invasion of Ukraine, suggest that we were already on our way towards stagflation, with high inflation first thought to be only a temporary problem, proving that it had staying power, with more and more evidence that it was accelerating and taking on a life of its own.

As I write this, gasoline prices increased by 5% in a single day where I live. It does not mean that inflation is running at a similar pace, but gasoline prices are certain to drive the price of everything up. The fact that it is rising at such a fast pace, makes it hard for demand destruction to set in fast enough to put an end to the continued rise in oil prices. The one factor that could have stopped a hyperinflationary situation from taking root used to be a stagnated wage environment. At some point, people simply run out of money if wages do not rise in tandem with inflation, so they drive less spend less on shopping. It becomes a classical demand destruction event. Lately, companies have been responding to a tight labor market with extra wage incentives. Wages have been rising at a robust pace, almost keeping pace with inflation in the past year, even as inflation itself kept rising.

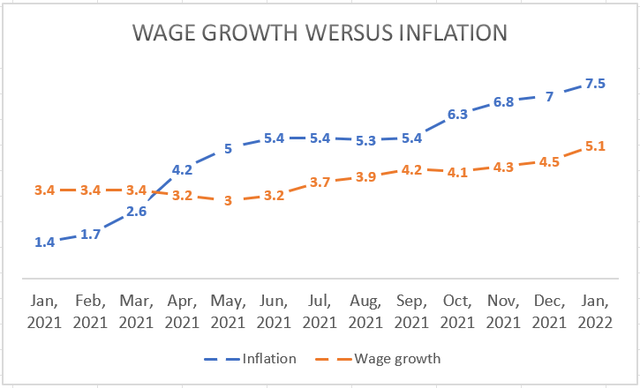

US wage growth versus inflation (Economic Policy Institute, US Inflation Calculator)

As we can see, wage growth picked up last year, soon after inflation rates started coming in at a higher pace than wage growth. As inflation continued accelerating, so did wage growth, even if it did fail to keep pace with inflation. What this tells us is that employers are highly motivated to offer employees at least partial compensation for the rising costs of living, even if it is not full compensation for that increase.

If the already established trend of employers offering to constantly increase wages of people, just enough to almost keep pace with inflation continues, it will provide the final ingredient needed to unleash a hyperinflationary environment that will feed on itself, regardless of whether the original trigger factor will persist or not. Whether it will reach 50%/month to make it official or not is irrelevant. The pace of inflation we saw in places like Romania or Hungary in the 1990s was enough to increase wages as well as the price of most goods about 100x and 20x respectively over the period of about a decade. One cannot find many people who look back with fondness to those times, even though inflation rates were not quite enough to make it officially hyperinflationary.

Because wages will not keep up with inflation, in time the economy will slow, leading to a decline in employment levels. At that point, the government will need to step in and offer more social support in order to maintain social cohesion. Accelerated government spending will also feed into the inflationary trend, keeping it going, even as the pace of inflation compensation by employers will slow, relative to inflation rate growth, leading to that gap we see above in the chart widening even further as time passes. The stagflationary vicious cycle will thus be completed.

Investment implications:

I have been touching on this subject regarding what the future of investing looks like this decade, given my long-held view that we are at real risk of sliding into a stagflationary trap in many previous articles. The investment outlook is overall bleak in real terms going forward. For instance, this year, we risk a shift in inflation growth into double-digit territory. A portfolio that will yield 10% in total returns this year will only break even at best by the end of the year in real terms. It is more than likely that achieving that rate of return will not be enough to preserve one’s real wealth this year, assuming that one can even achieve that feat this year. Things may get far worse beyond this year if the trend catches on.

If we will continue to see an acceleration in inflation, then inflation-hedging assets such as gold can turn out to be among the best ways to preserve wealth. I should note that the bold move to sanction Russia’s Central Bank, by preventing it from making use of its Euro & USD reserves to shore up the economy may cause an increase in interest for central banks around the world in accumulating more gold. As I pointed out in a recent article, published just a day before the Russian invasion of Ukraine, the marriage of physical gold assets with a gold-backed cryptocurrency may provide much-needed flexibility in terms of conducting business & trade in a gold-backed cryptocurrency, where the centuries-old issue of convenience in regards to using gold as a means of transaction may be finally resolved. We can hypothetically see Russia resorting to such a scheme if the current economic confrontation will continue, where it may launch a gold-backed crypto coin, which it could make convertible into physical gold on demand. To shore up such a system, it could start demanding gold payments for some of its globally indispensable resources, such as oil, gas, wheat, palladium, and so on as a way to adapt to the sanctions situation. In the interest of full disclosure, I currently have some GLD (NYSEARCA:GLD) in my portfolio, as well as Barrick (NYSE:GOLD) and physical gold.

Stocks related to the global energy situation should do alright in terms of keeping up with inflation. Oil & gas producers are set to enjoy the fruits of growing scarcity, even if we are likely to see some steady demand destruction going forward. As many may already know, last year we consumed about 45 billion barrels of oil equivalent in conventional oil & gas, while global discoveries only amounted to about 5 billion barrels of oil equivalent. Oil & gas prices may be volatile going forward, but the overall price trend will be to at least keep pace with overall inflation in the long run. For this reason, I prefer oil companies that are diversified in terms of their upstream-downstream balance, which can reduce stock price volatility, while at the same time they have a solid upstream reserves situation. I find Suncor (NYSE:SU) to be an ideal candidate that most closely resembles that profile.

Companies that are set to provide the means to reduce our global reliance on an increasingly scarce supply of oil & gas, should also do alright. Tesla (NASDAQ:TSLA) is the obvious choice in this regard, but also companies that are conducting an increasingly successful operation to shift some of their conventional car production to EVs should do alright. I find Ford (NYSE:F) to be an intriguing story in this regard, with its Mustang-based EV, as well as the electrification of the F-150, two iconic models in the company’s portfolio, where the EV transformation becomes just a continuation of a decades-old evolution of those models. Even though global car sales may struggle to keep the growth momentum going forward in a stagflationary environment, companies that can gain market share at the expense of others may do alright.

In regards to companies that can reduce our reliance on natural gas for instance, there is the case of Shell (NYSE:SHEL), which is headed in that direction, with its upstream reserves shrinking fast, while more and more of its capital spending is directed towards green energy initiatives, such as EV charging facilities, wind power, as well as hydrogen projects that will be derived from wind power. As I pointed out in a recent article, Shell’s overall situation and its plans going forward do present a potential opportunity for investors to see an increase in their stock values, but the plan could also become a major flop, given that revenues and profits from its growing green energy side of the business may not be nearly enough to make up for impending shrinking revenues from its declining upstream sector. Shell’s recent announcement that it is completely withdrawing from Russia is just the latest in a long string of business decisions that seem to have less and less to do with profits and more to do with politics and ideology. Here we may have a case where a company may indeed become a major provider of goods and services that will be in high demand as an alternative to increasingly scarce oil & gas, yet it will not provide returns for investors, because it will be unable to grow the revenues and profits from its emerging green sector to make up for what is likely to be a dramatic decline in its upstream oil & gas sector this decade.

When we will look back at this current decade, it will be seen as one of great turmoil and dramatic economic and geopolitical changes. As much as we may strive to try to understand the investment implications of it all, there will always be unforeseen factors or events that will blindside us, making it a very challenging time to be invested in the markets. Even so, it is much better for us to do our best and try to first and foremost recognize the fact that this is a decade of turmoil and then try to make some educated decisions in regards to positioning one’s investment in a manner that is well-adapted to these changing times, rather than just assuming that this decade will be just some more of the same as the past few decades. It is definitely better than recognizing a great deal of risk, getting intimidated, and going into increasingly fast-devaluating cash. This is going to be a decade where store of value assets need to be identified and invested in, in the face of the shrinking buying power of cash, as well as shrinking global prosperity. The blowback from the sanctions imposed on Russia only exacerbated an already existing trend, making it even less likely that we can avoid a global stagflationary trap that is set to be with us for a long time to come. There may still be a window of opportunity to avoid this catastrophic scenario from playing out, but it seems to be closing with every new development. There is a good chance that we already passed the point of no return, we just didn’t get the official memo yet.

Be the first to comment