Jonathan Kitchen/DigitalVision via Getty Images

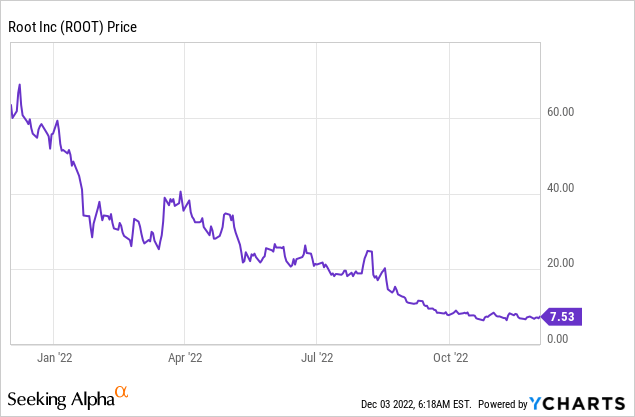

Down 87% year-to-date, the pullback of Root’s (NASDAQ:ROOT) common shares this year has been material and at times seemed like the market no longer thought of the firm as a going concern. The stock performance of the Columbus, Ohio-based car insurance company perhaps represents one of the most dramatic illustrations of how far sentiment has moved from its pandemic-era highs. Root went public at $27 per share in late 2020 and after nearly two years was heading below NASDAQ’s $1 minimum listing requirement. Faced with the risk of being pushed to over-the-counter securities trading and the company engineered a 1-for-18 reverse stock split. The alternative would see the company largely cut off the company from its institutional and retail investor base.

With a market cap now at $106 million, bulls are flagging a broad basket of valuation metrics as showing undervaluation. The company’s 0.32x price-to-sales multiple is 89% lower than its sector average and its price-to-book value is nearly 76% lower than the average. Of course, whilst the PS ratio takes precedence when a company isn’t profitable it has some drawbacks. Root’s collapse has also been built on extremely poor profitability, cash burn, and a broader containment of its total addressable market.

Profitability And Cash Flows: Should Investors Go Bottom Fishing?

Root is chasing a somewhat disruptive and personalized approach to car insurance. The company was the first licensed insurance carrier powered entirely by mobile and has built its insurance rates based on actual car driving data versus more blunt metrics like credit scores. Drivers sign up and drive with the Root app which allows the company to collect and analyze their driving data to create a highly specific quote. Root also offers renters and homeowners insurance.

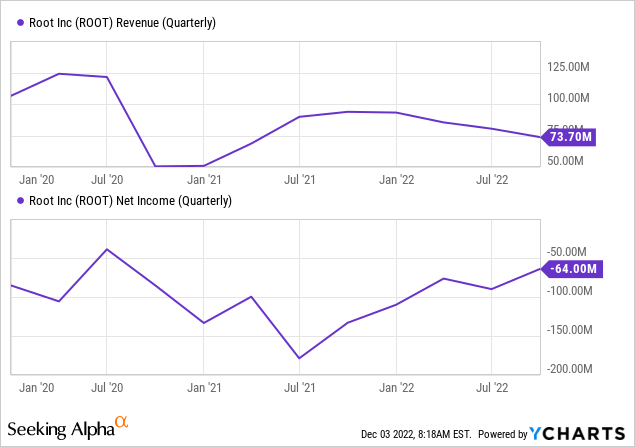

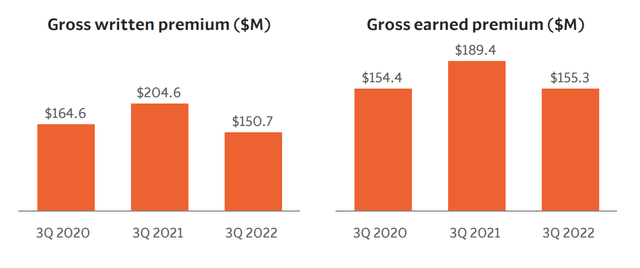

The company last reported earnings for its fiscal 2022 third quarter saw its revenue come in at $73.7 million, down 21.4% year-over-year and a miss of $930,000 on consensus estimates. This decline was the fourth straight quarter of negative growth and was driven by a fall in gross written premium. The total amount of premiums Root received from its policyholders fell to $150.7 million from $204.6 million in the year-ago quarter.

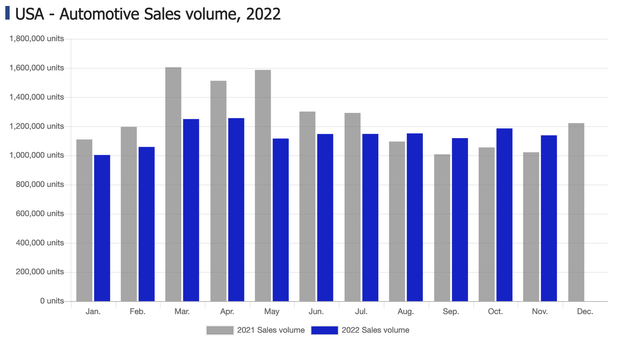

Gross earned premium declined by 18% over its year-ago quarter to reach $155.3 million. Understandably, car sales have not been immune to the current macroeconomic conditions of inflation, rising Fed fund rates and weak economic growth. These factors would have driven some weakness in its core total addressable market which saw sales fall by just under 1% during the third quarter. The trajectory of new and used car sales has an impact on Root’s premium growth as drivers typically get a new insurance policy when they purchase a new vehicle or when their existing policy comes up for renewal.

Whilst car sales volume has been weak compared to 2021 figures, the figures from August onwards are encouraging as shortages of computer chips continue to ease to drive greater factory production from automakers like General Motors (GM). However, interest rates are set to rise further with the FOMC likely to hike by another 50 basis points when they next meet in a few weeks.

Root Likely Unable To Grow Alpha In The Near Term

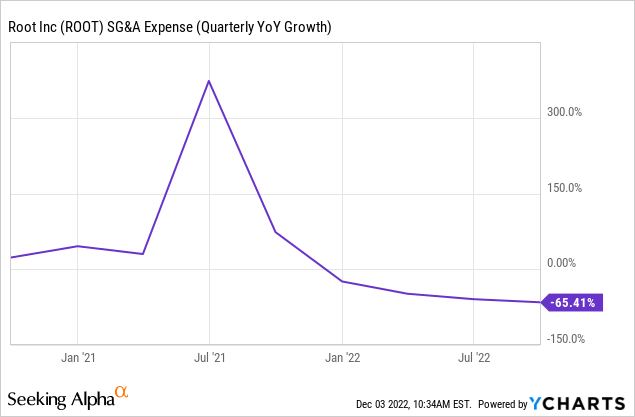

Profitability during the quarter was poor. Net loss for the period was $64 million, nearly 87% of revenue as cash burn from operations came in at $59 million. Whilst bulls were glad that this was down markedly from $137.8 million in the year-ago quarter, total operating expenses continued to be disproportionate to revenue even after significant progress by Root to reduce its SG&A expenses.

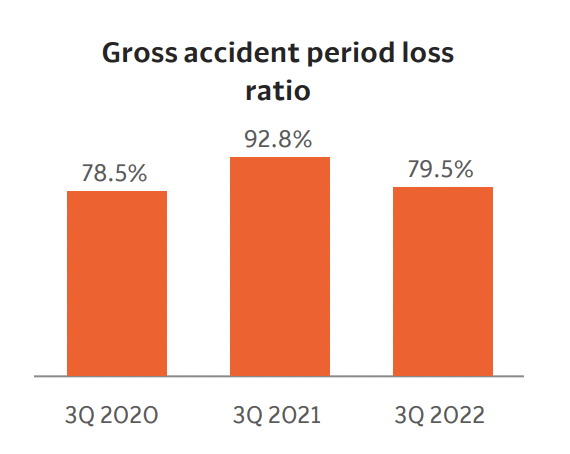

This fell around 65% year-over-year to $39.1 million as management remained focused on driving the company towards positive cash flow. The company recognized a 79% gross accident period loss ratio, down by 1330 basis points from the year-ago figure.

Root

Root expects to be able to realize a further $50 million reduction in expenses with current cost-cutting efforts by its management progressing. This ranges from a reduction in headcount and what has so far been a $60 million reduction in marketing spending since the third quarter of the prior fiscal year. The quarter was poor but one that perhaps signalled the muted sprouting of a potential turnaround.

The current price-to-sales multiple highlights the extent of Root’s pullback. Has the baby been thrown out with the bathwater? No. There is a very limited financial case for buying the commons now. The company’s revenue trajectory is negative, its operations are deeply unprofitable, and the broader macroeconomic conditions signal more future headwinds for its TAM. Near-term upside will be limited and the normal end-of-year-tax loss harvesting could still apply some more pressure on shares.

Be the first to comment