Blue Harbinger Kraig Scarbinsky/DigitalVision via Getty Images

We just had the best week for stocks since 2020, with all three major indexes up big (SPY) (QQQ) (DIA). But don’t let that cloud your judgement as those same indexes are all down significantly this year and the market still faces significant challenges (such as inflation and geopolitical risks). In this report we share data on 100 big-yield investments (including REITs, BDCs, CEFs and dividend growth stocks) and then conclude with a warning for investors about how they should be playing current market conditions.

The Week in Review:

For starters, here is a video by Blue Harbinger’s Mark Hines on the week in review, discussing increased clarity in the market from China’s announcement that its tech crackdown will end soon and the US fed’s announcement that they expect to increase the target federal funds rate six more times this year (following the 25 basis point hike we saw this week).

In a nutshell, the two takeaways from the video are that (1) the market hates uncertainty and (2) you shouldn’t ditch your long-term investment strategy just because the market had one good week. Stay disciplined, stay focused.

100 Big-Yield Investments

If you are like a lot of investors, you are sick and tired of losing sleep at night because of the extremely volatile market conditions we have been experiencing over the last 2 years. From the initial pandemic crash in early 2020, to the massive rebound (especially for high growth stocks), and now the market’s significant decline this year (especially for volatile high growth stocks) as the US fed deals with the devastating inflation numbers (Feb CPI increased 7.9% year-over-year-the highest in over 40 years!) that are basically the result of the government’s panic-driven stimulus reaction to the pandemic (e.g. low rates, stimulus checks and massive fed balance sheet expansion, to name a few).

Many investors gain comfort from investments that pay steady high-income payments (e.g. dividends) because they love to keep receiving that income even when the market is selling off. Obviously, not all income payments are created equally, and they each have their own unique risks, so we have broken the 100 into four distinct categories. Let’s start with high-income Closed-End Funds (“CEFs”).

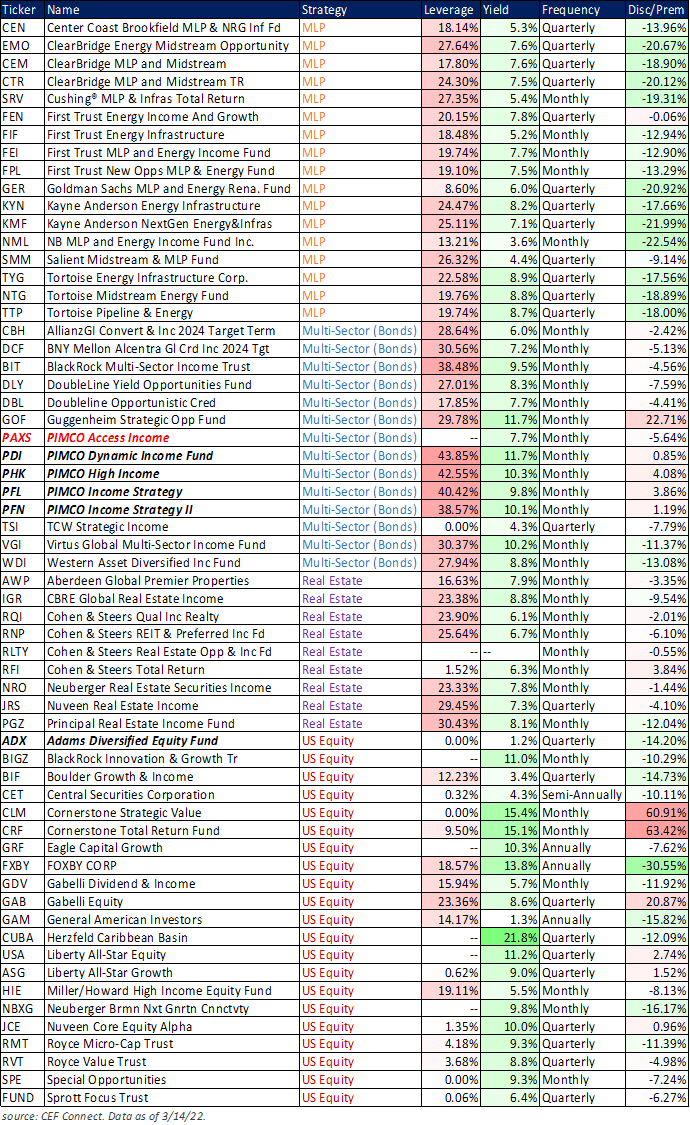

25 High-Yield CEFs

CEFs are often an income investor favorite because they can pay high levels of income (often monthly), provide some levels of instant diversification (because their underlying holdings often include many different individual investments) and because they can occasionally trade at attractive prices relative to the underlying value of their holdings (i.e. discounts and premiums versus net asset value or “NAV”).

Here is a table we shared with members of our Seeking Alpha marketplace service, Big-Dividends PLUS, earlier this week. One thing we noted was the attractive prices on a few PIMCO Bond CEFs (such as (PDI) (PAXS)), which have basically increased in price sharply since then as the market has rallied following increased clarity from the fed.

Blue Harbinger

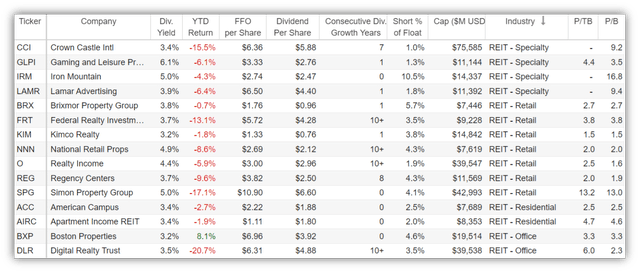

25 Big-Yield REITs

REITs are another income investor favorite because they too can offer big dividends (to help you sleep well at night), plus they generally own physical assets (real estate) which can do well in an inflationary environment. Here are 25 big-dividend REITs, sorted by industry.

Stock Rover (data as of 3-18-22) Stock Rover (data as of 3-18-22)

Noteworthy from the above table are Realty Income (O), Digital Realty (DLR), Stag Industrial (STAG) and W.P. Carey (WPC) because they all offer attractive dividend yields that have been increased for at least 10 years straight and they are all trading at lower prices this year. We’ve written in more detail about them recently for members.

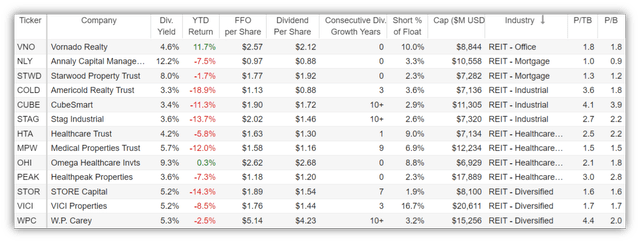

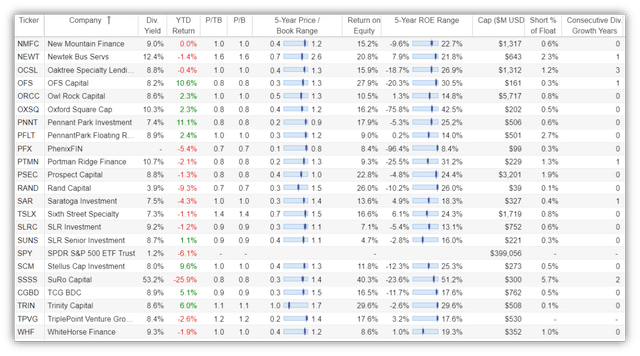

Big-Dividend BDCs

BDCs are business development companies, and they basically provide financing (mostly loans) to middle market businesses that are often too small (or a little bit too risky) for big banks (especially considering the more stringent bank lending rules that came into place following the financial crisis of 2008-2009 when many traditional big banks were deemed “too big to fail”).

Stock Rover (data as of 3-18-22) Stock Rover (data as of 3-18-22)

One interesting thing about financials in general (especially those that provide capital though lending) is that their entire business is based largely on net interest margins, and those net interest margins generally increase (leading to more profitability) when interest rates go up. Obviously, there are many different types of BDCs (and many different types of loans with significantly different risk profiles), but ceteris paribus, BDCs could be helped by the fed’s new trajectory of six more expected interest rate hikes this year (because it can ultimately help to improve BDC net interest margins). Furthermore, BDCs hold some of the higher yielding assets that big banks wish they could (but they cannot because of the new more stringent balance sheet rules following the ’08-’09 financial crisis).

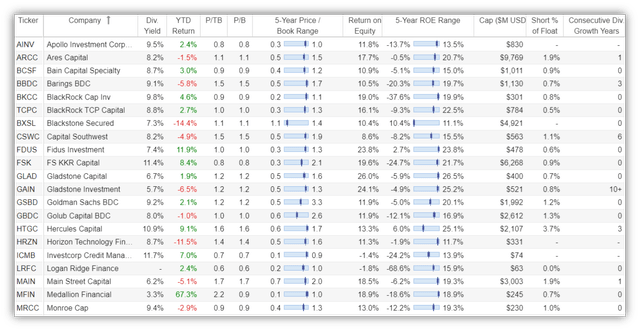

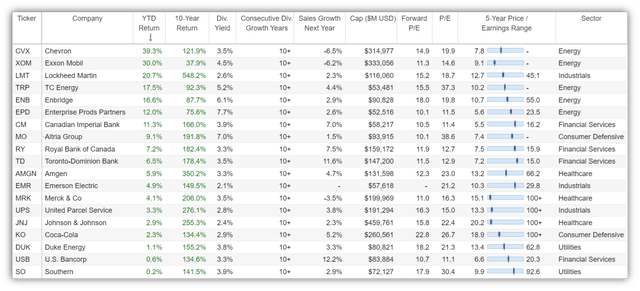

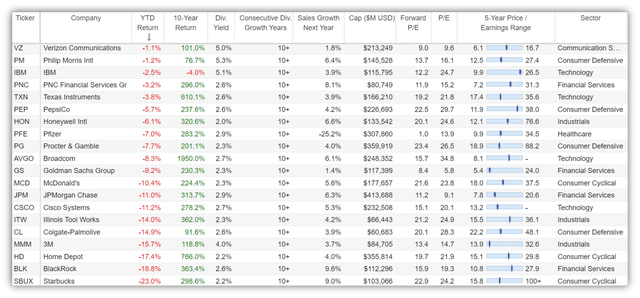

25 Dividend-Growth Stocks

Sometimes there really is no need for investors to chase after the stocks that offer the largest potential returns because they generally come with a lot more risk and volatility (something a lot of investors are just sick of and don’t have the patience to tolerate, depending on their stage in life). To the contrary, blue-chip dividend-growth stocks are often well-established, healthy business that can be profitable in good times and in bad (thereby reducing some of the volatility and risk that so many investors hate), plus many of them pay healthy growing dividends, such as those listed in the following table.

Stock Rover (data as of 3/18/22) Stock Rover (data as of 3/18/22)

Blue-chip dividend growth stocks are certainly not immune to volatility (you can see many of them are actually down this year in the table above), however they generally decline less that many other stocks, and buying them when they are actually down a bit can be lucrative from a contrarian standpoint, especially considering their healthy dividends just keep growing over the years and thereby helping to compound your longer-term wealth. Many readers likely have their own favorites from the above list.

Conclusion

The major stock market indexes just had their best week since 2020, but that doesn’t mean we are out of the woods. For perspective, the “dot com” bubble that peaked in March of 2000 took over two years to burst and it fell over 76% from peak to trough (technically it has since made up all those losses since then plus a lot more-that’s the power of long-term compound growth). Unfortunately, many investors incorrectly tried to call a bottom in that bubble every time it fell 10% or so, and they ended up being wrong (and losing money) for over two years straight. At the end of the day, no one knows where the market is going in the short-term, but disciplined, goal-focused, long-term investing tends to be a highly successful strategy, and owning things that offer big healthy yields can make it that much easier for you to sleep well at night.

Be the first to comment