hapabapa

After the bell on Wednesday, we received third quarter results from electric truck and SUV maker Rivian (NASDAQ:RIVN), seen in this shareholder letter. The company has been working hard to ramp its production volumes throughout this year, and it is in much better financial shape than most early-stage EV names. While Q3 saw another large loss and cash burn reported, the overall report was fairly decent, which should set the name up for a strong 2023.

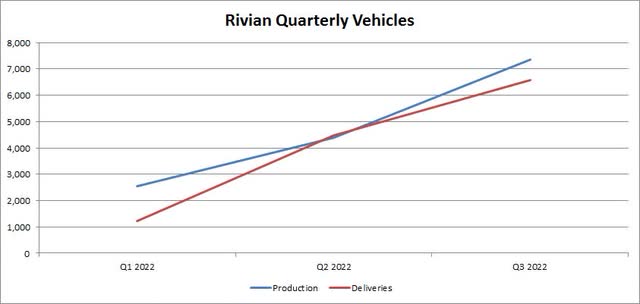

For the quarter, Rivian reported revenues of $536 million. Obviously, the revenue growth number here is quite ridiculous given last year’s period was nearly a zero-revenue quarter, but Q4 will finally start to lap some quarters with more than just a token amount of sales. The top line number did miss street estimates by almost $20 million, however, as analysts still try to figure out how much revenue is being generated here. As a reminder, Rivian released its quarterly production and delivery figures back in October, as its ramp continues as seen below.

Rivian Quarterly Vehicles (Company Reports)

Rivian has gone to a second shift at its plant, and the company reiterated guidance for the production of 25,000 vehicles this year. Due to the nature of the production ramp, as well as the move to rail transportation, production will outpace deliveries by a sizable margin in Q4. The average analyst revenue estimate going into the Q3 report implied almost 9,600 vehicles to be delivered in Q4, if you use average revenues in Q3 per delivery. I’m thinking that from what we’ve seen so far this year that might be a little optimistic currently if production will be a little less than 11,000 vehicles, but I don’t think the delivery number should be too far below that.

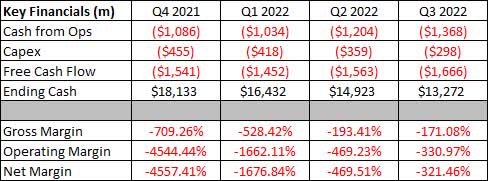

Perhaps the more important item for Rivian now is its loss and cash burn position. The company is still losing quite a bit of money, but as the table below shows, overall loss margins are improving each quarter currently. The company’s non-GAAP loss narrowed by $34 million to $1.437 billion, but that translated to a $1.57 per share loss that handily beat street estimates for a $1.83 loss. Cash burn did tick up slightly, but the company has a sizable cash balance to work with currently unlike many other EV startups out there.

Q3 2022 Key Financials (Company Earnings Reports)

Another good thing right now is that Rivian doesn’t have a demand problem, and it likely won’t have to worry about demand for quite a while. The company finished Q2 of this year with about 98,000 net pre-orders, but the following quote is the update that management provided on this key metric in the shareholder letter. These pre-orders are in addition to the 100,000 initial order of electric vans made by retail and internet giant Amazon (AMZN).

As of November 7, 2022, our net R1 pre-order backlog was over 114,000. This net pre-order backlog only includes orders made from U.S. and Canadian based customers, is net of any deliveries and cancellations, and includes all configured pre-orders made prior to May 25, 2022 and all reservations made on and following May 25, 2022.

As Rivian has ramped up production and started to generate meaningful revenue, this will be a big name to watch in 2023. We could be seeing a company that could potentially do more than 40,000 deliveries if all goes right, and that should mean at least $5 billion in annual revenue. As volumes and revenues surge, the key will be to keep costs under control and reducing the cash burn per quarter. It also will be interesting to see how competition shapes up, as Ford (F) is working on its own ramp of its electric pickup, with EV giant Tesla (TSLA) expected to launch its Cybertruck next year.

As for Rivian shares, they closed Wednesday a little over $28 but were trading close to $30 in the after-hours session. Wall street analysts think this name could double moving forward, although to be fair the average price target was nearly $140 when this name went public about a year ago. Rivian shares have lost most of their value from their nearly $180 peak, but unlike a lot of other names currently, they aren’t right at a 52-week low which was $19.25.

In the end, Rivian announced a decent set of results for Q3, which should set the name up nicely for 2023. While revenues could have been higher, the company is working to reduce its costs as it ramps production. The pre-order book is still strong, and management reiterated its guidance for 25,000 units of production this year. This name certainly looks to have some staying power in this space, especially thanks to significant support from Amazon, but I can’t say to buy just yet as the overall market remains quite weak and that could drag the name down some more as we finish out this year.

Be the first to comment