Lisa Maree Williams/Getty Images News

Over the past quarters, we have intensively covered Roche Holding AG (OTCQX:RHHBY) (OTCQX:RHHBF). Today, the Swiss pharmaceutical giant just released its half-year results, and most surprisingly, it announced the non-re-election of Chairman Christoph to the company’s board. Looking at the press release, we note that Thomas Schinecker, current CEO of the Diagnostics division, will be appointed as the next Roche Group CEO starting from March 2023. The CEO transition does not come as a surprise, for our readers, we should emphasize that Thomas Schinecker is well admired by the investor community thanks to his dedication and results achieved during the COIVID-19 outbreaks.

As mentioned in our previous publication, we reaffirm that we are positive about Roche over the long-term horizon, but we see some difficulties in the short term. Therefore, we rated Roche with a holding rating. This was supported by a lower forecast in the Diagnostic Division and by the biosimilar competition.

Half-Year Results

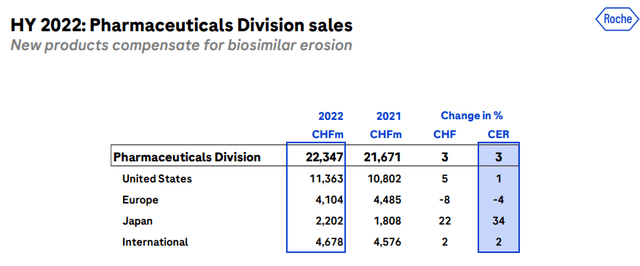

Looking at the Wall Street analyst’s expectation, Roche outperformed the consensus by 2% at the revenue line and by 5% at the operating profit level. Regarding the two divisions, we note the following:

- The pharmaceutical division delivered a mixed performance. On the positive side, we should mention Ocrevus, Evrysdi and Hemlibra which respectively grew by 17%, 106% and 30%. Whereas, despite a +13% in sales, Tecentriq was one of the investor’s biggest disappointments. Concerning the margin, pharma recorded an important expansion. For the first half of the year, the core operating profit margin stood at 46.2% compared to the 44.1% margin achieved in 2021. This was possible thanks to Roche’s resiliency versus the biosimilar competition.

Source: Roche Q2 Results

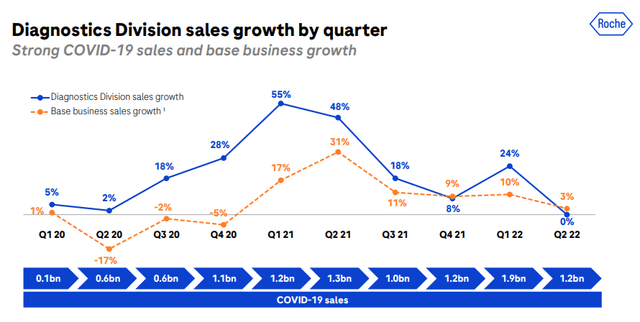

- The diagnostics division reported a 0% top-line increase. This was a strong result given the fact that the COVID-19 pandemic is easing around the globe. Compared to Wall Street analysts, second quarter performance beats expectation by 7%. Looking at the specifics, rapid test sales were pretty strong, whereas PCR tests reported lower figures. Again, this is not coming as a surprise. There is uncertainty over the remaining part of the year, and of course, another outbreak will be definitely an upside for the Swiss company. Concerning the margin, the diagnostics division recorded a 26% operating profit margin in line with 2021 half-year results.

Source: Roche Q2 Results

Conclusion And Valuation

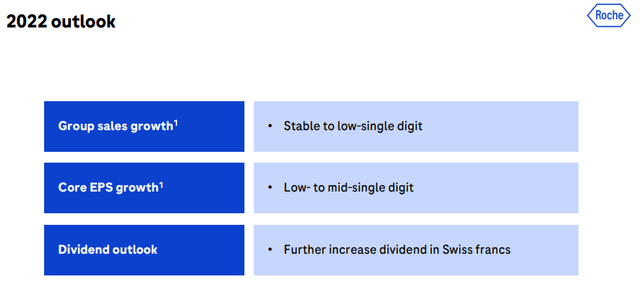

The Swiss pharmaceutical giant reiterated its guidance for 2022, confirming top-line sales from stable to low single-digit growth and earnings per share in line with turnover. Adjusting our internal model, we see a positive surprise at corporate level costs that were at CHF -210 million versus the expectation of CHF -310 million. We are forecasting a decrease in the top-line due to lower COVID-19 sales by almost CHF 2 billion and another hit from biosimilar erosion (again, we estimate another CHF 2 billion impact).

Based on a P/E, the company is still currently trading at a premium valuation compared to its peers. Given the strong track record and company’s pipeline, we believe this is justified. Then, we reiterate our neutral rating with a price target of CHF 350 per share.

Source: Roche Q2 Results

Be the first to comment