Kwarkot

Investment Thesis

Rithm Capital Corp (NYSE:RITM) mainly provides capital and services to the real estate and financial services sector. The company pays an attractive dividend yield which I believe can grow over the coming years. This solid dividend yield makes the company an attractive investment opportunity for risk-averse and retired investors expecting a fixed, regular income bearing limited risk.

About RITM

RITM is a real estate investment trust which manages assets and investments across the real estate space. It manages and invests in mortgage-related assets which offer attractive risk-adjusted returns. The company’s portfolio consists of consumer loans, mortgage servicing rights, residential mortgage-backed securities, mortgage origination & servicing, residential securities, and properties & loans. The company operates in six business segments: Origination, Servicing, Residential Securities, MSR Related Investments, Consumer Loans, Mortgage Loans, and Properties & Loans. The Origination segment has multiple lending platforms which offer purchase and refinance loans. These multi-channel lending platforms include channels such as Direct Consumer, Joint venture, Wholesale, and Correspondent lending channels. The company is considered one of the largest non-bank mortgage originators in the USA, as it funds mortgages of $123.3 billion. Despite industry capacity constraints, the demand for loans rapidly increased, which helped the company to maintain an attractive gain on sale margins. The Servicing segment conducts business through its performing loan servicing division and Shellpoint Mortgage Servicing (SMS). This segment mainly includes the remittance of principal & interest payments to investors, collection of loan payments, and management of escrow funds for mortgage-related expenses. MSR Related Investments segment provides certain rights to a mortgage servicer to service a pool of residential mortgage loans for which interest payments are made. The purpose of these advances is mainly to provide liquidity. Residential Securities, Properties & Loans segment deals in residential mortgage loans. Most residential mortgage loans are packaged into pools & held in securitization companies that issue securities (RMBS). The Consumer Loans and Mortgage Loans segment generates revenue by providing loans that help the company to diversify its portfolio.

Attractive Dividend Yield

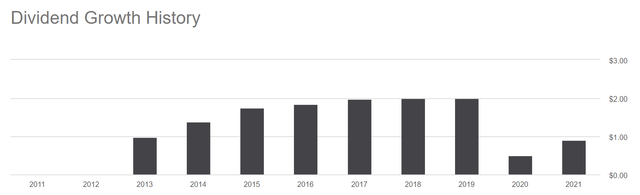

Dividend Trend (Seeking Alpha)

We can see in the above chart that the company has a long track record of dividend payment. However, In FY2020, the dividend payment decreased significantly due to uncertainty and a slowdown in the market due to Covid-19. The company paid a $2.00 dividend per share in FY2019. In FY2020, it paid only $0.50, which is a decrease of 75% YoY. But now dividend payment is slowly increasing. For the year 2021, the company distributed an annual cash dividend of $0.9 per share, which was driven by the tremendous growth of the company by the acquisition of Caliber, which made it one of the largest non-bank mortgage originators in the USA. In 2022, it distributed a cash dividend of $0.25 per share in each of the three quarters. This high payment of dividends signals the excellent position of the company. I believe this dividend to remain constant for the fourth quarter and a further increase in the coming years, as the company can experience strong growth in its single-family rental and Genesis business in the coming period. Therefore, I estimate a dividend of $0.25 in the fourth quarter, which makes the $1.00 annual dividend per share, representing a dividend yield of 13.10%. I think this high dividend yield makes the company an attractive investment opportunity for risk-averse and retired investors, which can help them to generate a fixed income while bearing a limited risk.

What is the Main Risk Faced by RITM?

Changes in Credit Spreads

The value of fixed-rate securities is determined by a market credit spread over the interest rate on fixed-rate USA Treasury bonds with a similar maturity. Changes in LIBOR spreads have an equivalent impact on the value of floating rate securities, which are quoted based on a market credit spread over LIBOR. Based on the amortized cost basis of all securities, the RITM’s Non-Agency RMBS Portfolio contained 32.0% floating-rate securities, 68.0% fixed-rate securities, and 100% of the company’s Agency RMBS Portfolio included fixed-rate securities. The market will typically demand a greater yield on these assets as a result of an excessive supply and weak demand, leading to the use of a higher or wider spread over the benchmark interest rate to price such securities. The value of RITM’s real estate and other securities portfolios would typically decrease under such circumstances. The value of RITM’s real estate and other securities portfolio would typically rise, on the other hand, if the spread used to value such assets were to narrow or tighten. Such changes in the market value of the company’s portfolios of real estate securities might directly impact net equity, net income, or cash flow by affecting unrealized gains or losses on securities that are available for sale. Consequently, RITM’s ability to realize gains on such securities may have an indirect effect by impacting the company’s ability to borrow money and access capital. Widening credit spreads could result in net losses due to the company’s book value per share declining and the net unrealized gains on its securities and derivatives, which are included in other accumulated comprehensive income or retained earnings.

Conclusion

RITM deals in managing assets and investments across the real estate industry. The industry has observed a significant demand rebound in the sector which can provide growth opportunities for the company to grant more mortgage loans. The company can experience strong growth in its single-family rental and Genesis business in the coming years. RITM is subject to change in credit spread. The company has paid a high dividend yield over the years, which makes it an attractive investment opportunity for risk-averse and retired investors. Currently, RITM pays dividend yield of 13.10%. After analyzing all the above factors, I assign a buy rating to RITM.

Be the first to comment