Vertigo3d

Rithm Capital Corp. (NYSE:RITM), formerly known as New Residential Investment Corporation, is currently trading at a yield in excess of 11%. This raises the question of whether an investment in Rithm Capital is a yield trap.

Even though the trust’s 11% yield is impressive, Rithm Capital is not your typical mortgage real estate investment trust (“mREIT”) with a huge portfolio of mortgage-backed assets.

Rithm Capital, on the other hand, is a non-traditional trust with significant assets in residential loans, real estate securities, and Mortgage Servicing Rights.

In a rising-rate market, Mortgage Servicing Rights provide Rithm Capital with earnings potential.

Rithm Capital’s 11% dividend yield is neither a red signal nor a yield trap because it is also covered by earnings available for distribution.

Potential For Higher Distributable Earnings

Rithm Capital is not your run-of-the-mill mortgage trust. Rithm Capital invests in mortgage and real estate assets with leverage, although these assets are fundamentally distinct from those of mortgage real estate investment trusts like Annaly Capital Management, Inc. (NLY).

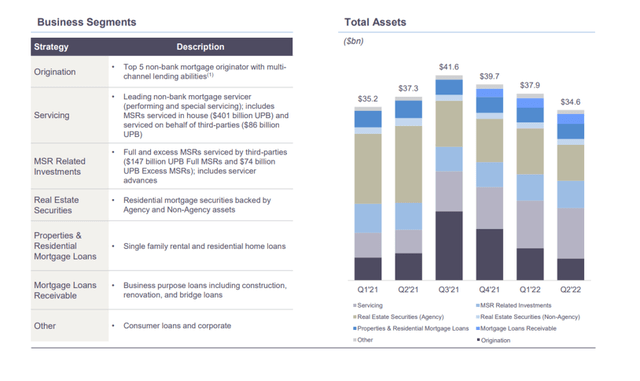

Rithm Capital invests in a wide range of mortgage assets, including agency and non-agency residential mortgage securities, single-family residential loans, and so-called Mortgage Servicing Rights.

The right to service a mortgage (an MSR) gains value for servicers as interest rates rise, which they will do significantly in 2022. Mortgage Servicing Rights become more valuable as interest rates rise, implying that the trust sees higher MSR values/income during periods of rising interest rates. Higher interest rates are a clear road to higher distributable earnings for Rithm Capital.

Portfolio Overview (Rithm Capital Corp)

Mortgage Servicing Rights are simply one avenue for the trust to generate more distributable earnings in the future. Another option to generate larger earnings in the near future is through the trust’s management internationalization.

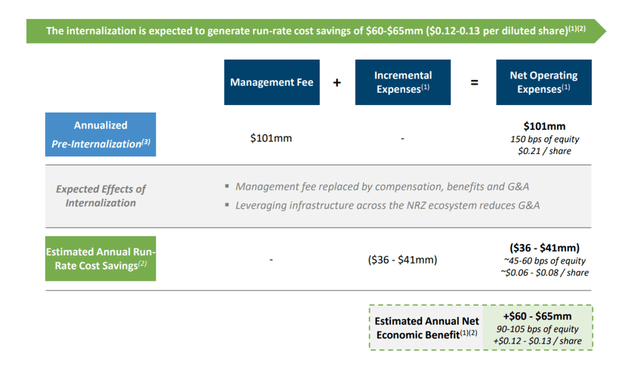

Rithm Capital recently internalized its management, which means the trust will no longer have to pay an incentive fee to its previous internal manager. The economic impact of internalization has been projected to be $60-65 million per year, or $0.12-0.13 per share.

For Rithm Capital and its shareholders, this means that a larger portion of profits will be available for distribution, which could result in a greater dividend.

Estimated Annual Net Economic Benefit (Rithm Capital Corp)

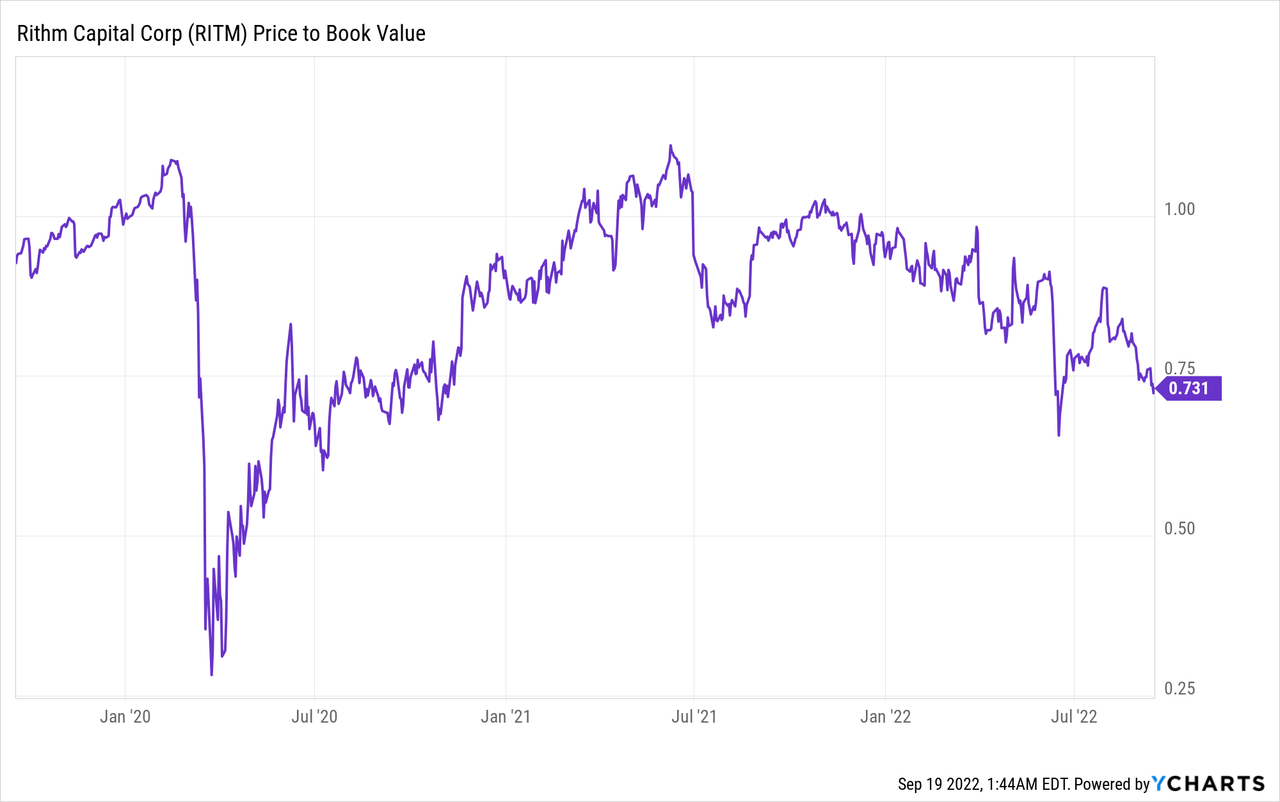

Excessive 27% Discount To Book Value For No Reason

I mentioned Rithm Capital’s low pay-out ratio based on distributable earnings in my previous article. It was 81% in 2Q-22 and 66% in the previous twelve months, indicating that the dividend is not only safe but also has capacity to increase.

Furthermore, the mortgage trust’s low valuation does not sufficiently reflect the low payout ratio, for which I don’t see a justification.

The discount to book value has recently increased to 27%, which I do not believe is justified given the trust’s low payout ratio.

Why Rithm Capital Could See A Lower Valuation

Rithm Capital, in my opinion, is significantly undervalued, owing to the exorbitant discount to book value and the fact that the mortgage trust is well-positioned for rising interest rates.

Furthermore, Rithm Capital has proved the ability to cover its dividend with distributable earnings, and the payout ratio is relatively low for a mortgage trust with a dividend yield in the double digits.

However, there are risks for Rithm Capital that could lead to a decline in book value, including rising loan losses, lower realized economic potential from internalization, and a cyclical decline in interest rates, which would negate my favorable comments about the trust’s Mortgage Servicing Rights portfolio.

My Conclusion

I’m loading up the truck with Rithm Capital’s 11.2% dividend yield right now because it appears not just safe, but it seems really safe.

The trust’s payout ratio based on distributable earnings was 66% in the second quarter, which gives plenty of room for dividend growth in the long term. The low payout ratio is truly unique, and it distinguishes Rithm Capital from other mortgage real estate investment trusts that I have previously examined.

The very steep and unjustifiable discount to book value that has recently expanded, in my opinion, significantly improves Rithm Capital’s value argument. Rithm Capital’s stock is a strong buy in my opinion.

Be the first to comment