Michael M. Santiago/Getty Images News

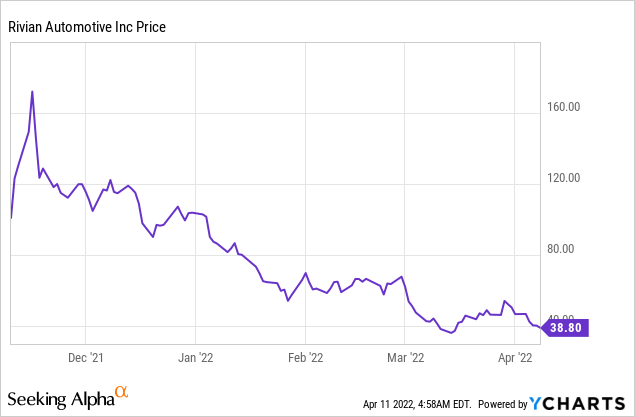

Rivian Automotive (NASDAQ:RIVN) is an EV manufacturer which has a first mover advantage in the lucrative pickup truck, SUV & delivery van market. The company had a monster IPO in November 2021 at $100/share, before spiking by 78% up to $178/share, or a $90 billion market cap. Following this bull run, high inflation and supply chain disruption caused component shortages and production issues. Thus the company had to slash their outlook by over 50% and the stock price took a dive, which means it is now down by over 70% since their IPO. The stock is now trading at a reasonable valuation & the company has a competitive advantage in the delivery van market, thanks to their lucrative partnership with Amazon. Let’s dive into the company’s business model, production outlook & financials in more detail.

Rivian Share Price (created by author ycharts)

Lucrative Business Model

Rivian manufacturers stylish EV vehicles which address large, profitable & underserved segments of the market. Their product offering currently includes a pickup truck starting at $67,500 and an SUV retailing at $72,500. Given the Ford F-150 pickup truck is the most popular vehicle type in the US, Rivian’s product offering is enticing. Rivian has the advantage of being a first mover in the valuable pickup truck & SUV market, as the electric Ford F-150 is not starting production until spring 2022 and the Tesla Cybertruck is not being produced at scale until 2023. Personally, I think Rivian has the most stylish offering, as the Tesla Cybertruck feels like more of a cult vehicle due to its ostentatious design, but I still believe it will sell extremely well.

Rivian R1T Pickup Truck EV (Rivian)

Rivian’s electric vehicles are based upon a simple “Skateboard” design which allows them to easily diversify into other product lines. For instance, Rivian is addressing the widely valuable last mile delivery van market and has a major partnership with Amazon, who have ordered 100,000 vans. Amazon has also invested into the company and has 18% equity in the firm. I believe this gives Rivian a strong competitive advantage over rivals, as they are effectively guaranteed cash flows from the world’s largest ecommerce company.

The van has been specifically designed to Amazon’s specifications, it’s stylish, clean and has many great usability features. I have analyzed the SEC filing for the order between Amazon & Rivian and cannot see specific prices for the vehicles, but given conservative estimates it’s a substantial order by any means. Rivian can also license their fleet management software (FleetOS) which add another form of lucrative high margin income

The company has followed Tesla’s direct to consumer market which cuts out the dealership network. For production, the state of Georgia has offered lucrative incentives to Rivian. For example, Georgia’s Mega Project Tax Credit could be worth approximately $118 million in state income tax credits.

Production Outlook

Similar to Tesla, there is clear demand for the company’s products but the challenge is manufacturing at scale. Elon Musk recently stated at the Giga Texas Rodeo.

“Making prototypes is relatively easy, producing them at scale is the hard part”

Rivian has produced 2,553 EV’s in Q1 2022 at its Illinois manufacturing plant and plans to ramp up production for the rest of the year. The company has reduced it’s 2022 production forecast to just 25,000 electric vehicles, but their order book is growing substantially. The company originally planned to produce 50,000 vehicles but due to ongoing supply chain issues, semiconductors shortages issues this has been cut in half.

This is one of major reasons the stock has sold off, as any delay will eat into the company’s first mover advantage & give more time for competitors to bring products to market. Tesla also is less vulnerable to supply chain issues as they have vertically integrated their processes as much as possible. For example, Tesla recently purchased 10,000 acres of land in Nevada which can be used for Lithium mining.

Future Financials

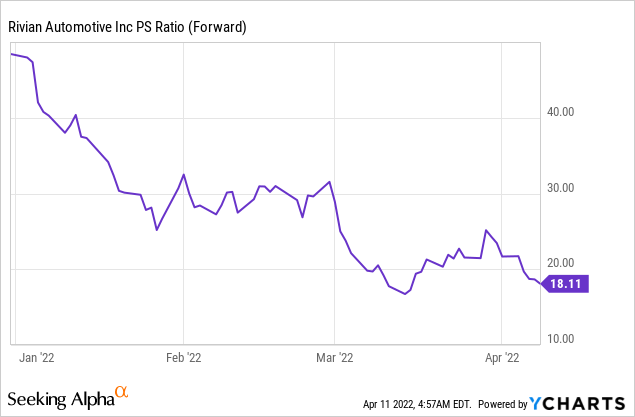

The majority of Rivian’s financial revenue is trapped inside future orders, thus we can only estimate this. For instance, Rivian’s production outlook for 2022 is 25,000 vehicles. If we multiply that by $70,000 (average price of a vehicle) we get $1.75 billion in revenue. At today’s market capitalization of $33 billion, that is a price to sales ratio of 18, which is much lower than historic PS multiples of close to 50!

Rivian PS Ratio (Created by author)

in terms of future pre orders, the company has 83,000 pre orders for their R1 models. Thus again assuming an average vehicle price of $70,000, this equates to $5.8 billion in pre orders. Given today’s market cap is $33 billion, they are trading at just 5.3 times sales. Tesla (TSLA) has a forward sales multiple of 10.1x and although at very different stages, it does help to give some indication of valuation. However, it should also be noted Rivian has a staggering $18.1 billion in cash. If we minus this from the current market cap, we get $14.9 billion thus this equates to 2.5x sales. But of course a portion of this cash will need to be deployed for production costs, materials etc.

Experienced Management

The management team at Rivian includes the CEO RJ Scaringe an MIT Phd. Nick Kalayjian, the executive VP who was the former VP at Tesla and has over 40 patents in his name. In addition to former Senior Directors at Toyota, Nissan, Jeep and Tesla.

Final Thoughts

Rivian is a growth company which has all the ingredients for potential success. The company’s partnership/investment from Amazon is their competitive advantage, as it effectively guarantees the firm consistent cash flows but also adds immense credibility to their product range. Rivian is trading at a low valuation of just 5.3x their future order book sales, thus the only major restriction to the firm’s success is the current supply chain disruptions. If the company cannot get materials efficiently and at a low cost this may give competitors time to get their product to market. Thus for me this is a growth company which is reasonably priced, but volatility is expected due to the current macroeconomic conditions.

Be the first to comment