anyaberkut/iStock via Getty Images

Thesis

We recently wrote an article on OPP where we detailed our view on its dividend and asset composition in today’s environment. The fund recently had a rights offering that just concluded. We are of the opinion that fixed income CEFs are very smart to do rights offerings in today’s environment because they can result in certain instances in significant capital raises which can be deployed to purchase assets at distressed prices.

OPP just announced yesterday the results for its recent rights offering:

RiverNorth/DoubleLine Strategic Opportunity Fund, Inc. (the “Fund”) (NYSE: OPP) today announced the preliminary results of its transferable rights offering (the “Offering”) that expired on September 23, 2022 (the “Expiration Date”). In the Offering, the Fund received subscription requests for 3,508,633 shares of common stock from rights holders. Accordingly, the Fund expects to issue 3,508,633 new shares of common stock for these subscriptions, pending the receipt of payment for “delivery-guaranteed” subscriptions, on or about September 29, 2022. Gross proceeds from the Offering are expected to total approximately $34.0 million, before expenses.

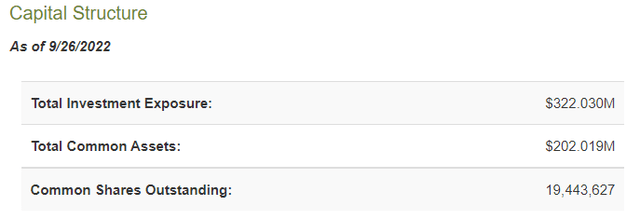

As per CEFConnect the fund had unleveraged assets of approximately $200 million prior to the offering:

Capital Structure (CEFConnect)

The new capital raise has thus resulted in a 17% increase in assets via the cash raise. While at the first glance the results look decent, they pale when compared to the ZTR rights offering. We wrote about those results here, which saw a 40% increase in the asset base. Investors did not express a risk appetite for the OPP name, and although the fund rights offering was not a “lemon” (I would think anything below 10% would fall into that category) it was not a success story either.

Furthermore, OPP offered a significant discount to NAV for its offering:

The Offering’s final subscription price per share was determined to be $9.70. The subscription price was established pursuant to the terms of the Offering and based on a formula equal to 92.5% of the reported net asset value (“NAV”). Using the formula described above, the NAV per share was $10.49. The final subscription price is lower than the original estimated subscription price of $10.89 per share. Accordingly, any excess payments will be returned to subscribing rights holders as soon as practicable, in accordance with the prospectus supplement and accompanying prospectus, filed with the Securities and Exchange Commission on August 17, 2022.

We can see from the above excerpt that the CEF offered a 92.5% discount to NAV, while most rights offerings do a 95% discount (this is what we saw happen in ZTR’s case).

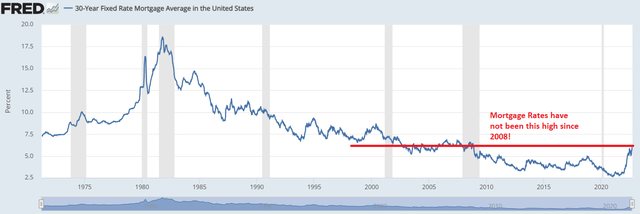

Do not get us wrong, ultimately even this rights offering is beneficial to OPP long term. The fund just raised $34 million, which can be used to purchase assets at great prices. The fund is overweight MBS bonds (both Agency and Non-Agency format) which have been absolutely trashed this year with mortgage rates through the roof:

Ultimately, if the fund keeps the same asset allocation it will end up buying AAA MBSs at very attractive yields, which will result in a robust performance going forward. However, our view is that $50 or $70 million in a cash raise via the rights offering would have been a more appropriate and attractive result.

Performance

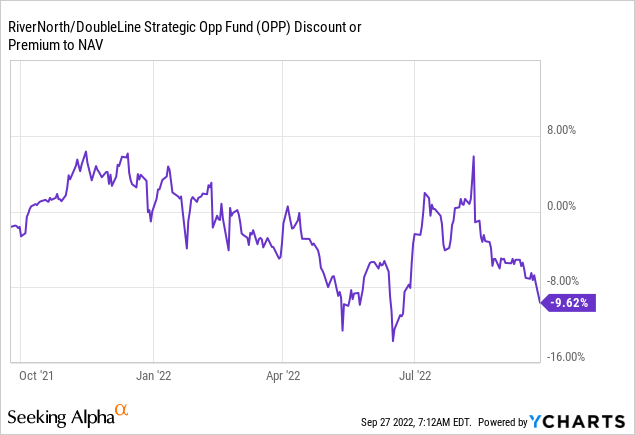

We can see the fund is reverting to a discount to NAV on the back of a risk-off environment:

From this perspective, this is not a bad time to enter the fund.

However, the vehicle has posted a terrible 2022 performance on the back of its large MBS holdings:

YTD Performance (Seeking Alpha)

Conclusion

OPP just concluded its rights offerings with a modest result. The fund was able to raise $34 million, or approximately 17% of its unleveraged asset base. Overall, the rights offering, which is a capital raise, is ultimately beneficial for the fund’s long-term results. Having cash in today’s environment and being able to purchase assets at distressed levels is a bonanza for the CEFs that are able to do so. This action will result in much more robust results going forward. From that lends the higher the rights offering take-out, the better for the fund. When compared to ZTR (another CEF that recently had a rights offering), OPP has shown modest results. Overall the capital raise was a positive but also saw the expression of investors’ restrained appetite for OPP shares.

Be the first to comment