Justin Sullivan

I have a somewhat mixed relationship with Roku (NASDAQ:ROKU) stock. Back in March 2020 I said it was time to start scaling into the ROKU shares. The stock was $77 at the time. Less than 12 months later ROKU was knocking on $500’s door; a 6x from my original call. After a swift decline from the $480’s and a double top in that range that soon followed in July of 2021, the stock has been in a slide that has offered virtually no relief for bulls at any point. The decline has essentially been a mirror image of the 2020-2021 run up to $480.

Given the relentlessness of the selloff, I assumed $150 was the bottom in February of this year and wrote about why I believed bulls would regain control based on seller exhaustion that I saw in my technical analysis. Shortly after my bottom declaration, I was served a marvelous helping of humble pie. I can still taste it now! Turns out, I saw what I wanted to see in the astrology that TA can often be. That didn’t stop me from taking another stab at Roku at $113 just a few weeks later following an abysmal earnings report. The stock has fallen another 50% from there. And here I am yet again; ready and willing for the purple sword that is a Roku bullish bias in a risk-off macro environment. This time truly is different; but don’t worry, I’m not using astrology to justify my thinking.

Is Roku Actually Cheap Down Here?

If you believe the market is forward looking, then I think we could argue that most of the problems Roku is now dealing with have already been priced in. Roku has essentially two revenue buckets, hardware and platform. The platform revenue comes from advertising and the hardware revenue is a negative margin customer acquisition expense. Essentially, Roku is willing to take a loss on the device sales so that it can acquire the eyeballs for ad serving.

The problem with each of these models in a recession is the consumer may stop buying the devices and the advertiser may stop buying the eyeballs. This is basically a worst-case scenario for Roku because it means both of their revenue buckets will be struggling at the same time. While Roku is still working towards getting to profitability, there are signs that have been encouraging.

The ARPU has continued to increase on a quarterly basis from $36.46 a year ago to $44.10 even as the company has seen pressure on ad-sales. When I see a company that has experienced a stock price decline of 90% from the high, it usually would be a sign that there is something very wrong with the business or the industry that the company is in is failing. I don’t think either are true for Roku and I actually think when we compare some of Roku’s valuation metrics to a streaming peer like Netflix (NFLX), it might indicate Roku has actually been de-risked following this massive sell-off.

| TTM | ROKU | NFLX |

| Price/Sales | 2.65 | 3.42 |

| EV/Sales | 2.12 | 3.73 |

| EV/EBITDA | 36.94 | 18.59 |

| Price to Book | 2.94 | 5.57 |

Source: Seeking Alpha

Comparing Roku to Netflix on metrics like Price to Sales and Price to Book, the case could be made that Roku is actually getting pretty attractive from a risk/reward perspective given the industry that it is operating in. The balance sheet is also screaming mispricing.

| ROKU | NFLX | |

| Total Cash | $2.05B | $5.82B |

| Total Cash Per Share | $14.87 | $13.09 |

| Total Debt | $721.3M | $16.91B |

| Net Debt | -$1.33B | $11.09B |

| Total Debt to Equity | 25.80% | 88.64% |

Source: Seeking Alpha

Roku has a negative net debt figure and a much smaller debt to equity position than Netflix. Furthermore, I didn’t pick Netflix as the comp by accident; these two companies are definitely linked at the moment.

The Netflix Narrative: It Does Make Some Sense

Netflix and Roku have been in the news together because of speculation that Roku could be a buyout target for Netflix. While Netflix’ sVOD model is completely different from Roku’s aVOD model, after steadfastly denying the development of an advertising-based supplemental business, Netflix is now openly planning to build out an ad-based service tier. For Netflix, acquiring Roku could solve a couple of problems. Obviously, an acquisition would bring an ad-based platform, sales team, and pre-existing ad client agreements under Netflix’ control. But the bigger reason for Netflix to buy Roku may be to own the Roku operating system entirely.

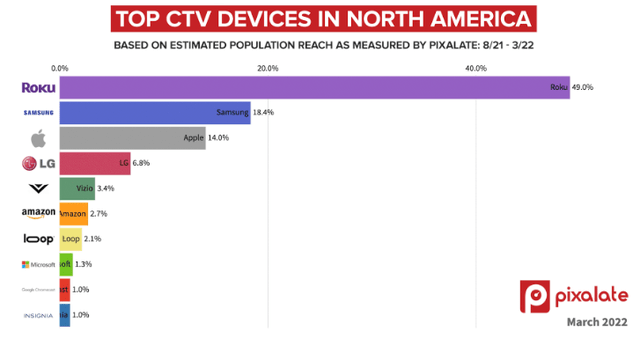

This is something that Netflix has never needed even while streaming channel peers like Apple+ (AAPL) and Prime Video (AMZN) are all owned by companies that are in the device game as well with Amazon’s Firestick and Apple’s AppleTV. This theoretically puts Netflix in a disadvantageous situation because it is now competing with companies that have the ability to put a thumb on the scale in the streaming market.

Since Netflix has already enjoyed significant market share domestically as a streaming platform regardless of which device the viewer is using, operating system control hasn’t been as important. But with Netflix’ now seeing subscriber churn and the streaming platform landscape adapting through the years, Netflix may now find itself in a position where it has to own a popular OS in addition to a popular platform to protect its own interests.

The deal would make sense for Roku as well. Roku is quite clearly entertaining the need for exclusive content to help drive viewing. The company purchased the Quibi assets and branded them as Roku Originals. The new Weird Al movie is premiering on The Roku Channel in November rather than on Netflix, Prime Video, or Hulu (DIS). From where I sit, a Netflix/Roku deal makes a lot of sense for all parties involved. And at an $8 billion current market valuation for Roku, Netflix may not have to pay too much of a premium to acquire the country’s most popular streaming OS, a viable aVOD channel, and $2 billion in cash with just $721 million in total debt. It’s kind of a no-brainer down here.

Summary

If it’s a no-brainer for Netflix to buy Roku, it might be a no-brainer for me to buy Roku as well. I’ve now added shares under $60. While my average is still ghoulish at a little over $100, I think this stock can get it back. We’ve recently seen Roku amend change of control language and close a trading window for employees. I understand many of the problems Roku is now facing. OS competition is certainly a concern and Roku attempting to protect itself through exclusive content is going to be a very expensive endeavor.

For Netflix, nothing lasts forever. The proliferation of streaming platform alternatives may continue to put pressure on its ability to buy or lease popular content. It wasn’t that long ago Marvel movies could be found on Netflix. Now, viewers need a different app for that. Things are changing in streaming media, quickly. That means Netflix is going to have to adapt. And one way that it can do that is by owning an OS the same way many of its peers do. I’ve been wrong about Roku all year. But after a 90% selloff from the high and buyout buzz that actually might make some sense, I think ROKU has been de-risked at $60.

Be the first to comment