aluxum

When we wrote about Cohen & Steers REIT & Preferred Income Fund (NYSE:NYSE:RNP) and Aberdeen Global Premier Properties Fund (NYSE:AWP), we had a clear message.

Sell AWP and Buy RNP.

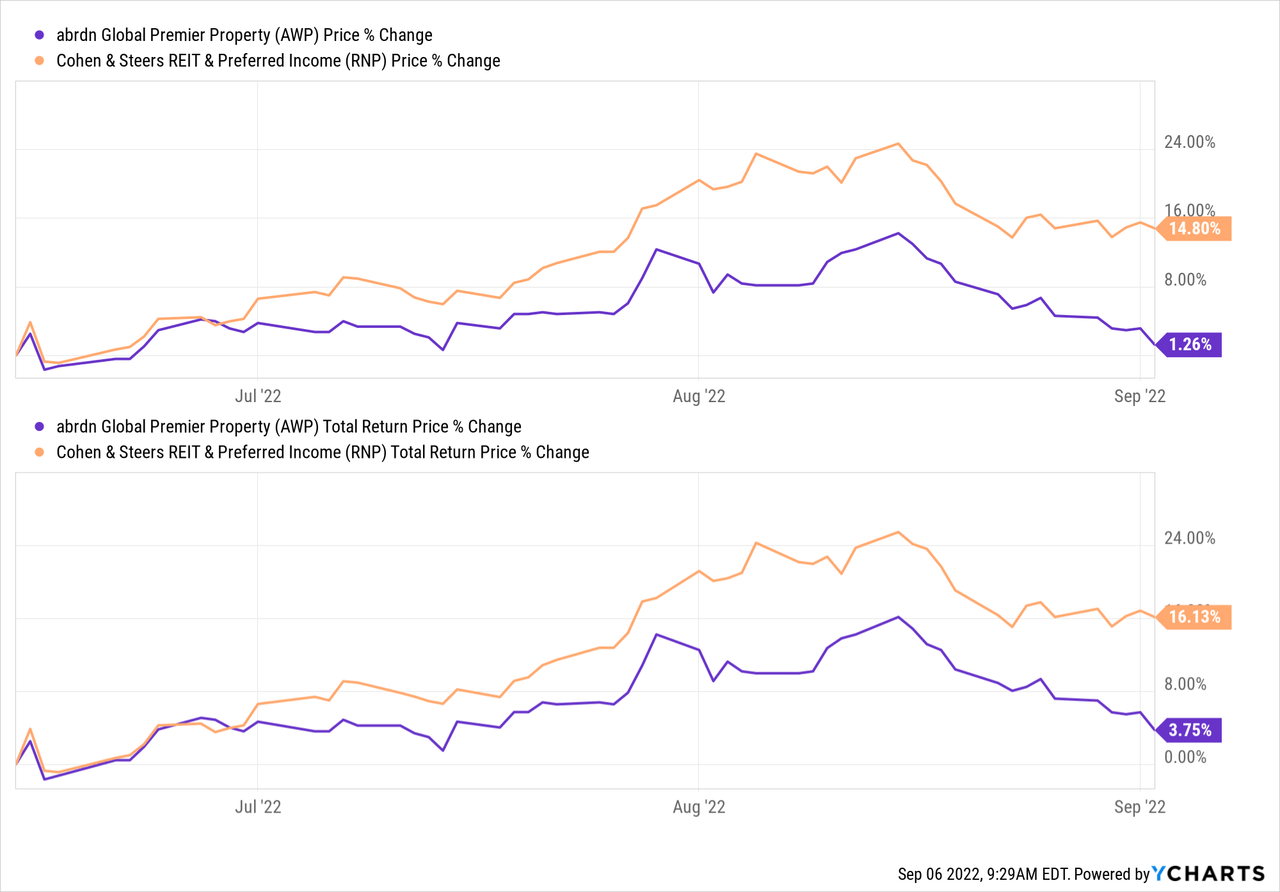

We made our argument based on a few different metrics and concluded that while the funds moved in a similar fashion, there was a lot of alpha to be had by throwing AWP under the bus for RNP. It was a good call. In terms of price, AWP has been flat since then while RNP is up 14.80%. Differences are very similar from a total return standpoint.

Y-Charts

A 50% plus annualized return from a switch should be enough for most. Of course the “Seeking Alpha” crowd always wants more, so we looked at whether we should stick with our bets or cash in our chips on this call.

Outlook

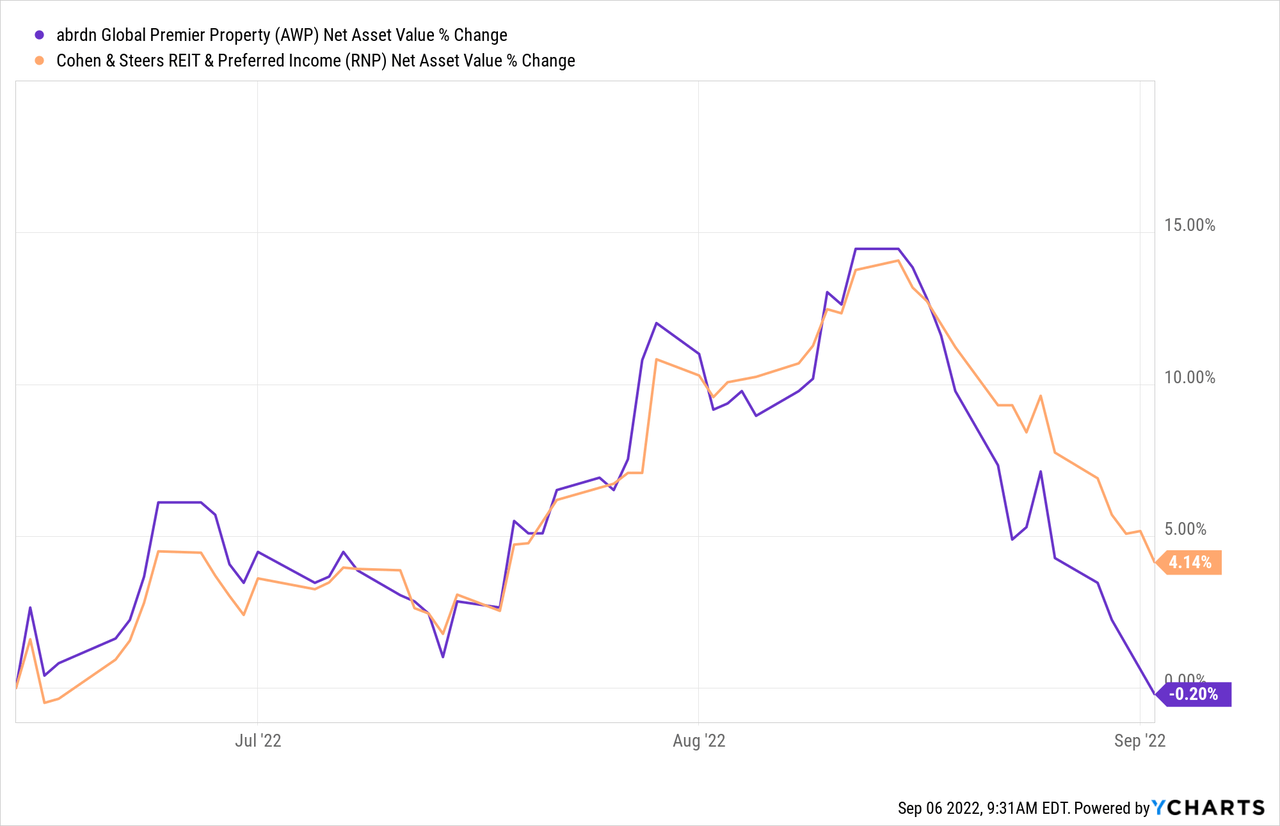

While it is easy to feel happy when a call goes right, it is important to examine the “why”. In the case of this paired trade call, we noticed that while the performance was spectacular at the price level, the performance at the NAV level was less extreme.

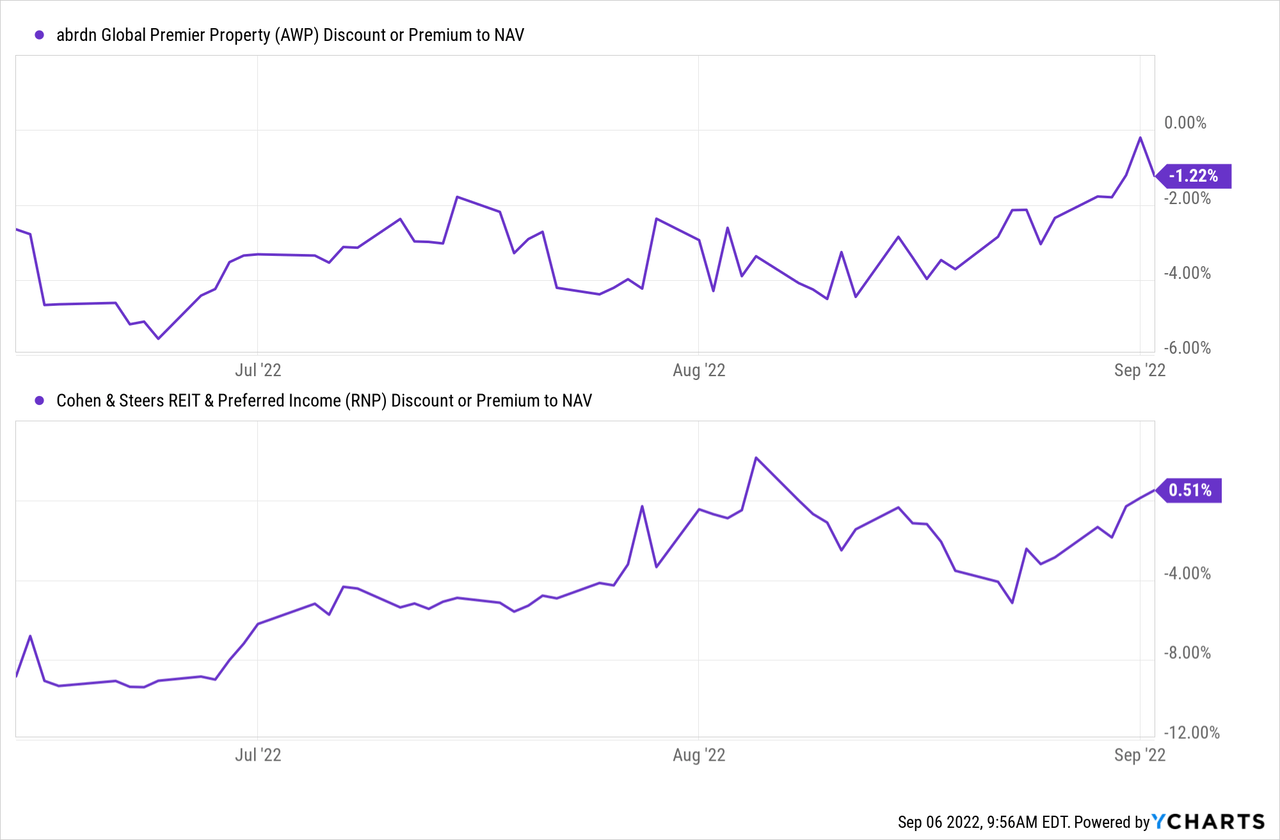

RNP NAV outperformed, but by a far smaller amount. This was actually the first leg of our bullish thesis. At the time of our last article, RNP traded at a big discount to NAV. AWP traded at a more modest discount. This made little sense as RNP is a far superior fund. Closing of this discount gap drove the bulk of the outperformance.

RNP now trades at a small premium, and AWP trades at a smaller discount. The spread has narrowed and the market is rightly giving RNP more credit. Going forward, we expect this to be less of a tailwind. As the bear market progresses, we expect both to trade at discounts, with AWP possibly reaching a 10%-15% discount and RNP closer to the 5%-10% range.

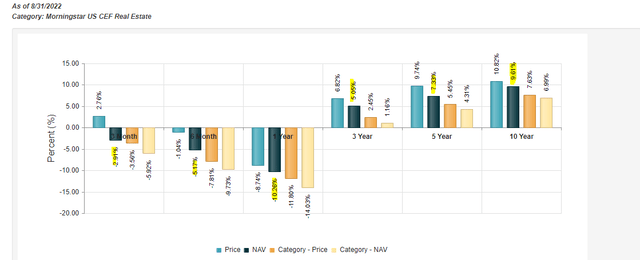

On the NAV itself, we expect, RNP’s outperformance to gain steam. It has done well to this point and it will do even better going into the bear market. we derive this from two aspects. The first being that RNP is just a better fund. When we look at total returns, it is not even close. Below we have put RNP’s numbers and you can look at total returns on NAV for all six different time frames.

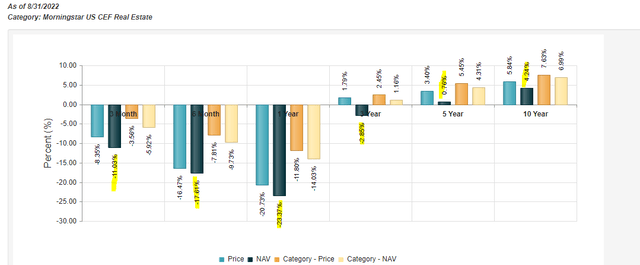

Next look at AWP.

The differences are almost embarrassing for anyone championing AWP over RNP. So betting on management of RNP over AWP is a no brainer.

The second aspect comes from the constituents of the fund itself. RNP has preferred shares whereas AWP is pretty much all common equity. While during the early part of this bear market both preferred shares and common shares got hit, we expect the former group to outperform. That comes from our thinking that the duration hit to preferred shares has largely been priced in and the higher yields should work to create a less negative total return for this asset class.

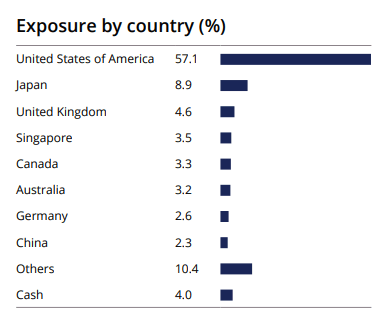

A final point we want to bring up here is the continuing strength of the US Dollar. This works against AWP, thanks to its large foreign holdings.

AWP Fact Sheet Pulled On Sep 6, 2022

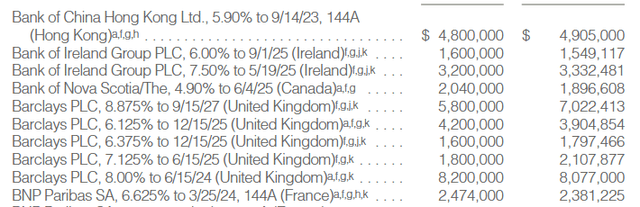

RNP is pretty much fully domestic on its common equity side. It does have some foreign preferred shares. A small sampling of those are shown below.

These are a smaller portion of the total portfolio than what we see with AWP’s foreign holdings. RNP also has currency hedges to counteract what happens on the preferred share side.

Verdict

RNP has convincingly won the first round here, but we think there is a little more juice in the trade. While premium/discount movements should not impact things as much as they have, we could get a little more out on that front in RNP’s favor. The bulk of forward outperformance will come from RNP being a superior fund and holding a lot in the safer asset class (preferred shares). AWP is still fighting US Dollar strength and we don’t think that headwind will dissipate till later this year. We reiterate our call to switch by selling AWP and buying RNP. Independently we rate them both as hold/neutral.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment