R_Type/iStock via Getty Images

Rocket Lab (NASDAQ:RKLB) has unveiled a new rocket called the Neutron which is Scheduled to fly in 2024 and which has been inspired by SpaceX’s (SPACE) Falcon 9.

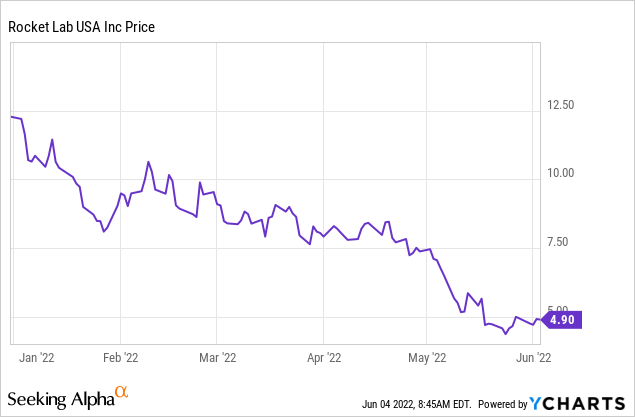

In the meantime, as shown in the chart below, its stock which has been down by over 50% for the last year, got some reprieve in May, after the Electron rocket successfully carried out its 26th mission. Elon Musk’s announcement that he was looking for funding valuing privately-held SpaceX at $125 billion also provided some support to the stock.

Thus, my mission with this thesis is to assess the rationale to invest in Rocket Lab through a comparison with SpaceX which is now perceived as a standard-bearer for space-destined launches.

Rocket Lab’s Electron

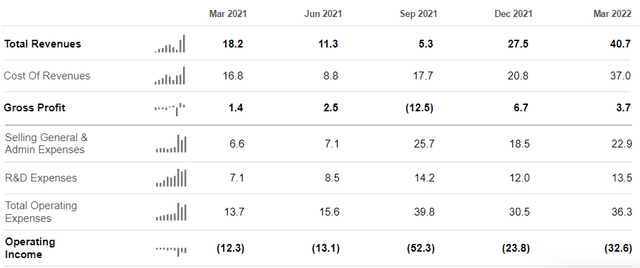

Rocket Lab’s Electron launch vehicle has proved instrumental in deploying a total of 146 satellites into orbit to date. As a result, quarterly revenues have been progressing reaching $40.7 million in the first quarter of 2022 (table below). Since Q1 ended in March, it does not include all the revenues obtained through the May 3 launch when 34 satellites were deployed.

Quarterly income statement (Seeking Alpha)

Revenues for the latest reported quarter represented a growth of 48% over the previous quarter and a whopping 124% increase compared to 2021. On the other hand, there was a reduction in gross margins due to unforeseen expenses related to the acquisition of SolAero, a company specializing in solar panels for space vehicles. Rocket Lab acquired the company in January of this year for $80 million. There were also additional overhead expenses related to a delayed launch in the first quarter.

Now, for those who like to watch rocket launches, it has been fascinating to see how SpaceX’s rockets, namely the first-stage booster flies back and lands safely while the second stage proceeds to deploy the satellites into orbit. This contrasts sharply with NASA’s or Russia’s Soyuz space missions we are familiar with where the booster is typically lost as it crashes down somewhere in the ocean. Hence, SpaceX is able to reuse a rocket for a second and third resulting not only in savings on material costs needed to manufacture a new vehicle but also allowing for an increase in launch frequency.

Now, in an attempt to partially emulate SpaceX, Rocket Lab’s latest mission attempted to catch the rocket booster while it was falling to the ground using a helicopter. The mid-air capture was only partly successful, as after hooking the rocket, the helicopter pilot had to drop it in the ocean where it was recovered by a ship dedicated to the purpose. As per the company’s CEO, engineers are closely examining what’s left to assess which booster parts can be launched again.

In case the rockets can be reused, it first means more launch revenues within a one-year period, and, equally important, it makes possible an improvement in gross profits too as production costs are slashed. Thus, even if the Electron was not designed like SpaceX’s Falcon to be reusable, Rocket Labs is making efforts to capture it, paving the way for more sales.

Risks and Revenue Diversification

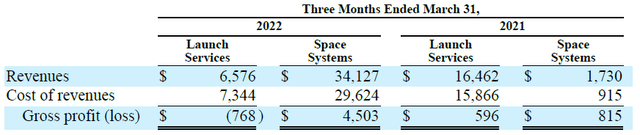

For this purpose, the company reports revenues into two segments, namely Launch services and Space systems as shown below.

Segmental Revenues (Rocket Lab IR)

Here, a noteworthy point is that sales obtained from Space Systems have gained momentum in Q1 compared to last year and accounted for the bulk of the company’s revenues at 84%. This segment consists of a wide array of services that cater to the satellite ecosystem like space engineering, spacecraft components, and manufacturing.

Now, considering the risks involved in launching a rocket, Space Systems is also synonymous with diversification. Additionally, if there is more competition in the launch services industry, the company can rely on this segment as another revenue stream. Space Systems is more profitable too and its non-GAAP gross margins were 28% in Q1 compared to only 1% for Launch Services.

Thinking aloud, Rocket Lab can also develop other industry verticals just like SpaceX has done with Starlink (STRLK) to provide satellite-based broadband communications services rapidly in many countries including Ukraine. This represents a more rapid connectivity option instead of laying down time-consuming fiber or deploying expensive mobile wireless.

The competition

Staying with SpaceX, the company has launched its Falcon 9 rockets 156 times since 2010. These have a payload of 22,800 kg for LEO (Low Earth Orbit) compared with 300 kg for the Electron. With Neutron, Rocket lab will have a 13,000 kg payload paving the way for it to compete more directly with SpaceX. This said, the Neutron still has to be tested first, but, its architecture will be based on the Electron which is operational with a solid track record of twenty-six launches, including 23 successes and three failures.

One failure occurred during an initial period when there was no satellite on board and after removing this test mission, I calculated the company to have a success rate of 92.3% (24/26). This compares to 95.1% for SpaceX, which nonetheless has a much longer history of flights with nine failures occurring from 2010 to 2019.

Thus, this is not a like-to-like comparison when taking into account the number of flights as well as the type of incidents encountered. Nonetheless, despite its newcomer status, Rocket Lab has to be credited with rapidly developing its technology as the Neutron’s booster stage is planned to be reusable, exactly like SpaceX, in what has now become the new launch standard aimed at reducing costs and increasing launch frequencies.

Both companies have also positioned themselves to profit from the rapidly growing space launch services market which is growing at a CAGR of 15.7% since 2020 and should reach $32.41 billion by 2027. In this respect, Rocket Lab has bagged a contract with NASA for carrying lunar CubeSats (square-shaped small) satellites using its Electron rocket with the launch window scheduled for this month. The company already deployed satellites to orbit for NASA in 2018. Any successful outcome could prove beneficial for the stock price, but any launch delay may trigger volatility.

Valuations and Key takeaways

In addition to space news-related events, there are also financial updates that can impart volatility to the stock. Thus, after missing earnings on May 16, it lost 19% of its value, despite beating revenues by $0.85 million. This shows that in a market where the value strategy prevails, investors tend to look predominantly at profitability. Therefore, investors should brace for some short-term volatility.

Looking at the longer term and comparing it with SpaceX’s $125 billion valuations, Rocket Lab with an enterprise value of just $1.82 billion is undervalued by a little under 70 times (125/1.82). This is not fair given its progress with small payloads and plans for larger ones.

First, considering the number of launches, SpaceX has 6 (156/26) times more space flights to its credit than Rocket Lab, and second, its payload capacity exceeds the latter by 76 (12800/300) times. Averaging out, I obtain 41 ((76+6)/2)) which represents the multiple by which Elon Musk’s company should be valued with respect to Rocket Lab. Thus, dividing SpaceX’s value by 41 equals $3.05 billion which is a fairer value for Rocket Lab. This in turn leads to a target of $8.2 based on the current share price of $4.9.

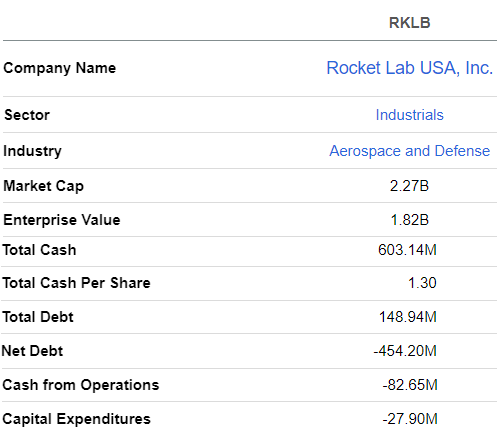

The company also has the cash to fund operations while suffering from a relatively lower debt level as shown in the table below.

Key metrics (Seeking Alpha)

Pursuing further, the company’s diversification path and capability as an end-to-end provider are illustrated through orders for three Photon spacecraft, by Varda Space Industries, following a bulk-order deal forged in August 2021. These orders for an undisclosed amount should add to the backlog of approximately $300 million Rocket Lab had at the end of Q1.

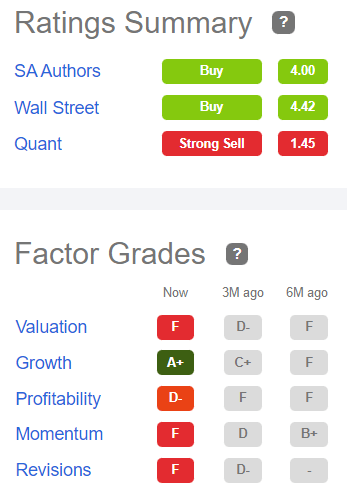

Adopting some caution, there are risks that the stock could suffer a further downside as inflation bites harder with some economists even talking about a recession. For this matter, the company scores a valuation grade of F as shown below and is rated a “strong sell” by SA’s Quant.

Ratings Summary and Factor Grades (Seeking Alpha)

However, Rocket Lab can rely on wholesale (bulk buying by clients) whereby the same rocket launch can be used to position relatively more satellites around the same orbit. This enables the company to sustain sales while keeping costs at around $7.5 million per launch, which is up by $2.5 million from what was being charged 3 to 4 years ago. Therefore, the company has pricing power.

Talking profitability, the real game-changer would be a successful hook-up of a falling booster by a Sikorsky 92 helicopter to be fully reused on the launchpad. This is feasible with some more practice and some tweaks. The company can also rely on the expansion of its more profitable Space Systems segment.

Finally, after considering all the risks, Rocket Lab is a long-term buy at $4.9, and again taking Elon Musk’s space venture as an example, this is a billion-dollar market with massive opportunities for a reliable satellite launcher.

Be the first to comment