PM Images

Main Thesis & Background

The purpose of this article is to evaluate the Invesco S&P 500 Equal Weight ETF (NYSEARCA:RSP) as an investment option at its current market price. This is an alternative play on the S&P 500, given that most ETFs track an index that is weighted by market cap. By contrast, RSP utilizes an equal weight strategy for the stocks in the S&P 500 index, with quarterly rebalancing.

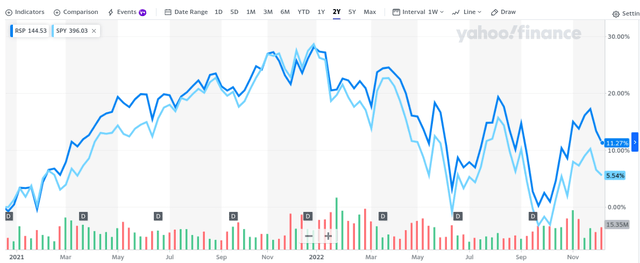

This is a fund I initiated coverage on about two years ago, when I recommended readers consider putting it in their portfolio. I have owned it since then, and have generally been pleased with the results. While the fund is down in 2022, the saving grace is that it has been beating the S&P 500:

YTD Performance (Google Finance)

Further, over a longer stretch of time, the out-performance is consistent, with RSP continuously leading the S&P 500 over the 2-year period I have owned it:

2-Year Performance (RSP & SPY) (Yahoo Finance)

With relatively strong performance on its side, I thought it was time to take another look at RSP to see if I should continue owning it in the new year. After careful review, I am convinced this should have a permanent place in my portfolio, and I will explain why in detail below.

Market Realities Are Finally Hitting Stocks

As my followers are aware, I started to shift to a more cautious tone in the middle of the year. I saw the market getting overhyped, and was not surprised when we started to see a drawdown and an uptick in volatility. Fortunately, November saw a rebound, but we are still sitting deep in negative territory for the year due to a number of different macro-factors.

Despite some pessimistic overhang, I see some merit to getting back into stocks – albeit selectively. I am not suggesting investors dive back in aggressively, especially if one had not been taking chips off the table during recent upswings. But I do see merit to beginning to build on to positions during periods of weakness for a number of reasons.

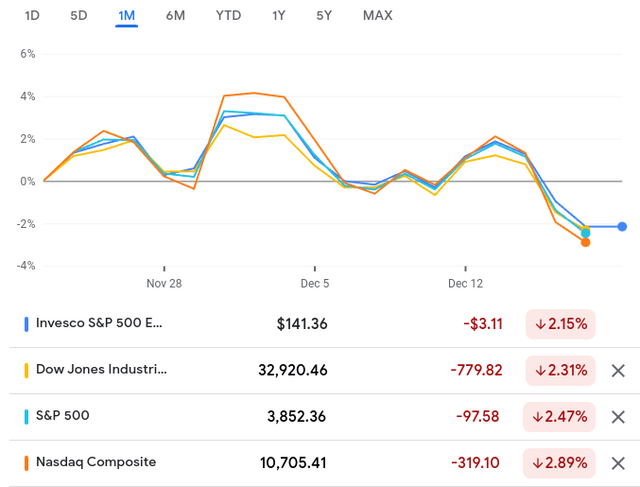

One, historically December – January are strong months for the market. Yet, valuations and share prices have started to drop, suggesting to me that buying in on this weakness makes sense on a historic basis. Again, I am not a “hand over fist” writer and shy away from hyperbole. But it is worth noting that the top indices are down during what is typically a strong time period for stocks:

1-Month Returns (Google Finance)

I have always been a proponent of buying weakness and selling strength, so widespread drops typically pique my interest.

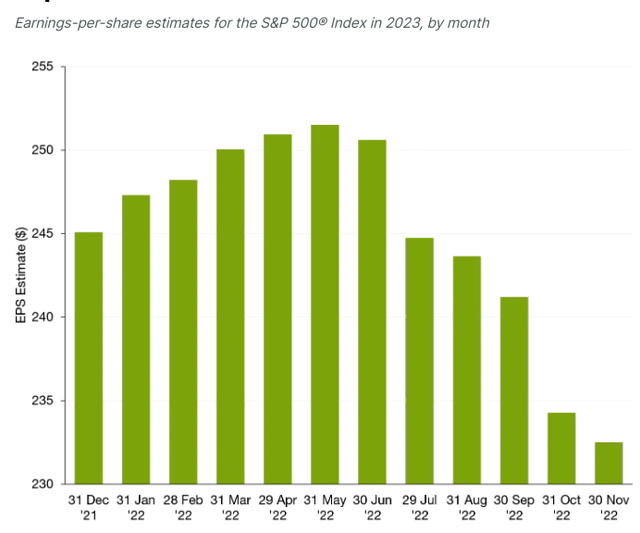

Two, the market is starting to come to terms with the fact that 2023 could be a challenging year. While this may sound counter-intuitive to a buy thesis, the reason I see this as good news is that I felt sentiment was too optimistic on future expectations of late. We have many signals that the Fed is not done hiking rates and that a recession is imminent. Yet, valuations and earnings expectations remained high – that made me cautious. Fortunately, as reality has set in, the market has also re-set earnings expectations for the S&P 500. Since the beginning of the year, forward expectations for 2023 have dropped markedly, as shown below:

S&P 500 Earnings Estimates (FactSet)

This may sound like odd logic and I appreciate that. Lower earnings and falling stock prices don’t generally inspire confidence. But the point I am making is I was more concerned when the market was ignoring the challenges ahead. Now that reality is setting in (in terms of anticipated lower earnings) I see a less frothy/risky market. This gives me more comfort when buying.

I See A Fed Shift Giving Stocks A Boost Soon

I will now take another macro-look at why I like RSP here. This is true because I see a challenging environment ahead which is going to pressure most stocks and/or sectors. So this lends merit to an equal-weight approach (which RSP offers) to balance out those risks. But I also like equities as a whole over the next few quarters because I believe a Fed pivot is going to occur in the next 3-6 months. This differs slightly from the market’s take – but I am okay with that. This is the same market that believed inflation would be “transitory” in 2020, when in eventuality it turned out to accelerate over the past two years. Further, the market began to plan for a Fed pivot earlier this past summer, which it again got wrong. So now – with the market anticipating the Fed staying hawkish for longer – I am once again taking the opposite view. I expect the Fed has maybe one more hike left in it, then it will hold rates in place and eventually begin to cut them in late 2023.

The significance here is that lower rates and a more dovish Fed are both generally bullish for stocks. So I believe buying weakness in RSP over the next few quarters will result in positive calendar year gains for 2023.

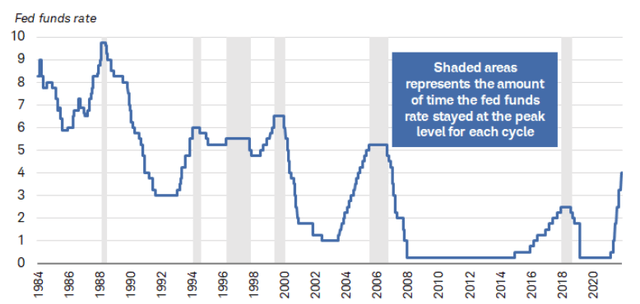

This belief also has a historical precedent. In past rate hike cycles, the Fed did not keep rates at the “peak” for very long. Often the stretch of time was quite temporary before a rate cutting cycle began to kick in. With a recession looming in mid or late-2023, this historical trend will probably repeat itself:

Length of Time From Peak Rates To Next Cut (Charles Schwab)

This is critical to my belief that equities may see a choppy Q1 and Q3, but will end 2023 on a positive note as the market welcomes a change in tone from the Fed and a forward outlook of expansion as opposed to recession in 2024. This is a tailwind for RSP, but also the equity market as a whole going forward. Again, I am not suggesting piling in with a complete risk-on approach here. But I am suggesting that weakness over the next 3-6 months represents a strong buying opportunity, and RSP is one of the funds I will be buying.

Dividend Growth Was Astounding In 2022

Looking at RSP specifically, another attribute I view very favorably is the dividend growth story. While the yield is certainly not “high”, similar to the S&P 500’s market weighted index, the level of dividend growth excites me. This suggests large-cap U.S. companies actually fared reasonably well in a very challenging year and may be better positioned to face a difficult 2023 than the market anticipates.

To illustrate, consider that year-over-year dividend growth exceeded 17% for RSP:

| 2021 Distributions | 2022 Distributions | YOY Growth |

| $2.08/share | $2.44/share | 17% |

Source: Invesco

I won’t get into too much detail here as this is a straightforward metric. But suffice to say it represents strength for the underlying companies and suggests to me this is a reasonable place to put cash while waiting for global headwinds to clear.

Equal-Weight Has Seen Multi-Year Alpha Before

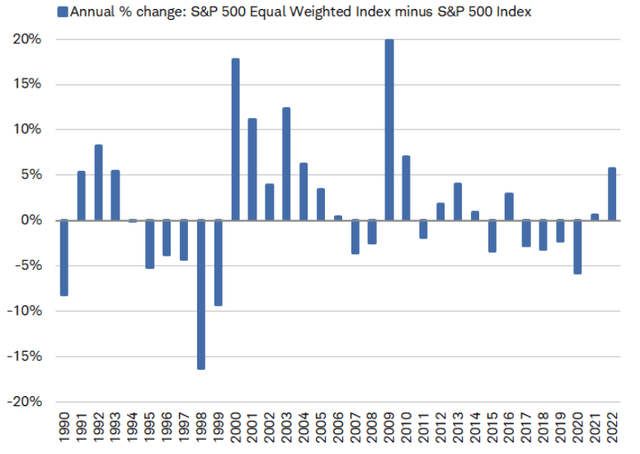

My final point considers the broader theme of going “equal weight” (i.e. through RSP) compared to just buying the S&P 500’s market weight strategy. Certainly during risk-on time periods when growth/Tech were winning, a pure play on the S&P 500 is rewarding. But during times of uncertainty and/or rising rates, the equal weight strategy often prevails because it holds a higher allocation towards more defensive names and less Tech.

The challenge here is that RSP has already been winning for a while. So investors may be considering rotating out of it and into other objectives because of this backdrop. The thought being the out-performance cannot keep on continuing.

To be fair, I would never fault someone for taking chips off the table and locking in wins. Being a prudent investor means not getting too exposed to one idea/sector/fund, etc. So if one already has a large stake in RSP and/or is sitting on large gains, then rotating a bit could be the right move. But for me, I don’t see the recent out-performance as a reason to get cautious. Again, looking back at history, we will find that equal-weight strategies often have multi-year stretches where they beat (or get beaten) by the market-weight alternative of the S&P 500 index:

Return of Equal-Weight Index – S&P 500 (By Year) (Bloomberg)

The takeaway for me is that a year of out-performance or under-performance by the equal-weight strategy is rarely reversed the following year. The trend will typically continue for a multi-year stretch, and then reverse for another multi-year stretch. While past performance is not always replicated, the last thirty years support this notion. Therefore, I see RSP’s recent strength as an indication to keep buying, not the other way around.

Bottom-line

While RSP is down for the year it has still given my portfolio a boost over a longer stretch of time. It provides diversification, dividend growth, and “alpha” all in one – hard to argue with that track record! While the new year ahead looks to be a difficult one, I think the way to play it is with defense and tactical options. RSP fits the bill on that count. As a result, I will use pullbacks and down days in the months ahead to add to my position in this ETF. This has been a strategy that has served me well long-term, and I suggest readers give the idea some consideration at this time.

Be the first to comment