Justin Sullivan

After disappointing investors last quarter and lowering the bar substantially for the remained of 2022, Ross Stores (NASDAQ:ROST) delivered a much better-looking fiscal Q3 on November 17. On the headline numbers, the retailer topped expectations by a good margin: revenues by $200 million, the widest of the past four quarters, and EPS by nearly 20 cents. The EPS outlook for Q4 also improved significantly.

With the company now showing signs of better execution in the face of risks and challenges that should remain into 2023, I think ROST is a buy. Value investors may be concerned about seemingly high valuations, considering muted growth. But I think that the stock is priced attractively for a company that could weather an eventual economic downturn better than most retailers.

Ross lowers the bar, then easily hops over it

In Q2, Ross’ management team opted to be “prudent and adopt a more conservative outlook for the balance of the year” due to a number of factors that ranged from macroeconomic uncertainty to a deeply promotional retail environment impacting pricing negatively. I believe that the 12% after-hours pop in share price on Q3 earnings day began to take shape back then, as the company’s executives may have overestimated the troubles that it would encounter in the October quarter.

Comparable sales contraction of 3% came in much better than the 8% decline that was guided at the midpoint of the range. The modest Q3 dip looks even better if compared to 14% positive comps posted this time last year, for a 5% annualized growth rate compounded since 2020.

During the earnings call, the management team explained that, while foot traffic was still relatively slow, larger basket size helped to support revenues. I see this as a positive, as shoppers seem to be finding the deals at the off-price retailer that help them offset lingering inflationary pressures.

Granted, lack of pricing power continues to be a problem. CEO Barbara Rentler repeated a couple of times during the earnings call that this should be “a promotional holiday season”. But while this could have been a head-scratcher for me in the case of a higher-end, full-price retailer with beefy margins to protect, I am less concerned for Ross, whose very business model is rooted in delivering value to its customers.

To be sure, Q4 operating margin was guided at above 10% at the midpoint of the range, higher than last year’s 9.8%. The outlook suggests to me that Ross should be able to roughly balance weak pricing with proper sourcing and inventory management, despite the loss of scale and what I suppose to be higher operating costs. Inventory, by the way, looked much healthier in Q3 relative to Q2, when it had jumped by an astounding 55% YOY and caused some investors to be concerned for a moment.

Why ROST is a buy

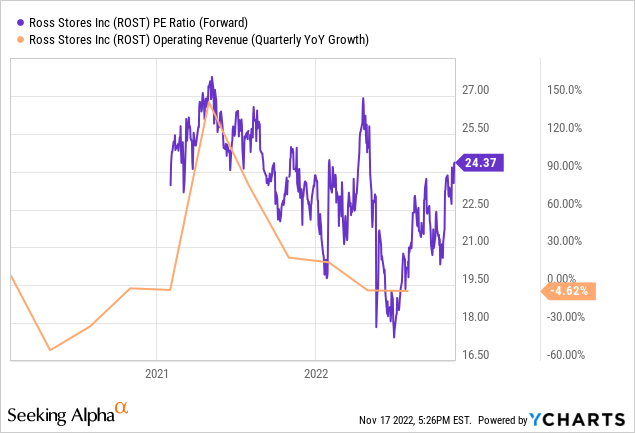

Ross Stores seems to be doing better than feared as the holiday season approaches. But how about a stock valued at a hefty 24x, up from around 18x in June 2022 (see purple line below), when the company has been barely able to grow revenues in a post-pandemic environment (orange line)?

This is what I believe most investors, especially value ones, get wrong. First, ROST’s valuations today are very consistent with those of peer TJX Companies (TJX), for example. But most importantly, the above-market P/E is justified not by growth prospects, but by lower risk of ownership. ROST is a stock that is likely to do better than most during times of more severe economic distress, which could become a reality in 2023.

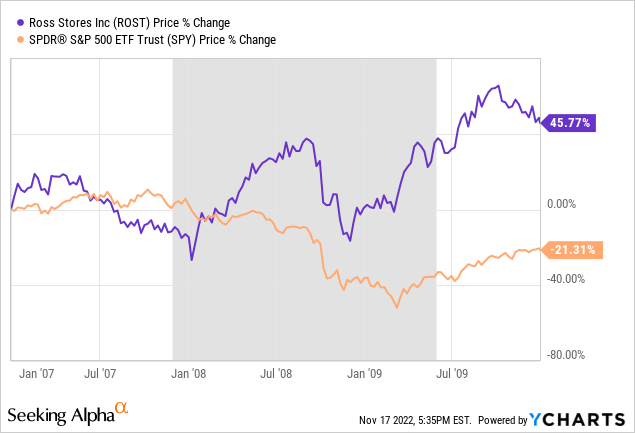

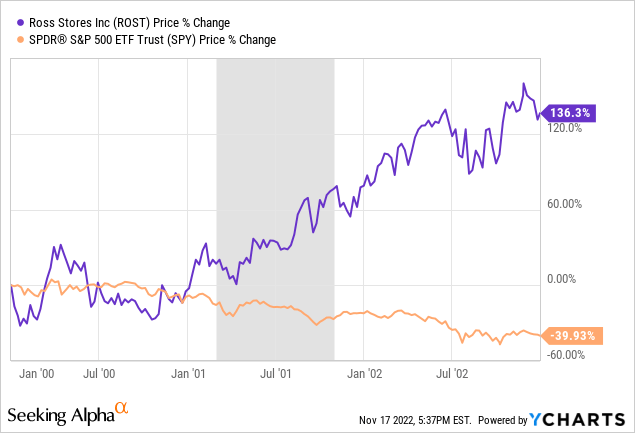

Intuitively, this makes sense. Ross is an off-price retailer that could still find plenty of demand in a low economic growth and/or high inflation environments, as consumers favor discount shopping. Recent history seems to support the idea, as depicted by ROST share price performance ahead of and during the two most recent full-scale recessions in the US (shaded areas in grey), in 2008 and 2001:

Therefore, I see ROST as a good complement to a diversified portfolio — an equity hedge of sorts for the short term, but with upside potential over the long haul regardless of the macroeconomic landscape. While my bullish convictions on this stock were shaken by a disappointing Q2 print, I now feel better about how the company should perform in the important holiday period and the early parts of next year.

Be the first to comment