Ian Tuttle

Thesis

Roblox Corporation’s (NYSE:RBLX) Q3 earnings release corroborated our previous thesis that its Bookings decline has likely bottomed out in Q2. However, we failed to appreciate that Roblox’s earnings power has likely been impacted, as it sought to invest in driving growth, resulting in a much lower-than-expected adjusted EBITDA margin and free cash flow (FCF) profitability for Q3.

Hence, we believe our thesis on the platform’s ability to recover its profitability could be at risk, further impacted by forex headwinds. While we postulate that the sharp surge in the dollar index (DXY) should eventually reverse, the Fed would likely need to keep interest rates higher for longer to combat inflation expeditiously. As such, currency headwinds could continue to impact the company’s profitability moving ahead.

Coupled with worsening macro headwinds moving ahead, we believe that the consensus estimates on Roblox’s earnings recovery need to come down further. The company’s inability to drive adjusted EBITDA growth even though it outperformed its Bookings estimates is a significant cause for concern.

Given its high-growth premium embedded in its current valuation, we don’t expect RBLX to be re-rated in the near term as the market assesses its ability to execute moving ahead.

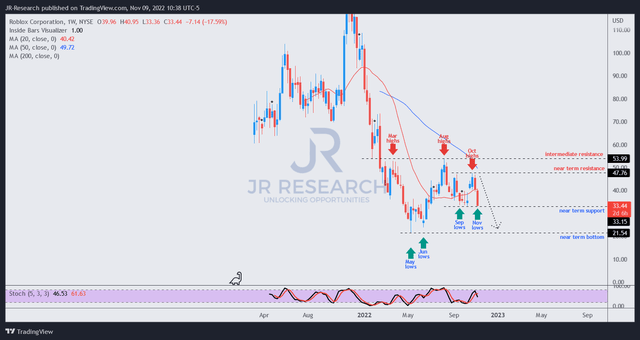

RBLX’s price action has also weakened considerably since our previous update, as it failed to retake its August highs.

As RBLX looks likely to re-test its September lows, we urge investors to resist the urge to sell in a panic, given the steep capitulation. Instead, investors looking to offload should wait for the re-test to occur first, which could trigger a short-term rally, allowing investors a better opportunity to cut exposure.

Moving to the sidelines from here, as we believe the reward/risk is no longer attractive. Revise from Speculative Buy to Hold.

Roblox Q3: Beat Bookings Growth But Underperformed On Earnings

Roblox demonstrated remarkable Daily Active Users (DAU) growth in Q3, as it posted a YoY growth of 24%, up from Q2’s 21% uptick. Furthermore, its engagement metric was also solid, as Roblox posted a 20% increase in Hours Engaged, up from Q2’s 16% growth.

Therefore, it helped Roblox to deliver Bookings of $701.7M, up 10% YoY (Vs. 6.8% consensus). Moreover, its remarkable Bookings metric undergirded our thesis that it had likely bottomed in Q2 when Roblox posted a Bookings decline of -3.8%. Furthermore, management highlighted in its earnings commentary that it expects a record Q4 (Roblox is seasonally strong in Q4).

Despite that, its adjusted EBITDA margin of 7.25% came in well below the consensus estimates of 9%. At the same time, management highlighted that it expects the platform to post adjusted EBITDA margins below 10% through 2023 as it invests in its growth.

However, the underperformance in Q3 is a red flag that we cannot ignore. Management attributed the poor performance in its profitability to the need to invest in its growth, as it accentuated: “Our net losses in Q3 2022 increased over the same period in 2021 due to the higher expense levels required to support the growth of the business.”

Hence, we postulate that Roblox could be attempting to juice its Bookings growth while sacrificing margins. As such, it could highlight an inherent structural weakness in its ability to sustain its growth through the recession at a healthy profitability level.

Therefore, we believe that investors need to be cautious, as Roblox has failed to convince us why it deserves to be given the valuation premium. We think there are significant downside risks to the current projections.

Is RBLX Stock A Buy, Sell, Or Hold?

With the significant underperformance in its adjusted EBITDA profitability, Street analysts are almost certain to downgrade their forward estimates. However, the market had already anticipated a weak Q3 release, as it rejected buying momentum at its October highs.

RBLX price chart (weekly) (TradingView)

RBLX last traded at an NTM EBITDA of 55.4x as it closes in against its September lows. Hence, it still trades at a significant premium.

We gleaned that RBLX failed to retake its August highs as the market astutely rejected further buying upside in October, as it anticipated a weak earnings card.

We see a potential false break at its September lows, which could lead to a short-term rally, allowing investors to cut some exposure.

However, we now expect a re-test of its May/June lows as possible, as the market likely needs to de-rate Roblox Corporation further to reflect more significant execution risks through the cycle.

Revising RBLX from Speculative Buy to Hold.

Be the first to comment