wildpixel

With inflation expectations consolidating and near multi-year highs, I believe the SPDR SSGA Multi-Asset Real Return ETF (NYSEARCA:RLY) ETF is still a fund to own. The RLY ETF gives investors a 1-stop exposure to commodities, natural resource equities, and infrastructure assets that should do well in an inflationary environment. However, in environments where inflation is not a concern, investors should avoid the RLY ETF as it significantly underperforms.

Fund Overview

The SPDR SSGA Multi-Asset Real Return ETF aims to provide exposure to securities that can achieve real rates of return. The fund has exposure in publicly traded companies in natural resource sectors, inflation protected securities, real estate, and commodities. The RLY ETF has $470 million in assets.

Strategy

The RLY ETF provides investors exposure to asset classes such as inflation protected securities issued by the U.S. government (“TIPS”) or foreign governments, domestic or international real estate securities, commodities, infrastructure companies, and companies operating in the natural resource or commodities sectors. The fund’s allocation among the asset classes is variable and depends on the adviser’s views on the returns and risks of each asset class. The RLY ETF primarily employs a fund-of-funds model and holds other ETFs and funds, mostly issued and/or managed by SSGA.

Portfolio Holdings

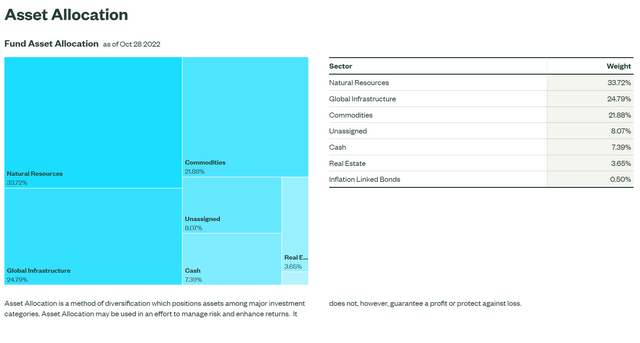

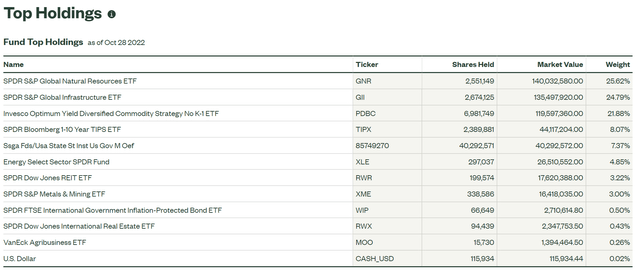

As of October 28, 2022, the fund’s asset allocation is shown in Figure 1. The fund has 34% of assets invested in natural resource companies, 25% in global infrastructure, 22% in commodities, and 19% in other asset classes and cash. Figure 2 shows the actual holdings of the respective ETFs and funds.

Figure 1 – RLY asset allocation (ssga.com) Figure 2 – RLY fund holdings (ssga.com)

Returns

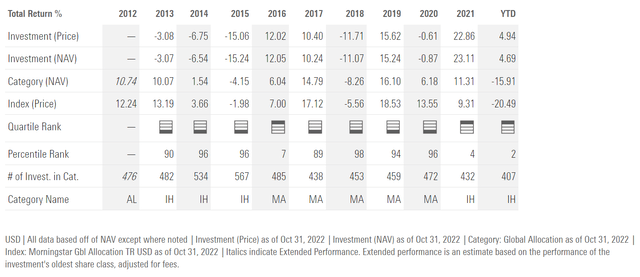

As of September 30, 2022, the fund has generated decent short-term returns of 2.5%/7.7%/5.2% 1/3/5Yr average annual returns (Figure 3). In particular, the fund has returned -2.3% YTD to September 30, 2022, significantly outperforming other asset classes such as the S&P 500 Index which returned -23.9% YTD.

However, the long-term performance of the RLY ETF has been poor, with 10Yr returns of only 1.6%.

Figure 3 – RLY fund returns (ssga.com)

Distribution & Yield

The RLY ETF pays a variable quarterly distribution, with LTM distribution of $3.48 / share or 12.8% LTM yield, primarily because of a strong Q4/2021 distribution of $2.9271 / share.

The standout contributor to RLY’s high 2021 distribution was the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC) that paid $7.14736 / share in 2021 or 42% trailing yield as commodities had a stellar 2021. The RLY ETF held 24.3% of the fund in PDBC in 2021 and currently holds 21.9%.

However, the most recent quarterly distribution was only $0.1001 / share paid on September 23, 2022. As commodity markets have been more volatile in 2022, it is unclear what the year-end distribution rate for PDBC will be, and by extension, for RLY.

Fees

The RLY ETF charges a relatively high 0.50% gross expense ratio.

RLY ETF Is Right Fund For The Times

There’s no denying that the RLY ETF is the right fund for the current macro environment with high inflation globally. RLY’s ability and willingness to allocate to commodities and natural resource companies have allowed the RLY ETF to handily outperform in the past 2 years, generating a strong 22.9% return in 2021 and 4.9% YTD to October 31, 2022, despite the global bear market in most asset classes (Figure 4).

Figure 4 – RLY calendar year returns (morningstar.com)

However, investors should note that the RLY’s commodity and natural resource exposure can be a double-edged sword, as seen in Figure 4 above. RLY’s peer ranking compared to other asset allocation funds (according to Morningstar) is either 1st quartile or 4th quartile, depending on whether those asset classes are in vogue.

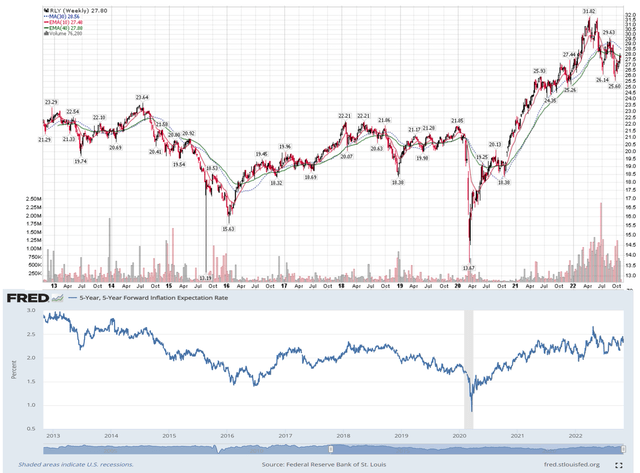

To get a sense of when the RLY ETF should do well, investors can monitor the 5-Year, 5-Year Forward Inflation Expectation Rate (“5Yr Breakeven”). When 5Yr Breakevens are rising, that means inflation expectations are rising, and commodities and natural resource equities should do well. Conversely, investors should avoid the RLY ETF and commodities/natural resource equities when the 5Yr Breakeven is heading lower, as it indicates inflation is not a concern (Figure 5).

Figure 5 – RLY vs. 5-Yr Breakevens (Author created with price chart from stockcharts.com and 5-Yr Breakevens from St. Louis Fed)

Conclusion

With inflation expectations consolidating near multi-year highs, I believe the RLY ETF is still a fund to own. The RLY ETF gives investors a 1-stop exposure to commodities, natural resource equities, and infrastructure assets that should do well in an inflationary environment. However, in environments when inflation is not a concern, investors should avoid the RLY ETF as it significantly underperforms.

Be the first to comment