belovodchenko

A Quick Take On Rush Uranium Corp.

Rush Uranium Corp. (RUC:CA) has filed to raise $740,000 in a Canadian IPO of its common shares, according to a SEDAR registration statement.

The firm seeks to develop rare earth elements and uranium mineral claims in Quebec, Canada and Wyoming, USA.

At its current stage of development, the company and its stock represent an ultra-high-risk speculation.

My outlook on the IPO is on Hold.

Rush Overview

Vancouver, Canada-based Rush Uranium Corp. was founded to acquire mineral interests in and engage in mineral extraction activities for rare earth elements and uranium deposits in North America.

Management is headed by Chief Executive Officer Peter Smith, who is also CEO and director of Sasquatch Resources Corp. and was a former clerk at the Supreme Court of Canada.

The company has acquired a 100% interest in the Boxi Property in Quebec and a 100% interest in the Copper Mountain Project in Wyoming.

As of June 30, 2022, Rush has booked fair market value investment of approximately $592,000 from investors.

Rush’s Market & Competition

According to a 2021 market research report by Research Reports World, the global market for uranium was an estimated $2.6 billion in 2021 and is forecast to reach $3.3 billion by 2027.

This represents a forecast CAGR of 3.6% from 2022 to 2027.

The main drivers for this expected growth are an increase in nuclear fuel spending by countries such as Canada, Australia and Kazakhstan in the coming years.

Also, the industry will likely be significantly impacted by the conflict between Russia and Ukraine.

Other market size reports put the size of the uranium industry at up to $11.5 billion by 2026.

Major competitive or other industry participants include:

-

GoviEx

-

American Uranium Corp.

-

Jinduicheng Molybdenum

-

Energy Resources of Australia Ltd

-

JOGMEC

-

AREVA

-

U3O8 Corp

-

BHP Billiton

-

Sinohydro

-

Orano

-

CNNC

-

Sinosteel

-

Cameco

-

China National Nuclear Corp

-

Kazatomprom

Rush Uranium Corp. Financial Performance

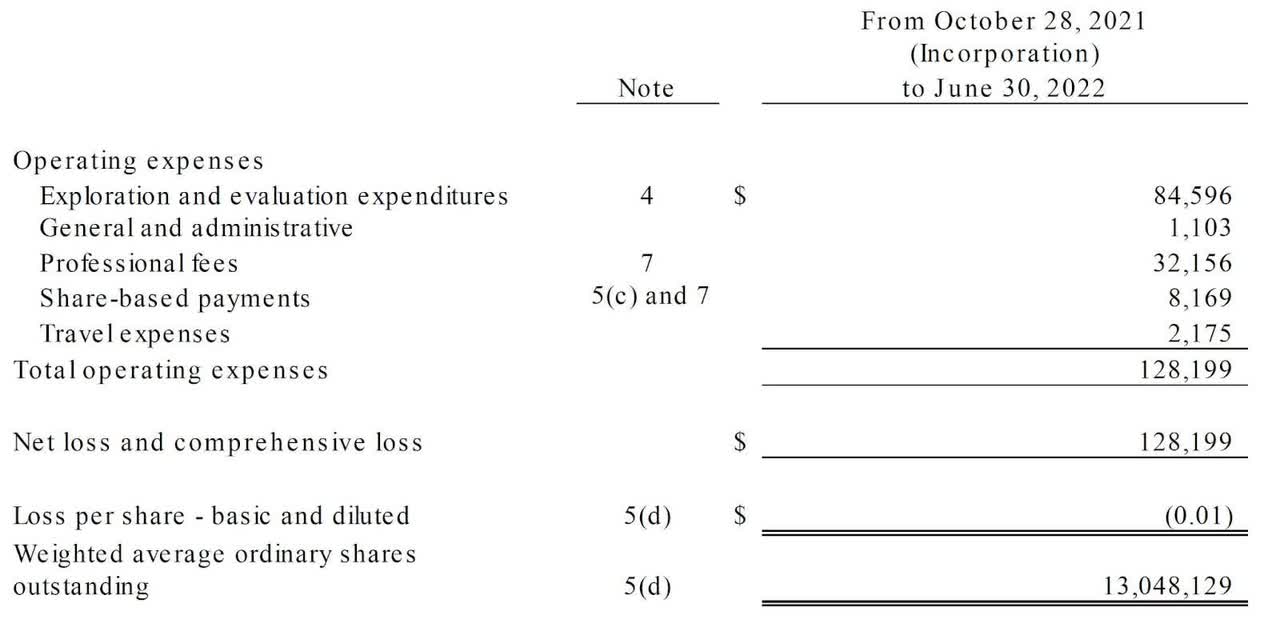

Below are relevant financial results derived from the firm’s registration statement:

Statement Of Operations (SEDAR)

As of June 30, 2022, Rush had $177,678 in cash and $12,850 in total liabilities.

Rush Uranium Corp. IPO Details

Rush intends to raise $740,000 in gross proceeds from a Canadian IPO of its common shares, offering up to 10 million shares at a proposed price of $0.074 per share.

The IPO is not being marketed to investors outside of Canada. No U.S. SEC filings have been made.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $2.0 million, excluding the effects of agent over-allotment options.

The float to outstanding shares ratio (excluding agent over-allotments) will be approximately 25.51%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

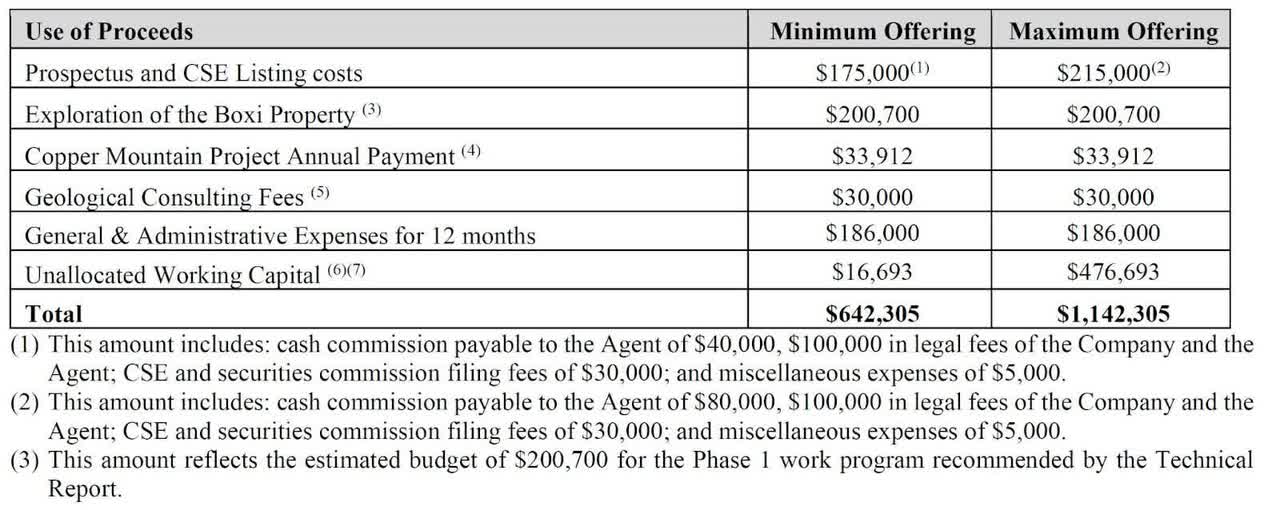

Management says it will use the net proceeds from the IPO as follows:

Proposed Use Of Proceeds (SEDAR)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says neither the Boxi Property or the company have been the subject of any legal proceedings.

The listed agent of the IPO is Echelon Wealth Partners.

Commentary About Rush’s IPO

RUC:CA is seeking Canadian investor funding to pursue further development of its Boxi and Copper Mountain mineral interests.

The company’s financials show no revenue and mostly exploration and G&A expenses to date.

The firm currently plans to pay no dividends and intends to retain any future earnings for reinvestment back into the company’s growth initiatives.

The market opportunities for rare earth minerals and uranium are large and expected to continue to grow in demand in the coming years, so the firm has good industry growth dynamics in its favor.

The primary risks to the company’s outlook are its tiny size, thin capitalization and lack of previous success in mineral production.

At its current stage of development, the firm and its stock are an ultra-high-risk speculative opportunity.

My outlook on the IPO is on Hold.

Expected IPO Pricing Date: To be announced.

Be the first to comment