Waldemarus/iStock via Getty Images

The Rocket Companies investment challenge

I’ve had a negative view on Rocket’s stock since my first Seeking Alpha report on March 4, 2021, when the stock was $17. Rocket’s stock is off 77% from its high, and 60% from my report, reflecting steady declines in its expected earnings. Analysts (Seeking Alpha) now expect Rocket to generate EPS of only $0.13 this year (implying second half losses), $0.54 next year and $0.83 in 2024.

While Rocket’s road ahead remains rocky, I think the stock is now cheap enough, and Rocket has enough strengths and a big enough eventual upside, to start nibbling at. So I’ve turned from recommending sales to a cautious buy.

The rocky road ahead – a summary

Because Rocket is very largely a mortgage banker. While the company calls itself “Rocket Companies”, it’s really “Rocket Mortgage”, with a little fintech business. The mortgage banking business added substantial capacity to handle a highly profitable COVID-driven refinancing and home sale boom. But the mortgage banking business is now well into a serious recession, as rising interest rates and a surge in home prices ended the refinancing boom ended and reduced home sales. Basic economics says that falling demand and the now-excess supply means lower prices and profits. And I believe things will get worse before they get better for mortgage bankers, based on my demand and supply outlooks.

The rocky road ahead – the demand risk

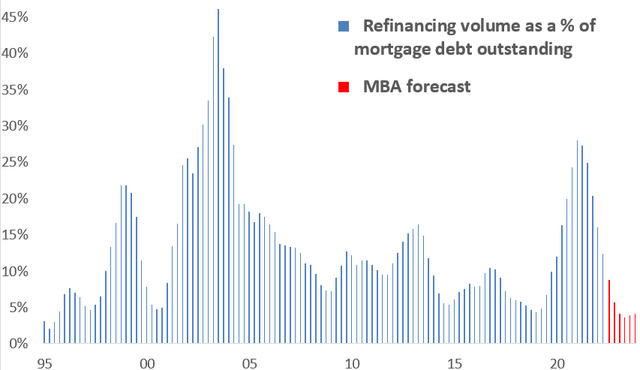

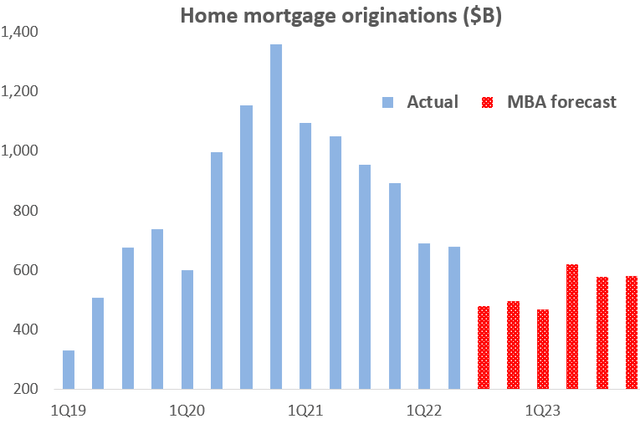

Mortgage originations obviously plunged over the past year, largely because of the more than doubling of mortgage rates. This chart shows the decline, plus the forecast by the Mortgage Bankers Association (MBA) through next year:

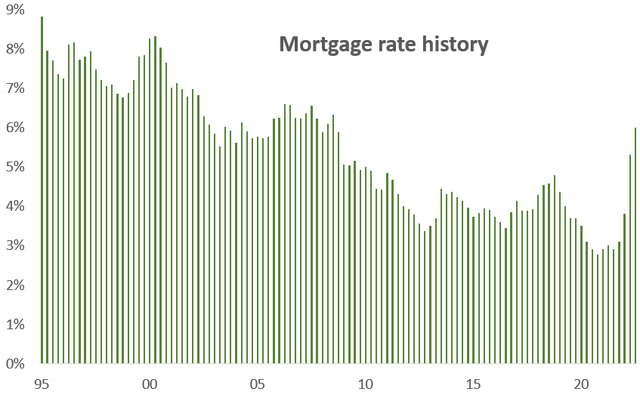

Could there be a downside even to the seemingly conservative MBA forecast? Sadly yes, because of this chart showing a history of mortgage rates since 1995:

The chart shows that this year we’ve had a mortgage rate shock not experienced in the U.S. since the 1980s.

How bad could mortgage origination volume get? The following two charts help us think about that question. They separately show mortgage originations for refinancing and home purchase, as a percent of mortgage debt outstanding. First, the refinancing data history:

Mortgage Bankers Association and Federal Reserve

You can see the surge in refinancing after the COVID interest rate cuts, then the MBA’s expected plunge to near-record lows. Could refinancing go even lower than the MBA forecast? Maybe, but not by much. So OK for Rocket and its mortgage banking peers here.

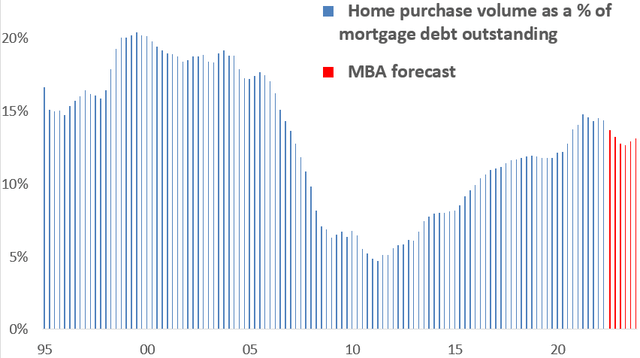

Now the home sale mortgage origination history and MBA forecast:

Mortgage Bankers Association and Federal Reserve

Here, the decline forecasted by the MBA is much more modest. While I am a long-term housing bull because the country has a serious housing shortage, I can imagine a materially bigger decline in housing turnover over the next few years because housing has become so much less affordable over the past year.

In sum, demand for Rocket’s mortgage banking business could still be disappointing. The MBA forecasts $3¼ trillion of mortgage originations from Q3 ’22 through ’23. They could easily be 10-15% less.

The rocky road ahead – the supply risk

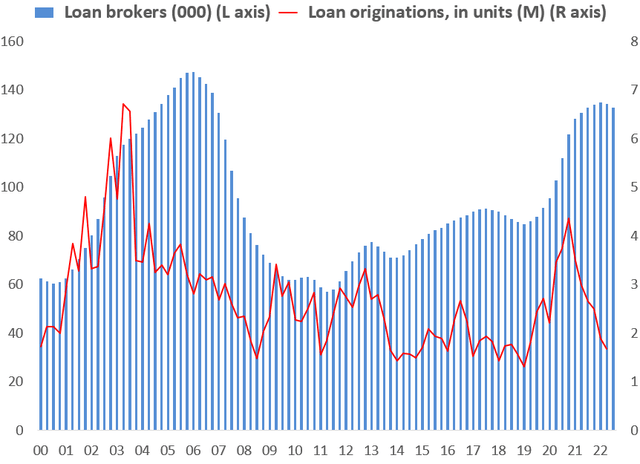

Estimating changes in the capacity of the mortgage industry to make loans is not a science. All we can do is get a feel for the trend by looking at a combination of the level of the industry’s manpower and the willingness of Rocket and its competitors to make loans.

On the manpower issue, a mountain of anecdotes says that mortgage bankers are actively shedding employees. For example:

“Following the latest round of layoffs, Homepoint has shrunk its workforce from about 4,000 workers in the summer of 2021 to about 1,000 this fall.” (HousingWire, September 12, 2022)

“Better.com laid off an unspecified number of employees last week in its fourth workforce reduction since December 2021.” (HousingWire, August 31, 2022)

Even mighty Rocket is slimming down: “Rocket Companies offered its second round of voluntary buyouts on Monday.” (HousingWire, August 31, 2022)

But unfortunately, the layoffs seem to still be in their early stages: “Economists from the MBA forecast production employment will likely have to be scaled back by 24% to 31% if origination volume drops 65% [as the MBA expects]…The bad news is that we are only between 2% and 10% as of the second quarter of 2022.” (HousingWire, August 31, 2022)The experience of the industry in response to cyclical demand declines is not very encouraging. This chart shows that it took 3 years for excess capacity to be worked off when the Great Recession hit:

National Association of Realtors, Bureau of Labor Statistics and Mortgage Bankers Association

Industry pricing tells us a lot about mortgage bankers’ “willingness to lend”. If they purposefully price at minimum gains or losses, that is a clear sign that the industry has too much capacity. And that is exactly what is happening now, according to a New York Times article (September 30,2022):

“‘Lenders are scrambling to keep up market share and keep business coming through the door’, said Guy Cecala, the executive chairman of Inside Mortgage Finance…Mr. Cecala expects to see lenders – especially lenders that are not banks, like Rocket and United Wholesale – compete much more fiercely on price…[For example], Rocket recently introduced its Inflation Buster program, which promises to cut a borrower’s interest rate by one percentage point for the first year.”

The price cuts are taking a toll. Here are the gross margin forecasts for the two industry leaders for Q3:

- Rocket expects a gross margin of 250-280 bp, compared to 292 bp for Q2.

- United Wholesale Mortgage expects a gross margin of 30-60 bp, compared to 99 bp for Q2.

As a result, Wall Street expects both companies to report small losses for Q3.

In sum, the mortgage banking industry has excess capacity, and the extra supply could take a year or more to work off.

So why buy Rocket now? 7 reasons

Reason #1: The mortgage banking business will eventually stabilize. Whether mortgage origination volume bottoms at a $1.9 trillion annualized rate, as the MBA forecasts, or 10-15% lower, it will hit bottom over the next year or two. And the industry will right-size its headcount over the next year or two. As those trends work through the system, gross margins will gradually recover.

Reason #2: Rocket is an excellent competitor. It has steadily taken market share since the Great Recession in ’08, reaching about 8% recently. I am confident Rocket will continue to do so as many weaker competitors shut down or hunker down. And Rocket should achieve its share growth the right way – by using a competitive advantage of efficiency created by technology.

Reason #3: Rocket has a strong capital position, one that can comfortably ride out the next year’s lack of profits or moderate losses. Its most recent 10-Q says the most restrictive of its regulatory and lender capital standards requires it to have $1.3 billion of net worth. It actually had $8.8 billion at that date. Further evidence of Rocket’s capital strength is that despite not earning much during the first half of this year, it could afford to buy back $145 million of stock and distribute $2.2 billion to its majority shareholders.

Reason #4: Rocket’s fintech business is in my view misguided, but luckily is small. Rocket is working to build a variety of consumer businesses related to core business, like personal financial counseling, used car sales and real estate brokerage. But there are many strong existing players in those businesses – think Schwab and CarMax and Anywhere Real Estate (formerly Realogy) just to name a very few. Then there are a variety of fintechs with similar growth strategies – think SoFi (SOFI) and Carvana (CVNA) and Redfin (RDFN), again to name just a very few. Yes, Rocket has access to lots of client data, but again so do many other financial institutions – think Bank of America (BAC), Capital One (COF) and Zillow (Z). I therefore expect Rocket to lose money in its fintech investments for the foreseeable future.

But outside of the $1.2 billion acquisition of online financial advisor Truebill, Rocket’s investment in these new businesses is small. I therefore expect their losses to be small. Not exactly a ringing endorsement for the stock, but not an impediment to investing, in my view.

Reason #5. The stock is no longer expensive. Mortgage banking stocks generally sell in the neighborhood of their book value, on the very reasonable belief that the business is so competitive that it can’t earn much above its cost of capital. Rocket’s book value is now about $4.50. Clearly the stock price was crazy when it was selling in the $10’s and $20’s. But its current $6.50 price is not far off book. And if the value of Rocket’s “mortgage servicing rights” (the present value of the 30 bp fees it earns for collecting payments on $480 billion of mortgages) were marked-to-market, I believe Rocket’s book value would be about $5.50.

Reason #6. I believe that Rocket’s normal earnings is about $1.00 a share. That is in the neighborhood of Wall Street’s expected ’24 EPS of $0.83.

Reason #7. I therefore have a 2-year target price of $10. That’s a 10 multiple that $1.00 of estimate normal earnings. That’s a 50% upside. Worth starting to nibble at. And obviously I’ll be getting more aggressive if the stock falls materially at all from its current price.

Be the first to comment