Mario Tama

Thesis

About two months ago, I highlighted Intel Corporation (NASDAQ:INTC) as a sell idea, and the stock has lost about 20% since. Despite the attractive valuation, I argued that Intel would be a value trap and estimated 27% more downside for the stock. Now, even though INTC stock is now slowly approaching my target price, I simply cannot see an opportunity for turning more bullish.

One major reason for my continued pessimism is anchored on management’s decision to aggressively push for the Mobileye Global Inc. (MBLY) IPO. After Mobileye’s valuation first crashed from $50 billion to $30 billion and now to $14 – $16 billion, why is there such a hurry to push the IPO? Given frozen equity markets and low valuations, the time is clearly not right.

As I am concerned about Intel’s management culture, INTC stock remains a “Sell.”

Intel’s Bet On Mobileye

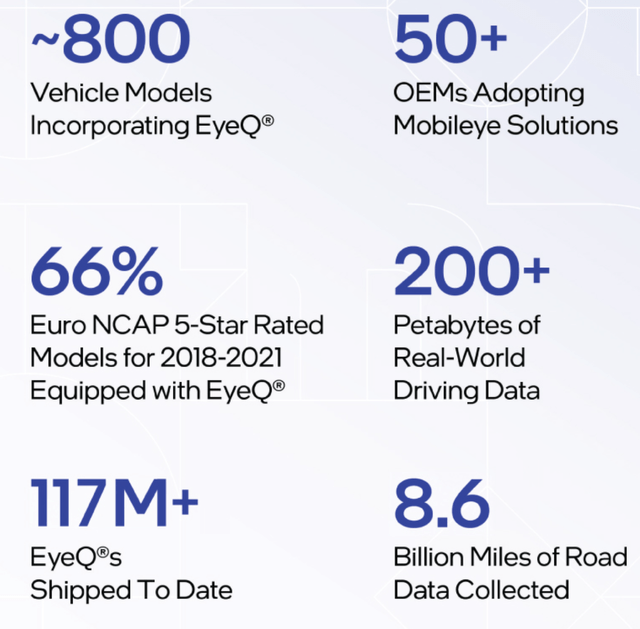

Intel acquired Mobileye, a sensor maker based in Israel, about four years ago and grew the company to become a leading supplier for AI-chips and software for driverless cars. As of June 2022, it is estimated that more than 100 million auto units deploy Mobileye’s solutions, and the company believes that another 250 million units could be added by 2030.

Mobileye is also committed to launch its own robotaxi service, which is expected to start operations as early as late 2022/early 2023 in Munich, Germany. Further testing is expected in New York City, where the company is hoping to accumulate data in a dense traffic environment, which is notoriously difficult to navigate. But so far, the permission for New York is still outstanding.

Mobileye’s growth has clearly outpaced that of Intel, but has failed to be a meaningful contributor to the parent company’s financials – accounting for only approximately 3% of Intel’s revenues. But still, Mobileye’s business expansion has been notable: Revenues have quadrupled since Intel bought the start-up in August 2017, generating about $1.4 billion of sales in 2021.

In Q2 2022, Mobileye grew revenues 41% year over year, to $460 million. The segment’s operating income jumped 43% respectively, to $190 million.

Intel paid $15.3 billion for Mobileye.

Self-Driving: Speculation & Glamour

Self-driving technology has for a long time enjoyed interest from the world’s major investors and technology companies. The ‘on-paper’ economics of robotaxis and SaaS-autonomous driving technology are simply too attractive to ignore. According to McKinsey, it is estimated that investors have so far bet around $100 billion on self-driving technologies.

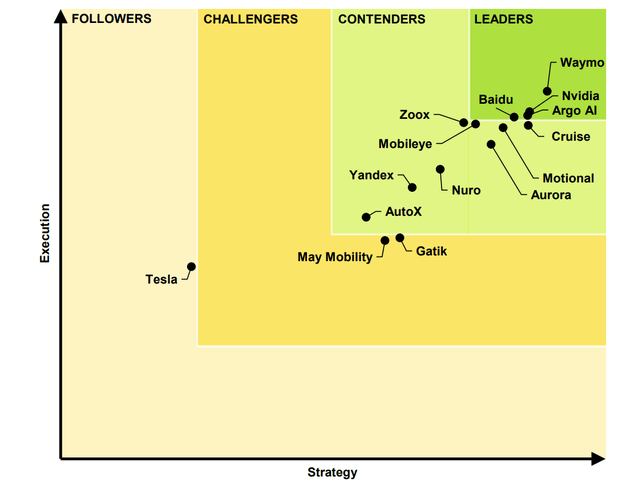

But as of 2022, both the technology as well as the economics of the technology must yet be demonstrated. Moreover, the industry competition, in which Mobileye is not necessarily a leader, is very crowded.

According to research done by Guidhouse Insights, Mobileye is only a “contender” to the leading innovators such as Google’s Waymo (GOOG)(GOOGL), Baidu (BIDU), Nvidia (NVDA) and Argo AI.

Reflecting on self-driving technology investments, investors should also consider that the technology is now much less “hyped” than a few years ago. For example, Waymo’s valuation was once as high as $175 billion. Now, the valuation is down to $30 billion.

Lower valuations are good for investors, but also indicate funding risk. I have recently written about Aurora Innovation, a self-driving tech company that is now struggling to find financing, as investors are increasingly reluctant to speculate on emerging technologies and long-duration bets – as evident by the sharp sell-off of growth stocks YTD: “Aurora Innovation: CEO Hints Possible Sale To Apple Or Microsoft” (NASDAQ:AUR).

IPO For $14 – $16 Billion?

On September 30, Intel filed the Form S-1 with the SEC to push ahead the Mobileye IPO. The move has been widely expected ever since Intel CEO Pat Gelsinger commented, that an IPO…:

… provides the best opportunity to build on Mobileye’s track record for innovation and unlock value for shareholders.

But the timing for the IPO could not have been worse, as falling valuation and global risk-aversion has frozen access to capital markets. That said, Intel had previously demanded a valuation of about $50 billion, but now cut the valuation almost by half — to $30 billion. Moreover, the S-1 filing lists 24 underwriters, including Goldman Sachs (GS) Morgan Stanley (MS) and Citigroup (C) — to name just a few. As I see it, the IPO needs lots of marketing to fill the books.

Intel has previously targeted a $50 billion valuation, then a $30 billion valuation, and now a valuation as low as $14.4 – $16 billion, which is approximately the same price Intel paid for MBLY 5 years ago.

But can Intel call a valuation of $14.4 – $16 billion? Investors should consider that at such a price, Mobileye would effectively be valued at about 12 times 2021 revenue. For reference, Tesla (TSLA) is currently valued at 10 times. Moreover, Mobileye is not yet net profitable. The prospectus highlights that in the 1H of 2022, despite $854 million of TTM revenues, the company posted a net loss of $67 million.

But perhaps more important than the question if Intel “can,” an investor should ask if they “should.” Intel management claimed that the IPO is designed to “unlock value for its shareholders.” But, at a valuation similar to what has been paid in 2017, despite additional funding to support loss making operations over the past 5 years, and despite an arguably successful management of MBLY, I have a difficult time to understand how the IPO should create value for shareholders.

Conclusion

Over the past decade, Intel management has lost much of its technological edge in chipmaking. And the stock price, which has been trading at $28/share already in 1998, clearly highlights this thesis.

In my opinion, Intel’s aggressive push to IPO Mobileye – despite a very unfavorable time and unappealing terms – is a latest sign that management might fail to take decisions that align with long-term value accumulation. If the company needs cash, I personally would like to see that the 5% dividend is cut in half. Remain “Sell” rated.

Be the first to comment