William_Potter/iStock via Getty Images

Article Thesis

Rithm Capital (NYSE:RITM) has seen its shares drop in recent months, which has made its dividend yield explode upwards, to 11%. Due to rising mortgage rates and compressing yield spreads many mREITs are coming under pressure, but Rithm’s unique business model should offer some insulation. Rithm looks like it is better positioned than many of its more traditional mortgage peers, and the dividend looks sustainable at current levels.

mREIT Selloff

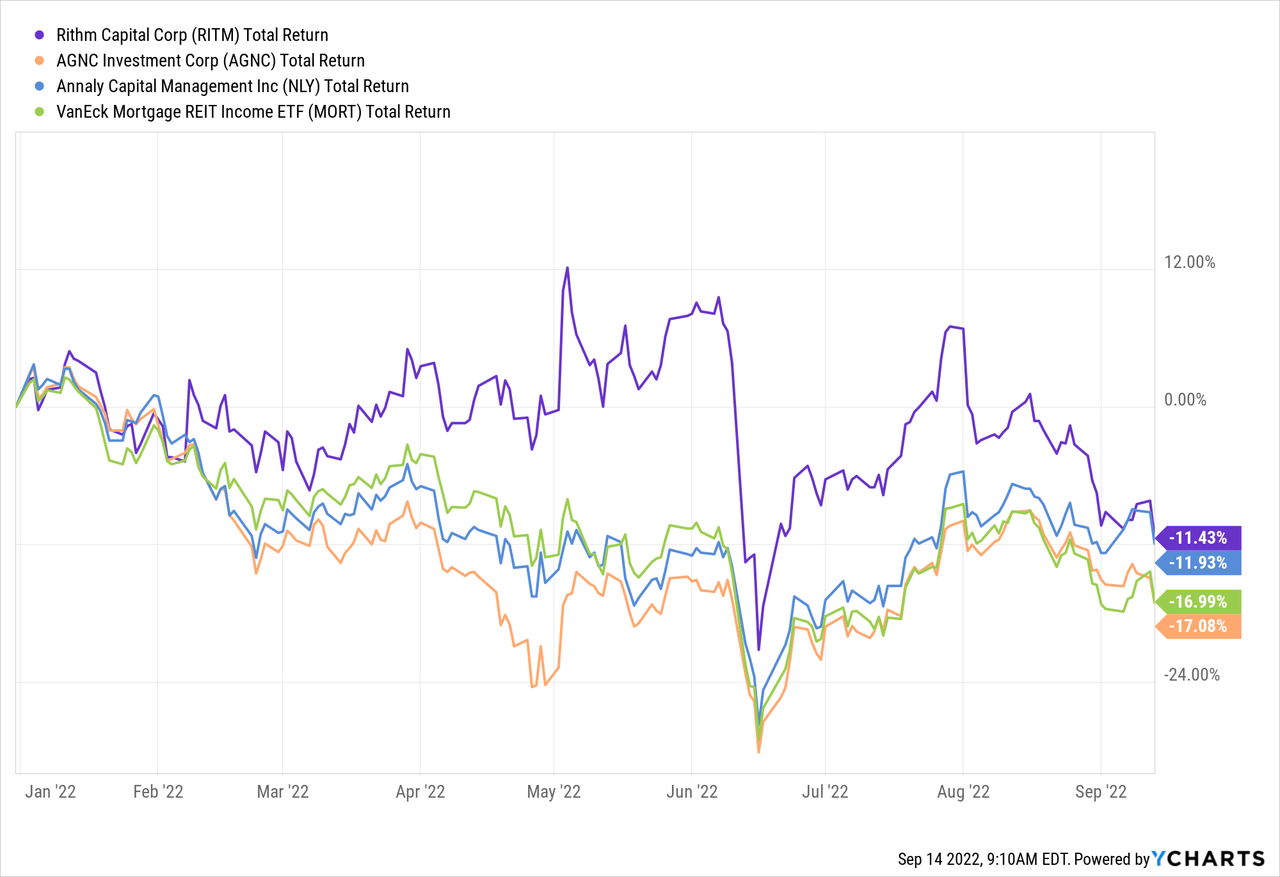

Rithm Capital is down this year, but that has happened to most mortgage REITs:

Even including their generous dividend payments, mortgage REITs such as Rithm Capital, AGNC Investment (AGNC), Annaly Capital (NLY), etc. are down considerably this year. The VanEck Mortgage REIT Income ETF (MORT) is down 17% so far in 2022 on a total return basis.

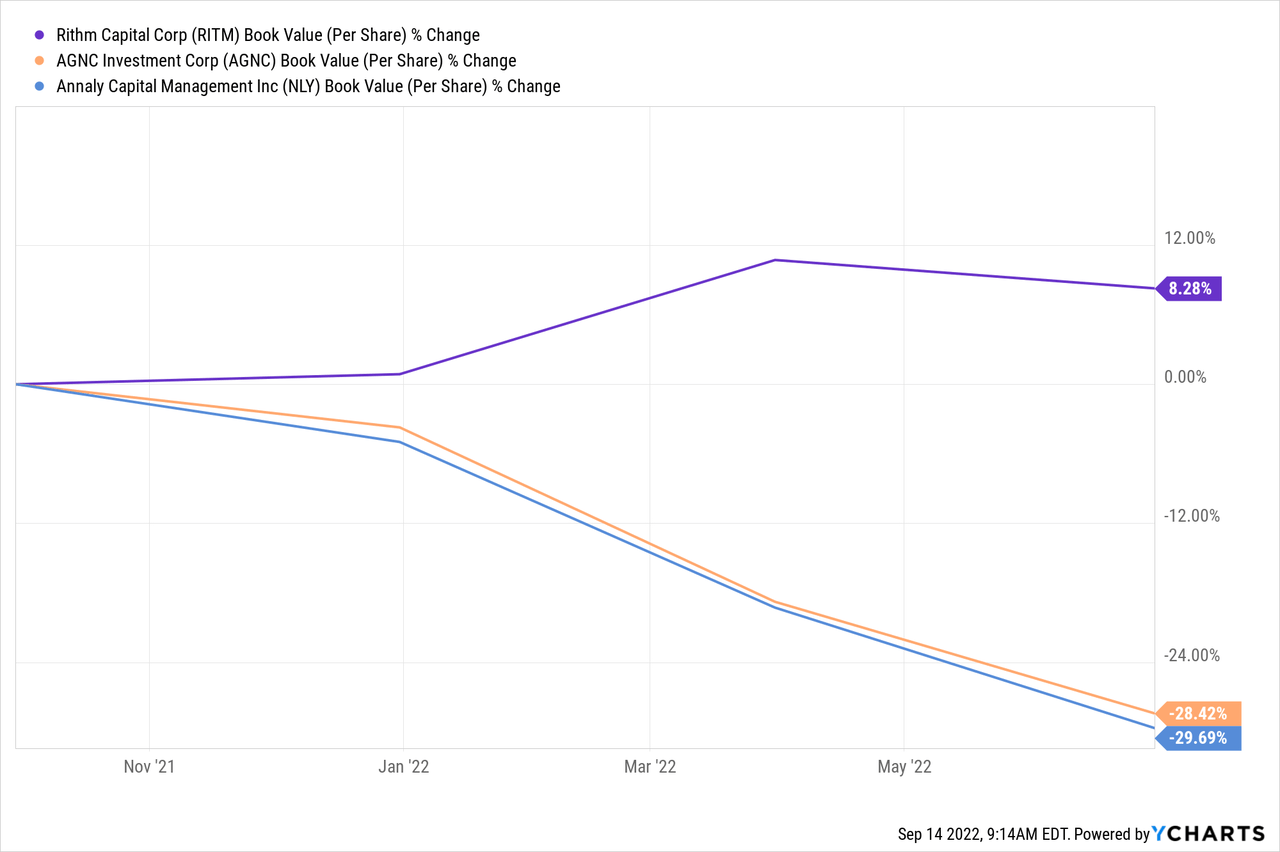

This can be explained by what is happening in fixed-income markets. High inflation has forced to Fed to hike rates considerably this year, which has led to increased yields on fixed-income assets such as treasuries and mortgages. Higher rates/yields for mortgages mean that the value of these mortgages sinks, all else equal. This has led to declining book values for many mortgage REITs:

AGNC and Annaly have seen their book value drop by around 30% on a per-share basis over the last year. The mortgages they own have declined in price, and due to the leverage they employ, this has had a considerable impact on their book value. Importantly, the same has not come true for Rithm Capital — its book value is actually up over the last year, despite substantial dividend payments that were made over the same time frame. This is the result of Rithm’s somewhat unique business model that better insulates it from interest rate headwinds. The fact that Rithm nevertheless has seen its share price drop considerably this year can be seen as a market irrationality, I believe. It looks like some investors are selling the stock due to it being an mREIT and due to the fact that the mortgage REIT universe, overall, is coming under pressure. The fact that Rithm is doing a lot better than other mREITs seems to have passed by some investors. I do believe that this irrational selloff could provide a buying opportunity for those that take a closer look and that see that Rithm shouldn’t be put into the same basket as AGNC, NLY, etc. — mREITs that have rightfully declined in price due to their dropping book value.

Rithm’s Unique Business Model Makes It More Resilient

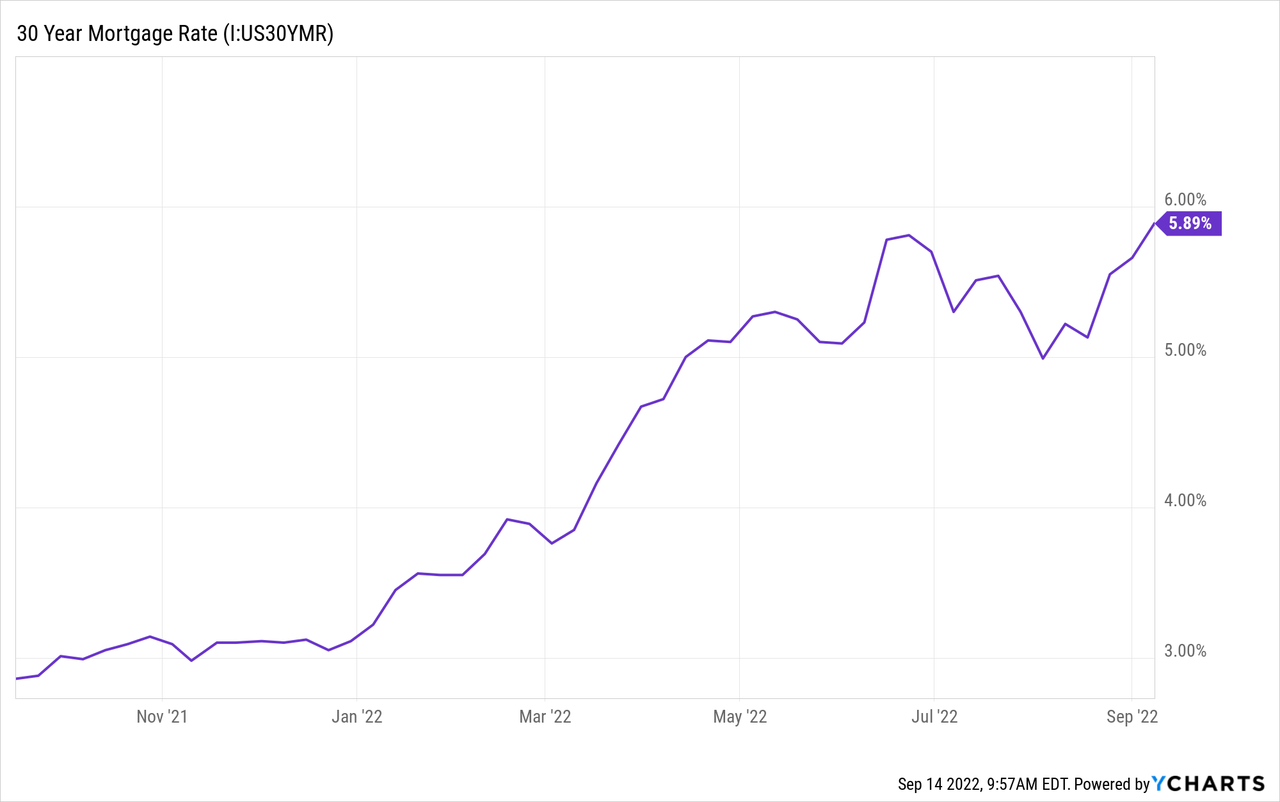

So why has Rithm been able to grow its book value while other mREITs are experiencing considerable book value declines? The explanation is that Rithm operates with a different business model than most other mortgage REITs. It does not own traditional mortgages primarily. Instead, it owns a large portfolio of (excess) mortgage servicing rights. These allow it to shave off some cash flow from mortgages that are in place, without owning the mortgages themselves. In the following chart, we see how mortgage rates have performed over the last year:

Mortgage rates (30 years) have roughly doubled over the last year. Today, at almost 6%, mortgage rates are at an elevated level relative to where they were over the last couple of years. This means that fewer people will refinance their mortgages, as there is no reason to — that only makes sense when it leads to interest savings, after all. With fewer or almost no mortgages being refinanced, more existing mortgages will remain in place and will continue to be paid. This increases the value of Rithm’s mortgage servicing rights — with those mortgages not being refinanced, they will continue to generate cash for Rithm for many years. During times of very low interest rates, e.g. during the peak of the pandemic, more mortgages were refinanced, which hurt Rithm’s mortgage servicing rights business. But those times have passed now, and Rithm’s MSR portfolio will benefit from high interest rates. This makes Rithm a uniquely positioned mortgage REIT that tends to benefit from the interest rate environment that hurts its peers so much.

MSRs are not Rithm’s only business, however. It should be mentioned that higher mortgage rates and fewer mortgage originations are negative factors for Rithm’s mortgage origination business. But thanks to the MSR focus of the company, Rithm has seen its book value grow during a time when its peers saw their book value drop. Likewise, Rithm is pretty profitable in the current environment. While its peers are seeing their profits come under pressure due to declining interest rate spreads, Rithm is less exposed to that theme. Short-term rates have risen more than long-term rates. Since traditional mortgage REITs borrow at short-term rates and lend at long-term rates, declining interest rate spreads result in lower profits for AGNC, NLY, etc. Rithm, meanwhile, is seeing its profits remain at a compelling level:

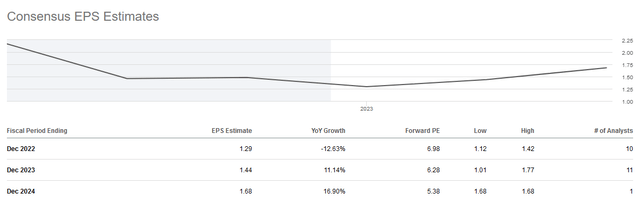

Analysts are currently predicting that Rithm Capital will generate slightly less than $1.30 in earnings per share this year. That’s down a little more than what the company earned last year, with this down move being explainable by lower mortgage originations. In 2021’s historic housing market run, RITM’s origination business was very profitable. Normalization is not surprising, as it was pretty clear that profits wouldn’t remain as high as during 2021 forever for that side of RITM’s business. But starting in 2023, Rithm Capital is forecasted to see its earnings per share climb again, with double-digit increases being expected for next year and the year after.

A Hefty Dividend And An Inexpensive Valuation

The $1.29 in earnings per share that are forecasted for the current year translate into a dividend coverage ratio of 1.3. In other words, Rithm Capital will pay out around 78% of its profits this year. That’s not a low payout ratio in absolute terms, but for a mortgage REIT that is also not an especially high payout ratio.

Next year, as profits rise to more than $1.40 (if the analyst community is right), the payout ratio drops to 69% and the dividend coverage ratio improves to more than 1.4. That’s a very solid dividend coverage ratio for a mortgage REIT, and it actually gives Rithm room to increase its payout.

Prior to the pandemic, Rithm, then called New Residential, was repeatedly paying out 80% or 90% of its profits, and there was no dividend cut until the pandemic disrupted the track record due to margin calls and forced portfolio liquidation. Rithm could thus increase its dividend to around $1.20 or $1.25 next year and its dividend payout ratio would still be in line with where it was historically. Even at a $1.20 annual payout, the dividend would be covered at a rate of 1.2, which would be decent for an mREIT.

Even if there is no dividend increase, RITM offers a hefty income yield. At current prices, the mREIT’s dividend yield stands at 11.2%. Normally, yields this high should give investors pause. But I believe that RITM may be a special case, as its business fundamentals and book value are intact, whereas the high yield seems to be the result of indiscriminate selling of mortgage REITs. I do believe that there is a high chance that AGNC, NLY, and co. will reduce their dividends over the next year, which is why their high dividend yields make sense — the market is pricing them for an upcoming dividend reduction. But indiscriminate selling seems to have made RITM an “accidental” high-yielder, as its dividend looks relatively sustainable. There is no guarantee of the dividend being maintained, and investors shouldn’t put an overly large portion of their portfolio into RITM, I believe. But compared to many other mREITs, RITM looks relatively well-positioned for the coming years, and I do not think that a dividend cut is particularly likely.

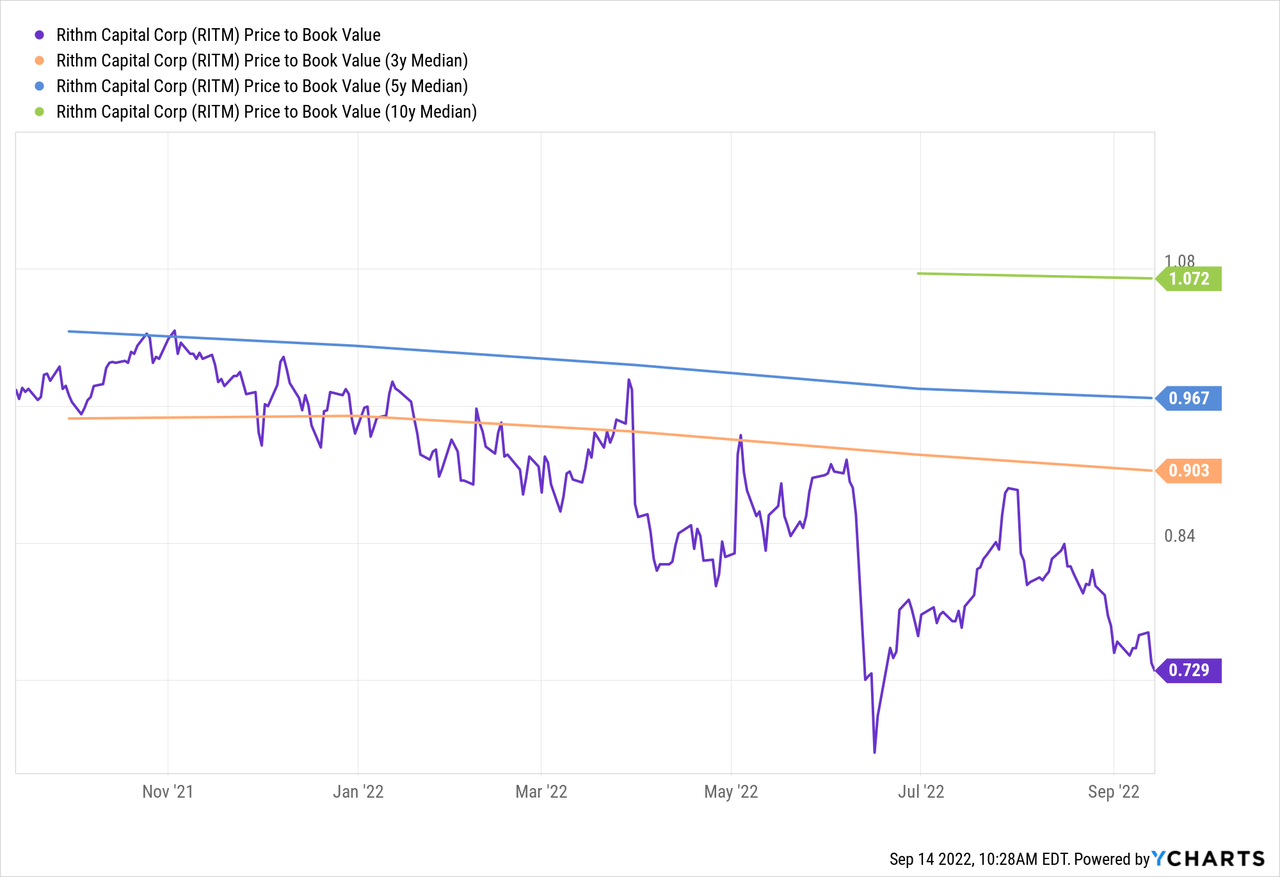

Rithm Capital also looks quite inexpensive at current prices. Its earnings multiple is just 6.9 based on this year’s forecast, and just 6.2 based on next year’s consensus EPS. Looking at its book value, Rithm again looks like it is trading at a very undemanding valuation:

In the past, Rithm/New Residential has mostly traded relatively close to book value. The 10-year median book value valuation actually was slightly above 1. Compared to that, RITM looks very inexpensive today. In fact, even a 30% share price increase would only translate into a 0.95x book value multiple, which would be almost perfectly in line with the 5-year median, and below the 10-year median. Even the 3-year median book value multiple, most heavily impacted by the pandemic, would suggest an upside potential of around 23% at current prices.

Between an 11% dividend yield and 20%+ upside potential towards its historic valuation norm, Rithm thus offers a compelling total return outlook, I believe.

Takeaway

Chasing high yields can be dangerous. But in RITM’s case, going for a high yield could pay off. Rithm Capital is better-positioned relative to its mREIT peers, and yet it has sold off just the same. Indiscriminate selling offers a chance to buy RITM at a historically low valuation right now.

There are risks, as the sell-off in spring 2020 has shown. But at current valuations and with a very high dividend yield, these risks may be outweighed by the potential rewards. RITM looks like a better pick than other mREITs and could be an attractive choice at current prices, I believe. I bought a first tranche on September 14.

Be the first to comment