chameleonseye/iStock Editorial via Getty Images

The price of iron ore has been under pressure after reaching an all-time high of nearly 220 US$/t in July 2021. In the wake of the ore price, Rio Tinto (NYSE:RIO) stock has been on a decline as well. During the latest quarterly update it became clear the realized price for ore was lower, unit costs increased, and the company confirmed the intention to increase capex. Consequently, dividend distributions will be reduced further.

Previously, it was demonstrated the Rio Tinto dividend is a factor 22 smaller than the average ore price in a year. In this article, the expected dividend is tied to past performance when ore was trading at a level below 100 US$/t. Based on historical performance, it is estimated the company will pay a 2023 dividend per share of US$3.70. Scooping up this stock below US$50 will generate a 7.4% forward dividend yield.

Income lower, costs higher

Rio Tinto is a global mining group which derives the majority of earnings from iron ore extraction and sales. The price of iron ore has been under pressure after reaching an all-time high of nearly 220 US$/t in July 2021. Recently, the price of iron ore dipped below 100 US$/t as a result of multiple factors such as ongoing Covid restrictions and a property crisis in China.

On top of this, the state-backed China Mineral Resources Group was launched to combat the ‘excessive pricing power of global mining companies’. In other words, the largest buyer of iron ore (China) is organizing demand from its steel mills to gain more control over pricing, obviously with the goal to drive prices down.

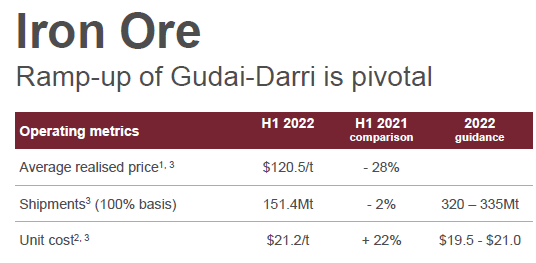

Even without this new conglomerate in place, Rio Tinto’s 1H22 results showed a decline in realized price for iron ore, see figure 1. To make matters worse, unit costs rose by 22% and came in slightly above 2022 guidance. The company however maintains unit cost guidance as it expects an increase in volume during 2H22.

Figure 1 – Iron ore segment operating metrics (riotinto.com)

Capex development

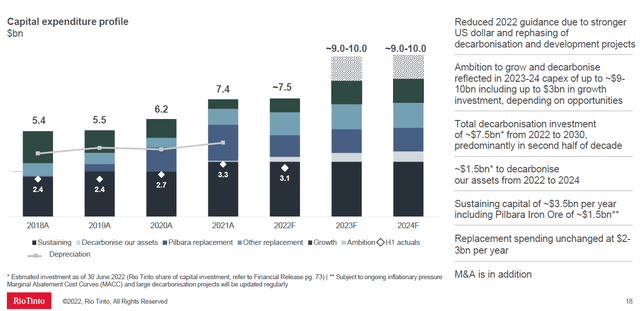

Figure 2 shows the forecasted capex profile. Compared to the investor day held in October 2021, the 2022 forecasted capex is revised downward from approximately US$8.0 to 7.5Bn. This slight revision is understandable given the current price development of iron ore, but the plan clearly shows the company intends to increase capital expenditures.

Figure 2 – Capex profile (riotinto.com)

The capital required to replace and sustain production amounts to a value of about US$6Bn per year. This implies the business can be maintained, but there is little left to fund growth. Especially as the company may wish to reduce its dependency on the iron ore business and consequently the reliance on China, capex must be increased.

Naturally, investors in this company will wonder what’ll happen with returns when the earnings drop and outflows are increased.

The dividend

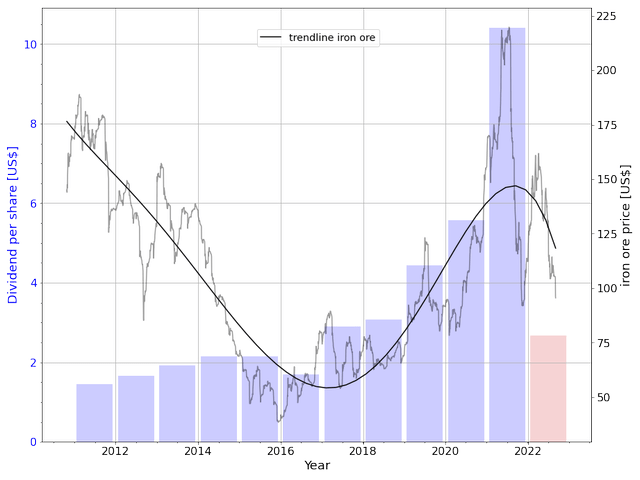

Rio Tinto returns mainly come in the form of dividends. Buybacks have been done in the past, but these have been infrequent and, apart from 2018, have been smaller in magnitude than the amount spend on dividend. In my previous coverage of Rio, it was demonstrated the dividend and iron ore price show a correlation. Long story short, the dividend is equal to the average iron ore price during the year divided by 22.

As the proof of the pudding is in the eating, the 2021 ore price is referenced against the dividend paid. Over the entire year, the ore price averaged 160 US$/t. The total dividend paid over 2021 was US$10.40 including both ordinary and special dividend. Using these numbers, the ratio becomes 16. One could argue that 2021 was an exceptional year with the ore price reaching an all-time high, meaning the factor is exceptionally low. Running the numbers using ordinary dividend only (interim + final), the dividend was US$7.93, resulting in a ratio of 20, more in line with the performance of last years.

Figure 3 shows an updated version of the graph upon which the ratio was determined. Given the current macroeconomic environment and the developments in China, the ratio of 22 will be used to estimate future dividends rather than a smaller factor. This also has to do with the fact the 22 number was based on a longer time frame (instead of a single year) and is, therefore, more reliable.

Figure 3 – Annual dividend versus iron ore price (investing.com, riotinto.com; chart by author)

So far, Rio paid US$2.67 as an interim dividend for the year 2022, depicted by the red bar in figure 3. Assuming the price will drop further to an estimated 85 US$/t in Q4, the full year average becomes approximately 120 US$/t. Based on the aforementioned ratio, this translates into a total dividend of US$5.45, meaning the final dividend will match the interim. With approximately 1.62 billion shares outstanding, this implies a total cash outflow of US$9Bn.

Back to normal

As noted before, iron ore prices have been on a decline and recently dived under the psychological mark of 100 US$/t. Consequently, mining stocks dropped as well, RIO being no exception. The question now becomes how lower-for-longer ore prices will affect returns.

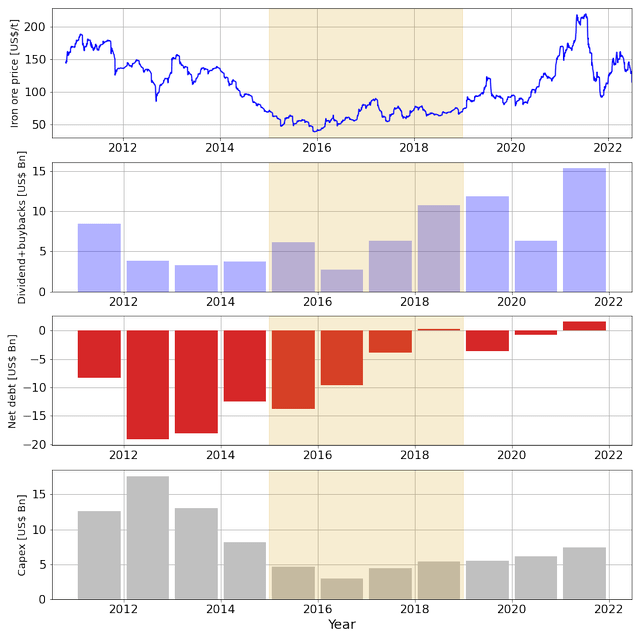

Before the coronavirus got a hold of the world, and the economy, ore prices were actually trading at levels well below the 100 US$/t mark, see figure 4. This figure shows the price of iron ore versus the total amount of dividend and buybacks, net debt and capital expenditures.

Figure 4 – Ore price versus RIO metrics (riotinto.com; chart by author)

Since 2011 the ore price was on a decline eventually passing the 100-mark somewhere in 2014. Effectively the company has been operating in a sub-100 dollar environment from 2015 until 2018, this is highlighted by the yellow shaded area in the figure. It was only in 2019 that the ore price regained some momentum.

In spite of iron trading at a subdued level from 2015 to 2018, the company managed to eliminate a net debt of US$13.8Bn and increase shareholder returns from US$6Bn to nearly US$11Bn while keeping capex at a relatively constant level.

Over the course of 2018, iron ore was trading at a level of 69 US$/t on average. The company had virtually no debt and returned over US$10Bn to its shareholders. Comparing this against the current environment with a significantly higher ore price, it can be expected the company will be able to return the aforementioned US$9Bn, or US$5.45 per share.

More important however is how much the company will be able to return next year if one needs to decide to invest in this company. Taking 2018 as a baseline, the company paid a combined US$15Bn in capex and shareholder distributions. At the time, the company did not have net debt and still does not.

Management intends to increase capex, but given the current macroeconomic environment management will likely steer for annual capex costs of US$9Bn, the lower end of the forecast, see figure 2. Taking the US$15Bn number, all else equal the amount available for dividend would be US$6Bn or US$3.70 per share.

A US$3.70 dividend may seem disappointing considering the amount that was paid last year, but at the current stock price, it still delivers a healthy 7% forward dividend.

Valuation

The estimate for the 2023 dividend as based on 2018 performance amounts to a value of US$3.70 per share. Tying the forecasted dividend to the required ore price using the 22 multiplication factor, an average ore price of US$81 would be required to achieve the estimated dividend. This amount is higher than the US$69 average of 2018, but then again capex will be nearly double the 2018 amount.

My 2023 dividend estimate is significantly lower than the US$10.40 dividend paid over 2021, or the estimated total dividend of US$5.45 per share for 2022. The upside however is that the estimated dividend generates a forward dividend yield of about 7% for 2023 at the current price of US$54 per share.

Since the Fed confirmed it will continue to fight inflation and accept ‘some pain‘ for the economy, fears of a recession have been growing and stock markets, Rio Tinto included, have been on a decline. As the stock is known to follow the iron ore price, RIO will continue to trade lower.

Now, it is easy to buy stock when the markets go up. You’ll bag a profit straight away and needn’t worry. In a bear market, this is more difficult however as you can be quite certain you’ll make a loss the instant your buy order is executed. The upside with RIO is that the dividend yield will remain substantial even at lower ore prices. Using a safety margin of 10%, the stock becomes a buy below US$50, which implies an estimated dividend yield of 7.4% in 2023.

Conclusion

Iron ore, the main earnings driver for Rio Tinto, is on a decline due to ongoing Covid restrictions and a property crisis in China. Moreover, state-backed China Mineral Resources Group was launched to gain more control over ore prices. As a result, Rio’s operating metrics showed a reduction in realized price and an increase in unit costs.

Based on historical performance it is estimated the company will pay a total dividend of US$5.45 in 2022, and US$3.70 for 2023 under the assumption the average ore price will decline to a level below 85 US$/t. The capacity of the company to pay the estimated dividend was proven between 2015 and 2018 when the ore price was well below 100 US$/t, and RIO still managed to reduce debt and increase shareholder returns.

Taking advantage of the expected decline in stock price investors will do well gradually adding this stock to their portfolio when it trades below US$50.

Be the first to comment