Pgiam/iStock via Getty Images

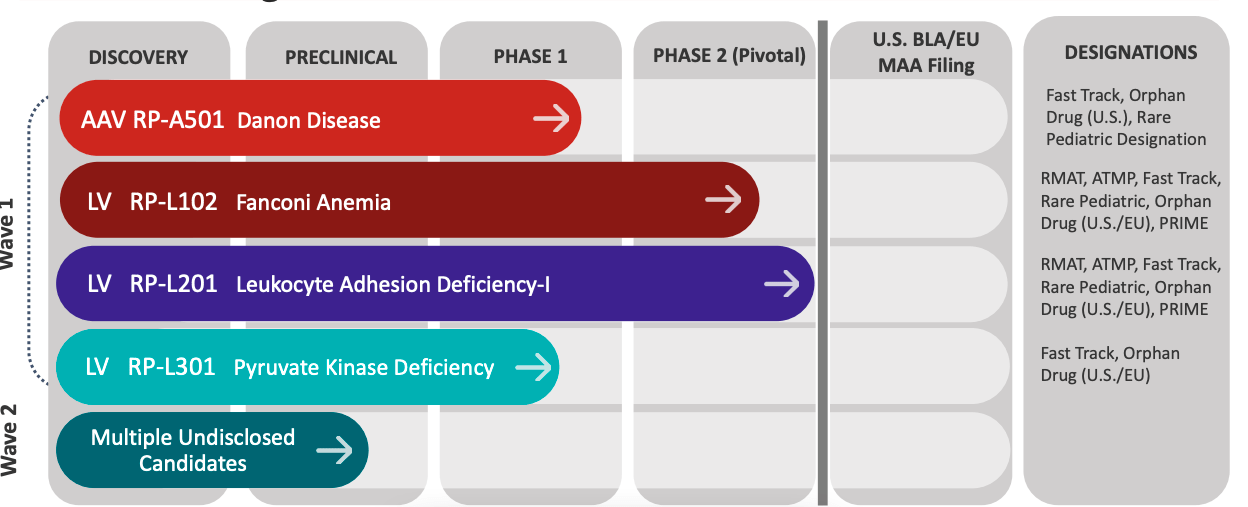

Rocket Pharmaceuticals, Inc. (NASDAQ:RCKT) aims to cure rare diseases using gene therapy. Its pipeline looks like this:

PIPELINE (Co website)

About the company, they claim the following in their Corporate Presentation: they have 4 programs with compelling clinical proof of concept. Each molecule is first, best, and only-in-class, with clear mechanisms of action and clinical endpoints. Their approach is directed towards less-expensive treatment options for diseases currently needing expensive transplants and lifelong care. They have a 100,00 sqft in-house AAV (adeno-associated vector) manufacturing capability in New Jersey. Management has experience developing over 20 commercial drugs.

The company has three clinical-stage ex vivo lentiviral vector (“LVV”) programs. These target Fanconi Anemia (‘FA), Leukocyte Adhesion Deficiency-I (“LAD-I”), and Pyruvate Kinase Deficiency (“PKD”). FA is a rare red blood cell autosomal recessive disorder that results in chronic non-spherocytic hemolytic anemia. LAD-I is a genetic defect in the bone marrow that reduces production of blood cells or promotes the production of faulty blood cells. PKD is a genetic disorder that causes the immune system to malfunction. [These descriptions are taken from the 10-K].

The company says that the phase 2 FA program and the phase 1/2 LAD-I program are in registration-enabling studies. This is possible in such earlier stage studies because these are extremely rare diseases. The company also has a program in Danon disease, which is a multi-organ lysosomal-associated disorder leading to early death due to heart failure. This program uses the AAV vector.

Data is available from a number of programs. In 2018, positive data was announced from a phase 1/2 trial in FA. Data in five patients showed a treatment effect, with all patients showing continuing improvement in restoration of functionality of hematopoietic stem cells in bone marrow. One patient had a 44% improvement in peripheral blood vector copy number (VCN), a measure of the transduction (transfer of genetic material) of hematopoietic progenitor cells. 12-month follow-up data on four patients showed durable engraftment, ranging from 18 – 30 months since gene therapy administration as well as improvements in two key measures of functional and phenotypic correction in FA.

In 2020, the company presented early phase 1 data from the Danon disease program. A low dose cohort saw a positive increase in cardiac protein expression. There was also a decrease in BNP, a cardiac biomarker, of more than 50%, and stabilization of clinical biomarkers CK-MB and Transaminases in two patients. Researchers also observed visible reduction of autophagic vacuoles (a primary hallmark of Danon disease) in heart muscle.

In May 2021 the FDA placed a clinical hold on this program to have the company add additional risk mitigation measures in the study protocol. By August, the hold was lifted.

In November, Rocket stock crashed after the company decided to exclude the high dose group from the study after one of the two subjects who received the higher dose developed dose-dependent toxicity that led to thrombotic microangiopathy (TMA). Although the issue was resolved, the company decided not to take any risks.

Last year, in the phase 1 LAD-I trial, RP-L301 showed durable normalization of hemoglobin levels up to 6 months following therapy and a similar 3-month trend in the second patient treated. In interim data from a phase 1/2 trial, the following data were observed:

-

The data are from the initial seven patients with severe LAD-I, as defined by CD18 expression of less than 2%, who were treated with RP-L201, Rocket’s ex-vivo lentiviral gene therapy candidate.

-

All seven patients demonstrated durable neutrophil CD18 expression that exceeded the 4-10% threshold associated with survival into adulthood and consistent with reversal of the severe LAD-I phenotype, the company said.

-

Peripheral blood vector copy number (VCN) levels have been stable and in the 0.5 – 2.5 copy per genome range.

The company has decided to pursue full approval instead of accelerated approval by collecting survival data. This came after the company unveiled 100% survival data in 7 patients from the phase 2 pivotal trial at the 25th Annual Meeting of the American Society of Gene and Cell Therapy in May. An NDA is being planned in 2023.

Financials

RCKT has a market cap of $918mn after steadily going down over the last several quarters and losing nearly $2bn in market cap. It has a cash balance of $346mn. Research and development expenses were $30.8 million for the three months ended March 31, 2022, while general and administrative expenses were $11.7 million. At that rate, and given the small size of their trials given the rare nature of the target indications, they have a cash runway of nearly 2 years.

Danon disease has an estimated US+EU prevalence of 15,000-30,000. Current treatment option is heart transplant, which is associated with considerable morbidity and mortality (10y OS 50%) and available to ~20% of DD patients only. For PKD, total worldwide patients are around 8000. The addressable market is just around ~250-500 transfusion-dependent post-splenectomy patients/year. Current standard of care includes chronic blood transfusions and splenectomy.

There is a major unmet need because these treatments could cause iron overload and extensive end-organ damage. For FA, there are around 4000 US+EU patients with around 500 patients per year. Current standard of care is Allogeneic hematopoietic stem cell transplant. This is associated with 100-day mortality, GVHD, and additional increased cancer risk. The same treatment is also standard for LAD-I-, which also has the smallest market, around 25-50 patients for severe LAD-I and 100 for the moderate version. [This information was taken from the Corporate Presentation].

I especially liked this nice marketing technique from this small company. The CEO is a Harvard/Columbia educated physician, and these little ideas show intelligence.

The company has not had an earnings call conference since August last.

Bottom Line

As I do generally, I liked this rare disease company. They have some strong clinical data from each of their 4 leading programs; they have cash; they seem to have smart management; they have major catalysts. They are also trading quite at a discount to their 52-week high. I think this is a buy the dip stock. The only caveat is the small market size for individual indications; however, since there is low competition in most of these markets, Rocket has positioned itself well.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Be the first to comment