akinbostanci

RLI Corp. (NYSE:RLI) is pretty unstoppable, again raising dividends and producing phenomenal growth in earnings. The company has some of the best execution we’ve seen, and their underwriting discipline continues to be evident. While a superb company, they are exposed to construction in the US, and housing in general has been a really hot market that is coming down. Those contracts are also not as long especially in surety, and there could be some duration trouble for RLI which relies on persistent growth for its valuation. We respect RLI but don’t see any value here.

Salient Q2 Points

RLI operates in 3 segments of insurance. Casualty, property, and surety. Property has grown massively with a 48% premium growth. Competitors have come out of this sector because of hurricane claims a couple of years ago. The gap in the market is pretty large and RLI says it can’t even fill it themselves. They are being overwhelmed by business here and have taken everything they can, even taking out more reinsurance for relief. It has become 33% of the revenue of the company.

Casualty has been less exciting. It has included things like the cyber business which really accentuated RLI specialty position. They are making an orderly exit from these businesses as the risk-reward has declined as limits rise, and effective rates are actually decreasing with the market becoming less rational. No thanks! The downsizing of efforts here contributed to a pretty muted quarter. Specialty exposures meant rate hikes were achieved, but overall growth in premiums has been only 5%. Transportation has been strong where premiums increased 13%, but driven primarily by rate change of 9%, and not so much volume. Personal umbrella has also seen a 21% premium growth on the back of rate increases and growth in underwriting volumes. The strong characteristics of the plans meant that net premiums actually earned grew ahead of the dollar volumes underwritten as the book matures excellently in this segment.

Surety has seen solid growth too at 13%. Construction projects are costing more on account of supply chain issues and rising material costs. Contract surety is growing on the basis of that, the dollar amounts underwritten are growing. Turmoil in the sector has meant competitors have gotten burned and turned off the industry. RLI was focused on supply chain risks since the beginning, and have come off well on account of better due diligence in underwriting. Gaps in the market are supporting growth here.

Conclusions

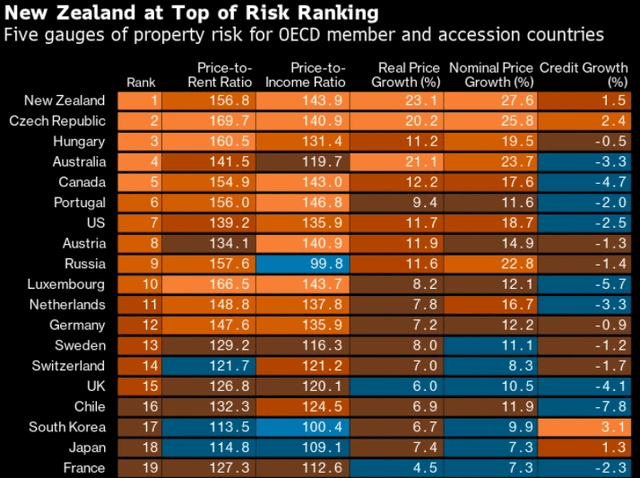

The company continues its dividends, although it hasn’t grown since last quarter. Indeed, it is an aristocrat. The issue with the company is the valuation. The PE is 30x and that reflects the exemplary record of the company and expectations for execution. We trust management, but a third of the company’s business is in construction, which could see issues as markets turn, especially housing markets, with the US being one of the world’s hottest ones right now.

Price to Rent Ratios (Bloomberg)

Transportation is also being harangued by labor shortages from achieving full growth, and the incoming problem might be latent pressures on employment. Things aren’t going to go into decline for RLI, and that’s clear. The book can still mature through a crisis and produce excellent cash flows. That’s the beauty of insurance. Our concern is that with surety in particular being shorter contracts, is there a duration risk when RLI needs to keep up underwriting levels there? Construction end-markets in surety might not hold out. Moreover, casualty is the biggest segment, and those contracts tend to be longer term in nature. If inflation doesn’t get under control and the Fed continues its rate hiking, things could get bad there too with rates lagging newfound conditions. It’s more of an economic loss, while the long contracts do provide stability too and a guaranteed source of cash flow. But if inflation propagates, slowing casualty growth and contracts with rates that’ll look increasingly uneconomical are not going to be good things to measure up against the valuation. Overall, it’s a solid company, but no compelling value or yield proposition with yields less than 1%. We pass.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment