SergeyZavalnyuk/iStock via Getty Images

Introduction

The mining giant, Rio Tinto (RIO) saw a stellar year during 2021 with booming commodity prices helping to propel their dividends to levels not seen in over a decade. When looking ahead, thankfully for income investors their capital allocation has only one choice and it is dividends, which even makes a continuation of their very high 10%+ yield possible.

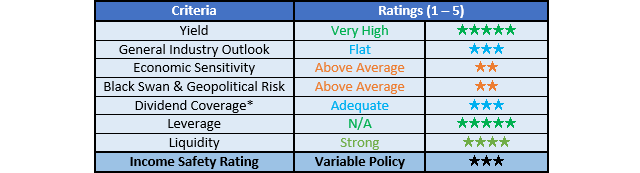

Executive Summary & Ratings

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

Author

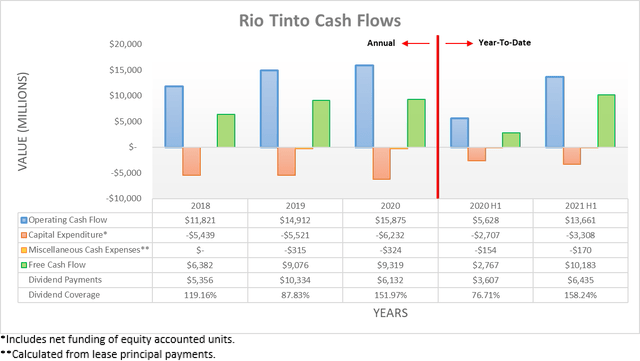

After seeing a scary start to 2020 as the COVID-19 pandemic swept the globe, commodity prices recovered quickly and further strengthened into 2021 with booming prices, which propelled their cash flow performance to amazing levels. Thanks to their continued restrained capital expenditure, it has allowed their $13.661b of operating cash flow during the first half of 2021 to generate a record $10.183b of free cash flow, which even surpasses their circa $9b per annum results from the full-years of 2019-2020 despite being merely half the time. This windfall has pushed their dividends to seldom ever seen levels during 2021 that aggregated to a total of $9.63 per share, which represents a very high yield of 12.66% on their current share price of $76.07 if continued in the future.

When looking ahead, their dividends will continue fluctuating across the years in tandem with the price of commodities given their variable dividend policy. The most notable being iron ore prices that are the single biggest contributor to their free cash flow during the first half of 2021 with their aluminum, copper and minerals business segments only contributing $900m, $600m and $400m to respectively, as per slides twelve through fourteen of their first half of 2021 results presentation.

Whilst the volatility of iron ore prices complicates assessing expectations for their future dividends, it remains possible to make judgments by considering their alternative three choices to allocate the excess capital provided by their free cash flow. The first of which being to increase their capital expenditure, although this appears off the table since they plan to keep it restrained around its current level, as the table included below displays.

It can be seen that they are planning to keep their capital expenditure at approximately $7.5b during the coming years, which management has not indicated at any point is likely to change further into the future and thus this choice to allocate their excess capital appears unlikely to transpire. The next choice is similar in nature, being mergers and acquisitions but once again, this seems unlikely within the foreseeable future, as per the commentary from management included below.

“I’m not ruling out anything on M&A, but I don’t see any big M&A on the horizon right now.”

-Rio Tinto H1 2021 Conference Call.

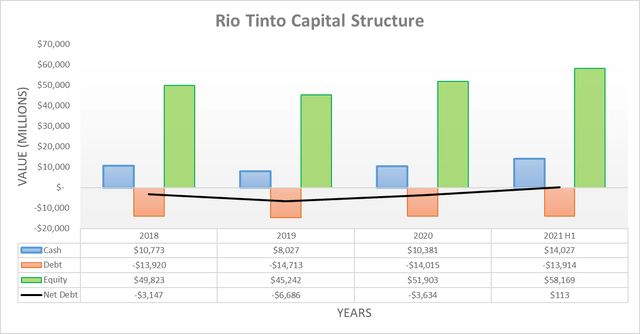

Whilst they may potentially reverse course on this choice in the future, they have no history of chasing large mergers and acquisitions throughout the at least last half-decade, which creates a positive precedence. This sees their excess capital allocation choices continue moving down the list to their third possible choice, which relates to their capital structure and broader financial position.

Author

Despite returning massive sums of cash to their shareholders throughout the recent years, they have still managed to not only keep their net debt stable but actually flip it around into a net cash position of $113m. Although only relatively small versus their massive size, this obviously brings immense fiscal strength, thereby meaning that they have no reason to continue allocating any of their excess capital towards their capital structure to deleverage. Even if they end up seeing net debt again in the future as they continue to return cash to their shareholders, at worst it would only be relatively minor and thus their leverage would only be very low, unless they take a sudden change of direction elsewhere in their strategy.

When a company has zero leverage and plans to restrain its capital expenditure whilst also forgoing the temptation to acquire rivals, it sees only one final choice remaining for their excess capital allocation and it is dividends or more exactly, cash returns to their shareholders that may also encompass share buybacks. Whilst they have conducted share buybacks during recent years, they are clearly more focused upon dividends given their double-digit trailing yield. This means that investors can expect management to return as much cash as possible to their shareholders in the future for whatever the prevailing operation conditions allow, which makes it possible to still see a dividend yield as high as 10%+.

Since their current market capitalization is approximately $121b, it would cost $12.1b per annum to fund a very high double-digit dividend yield, which is only marginally above the $10.183b of free cash flow that they generated during the first half of 2021. This makes it possible for shareholders to still see their very high 10%+ dividend yield continue into the future even commodity prices are not quite as strong as their recent boom-time levels. If not and their prices soften more noticeably back to their 2018-2020 levels, their average free cash flow of circa $8b per annum during this time frame still makes a high circa 6.50% dividend yield realistic, which is still desirable.

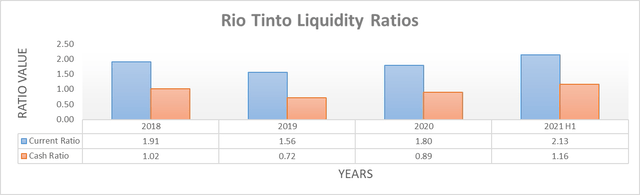

Author

After seeing their non-existent leverage, it should not be surprising to see that their liquidity is strong with current and cash ratios of 2.13 and 1.16 respectively. One of the biggest benefits they see as a massive mining company versus their smaller peers is easier access to debt markets and thus as a result, their ability to backstop their liquidity regardless of the prevailing operating conditions. When combined with their very healthy financial position, they should always find support in the debt markets to source capital even if central banks tighten monetary policy in the coming years.

Conclusion

Whilst the future of iron ore prices remains impossible to know, thankfully it remains abundantly clear that they only have one choice for their capital allocation and it is dividends, which could see a yield as high as 10%+ in the future. When their ability to return as much cash as possible for the prevailing operating conditions is combined with their immense fiscal strength, I believe that a bullish rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Rio Tinto’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment