Ian Tuttle

After a big rally since the mid-June low, Roblox (NYSE:RBLX) has clearly run too far for the current market realities. The stock needs a pause to refresh. My investment thesis remains bullish over the long term, but the current stock view is much more Neutral with the gaming platform still struggling to top tough comps while the stock recently doubled from the lows.

Only The Beginning

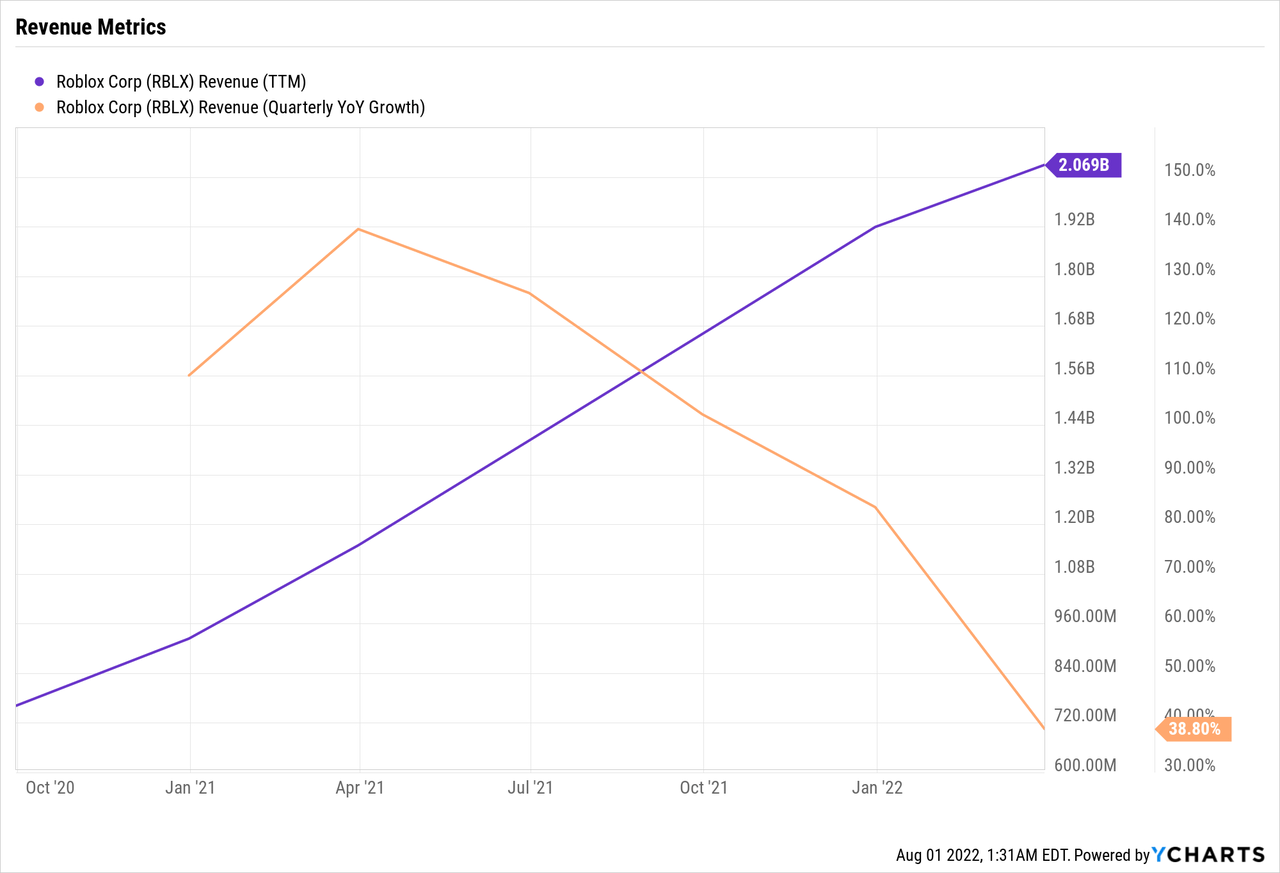

Roblox only recently became a multi-billion dollar revenue company. The company is forecast to just reach $2.7 billion in revenues this year, so Roblox is only at the beginning of the journey.

The company is quickly becoming a large mobile gaming business with Metaverse aspects, but the platform is still relatively small. Revenue growth has naturally slowed this year with the last quarter growth rate dipping to 39% growth and the May growth listed at only 29%.

With bookings growth turning negative, Roblox is headed towards a few quarters of negative growth rates. The May bookings are estimated to have dipped 10% over the 2021 levels even with daily active users up 17% to 50.4 million.

The stock market shouldn’t extract too much regarding the difficult time of topping prior periods where revenue growth jumped over 100%. The covid boost is normalizing in a logical move as markets reopen and people travel more causing less time to be spent online interacting in mobile games.

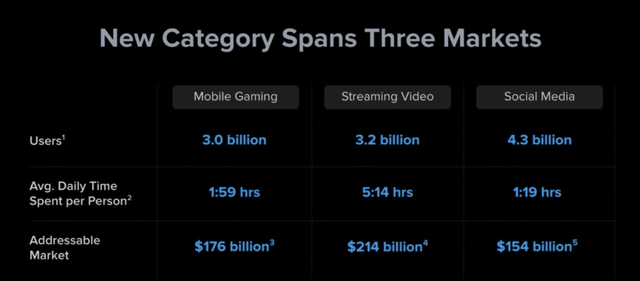

The whole media category encompassing mobile gaming, streaming video and social media accounts for over 4 billion users and a combined addressable market of $544 billion. Management sees these industries combining into a new category labeled human co-experience with gaming, social and entertainment colliding into one large experience.

Source: Roblox 2021 Investor Day

The mobile gaming platform will span the combination of these market categories over the next few years. Roblox doesn’t even account for 1% of these markets and just hits 1.5% of the large mobile gaming platform where the platform is generally focused today.

The company is increasingly become a social network with players coming to the platform to interact with friends. The whole idea of Roblox is the social interaction within mobile games and this just the beginning of the social aspect.

Too Far, Too Fast

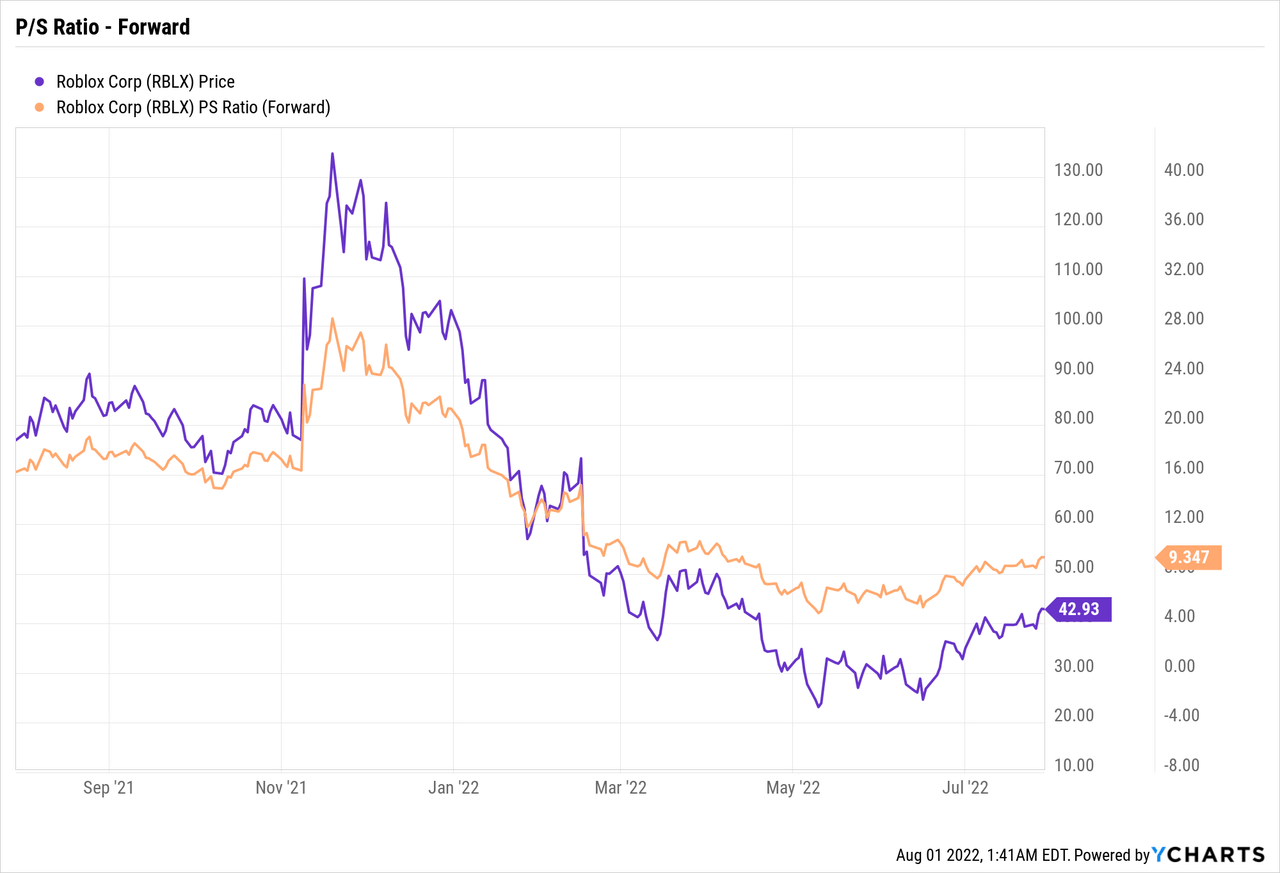

Roblox hasn’t even turned the business around yet with bookings turning very negative, yet the stock is already back to $42 with a $25 billion market cap. Suddenly, Roblox already trades at over 9x forward revenue targets.

The stock traded at far higher multiples during the peak back in 2021, but 10x forward sales is typically a very aggressive valuation. Roblox isn’t even forecast to grow revenues in 2022, though revenue growth is forecasted to bounce back in 2023 to reach $3.3 billion.

The target growth rates definitely don’t warrant the rich valuation whether or not one sees the company has having a promising future. The US economy is likely in a recession and Roblox is highly reliant on these users for bookings.

The current valuation is definitely difficult for shareholders to grasp the new reality. Roblox went public back in early 2021 with a direct listing at an opening price of $65. The stock had an insane initial valuation of $47 billion after soaring $20 above the original reference price of $45. Amazingly, the stock appears over priced now below the reference price over 16 months after going public, while generating substantial growth during the period.

Hopefully, investors learned a great lesson of how Roblox was a massive sell above $140. People buying the stock at the direct listing opening made over 100% at the market top, but those people are now down substantially.

Anyone buying the lows after the hype ended has made some decent money here while those chasing the stock only made money by acting like a trader.

Takeaway

The key investor takeaway is that Roblox probably does have a bright future, but the stock price is already pricing in a major recovery. Analysts probably need to cut the 2023 targets, which is likely to send the stock back into the mid-$30s where Roblox will become another buy.

Be the first to comment