Sundry Photography

Shares of TJX Companies (TJX) rose big following its earnings results earlier this week. July’s Advance Retail Sales report was also seen as better than expected. The consumer is apparently still faring fine despite a few dire earnings reports in May and retail profit warnings lately. Retail stocks in general are up big from the June low – higher by more than 20% on the SPDR S&P Retail ETF (XRT).

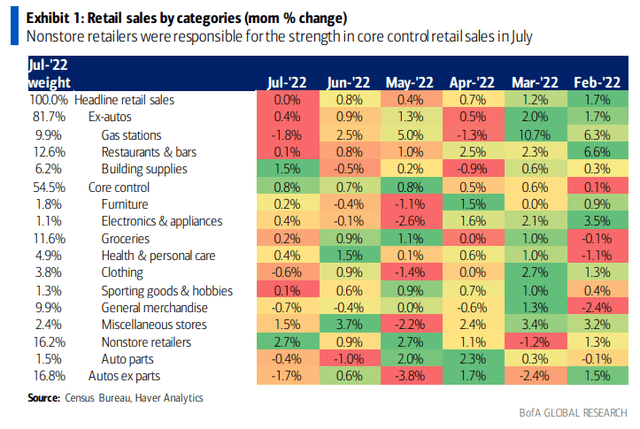

Retail Sales Ex-Autos Was Solid, But Weak For Clothing Retailers

BofA Global Research

One company that had a dreadful stock price reaction to its Q1 earnings report three months ago was Ross Stores (NASDAQ:ROST). After a top- and bottom-line miss, ROST cratered nearly 25% from $92 to under $70 in mid-May. The stock has recovered right back to that key level ahead of its crucial Q2 profit report due out this afternoon.

According to Bank of America Global Research, Ross Stores is the second largest off-price retailer in the U.S. The company operates over 1,500 stores under the “Ross Dress for Less” banner and over 200 stores under the dd’s DISCOUNTS brand. Both brands target women and men between the ages of 18 and 54. About 75% to 80% of the company’s customers are females shopping for themselves and/or family members. Ross targets customers from middle-income households while dd’s targets customers from more moderate-income households.

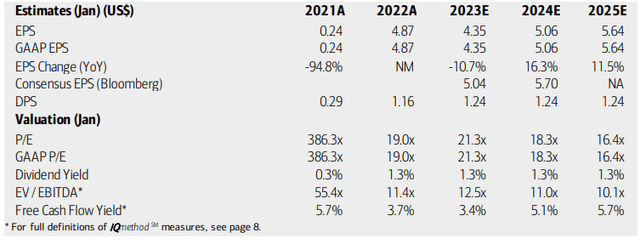

The California-based $32.4 billion market cap Specialty Retail company in the Consumer Discretionary sector features a lofty price-to-earnings ratio of 20.6 and a low 1.3% dividend yield, according to The Wall Street Journal. Analysts at BofA expect earnings to drop next year before normalizing at a solid growth rate through 2025. That growth rate likely warrants an earnings multiple premium, but uncertainty around the strength of the consumer casts a bearish cloud. The firm’s EV/EBITDA multiple is elevated, too, and free cash flow yield is not very high.

Ross Stores: Earnings, Valuation, Dividend Yield Forecasts

BofA Global Research

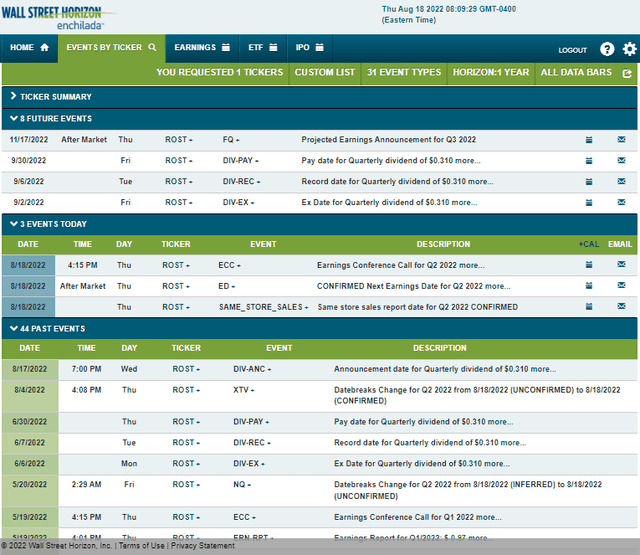

ROST’s corporate event calendar is highlighted by this afternoon’s Q2 earnings report. A conference call follows the release at 4:15 PM ET, according to Wall Street Horizon. You can listen live here. The stock has an ex-dividend date of Friday, September 2, and the next quarterly profit report is projected on Thursday, November 17.

Corporate Event Calendar: Earnings Report & Conference Call This Afternoon

Wall Street Horizon

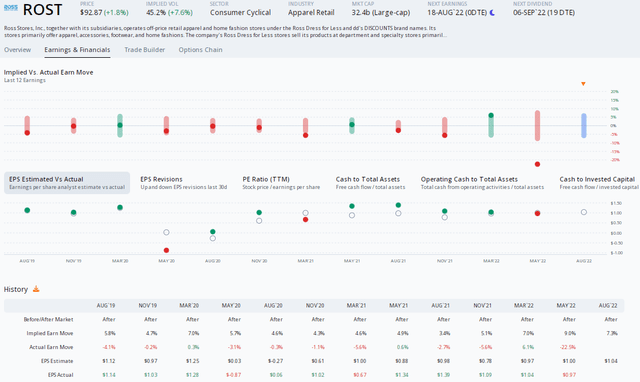

Digging into the market’s expectations for today’s earnings report, data from Options Research and Technology Services show an implied earnings-related stock price move of 7.3% using the nearest-expiring at-the-money straddle. Analysts expect $1.04 of EPS, which would be a modest increase from $0.98 in the same quarter a year ago, but negative after inflation. Ross has beaten earnings estimates in four of the previous five quarters, but its Q1 miss resulted in a massive stock price plunge.

Ross Earnings Preview: A 7.3% Implied Swing

ORATS

The Technical Take

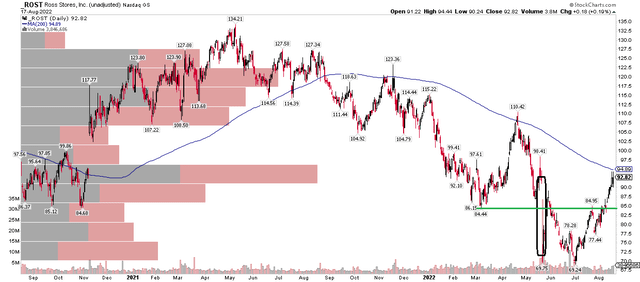

I see resistance at current levels on shares of ROST. The chart below illustrates that there is significant volume previously traded in this range using the volume-by-price indicator on the left. Moreover, the stock’s downward-sloping 200dma, which was a selling area late last year and in 2Q22, has come into play (like for so many stocks in the market right now). Finally, notice that shares are right back to their gap-down level from the May quarterly earnings report. I think there could be some downside in today’s report based on the resistance factors.

I see support, though, in the $84 to $85 area, so I’d be a buyer should ROST pull back to that range. I like the double-bottom pattern around $69 that was established in May and early July.

ROST Stock: A Confluence Of Resistance, Mid-$80s Support

Stockcharts.com

The Bottom Line

Ahead of earnings, shares of Ross Stores look primed for a pullback. The options market sees a 7% move in either direction while resistance on the chart creates near-term problems for the bulls. Long-term investors should look to buy the stock on a pullback to the mid-$80s.

Be the first to comment