Vertigo3d/iStock via Getty Images

Introduction

Riot Blockchain, Inc. (NASDAQ:RIOT) is considered among the biggest companies in the Mining Industry.

When we talk about a particular industry like Bitcoin mining, we must consider numerous aspects.

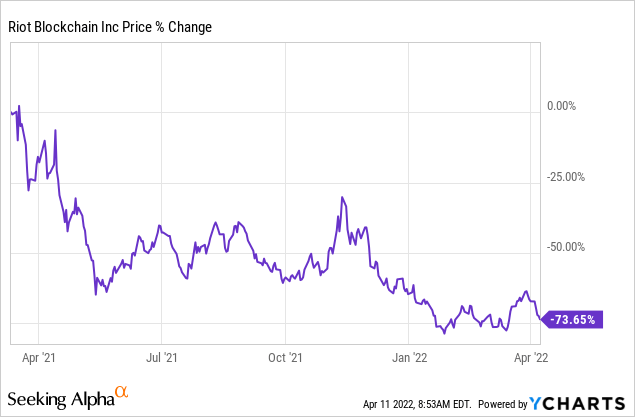

Despite seeing a significant price collapse from the highs of more than 70% from the March 2021 highs, the company has improved some features of its business.

So, before analysing the company specifically, let’s explore the features and key players in this industry.

Sector Overview

The Bitcoin mining industry is capital-intensive, so the big players that make it up are few.

Being capital intensive requires significant and ongoing investment. Therefore, those who do not invest adequately are destined to lose their market share quickly.

In this business, a company’s weight in the total market can be represented by the ratio of the company’s hash rate to the network’s total hash rate: the higher a company’s hash rate, the greater the company’s ability to mine Bitcoin (BTC-USD).

Therefore, continued investment in new infrastructure is required as the overall hash rate and complexity of transactions grows.

Bitcoin Impact On Miner’s Business

Just as oil companies’ business is connected to oil price trends, similarly, the business of Bitcoin mining companies is deeply connected to Bitcoin price trends.

Since most mining companies keep mined bitcoins on their balance sheet (they only sell when they need to fund themselves and need traditional currency), it is clear how an increase in the price of bitcoin leads to the value of the company’s assets increase in value. Similarly, however, a decrease in bitcoin price will cause the company’s assets to decrease.

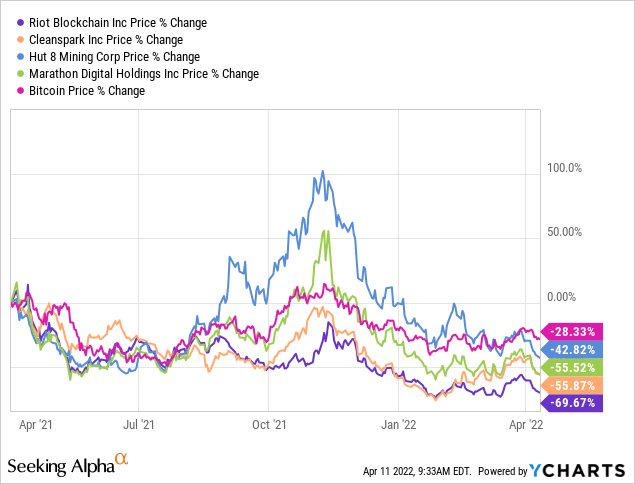

In the following chart, we see a similar price trajectory between some of the major mining companies (Riot Blockchain (RIOT), Marathon Digital Holding, Inc. (MARA), Hut 8 Mining Corp. (HUT) and CleanSpark (CLSK) and the price of bitcoin.

It is visibly evident how price changes are positively correlated.

This correlation makes mining companies attractive to those who do not want direct exposure to BTC but still want to take advantage of its price increases.

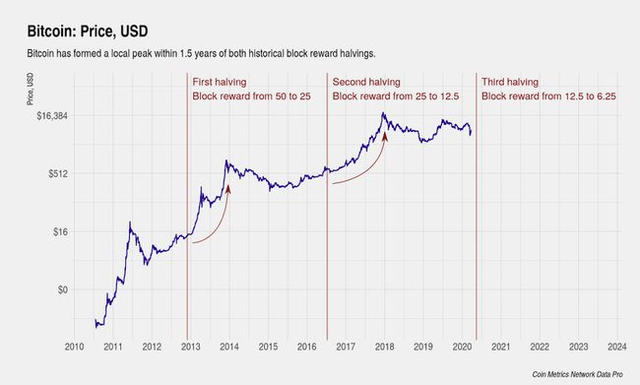

Another vital insight must necessarily be made into the phenomenon of Bitcoin halving. Bitcoin halving is when the amount of bitcoins paid to miners as a reward is halved. It happens every four years, and the next time it will happen will be in 2024.

But How Will Halving Impact The Mining Industry?

The effect can be twofold. On the one hand, if we look at the price trend of BTC after halving, we see how it has always seen an increase. This can be seen in the graph below.

BTC price after halving (Investopedia)

However, there is a point to be made that the price increase of BTC did not increase solely due to halving, and as a result, it would have increased regardless at the same pace as the increase in BTC’s popularity.

Therefore, despite the past increases, there is no guarantee that the halving of 2024 (and subsequent halvings) will lead to a rise in BTC prices. Anyway, if an increase in BTC price happens, there will be a positive effect on corporate assets.

On the other hand, halving means that the profitability of mining is divided by two. And in our opinion, this is the aspect that poses the most risk to all mining companies in the short term. The halving of the profitability of a business means that investments and acquisitions must be well thought out. Moreover, even if this halving is absorbed, another halving will occur in 2028 (i.e., six years from now). This means that mining activity in 2028 will be a quarter of what it is today. This is a critical consideration in the analysis of both Riot and other mining companies.

Riot Business Model

Now that we’ve laid the groundwork and framed the characteristics of the industry, let’s move on to analyse Riot specifically.

Riot has a business model that can be divided into three areas.

The first area concerns mining activity. This is the central part of the business and impacted about 86% of the company’s total revenues in 2021.

As of March 2022, the company owns approximately 6,062 BTC, all of which come from its mining operations.

Also, in the March 2022 data release conference, the company expected to end up with 53,379 miners, with a mining capacity of about 5.4 EH/s from April 2022 (from about 3.9 EH/s currently).

The mining capacity indicates the ability of the mining device to perform calculations faster and therefore shows the miner’s power to confirm transactions and receive BTC as a reward for the operation.

So, in an industry like this, the hash rate of a company’s mining devices is a good indicator of its competitiveness against its competitors.

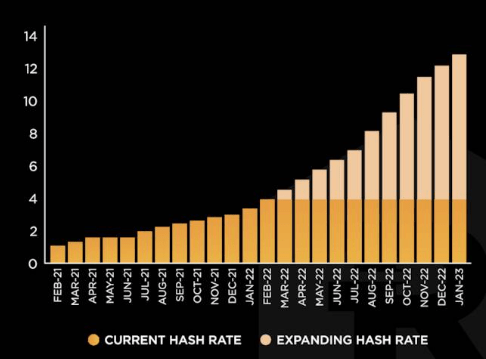

As we can see from the chart below, Riot’s hash rate is always on the rise, which means a lot of investment and an increase in the company’s competitiveness.

By the beginning of 2023, the company expects to have a hash rate of around 12.8 EH/s, an expected increase of about 315% compared to the hash rate at the beginning of 2022.

After the last halving (July 2016), the observable global hash rate CAGR was about +135% annually for almost six years. If we compare it with the projections of RIOT, we see that the company expects to gain market share in the coming months.

Riot Hash Rate (Riot Investor Presentation)

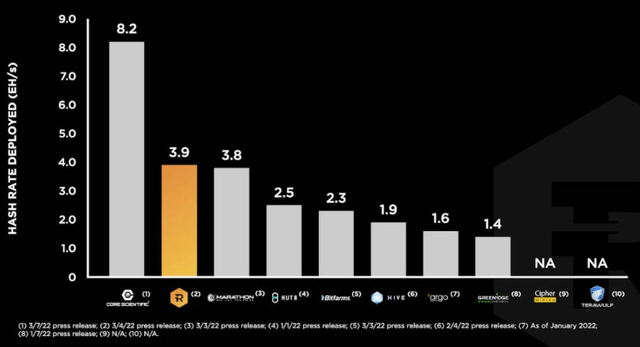

If we look at the Hash rates of other companies in the industry, Riot ranks second after Core Scientific (CORZ) for hash rate.

So we can say that the company is well-positioned and competitive in the industry. However, growth in hash rate doesn’t mean a competitive increase of the company as undoubtedly other companies will also increase their hash rate. Therefore, there is a real possibility that some companies will overperform Riot’s growth in terms of hash rate and that the industry overall will increase faster than the historical growth in hash rate.

Comparison of competitors’ hash rates (Riot Investor Presentation)

The second business area is the Data Center Hosting. This business segment focuses on providing co-location services for institutional-scale Bitcoin mining companies. To operate this business, the company has bought the Whinstone Facility. Currently, this business impacts approximately 12% of its total revenues.

The third business area is Engineering. They entered this business by acquiring a strategical partner: Ferrie Franzmann Industries, LLC (“ESS Metron”). This acquisition provides Riot access to critical electrical components and engineering services to develop and improve their infrastructure.

This business accounts for only about 2% of total revenues.

Expected Riot Growth Vs Other Miners Expected Growth

Riot is investing heavily in developing new technologies that will allow them to grow in terms of Hash Rate faster than the global network. A clear example is a development they have underway of immersion-cooled miners. This type of miner will allow Riot, once implemented, to have an increase over air-cooled miners in performance of about 50%, which implies an increase of about 25% increase in Hash Rate.

Riot expects the growth to reach 12.8 EH/s by January 2023, but let’s look at some of the competitors to see how the industry will look in the following years. If we calculate a growth for the whole of 2022, starting from 3,1 EH/s (Hash rate capacity at the beginning of the year), we see an expected growth of 316% for the whole of 2022.

The growth in terms of Hash Rate and mined BTC does not only affect Riot but also all other companies in the industry.

Some examples: Marathon (MARA) is expanding its fleet of miners and expects to be carbon-neutral in 2023 with a Hash Rate capacity of around 23 EH/s. (Marathon Digital Holdings Announces Bitcoin Production and Mining Operation Updates for March 2022). So, if we consider that MARA had 3,9 EH/s at the beginning of the year, to arrive at 23 EH/s, the company’s capacity is expected to grow 497% its Hash Rate capacity in the whole of 2022.

Another example: CleanSpark (CLSK) expects to grow from the current 2.9 EH/s to over 10 EH/s by spring 2023 (CleanSpark Announces March 2022 Bitcoin Production). This means a growth in 2022 of 244%.

Core Scientific (CORZ), the actual leader in terms of Hash Rate capacity, had at the beginning of the year a capacity of 13,5 EH/s and expects to reach 40 EH/s between the end of 2022 and the start of 2023. This means a growth of 196% in EH/s capacity.

Conclusion

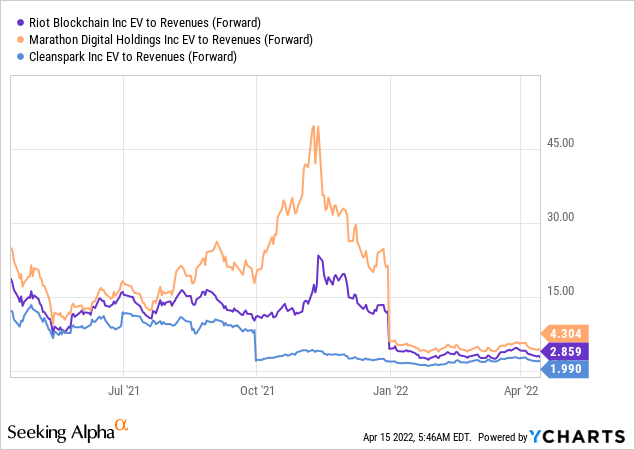

In terms of forward multiples, we see that RIOT has an EV/Sales ratio between MARA, CLSK and CORZ.

Despite already being one of the leading companies, RIOT expects to be able to grow its capacity at one of the highest rates in the industry, which may allow it to maintain good revenue growth, should there be no major shocks to the price of Bitcoin. Of course, this does not come at zero expense. For example, RIOT had to invest $274.8M as deposits for equipment, primarily for miners, last year. In addition, the company has pursued various acquisitions that collectively have further diluted shareholders.

Over the next few years, further investment will be required to continue the company’s firm policy, which is very unlikely to bring RIOT to a profitable level of free cash flow.

Overall, in our opinion, the high capital intensity required to carry on the growth of the company, as well as every other company in the crypto-mining industry, makes it unattractive at first glance.

However, the bottom line is heavily dependent on Bitcoin, and therefore we believe an investment in BTC is more conservative and lower risk. In the event of a substantial rise in BTC, crypto-miners could do better in the short term, but a lot of investment is required to sustain the industry’s growth, which will erode the company’s bottom line in the short term.

Be the first to comment