LorenzoT81

Founded in 2013, Robinhood (NASDAQ:HOOD) is a financial services platform with a mission to democratize finance for all. The company was one of the first to introduce commission-free stock trading that could all be accessed from mobile devices, and has further expanded its product offerings from stocks to crypto & more recently, a cash card.

Robinhood’s products can be split into four main categories: Investing Solutions, Robinhood Crypto, Robinhood Gold, and Cash Management.

Investing Solutions allows customers to invest commission free in US-listed stocks, ETFs, options, and ADRs from their smartphones. The user interface is designed to be easy to understand, in an attempt to making investing seem less daunting & more accessible to individuals. Through the Robinhood App, users can invest in fractional shares, set up recurring investments, and access initial public offerings at an IPO price.

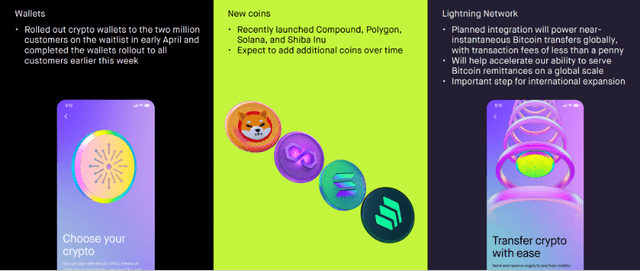

Robinhood Crypto is its commission-free cryptocurrency trading product, which utilizes the same user-friendly interface as its Investing Solutions. The company has continued to invest heavily in its crypto offerings through 2022, with the addition of crypto wallets, the launch of new coins, and the planned integration with the Bitcoin Lightning Network.

Robinhood Q1’22 Investor Presentation

Robinhood Gold is a premium subscription service with a flat monthly fee. Gold subscribers can benefit from enhanced instant access to deposits, unlimited access to professional research through Morningstar, access to investing on margin, and the ability to see more data on any given stock or option through Nasdaq Level II market data.

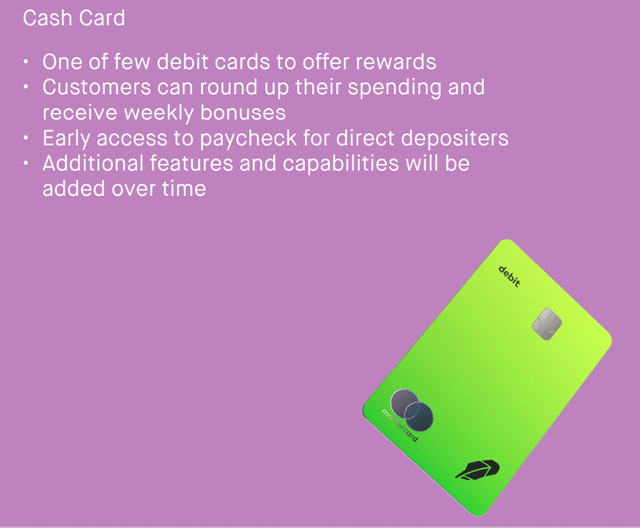

Finally, the Cash Management product allows customers to earn interest on idle cash sat in their Robinhood brokerage account through banking partners. There is the additional option to spend cash through a Robinhood-branded Mastercard debit card.

Robinhood Q1’22 Investor Presentation

Robinhood’s name is taken from the English tales of a man who steals from the rich to give to the poor – as the company looks to open up investing not just to the rich on Wall Street, but to anyone. This is a great mission for a company, but in my opinion it has been very poorly executed.

A Broken Business Model

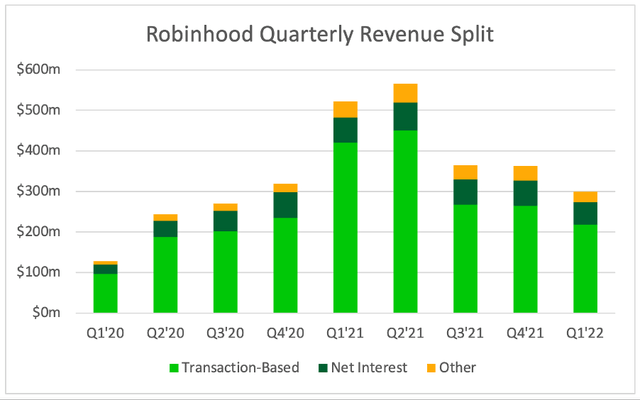

The majority of Robinhood’s revenue is transaction-based, despite the company’s marketing of being commission free – they do take a payment for order flow fee when it comes to the buying and selling of equities or options. The company also makes a similar fee-based revenue from any cryptocurrency trades. In 2021, transaction-based revenues accounted for 77% of total revenues, with net interest revenue making up 14%.

The net interest revenue is gained through lending shares as well as holding collateral for the margin loans that Robinhood extends to its users. The company also earns interest revenue on margin loans to users, but more on this later…

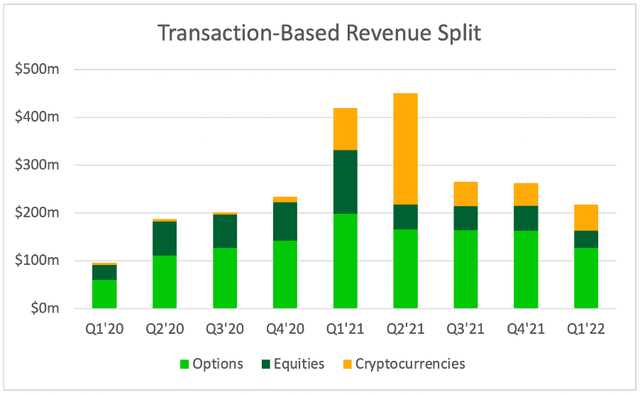

Clearly the transaction-based revenue is the biggest money maker for Robinhood, but what is making the majority of that money? Well, the below split does not pain a pretty picture.

One of the big problems here is that growth has clearly hit a massive wall. Robinhood benefitted substantially from lockdowns (as fewer people were able to go to work, and ended up trading) as well as a roaring stock market in 2020 and 2021. We can this spike clear as day in their revenues, but that has since come crashing down to earth, with transaction-based revenue in Q1’22 falling by almost 50% YoY.

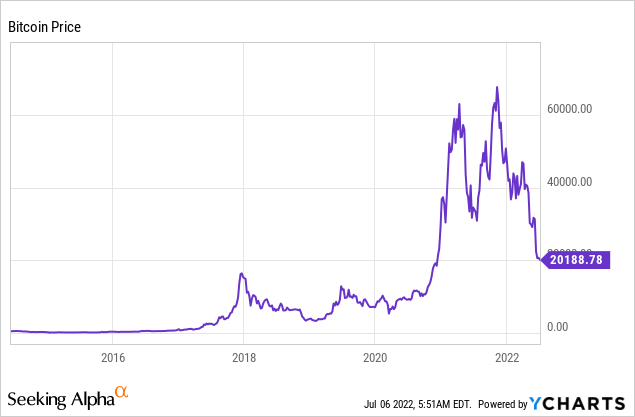

I’m all for democratising finance, but the problem for Robinhood is that equity trading just doesn’t make as much money as some of the other products out there. The first thing that jumps out in the above graph is the huge crypto spike in Q2’21, but anyone who has followed cryptocurrency knows that the trading of it is very cyclical. There are times when everyone talks about crypto as prices soar and more people rush to try and make money. This results in huge revenue spike for Robinhood (as we can see in Q2’21), but this level of revenue cannot be regularly relied on (as seen in every other quarter).

Next up, we’ll look at options, which are clearly the main revenue generator for Robinhood. The issue that Robinhood has faced is that it has a history of offering overly complex products to users – and overly complex financial products that are available with limited checks can result in individuals getting into a lot of difficulty.

Profits Earned Through Risky Offerings

Not only does Robinhood offer its users complex financial products, but doing this combined with the ability to trade on margin can result in huge blow ups. There are multiple stories out there about people who have lost a ton of money on Robinhood, and tragically one user who took his own life in 2020 after having used options despite his lack of financial experience, after which he incorrectly received a notification that he had a negative balance of $700,000 on his account.

The company also came under fire after it shut down trading of certain ‘meme stocks’ following the GameStop craze in 2021, which then went on to land the company in hot water with the government.

The problem here is that Robinhood’s business model is built upon complex financial products and speculative cryptocurrency. In my eyes, the only sustainable business model is finding a way to extract value from the buy-and-hold style of equity investors, as these will remain on the platform for much longer – but this business model is very similar to traditional brokerages.

Robinhood makes most of its money when trades are made – so they’ll do extremely well in periods when the stock market is hot, when meme stocks are going to the moon, and when you can buy a Tesla with Dogecoin. But, in a world where a recession is looming, inflation is out of control, and money is not being thrown around like it was in 2021, Robinhood’s business model is in trouble, in my view.

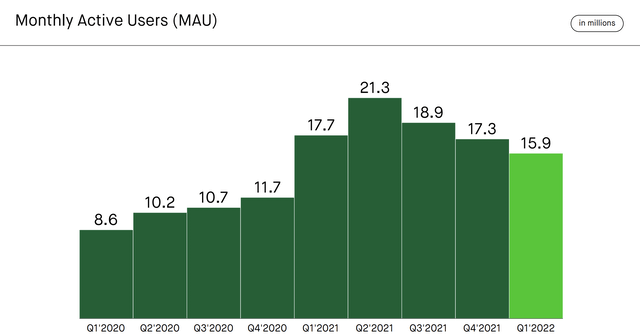

User Growth Is Crumbling

As more people return to work & are no longer stuck indoors, it’s no surprise to see Robinhood haemorrhage active users – it’s also possible because the majority of retail traders lose money over the long run, so I doubt many of them stick around on the platform. We can see that Robinhood’s monthly active users are trending in the wrong direction.

Robinhood Q1’22 Investor Presentation

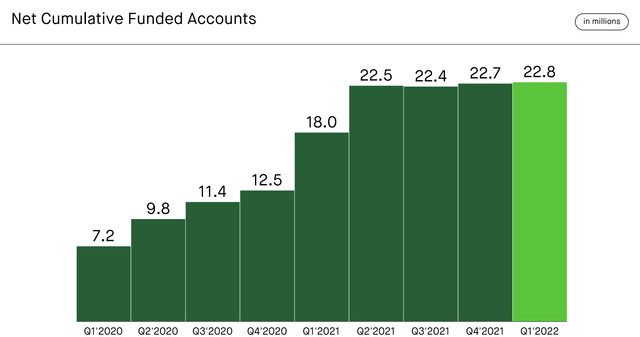

But here’s an interesting point – what about the number of accounts funded on Robinhood?

Robinhood Q1’22 Investor Presentation

So monthly active users are crashing, revenue is crashing, but the number of accounts funded has remained pretty stable over the past year?

This is, once again, due to the problems with Robinhood’s business model – it doesn’t make a substantial amount of money from buy-and-hold investors, and these are the users that will happily leave their money in their Robinhood accounts for years to come.

Bottom Line

I think that last graph shows that Robinhood does bring some value to this world; it is a great, user-friendly platform that anyone can use to invest in the world’s greatest wealth building machine – the stock market.

But in my view, this is a broken business right now. The company highlights its expansion into crypto in the Q1’22 Investor Presentation, and this is not what the company should focus on – leave that to a specialist like Coinbase (COIN), who are also struggling.

I believe Robinhood is failing to address its core problem; the business model it currently employs is not sustainable, and relies far too heavily on hype surrounding both stocks and crypto. Given that Robinhood realises a significant amount transaction-based revenues on options, they would clearly benefit from a higher number of people using these. As a result, Robinhood has been accused of not having stringent enough checks & potentially giving people access to these complex financial products who are not appropriately qualified.

I’ve never written an article with a ‘sell’ recommendation before, but I’ve also never seen a business this bad; unless Robinhood shifts its business model fast, this company is destined to fail.

Be the first to comment