Sundry Photography

Overview

Ross Stores (NASDAQ:ROST) is currently undervalued by 45%. I believe ROST’s true value will be realized as it continues to show investors that it is a beneficiary of the current macro environment – demand and supply situation and weak consumer sentiment. I expect my thesis to start playing out post FY23 where ROST will grow its top line at rates similar to FY09 and FY10, and achieve similar profitability to pre-covid levels.

Business description

ROST operates two discount clothing and home goods retail chains under the ROST Dress for Less® and dd’s DISCOUNTS® names.

As of 1FQ23, ROST is the largest off-price apparel and home fashion chains in the United States, with 1,648 locations. Mainly catering to middle-class families, ROST offers prices that are 20-60% lower than those at conventional department and specialty stores.

Also in 1FQ23, ROST operates 303 dd’s DISCOUNTS that provide more affordable clothing, accessories, footwear, and home fashions, typically at a discount of 20%-70% off the regular prices found at moderate department and discount stores. Customers at dd’s DISCOUNTS tend to have lower incomes than ROST customers, and the typical dd’s DISCOUNTS store is located in a well-established shopping center in a densely populated urban or suburban neighborhood.

Consumers trade-down to cheaper goods benefits ROST

Given the current macro environment-rising interest rates and weak consumer sentiment-the apparel sector, which has benefited from wardrobe restocking tailwinds in recent quarters, will most likely face significant headwinds in the coming quarters. I believe this is especially true for lower-income consumers, who will see their disposable income dwindle as the cost of goods rises and cash income falls (there is no more cash stimulus). But this is good for businesses like ROST because it makes their value proposition stand out. Off-price channels benefit from trade-down behavior, which is when people still want to buy fashionable clothes at a lower price.

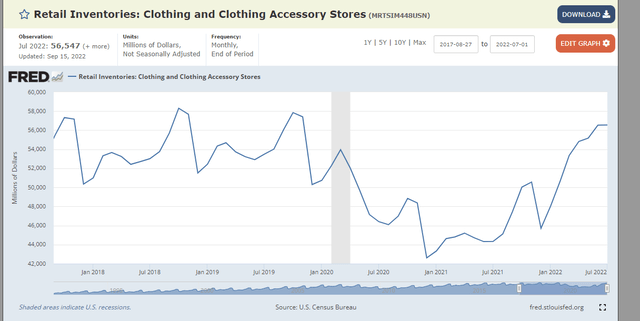

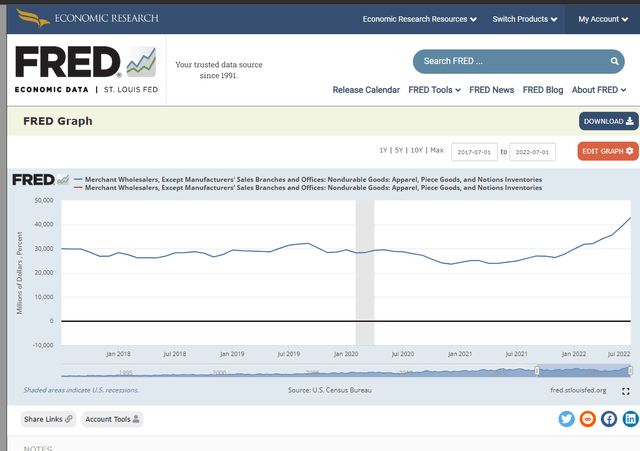

Given the dramatic rise in industry-wide stock at the retail level, the playing field is skewed in favor of low-cost competitors such as ROST. My guess is that this increase is due to the supply chain settling (i.e., goods that were stuck at the freight level have now passed through the system and reached the retail stores). Furthermore, I expect this situation to worsen as there is an excess of inventory at the wholesaler level, which will eventually be pushed down to the retail level, which I expect to happen over the next few quarters. The result is a surplus of clothing in an environment with low consumer demand. This is great news for ROST as off-price retailers should have more opportunities to hold closeout and packaway sales due to a surplus of inventories that need to be cleared.

Among all of the factors mentioned above, the fact that consumers focus on value is a competitive advantage for off-price retailers. I believe that as consumers place a greater emphasis on value, off-price apparel retail will gain market share in comparison to other full-price apparel retail formats. My thoughts are backed up by ROST’s recent earnings calls, which show that consumers are opting for less expensive options. In a trade-down situation, I think that selling branded, high-quality items at discounted prices will be a relative winner.

“But with inflation continuing, one would think that would be a logical conclusion that over time that we could potentially pick up additional market share.” ROST CEO, 4FQ22 earnings call

“Moving forward, consumers’ increasing focus on value and convenience along with a large number of retail, recent retail closures, and bankruptcies, make us confident about our prospects for continued market share gains in the future.” ROST CEO, 3FQ22 earnings call

“It’s Michael Hartshorn. On market share gains,, longer term, we’re very excited about the market share opportunity ahead of us. We’re in a very healthy sector of retail with the consumer even more focused as you mentioned on value and convenience.” ROST COO, 3FQ22 earnings call

ROST’s historical performance adds to my confidence in its ability to perform. Looking back in time, ROST has performed relatively well during periods of weak macroeconomic conditions, such as the Great Financial Crisis in 2009. Throughout the crisis, from 2007 to 2009, ROST reported positive revenue growth in every quarter. Compared to the US GDP, this shows that ROST is defensive and that its business model is strong.

Scale is a big competitive advantage

The off-price industry relies heavily on efficient inventory management, which is greatly aided by economies of scale. For off-price businesses to turn a profit, inventory management is crucial. When compared to a top-down, chain-wide assortment, ROST’s “micro-merchandising” system dictates supply assortment on a store-by-store basis using historical data in a bottom-up planning approach. The target was to enhance the process of delivering the right stock to the right stores at the appropriate times in order to increase both turnover and profit. On the surface, this seems like a straightforward process, but it’s actually quite complicated due to factors like fluctuating supplies, varied production facilities, shifting demand, and so on. As a result, accurate forecasting is next to impossible. If there wasn’t a reliable system in place to handle this on a daily basis, it would be a nightmare to implement across all 2,000 stores.

Data is the backbone of this system, and ROST has been collecting data for well over a decade now, ever since the system was first put into place. Due to a lack of data, it would be impossible for a new entrant to enter and merely replicate the model. Having a lot of data is also helpful for many other things, like predicting demand and supply, how well merchants will do on the buying team, and how well the assortment will be distributed.

Off-price buyers are constantly on the move, searching the inventory of thousands of stores for the best deals. There are no supply contracts in place to ensure consistent inventory, and the product turns over very quickly (ROST’s average turnover is 6 to 7 times a year). In order to address this issue, ROST has over 900 merchants on its purchasing team to support vendor relationships. The off-price sector has become increasingly significant to these vendors as the annual buying orders from the off-price sector have grown in size. Because merchants have significant purchasing power, experience is critical in executing off-price strategies.

As a result, I believe the ROST business model will be difficult to replace, given ROST’s significant scale, extensive inventory data, and the brand that consumers have associated with coming to find “cheap” and “value” goods.

Value proposition attracts a niche group of customers that are sticky

ROST’s popularity among its core customer base is, in my opinion, largely due to the frequency with which new products are introduced. ROST is able to accomplish this due to its size, inventory data, and purchasing expertise. Customers will only benefit if they actively seek out the discounts offered because ROST only offers in-store purchases and does not promote any of its individual brands. ROST gains a strong reputation in the community as a result of this, as customers’ excitement at finding a good deal can serve as a powerful source of free advertising for ROST.

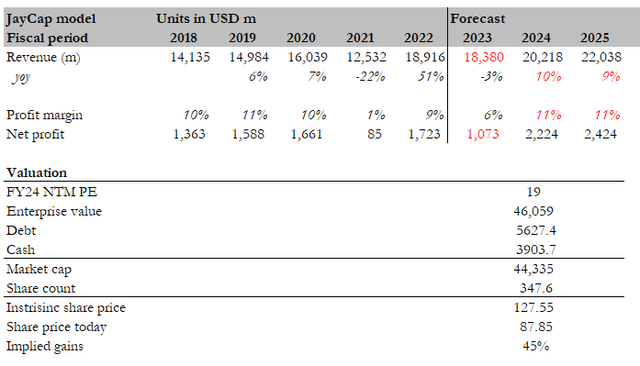

Forecast

Based on my investment thesis, I expect ROST to benefit from the glut of inventories that will pass through the systems to the retail level and from consumers trading down to cheap and valued goods. I believe the thesis will start to crystalize. As such, for my model, I expect growth to step back to 10% in FY24 and 9% in FY25 (similar levels in FY09 and FY10). As for FY23, I have a similar view as consensus, which assumes a slight decline in growth following management’s conservative outlook that 2H23 will see a decline in same-store-sales due to a tough comp last year. Profit wise, ROST should achieve similar profitability as a normalize period (pre-covid) given there is no specific reason why it cannot do so, particularly when the environment is well setup for its success.

Assuming the aforementioned assumptions and a 19x NTM PE (which is where it is trading today), I calculated an intrinsic value of $127, ~45% higher than the current share price of $87.85.

Red flags

History does not rhyme

There is a chance that this time is different, such that consumers are not trading down but instead are saving up. This would be a thesis breaker since I expect consumers to behave in similar ways to what they did back during the Great Financial Crisis.

Inflation

This inflationary environment is good for the industry ROST is operating in. However, if inflation were to sky rocket to a very high level, ROST may find it challenging to price goods in line with inflation and wages, which could reduce customer value perception if constant price hikes are necessary.

Large retailers reduce discounts

If large retailers and department stores stick to their strategy of reducing inventory and advertising discounts less frequently, we may see a decline in the number of discounted products available. What I thought would be good news for ROST could turn out to be neither positive nor negative.

Conclusion

ROST has a very simple business model – selling discounted goods – but has an underlying complex system to support it, which makes it difficult for new entrants to replicate or displace it. The current environment can be considered as “stars are fully aligned” for ROST as demand and supply are combined with weak consumer demand. I think ROST is in a good position to take advantage of this tailwind over the next few quarters, and its share price should reflect its true value as investors see the results in its quarterly reports.

Be the first to comment