Erikona

Occasionally there are moments when the world’s entire investment community seems to be paying attention to one or two seemingly all-important themes or trends. That has no doubt been the case in the last few years. Remember when we investors were all riveted by any new data point on Covid transmissibility or infection counts? How about any whiff of news of a vaccine forthcoming?

Both of which bring us to inflation today. We all have had to try to become experts in core vs non-core, services vs manufacturing, cost-push vs demand-pull, and even arcane things we had hoped never ever to think about again after the CFA Level III exam, like the Phillips Curve. Yet here we were, cracking open our CFA study books all over again. (Though we are still not sure we fully grasp the intricacies of the Phillips Curve and what if anything it means for stock picking!)

Yes, there are times when anyone with a Bloomberg terminal seems to be closely monitoring the exact same things—which is slightly unnerving if you think about it. Our industry, which prides itself as being full of independent and we dare say contrarian thinkers, can in fact be an industry of informational herders. A galloping horde of financial nerds, glued to our screens. And yet we have to confess that we have been guilty of being part of the herd at times (certainly the nerd part applies to us), checking our news feeds as we watch an event unfold along with everyone else on the planet.

But there are also moments when something big is happening in global markets that is much less widely followed. It is not the story of the moment. It is not the news of the day. It may still even be hiding in the data, on the sly, waiting to be discovered and trumpeted by CNBC and sell-side analysts.

We at Rondure believe one such Next Big Thing is likely starting to unfold right now in the market. That Next Big Thing is the re-emergence of emerging markets.

By re-emergence, we mean the potential for the outperformance of many emerging markets (both stocks and bonds) versus the United States and other developed markets in the coming years. In fact, this outperformance has already begun, even in the face of textbook headwinds:

- A more aggressive Fed than anticipated. The December 2021 dot plot projected 0.5-1.0% fed funds rate for 2022. It stands today at 4.25-4.50%.

- A strong dollar by historical standards relative to other major currencies (20% rally in the DXY during 2022).

- A longer-than-anticipated China lockdown that severely affected economic growth.

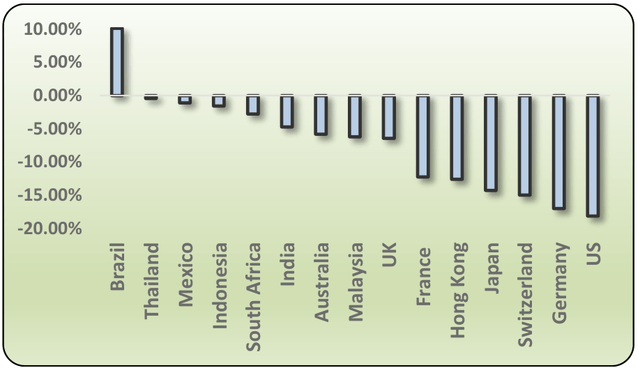

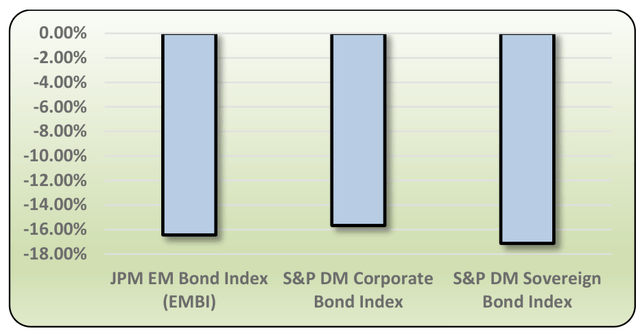

Asked if emerging markets would underperform given this scenario, even the most sophisticated investors would likely answer in the affirmative. Yet look at the two charts below. In 2022, many large emerging stock markets outperformed the US, Europe, and Japan, while EM corporate and sovereign debt fared no worse than their developed market peers.

Figure 1. Total Returns of Public Equities by Country, 2022 (USD) (Source: Bloomberg)

Figure 2. Total Returns of Corporate and Sovereign Bond Indexes in Emerging and Developed Markets, 2022 (USD) (Source: Bloomberg)

What is in store for 2023?

We believe more of the same. After faring so poorly relative to US equities since 2010, we believe leadership is shifting to emerging market equities. Recently, Blake and Laura wrote a white paper, “After a Lost Decade, Emerging Market Equities Deserve a Fresh Look,” mapping out why we think it is time for investors to take a fresh look at this unloved pocket of the global equity market.

When we reflect on 2022, we believe the year’s most important story may not be the Powell Pivot, but the Xi Pivot. The Xi Pivot—from a draconian policy of Zero Covid to a stance of greater openness in pursuit of herd immunity—may prove to be equally consequential to global market outcomes in the months and years to come.

The world’s second largest economy is awakening after three years of Covid-driven containment. Freedom of travel is increasing. Consumers are heading out of doors again. Businesses are beginning to operate less fettered by pandemic-era policies. These changes have brought about a collective sigh to global markets, encouraged by some rays of sunlight replacing the dark clouds of the Chinese economy.

The retiring of Beijing’s Zero Covid policy seems almost certain to be incredibly positive for corporate earnings growth in the Middle Kingdom. Moreover, we believe it should benefit valuation multiples as investors feel greater confidence in Xi’s desire to grow the economy and fulfill what we continue to believe is the vast potential of the Chinese real economy.

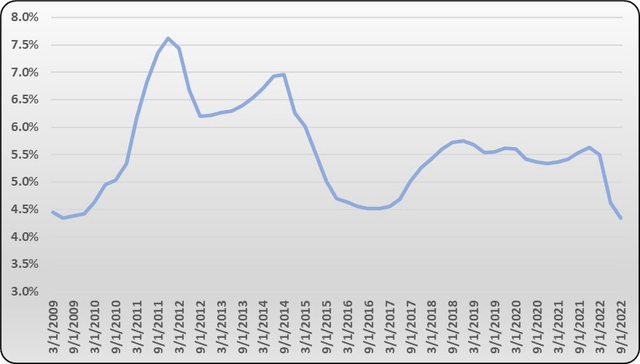

Interestingly, not only are Covid restrictions easing in China, but regulation is, too. China’s property sector, which accounts for ~30% of GDP, is seeing a surge of policy support in an attempt to right the country’s precarious real estate sector. Not only are mortgage rates falling (Figure 3), but the government is planning to relax the “three red lines” policy introduced in 2020 that govern industry leverage metrics. Allowing property companies to add more leverage, whether good or bad, will jumpstart growth. This policy change comes on the heels of RMB 1.3 trillion worth of supportive property measures announced in November (e.g., lower down payment requirements, access to more of the pre-sale funds, lending support for construction companies, easier access to capital in general). Beijing also appears to be lifting certain restrictions on the gaming and internet industries. Plummeting economic growth has sidelined Xi’s “common prosperity” drive, at least for now.

Figure 3. China Weighted Average Mortgage Rates (Source: Bloomberg)

This effort to stabilize the economy and promote consumption is not just good news for China. It is good news for the region, and indeed, the world.

While unusually high policy and economic uncertainty remains with respect to Europe and the United States in 2023, given the Ukraine War and the macroeconomic dilemmas facing both regions, we see greater line of sight to an economic and earnings recovery in China and the emerging world. Coupled with reasonable valuations in most of these markets, prospects look good for emerging market equity returns, from our vantage point.

The case for emerging markets is strengthening with the dissipation of three stiff headwinds: Fed tightening, a strengthening dollar and a moribund Chinese economy. It may not be a smooth ride (is it ever?), but we believe broad outlines of a rally in the developing world are beginning to come into focus.

Overview of Rondure New World Strategy

Our end of year bottom-up screening was done in parallel with the bottoming of emerging market stocks. During our annual review, we realized that individual quality companies had finally gotten cheap enough to buy. We bought. Then, by chance, Xi pivoted. Deploying our capital before the full pivot, enabled us to capture much of the upside in the bull market, while we also protected on the downside during the bear market.

This is the most optimistic we have been on emerging markets in years. Our view is a dramatic change from what we wrote to you in the last quarter. In essence, we pivoted too.

The reasons are simple:

- So goes the dollar, so goes international and emerging market stocks. The dollar appears to be peaking with inflation.

- Emerging market stocks had gotten cheap. They have been in the doldrums for a longer period than developed market stocks. The big correction started in February of 2021 when China peaked, and since then, stocks fell further. In the fourth quarter and now, stocks look inexpensive on both an absolute and relative basis.

- Chinese companies, the big ecommerce companies in particular, started getting more aggressive with their cash balances. Financial engineering started to accelerate.

- China started to end its Zero Covid policy.

- China started to pull back on regulation and focus on growth.

Our value trap comments on China from last quarter now fall into the camp of famous last words. China looks cheap, and we now have a real catalyst with their growth push to get stocks moving again. We made a big adjustment to our China exposure during the quarter, and so far, our timing has been excellent.

We lagged the initial rally, but we are now geared to do better in bull markets. While we have no ability to predict the future, we are keenly aware of times when asset classes have the wind at their backs. 2023 feels like a better year than most to be positive.

Overview of Rondure Overseas Strategy

We experienced a strong bull market rally in the fourth quarter. We kept up, but we did not capture all of the upside.

As mentioned throughout this letter, we think the backdrop for being more aggressive makes sense in 2023, and we also see a lot of great value in quality companies.

China has a strong footprint in the aggregate global economy and hence the Overseas portfolio. We see opportunity in European exporters and industrials, European luxury goods companies, Australian small caps, and Japanese convenience stores, drug stores and cosmetics stores, in addition the countries of Thailand, Taiwan, South Korea, Hong Kong and Japan are obvious beneficiaries of China’s revenge spending and travel, and we see many opportunities in stocks in these places. We are optimistic about what we are finding and the year ahead.

Firm Updates

Our most important jobs are performance and providing excellent client services. Since our founding, our Chairwoman, Laura Geritz, has held far too many titles. In recognition of the great work accomplished by the team this year, we are improving our governance structure and division of labor. As of January 2023, industry veteran and partner, Jennifer McCulloch Dunne, is now Rondure’s Chief Executive Officer. She will also be spearheading our ESG efforts along with Blake Clayton. Jennifer is an exceptional partner, person, and leader, and we look forward to what she accomplishes in the years ahead. Blake is now the firm’s Chief Investment Officer. Blake has been an instrumental voice in our process and how we think about investments. Amy Hone, who has been an outstanding member of the Grandeur Peak and Rondure operations efforts since inception, has been named as Rondure’s Chief Compliance Officer in addition to her role as Vice President of Compliance and Operations for Grandeur Peak. We are truly lucky to have her and excited about what her leadership and tenured experience will bring to Rondure’s team. Finally, our excellent industry veteran, Sunshine Alexis Stein, will remain at the helm on client relations and DEI, while Laura Geritz will remain Chairwoman and Portfolio Manager. The team views these evolutions as extremely positive—a reflection of the confidence we have going forward and the enthusiasm we have for the upcoming year.

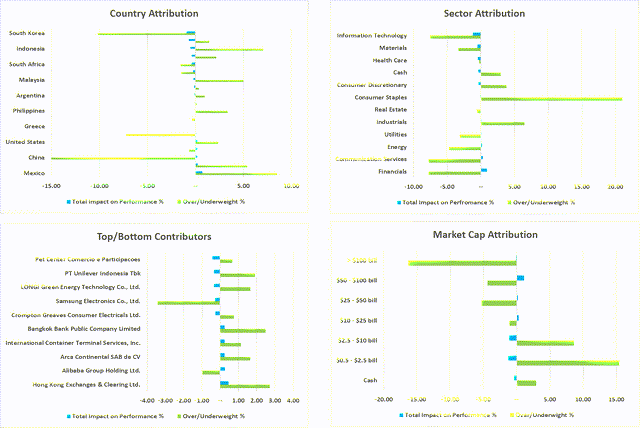

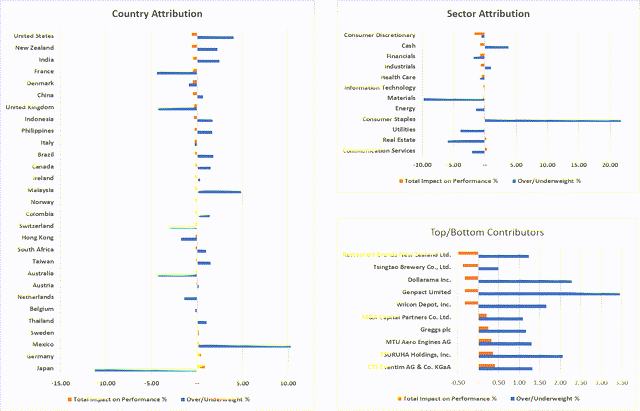

NEW WORLD ATTRIBUTION DASHBOARD 4Q 2022

|

Source: FactSet – 9/30/22 – 12/31/22. Current and future holdings are subject to risk and may change at any time. References to specific securities are not a recommendation to buy or sell. Past performance is not a guarantee of future results. References on this page to Over/Underweight are based on comparison to the MSCI Emerging Markets Total Return USD Index. Please see attached disclosures. |

OVERSEAS ATTRIBUTION DASHBOARD 4Q 2022

|

Source: FactSet – 9/30/22 – 12/31/22. Current and future holdings are subject to risk and may change at any time. References to specific securities are not a recommendation to buy or sell. Past performance is not a guarantee of future results. References on this page to Over/Underweight are based on comparison to the MSCI Emerging Markets Total Return USD Index. Please see attached disclosures. |

Rondure Funds Performance as of 12/31/22

|

Rondure New World Fund |

QTR |

YTD |

1 Year* |

3 Year* |

5 Year* |

Since Inception |

|

Institutional |

7.36% |

-13.99% |

-13.99% |

1.72% |

1.60% |

22.40% |

|

Investor |

7.22% |

-14.19% |

-14.9% |

1.44% |

1.33% |

20.62% |

|

MSCI Emerging Markets TR Net Index1 |

9.70% |

-20.09% |

-20.09% |

-2.69% |

-1.40% |

12.16% |

|

Rondure Overseas Fund |

QTR |

YTD |

1 Year* |

3 Year* |

5 Year* |

Since Inception |

|

Institution |

9.82% |

-24.96% |

-24.96% |

-0.78% |

0.46% |

18.80% |

|

Investor |

9.68% |

-25.18% |

-25.18% |

-1.05% |

0.23% |

17.14% |

|

MSCI ACWI ex US Mid Cap TR Index2 |

14.41% |

-18.66% |

-18.66% |

-0.82% |

0.20% |

17.12% |

|

MSCI EAFE TR Index3 |

17.34% |

-14.45% |

-14.45% |

0.87% |

1.54% |

25.72% |

|

*Annualized 1 The MSCI Emerging Markets Total Return USD Index is an unmanaged total return index, reported in U.S. Dollars, based on share prices and reinvested dividends of approximately 1,383 companies from 26 emerging market countries. You cannot invest directly in an index. 2 The MSCI ACWI ex USA Mid Cap Index captures mid cap representation across 22 Developed Markets (DM) and 24 Emerging Markets (EM) countries*. With 1,200 constituents, the index covers approximately 15% of the free float-adjusted market capitalization in each country. You cannot invest directly in an index. 3 The MSCI EAFE Total Return USD Index is an unmanaged total return index, reported in U.S. dollars, based on share prices and reinvested net dividends of approximately 900 companies from 21 developed market countries excluding the US and Canada. You cannot invest directly in an index. |

|

Data shows past performance, which is not indicative of future performance. Current performance may be lower or higher than the data quoted. To obtain the most recent performance data available, please visit www.rondureglobal.com. The Advisor may absorb certain Fund expenses, without which total return would have been lower. These expense agreements are in effect through August 31, 2023. Investment returns and principal value will fluctuate and shares, when redeemed, may be worth more or less than their original cost. The Advisor has agreed to waive and/or reimburse fees or expenses in order to limit Total Annual Fund Operating Expenses After Fee Waiver/Expense Reimbursement (excluding acquired fund fees and expenses, brokerage expenses, interest expense, taxes and extraordinary expenses) to 1.35% and 1.10% of the Fund’s average daily net assets for the Fund’s Investor Class Shares and Institutional Class Shares, respectively. This agreement (“the Expense Agreement”) shall continue at least through August 31, 2023. The Adviser will be permitted to recapture, on a class-by-class basis, expenses it has borne through the Expense Agreement to the extent that the Fund’s expenses in later periods fall below the annual rate set forth in the Expense Agreement or in previous letter agreements; provided, however, that such recapture payments do not cause the Fund’s expense ration (after recapture) to exceed the lesser of 9i) the expense cap in effect at the time of the waiver and ((ii)) the expense cap in effect at the time of the recapture. Notwithstanding the foregoing, the Fund will not pay any such deferred fees and expenses more than three years after the date on which the fee and expenses were deferred. The Expense agreement may not be terminated or modified by the Adviser prior to August 31, 2023, expect with approval of the Fund’s Board of Trustees. An investor should consider investment objectives, risks, charges, and expenses carefully before investing. Visit www.rondureglobal.com to obtain a Rondure Funds Prospectus, which contain this and other information, or call 1.855.775.3337. Read the prospectus carefully before investing. See the prospectus for additional information regarding Fund expenses. Rondure Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. Performance data does not reflect the deduction of this redemption fee or taxes, which if reflected, would reduce the performance quoted. For more complete information including charges, risks and expenses, read the prospectus carefully. The objective of all Rondure Funds is long-term growth of capital. RISKS: Investing in foreign securities entails special risks, such as currency fluctuations and political uncertainties, which are described in more detail in the prospectus. Investments in emerging and frontier markets are subject to the same risks as other foreign securities and may be subject to greater risks than investments in foreign countries with more established economies and securities markets. Diversification does not eliminate the risk of experiencing investment loses. Rondure New World Fund (RNWOX/RNWIX) – Inception date of 05/01/2017. Expense ratios as of prospectus dated 08/31/2022 are: RNWOX: 1.58% Gross / 1.35% Net, RNWIX: 1.27% Gross / 1.10% Net Rondure Overseas Fund (ROSOX/ROSIX)) – Inception date of 05/01/2017 Expense ratios as of prospectus dated 08/31/2022 are: ROSOX: 1.88% Gross / 1.10% Net, ROSIX: 1.56% Gross / 0.85% Net RON000463 / Exp. 05/01/2023 |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment