recep-bg/E+ via Getty Images

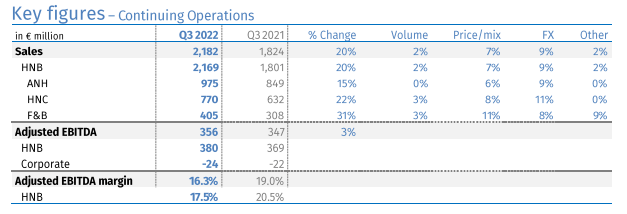

We have mixed feelings about Royal DSM’s (OTCQX:RDSMY) third quarter results. The company did deliver very strong organic sales growth despite the challenging environment, but the adjusted EBITDA margin deteriorated significantly. As can be seen in the table below, most of the organic growth came from price increases as can be seen in the price/mix column. Overall growth was even stronger, thanks to foreign exchange effects, and the ‘Other’ increase relates to a small acquisition. Unfortunately, volume growth was extremely weak, varying from 0% to 3% depending on the business segment. At least volume did not go negative due to the price increases.

Royal DSM Earnings Release

The company also confirmed that the divestment of DSM Engineering Materials is on track, and should be completed soon. This should leave a transformed Royal DSM ready to merge with Firmenich next year. We were a little bit disappointed that more details were not shared with respect to the merger with Firmenich other than to say that “good progress has been made to close the forthcoming merger with Firmenich”. As a reminder, the company has previously said they expected the merger to complete in the first half of 2023.

Q3 2022 Results

Adjusted EBITDA was up +6%, despite the adjusted EBITDA coming in lower compared to the previous year quarter. Sales grew significantly, including organic growth. The company reported that market demand remained resilient despite the challenging macro-economic environment. Energy and input costs accelerated in the quarter, especially in Europe. As a result full-year outlook 2022 was lowered, with Adjusted EBITDA expected to increase only by low single digits. The company says they remain confident in the mid-term financial targets they have shared.

DSM-Firmenich

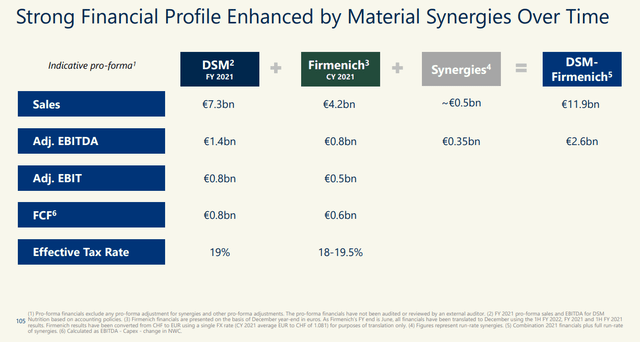

Royal DSM is expected to become a new company, called DSM-Firmenich, which will be domiciled in Switzerland. As part of the merger there will be a public offer for Royal DSM shares in exchange for DSM-Firmenich shares. At inception, Royal DSM’s shareholders are expected to own 65.5% of DSM-Firmenich. Firmenich shareholders will also receive shares in DSM-Firmenich in exchange for their Firmenich shares, and also €3.5bn in cash. It is therefore expected that at inception the various shareholders of Firmenich will own in aggregate 34.5% of DSM-Firmenich. The new company is expected to have a Euronext Amsterdam listing, and completion of the merger is expected in the first half of 2023. There is an expected benefit of recurring run-rate pre-tax synergies of approximately €350m in Adj. EBITDA per year by 2026.

So what is Royal DSM getting by merging with Firmenich? This is a family owned company with ~10,000 employees. It is one of the global leaders in perfumery and ingredients, with revenue of ~4.5 billion CHF growing at a CAGR of ~5%. It has roughly a 20% adjusted EBITDA margin despite investing heavily in R&D. It’s R&D spend is about 9.3% of revenues.

Royal DSM Investor Presentation

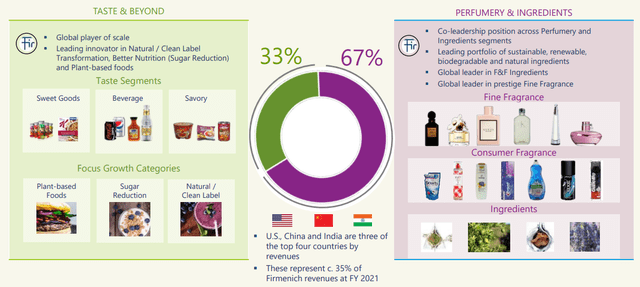

Although perfumery and ingredients is the main business segment for Firmenich, it also has a significant business in food and taste. The slide below shows some of the applications of their products, which include plant-based foods and sugar reduction solutions. The company is bringing to market some very interesting products, including an Eco-friendly long-lasting fragrance for laundry. In general it is also helping to create healthier, great-tasting, affordable food & beverages with more natural and sustainable ingredients.

Royal DSM Investor Presentation

Merged Financials

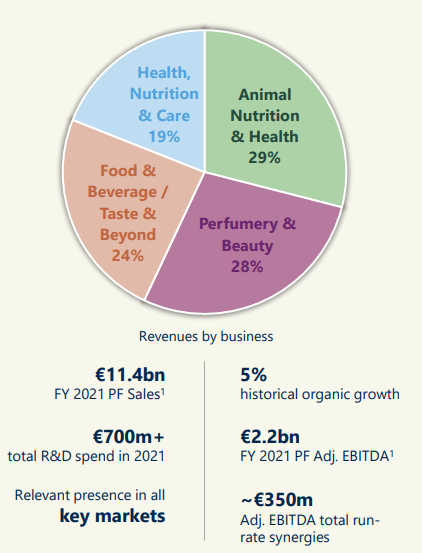

The combined company is expected to have a leadership position across nutrition, beauty, and well-being. Royal DSM is about twice the size of Firmenich, with ~18,000 employees compared to the ~10,000 that Firmenich has. Royal DSM has about 12,000 patents, nearly three times as many compared to the ~4,000 at Firmenich. Royal DSM has 2021 sales of ~€7.3 billion, which is significantly more than the ~€4.2 billion in sales Firmenich had in 2021. When combined, the merged company is expected to have sales of ~€11.4 billion, growing at a ~5% organic growth rate, and with a pro-forma Adjusted EBITDA of approximately €2.2 billion. The new company will be nicely diversified across its four key businesses.

Royal DSM Investor Presentation

At the outset the company is expected to have ~20%+ Adj. EBITDA margins, with a medium-term outlook of 22-23%, supported by synergies. The company is targeting a Debt/EBITDA of ratio 1.5-2.5x over the medium term, and is committed to a strong investment grade credit rating.

When considering synergies, the combined company is expected to have a €500 million annual sales uplift, especially from combining Royal DSM’s Food & Beverage and Firmenich’s Taste & Beyond businesses. If synergies are successfully delivered, this would increase total sales to ~€11.9 billion, and adjusted EBITDA to ~€2.6 billion. The synergies implementation cost is expected to be ~€250m.

Royal DSM Investor Presentation

Valuation

It is difficult to value the company as it is not yet completely clear how the company will look post the Firmenich merger and disposition of the Materials business. Currently Royal DSM’s market cap is ~€23 billion and its enterprise value is ~€25 billion, that means that once shares are issued for Firmenich the enterprise value should increase to more than €35 billion. If we ignore synergies, that would result in an EV/Adjusted EBITDA multiple of over 16x. With synergies, the valuation multiple should go down to ~14x. These are very rough estimates, as it is very hard to tell how exactly the business will look after the disposition of the Materials business and the merger with Firmenich.

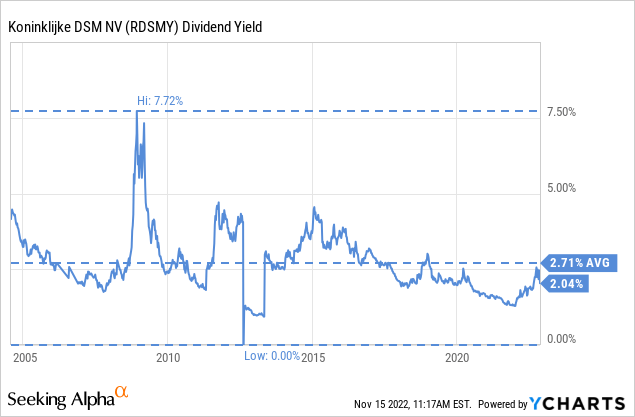

Given the quality of the business and the growth prospects, we view this valuation as reasonable, but far from being a bargain. We would put it in the “wonderful business at a fair price” pile. The combined company is expected to have a dividend payout ratio of 40-60% of adjusted earnings. This could mean a higher dividend, as the current dividend yield for Royal DSM is only ~2%.

Risks

There are several risks to consider with Royal DSM including the integration risk with Firmenich, and the continued impact inflation can have on earnings. In particular, energy costs in Europe have had a significant impact on profit margins, and it could get worse before things get better. These risks are mitigated by the fact that Royal DSM operated in relatively stable industries with attractive economics.

Conclusion

We have mixed feelings about Royal DSM’s third quarter results, with inflation and energy costs impacting profit margins more than we expected. The merger with Firmenich appears to be on track, as well as the sale of the Materials business. Royal DSM is close to completing its transformation into a business focused on health, nutrition, and well-being. Given all of the moving parts it is difficult to value the company precisely, but shares appear to be reasonably valued, and we believe this puts the company in the “wonderful business at a fair price” investment category.

Be the first to comment