Ian Tuttle

Roblox (NYSE:RBLX) has reported strong top-line measures, while profitability was the weakest point in its recent earnings report. As a growth company, management is focused in investing in the business, which is positive to create long-term value for shareholders.

Background

As I’ve covered in previous articles, I’m bullish on Roblox over the long term, due to its growth prospects in the gaming sector, plus its platform is very well-fitted for the metaverse, which can be another important growth source over the long haul.

However, like many growth stocks that are still unprofitable, Roblox’s share price has been in a downtrend over the past year, as organic growth has clearly slowed down following the pandemic, and investor sentiment has been generally negative for growth stocks in recent months.

Its share price is down by more than 70% from its all-time highs, but Roblox’s operating momentum has shown good signs of improvement recently. Since the company reported today, I think it is a good time to revisit its investment case to see if Roblox is still a good long-term investment in the gaming/metaverse investing theme or not.

Roblox Q3 Earnings Analysis

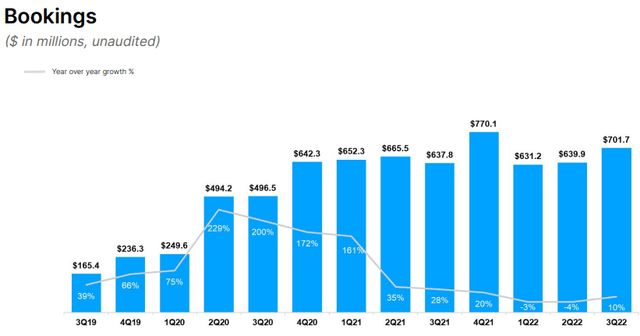

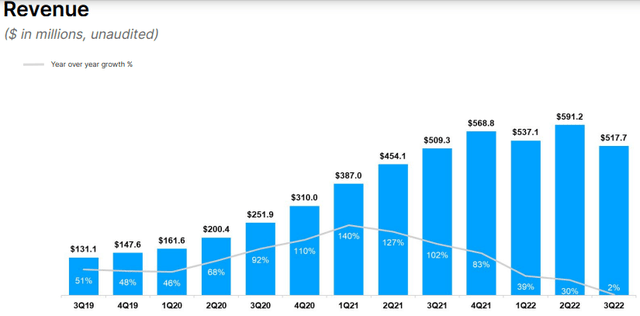

Roblox’s Q3 earnings were below expectations on the bottom line, but revenue and bookings were ahead of estimates. Indeed, its quarterly revenue amounted to $517 million, up by 2% YoY, beating estimates by some 2.7%. Its bookings were $702 million (+10% YoY) and close to $12.5 million above estimates, being the second-best quarterly figure in its history and much higher than compared to the pandemic period, showing that its growth has not stagnated as bears say. On the other hand, Roblox’s Q3 EPS of -$0.50, missed street expectations by $0.16.

Investors should note that due to Roblox’s revenue recognition policy, the company reports revenue throughout the user’s average expected lifetime (which was around 28 months in Q3, compared to 25 months in the previous quarter), thus bookings are the best measure for future growth and can be considered a leading indicator of Roblox’s revenue stream over the coming quarters.

Its average daily active users increased to more than 58 million in the past quarter, representing a solid growth rate of 24% YoY. This growth is justified by the company’s strategy to increase the users’ average age and pursue international growth. Roblox’s age group above 13 now accounts for some 54% of daily active users, while historically most of its users were in the 7-13 cohort, which is a positive step as older users are more likely to spend money on the platform.

Moreover, as more users become active on the platform, the likelihood that booking will increase in the next few quarters is higher, as users’ interest and engagement in the platform usually increases over time.

As can been seen in the next graph, there is a big gap between quarterly bookings ($702 million) and revenue ($517 million), which means that Roblox’s revenue growth is likely to reach a bottom in the next quarter, and much higher YoY growth is expected during 2023.

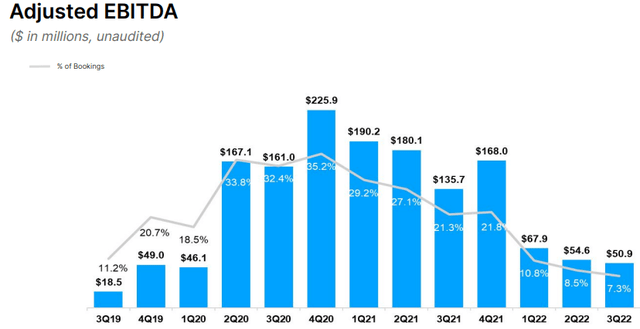

Regarding expenses, Roblox reported lower cost of revenue due to a higher average user lifetime, but other expenses increased as the company continues to invest in its platform. This led to an adjusted EBITDA in Q3 of $50.9 million, below expectations of $59.6 million.

During the first nine months of 2022, Roblox’s revenue amounted to $1.646 billion, an increase of 22% YoY, but operating expenses also increased greatly, particularly research & development (R&D) expenses (+74% YoY to $625 million). This led to a larger operating loss of $621 million in the period, some 75% worse than during the same period of 2021, and its GAAP loss for the period amounted to $642 million.

Despite these losses and lower profitability than in recent quarters, based on adjusted EBITDA, Roblox continues to focus on growing its platform and while other technology companies are pursuing layoffs, Roblox intends to continue hiring throughout 2023. While this may be negative in the short term for profitability, it clearly shows that its management has a long-term mentality, which is in my opinion, the best way to manage a growth company like Roblox. Also, the company has a $3 billion cash position, thus it is in a strong financial position to continue to invest for growth and does not need to pursue profitability over the next two to three years.

In addition to its quarterly earnings, Roblox also reported key metrics related to daily active users regarding the month of October, which amounted to 58.2 million, while estimated bookings for the month were between $231-$235 million. Investors should note that at the end of October 2021, Roblox had a platform outage that lasted 72 hours, thus YoY comparisons are not particularly meaningful for the month of October.

Medium-term Estimates & RBLX Stock Valuation

Despite its bookings being more or less flat during the past few quarters, Roblox’s revenue is expected to increase by 38% YoY to $2.65 billion in 2022. Over the following three years, according to analysts’ estimates, Roblox is expected to report annual revenue growth of about 15% per year, to more than $4 billion by 2025.

Throughout this period, Roblox’s expenses are also expected to grow significantly as the company continues to invest in business growth, leading to operating losses during this period. This means that breakeven is not expected to be reached during the next three years, which, to some extent, justifies why its valuation has de-rated considerably in recent months.

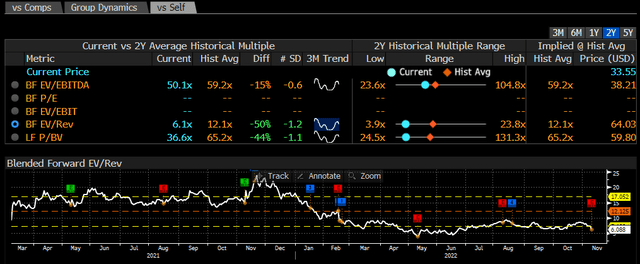

As shown in the next graph, Roblox’s valuation based on forward revenue has declined from a peak of close to 25x revenue achieved at the end of 2021, to a current valuation of only 6.1x forward revenue.

This valuation seems to be quite cheap and unwarranted, as Roblox is showing a recovery in bookings that should lead to higher revenue growth in the near future. Indeed, assuming the same valuation multiple of about 6x revenue to estimated revenue of $4 billion by 2025, leads to a price target of about $45 per share by end-2024 (upside potential of about 36% compared to its current share price).

However, this multiple is near the bottom of its historical average over the past 18 months, thus assuming a higher multiple as Roblox’s growth improves over the next couple of years, a conservative valuation of about 10x forward revenue leads to a price target of around $75 per share, or more than double its current share price, which shows that Roblox’s shares have great upside potential over the next two years.

Conclusion

While Roblox’s bookings in the past few quarters were quite weak, during the past quarter, this metric was strong and ahead of expectations. This bodes well for future growth and was higher than during the pandemic, putting to rest bear arguments that Roblox’s growth during the pandemic was not sustainable.

While profitability is decreasing and users are spending less, on average, in its platform, this is justified by the company’s investment in organic growth, the tough macroeconomic situation, and higher dollar that hurts foreign revenue. However, long-term investors should look beyond short-term issues, focusing instead on Roblox’s growth prospects and potential share price upside over the coming years.

Be the first to comment