DNY59

Thesis

Investors in mREITs like Rithm Capital Corp. (NYSE:RITM) have come under significant pressure over the past three months. Rithm (previously known as New Residential) stock has also been battered, despite having a “large portfolio” of Mortgage Servicing Rights (MSRs).

The market has been parsing the risks on Rithm Capital’s forward distributable earnings per share, given the expected hit to its originations due to the record high mortgage rates. The housing markets have continued to weaken, with affordability challenges continuing to put more pressure on new originations. Economists are also uncertain about their views of the forward mortgage rates, as the surge in the 30Y mortgage rates has obliterated their previous forecasts.

However, we gleaned that the panic in RITM has created a massive opportunity for investors who can tolerate some near-term downside volatility. We believe the market has de-risked RITM markedly to reflect the unprecedented surge in mortgage rates on their forward distributable EPS, potentially impacting their dividend payouts.

However, we also observed that the market forced a rapid selldown since July to take out weak holders in RITM rapidly, akin to a capitulation move preceding a bullish reversal. Our analysis suggests that the selling has likely subsided, with a mean-reversion opportunity already underway.

Therefore, we urge investors still sitting on the sidelines to capitalize on RITM’s current weakness and add exposure. Accordingly, we rate RITM as a Buy.

Record Surge In Mortgage Rates Freaked Out Weak RITM Holders

US 30Y mortgage rates price chart (monthly) (TradingView)

As seen above, the US 30Y mortgage rates surged incredibly from a low of 2.67% in December 2020 to a high of 6.92% recently (increased further to 7.15% as of October 18). Of course, the record surge in the US Fed Fund rates (FFR), which lifted the US 2Y treasury yields from near 0% to 4.5%, played a significant role in the rapid collapse in mREIT stocks.

Little wonder mREIT investors freaked out and fled for the hills, including RITM investors, as RITM lost nearly 40% from its July highs to its October lows, underperforming the broad market significantly.

However, we postulate significant damage in RITM’s forward expectations has already been reflected in its current valuation.

Rithm Capital’s Distributable Earnings Estimates Have Been Slashed

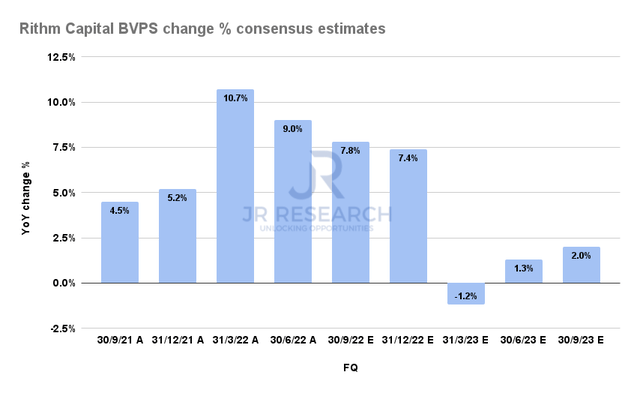

Rithm Capital BVPS change % consensus estimates (S&P Cap IQ)

We believe some investors in RITM must have been aghast about the stunning collapse in RITM over the past few months, despite Rithm Capital posting a solid YoY increase in its book value per share (BVPS).

Rithm’s MSRs have helped mitigate the challenges with new originations in the current mREITs malaise, as its MSRs portfolio posted marked-to-market changes of $515M in Q2.

However, Rithm’s combined pre-tax income for its Servicing & MSRs segment still fell to $620M (down from Q1’s $908M). Hence, the market is concerned with the hit to its distributable earnings, which ultimately affects its distribution. Therefore, the right way to look at RITM is to assess the impact on its distributable EPS.

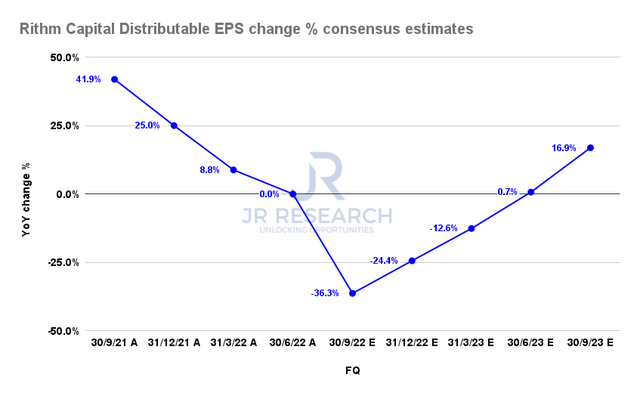

Rithm Capital Distributable EPS change % consensus estimates (S&P Cap IQ)

Wall Street has already gone into panic mode, slashing forward estimates for Rithm Capital’s Distributable EPS through Q1’23. As seen above, Rithm Capital is projected to post a 36% decline in its Distributable EPS for its upcoming Q3 earnings release on November 2.

Notwithstanding, the market had already anticipated the marked impact on its earnings estimates at its July highs, as it drew in buyers rapidly before the “kill.”

The consensus estimates suggest that Rithm Capital’s Distributable EPS could stage its nadir in Q3 before recovering through FY23.

We postulate that the estimates are consistent with our expectations of a peak in the 2Y yields after the December FOMC meeting, which should also lead to a peak in mortgage rates. Edward Yardeni also highlighted in a recent commentary (October 18):

We know that historically when the yield spread between the 10-year bond and 2-year note has been inverted, we were approaching a peak in the bond yield. The daily 10-year versus 2-year yield spread has been inverted since July 8. [Our forecast] would put the [terminal] FFR at 4.50%-4.75%, which is probably the current consensus forecast as well. The 2-year yield is currently around 4.40%. So it is very close to our forecast of the terminal rate. The bond yield [will] most likely peak following November’s 75 bps hike in the FFR. It might do so anticipating that the December hike will be the terminal one. – Yardeni Research

Is RITM Stock A Buy, Sell, Or Hold?

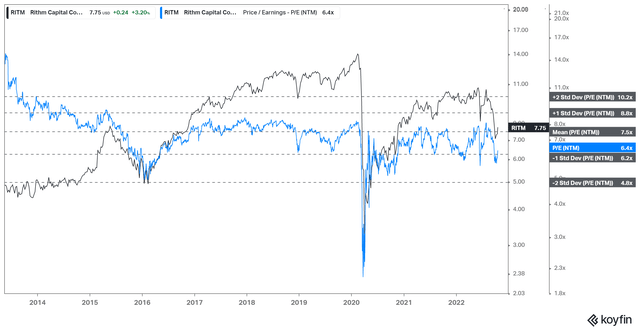

RITM NTM Distributable EPS multiples valuation trend (koyfin)

RITM last traded at an NTM Distributable earnings multiple of 6.4x, in line with the lows that supported its valuation since 2021. Therefore, we deduce that RITM had been battered, as it has fallen to the one standard deviation zone under its mean.

While the possibility for downside volatility cannot be ruled out, we assess that the current valuation levels seem attractive.

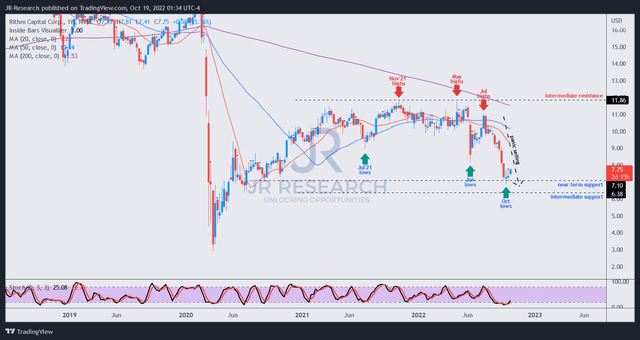

RITM price chart (weekly) (TradingView)

Furthermore, we gleaned that the steep selldown from July represented a massive capitulation move that took out the gains all the way back to the lows in September 2020. Also, we observed that the selling downside has likely subsided, with a potential bullish reversal already in the works.

Coupled with a relatively attractive valuation, we are confident that the current levels should hold robustly.

Accordingly, we rate RITM as a Buy with a medium-term price target of $9.5 (implying a potential upside of 23%).

Be the first to comment