ArLawKa AungTun/iStock via Getty Images

Today’s article covers Vanguard’s Global ex-U.S. Real Estate ETF (NASDAQ:VNQI). Instead of placing a buy, hold, or sell rating on the ETF, we’ve provided an evidence-based trading strategy for investors to consider. The article emphasizes the asset’s performance under various market circumstances and outlines key allocational risks. Despite delivering consensus on certain variables, the purpose of today’s analysis is not to share our thoughts on the current market climate.

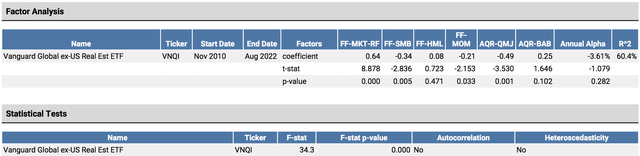

Factor Analysis & Literature

Factor analysis measures an ETF’s price action relative to different financial market circumstances. For instance, it measures how the ETF has historically performed in growth-orientated markets, value-seeking markets, momentum markets, etcetera.

Based on our regression, the Vanguard Global ex-U.S. Real Estate ETF tends to outperform the broader financial markets whenever investors favor large market capitalization securities. Furthermore, the ETF usually outperforms whenever the market prefers value assets, underperforms whenever the financial markets are in a momentum trend, and underperforms when the financial markets are quality-seeking. Lastly, the ETF usually outperforms the broader market whenever the financial markets prefer low-volatility stocks.

Here are the denotations. Note that I hyperlinked all of them in case you’d like to learn more about the respective factors.

- SMB (small market cap).

- HML (high book value).

- MOM (momentum).

- QMJ (quality) – Assets with robust financial statements.

- BAB (bet against beta) – Low volatility securities.

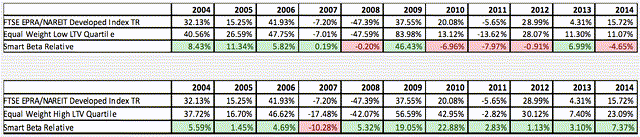

To further the research, let’s look at the Loan-to-Value factor’s influence on global ETF returns. Note that we obtained the regression from a third-party source; thus, we don’t take credit for the work.

The regression discovered that an investor could rotate in and out of highly leveraged developed market REITs and outperform an equally weighted REIT portfolio. The result might seem counterintuitive; however, the regression provides an informative representation as it tested global REITs throughout the 2007/08 housing crisis as well as during various bull markets.

Regressing NAREIT Against LTV (Alex Moss, Consilia Capital Kieran Farrelly, The Townsend Group)

As an add-on, note that the LTV regression was not performed on the Vanguard Global ex-U.S. Real Estate ETF, nor was it performed on a multifunctional real estate ETF. Thus, only partial inferences can be considered.

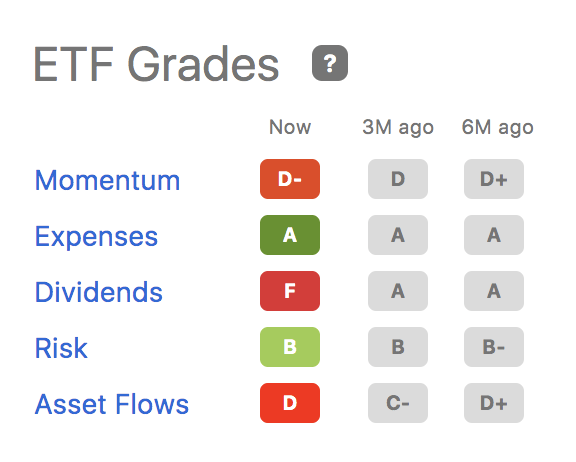

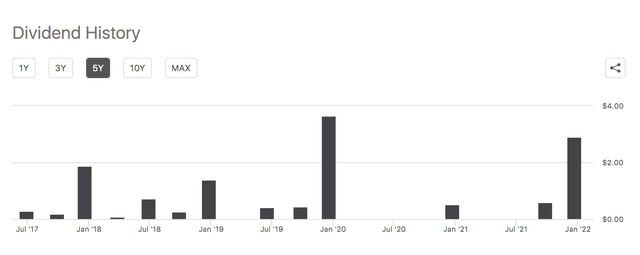

The final factor-based variable to consider is Vanguard Global ex-U.S. Real Estate ETF’s dividend inconsistency. Seeking Alpha’s factor grades and the ETF’s dividend record suggests that it exhibits an inconsistent dividend policy, which is unfavorable in today’s market climate (explained later).

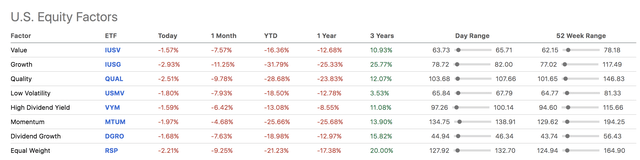

The reason why weak dividend-paying securities could suffer in today’s market is likely due to risk aversion. Seeking Alpha’s year-to-date factor-based performance shows that assets with high dividend yields and low volatility have clearly outperformed other investment styles.

It’s known by now that investors prefer high dividend yields in uncertain market environments. Thus, raising the possibility that Vanguard’s Global ex-U.S. ETF’s poor dividend profile could be a headwind.

The ETF’s Allocation Assessed

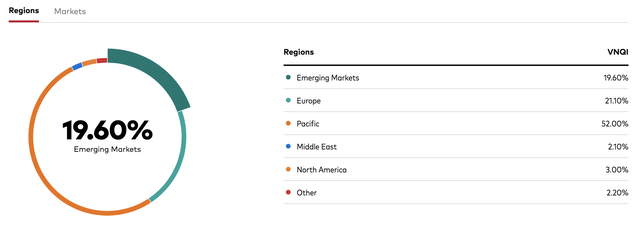

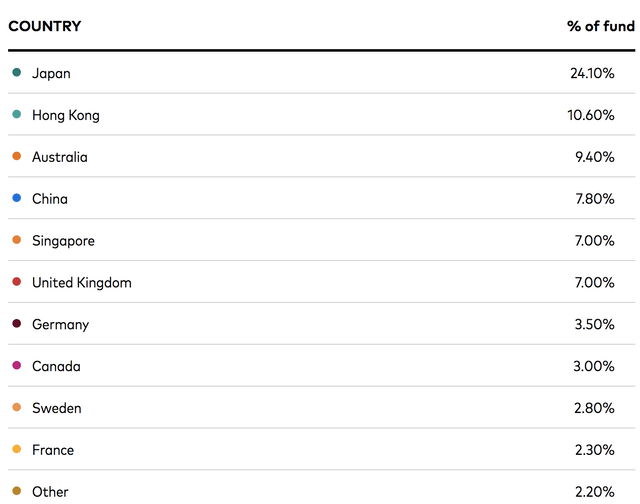

The ETF’s exposure ranges from the Pacific, Europe, and various emerging markets. The fund invests across a variety of real estate business modes. Thus, investors should notice that the vehicle generates revenue in a multitude of ways and not just from REITs.

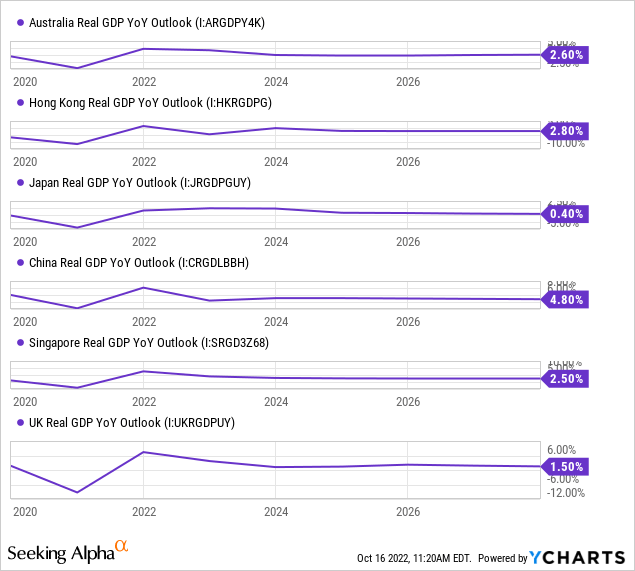

At first glance, the ETF’s well-diversified as it is exposed to nations with high prospective GDP growth rates. For context, a GDP growth rate above 2.5% is usually considered healthy, and real estate’s performance tends to be interlinked with economic growth.

Despite the data-driven optimism, there are a few macroeconomic risks that investors should be aware of.

Let’s run through a few of them.

- The United Kingdom is in political turmoil as the Tory party’s divide makes it impossible for cohesive policy implementation. Circumstances such as a fading Pound Sterling, rising living costs, and rising civil unrest could wane commercial spending and real estate activity in due course.

- Japan’s taken a contrarian pathway to deal with post-pandemic inflation. The country stands by its low (to negative) interest rate policy while mitigating living costs with subsidies. In our opinion, this could support the property market; however, we also believe it could lead to a crash if economic mean reversion settles in.

- Singapore and Hong Kong’s property markets are bound to property cooling measures in an attempt to curb price rises. Despite an exponentially growing GDP, we see government intervention in private sector property as a key risk.

- Lastly, China remains lockdown obsessed. We don’t think its hardline covid policies will come to an end soon, which could taper its GDP growth. As such, we believe China’s political risk to be key.

We’re fully aware that there is further scope to assess the ETF’s regional exposure. However, we wanted to convey a parsimonious explanation of the key risks involved.

Concluding Thoughts

As the introduction mentions, this article provides a trading strategy instead of an allocational recommendation. Based on a simulation and financial literature, this ETF could outperform the broader financial markets whenever market participants are large-cap, value, and low-volatility seeking. In addition, high loan-to-value real estate securities tend to outperform low loan-to-value real estate assets.

Our strategy probably isn’t full proof; however, overwhelming evidence suggests it’s an effective way to rotate this ETF.

Be the first to comment