Zeki Taluer

As many of my regular readers know, I teach REITs at New York University, and I will be starting a new class in a few weeks (first class is on September 15th).

Just like writing, one of my passions in life is to help ordinary investors understand how to navigate the wonderful world of Real Estate Investment Trusts.

When I was in college, there were no REIT classes; however, I did take a basic real estate class in which I later obtained my South Carolina Real Estate License (I still have one) in addition to numerous business electives such as corporate finance, security analysis, economics, and accounting.

After I graduated from college, I contemplated getting my MBA, but I opted to join the workforce instead, so that I could begin to make some fast bucks and begin paying off my student loan.

More importantly, I wanted to gain experience so that I could one day become a large landlord, owning office buildings, warehouses, and shopping centers.

Although I had big dreams of success, I knew that the only way that I could achieve my goal was to begin small and build up my net worth one property at a time.

My first real estate deal was also my first home. I scooped up a two-story house and converted it into a duplex. Since I had no credit, I asked the previous homeowner to finance the purchase and I collected enough rent from my tenant (upstairs) and roommate to cover the entire mortgage.

My only expenses were taxes and insurance, so it cost me around $4,000 per year to own my first home.

Then I began to purchase more duplexes, until I had a nice base of assets, so that I could provide my bank with a solid financial statement, demonstrating that I had a net worth in excess of $500,000.

Once I got to this level (maybe three years out of college), I began to seek out commercial real estate deals, but I knew I needed to start small…

I remember cold calling the real estate manager at Advance Auto Parts (AAP). At the time, the Roanoke-based auto parts chain had around 100 sites and the company was privately-held.

I pitched a deal in the small town on Union, SC, a sleepy southern mill town, with a population of around 20,000. At the time, AAP was looking to expand south and it seemed as if Union was in the middle of the path of progress.

I was successful in getting the site approved and then I began pitching other cities in South Carolina including Spartanburg, Greenville, Mauldin, Woodruff, Laurens, Gaffney, Walterboro, Lancaster, and others.

I then began to build stores in Georgia in towns such as Calhoun, Cartersville, Lafayette, Sandersville, Jesup, Statesville, Vidalia, and Macon. I also went into Alabama (Cullman and Huntsville) and North Carolina (Boone) to develop stores.

Over a five-year period, I developed around fifty stores for Advance Auto and that allowed me to build a solid financial statement as well as credit history for local banks.

More importantly, I gained valuable experience in site selection, civil engineering, construction management, and finance.

With a solid base, I wanted to continue growing my empire, so I pursued other tenant relationships such as Blockbuster Video, Hollywood Video, Payless, Econo Lube, PetSmart, Barnes & Noble, Outback, Dollar Tree, Dollar General, IHOP, Waffle House, Bi-Lo, Walmart, and others.

I continued working as a developer for over twenty years and during that time I gained considerable knowledge, and my net worth grew substantially. Yet little did I know that my greatest lesson was right around the corner…

The Great Recession

As I explain in my book, The Intelligent REIT Investor,

“Every bear market leads to a bull market eventually, and every bull market leads to a bear market. Moreover, one sector suffering will often lead to another’s rise and vice versa.

So it’s not surprising that the highly speculative dot.com bubble bursting would send despondent investors back into safer stocks like REITs. That renewed interest in value investing brought REITs to levels it had never experienced before… right up until the next bubble burst.”

I knew that particular bubble well, and of course I’m referring to the Great Recession, as I explained (in my book),

“Sometimes stocks and sectors suffer from their own foolishness. Other times, they’re the victims of outside sources beyond their control. And, in this case, it was much more the latter.

A volatile cocktail of government policies, a lack of banking integrity (or intelligence), and public enthusiasm – among other factors – sent property prices skyrocketing. And when the housing market proved to be less than perfect, those bank bets came crashing down, leading to the collapse of Bear Stearns and Lehman Brothers, Merrill Lynch selling itself to Bank of America, Wachovia selling itself to Wells Fargo, and AIG almost collapsing under its own weight.”

I was right there in the midst of this chaos, as I went on to write,

“While national leaders and legislators decided to bail big banks and car companies out, REITs weren’t anywhere so lucky. They were left to deal with the fallout on their own, including vacancy rates as high as 17.5% in certain subsectors.

They also had to deal with overall debt leverage levels that shouldn’t have been unmanageable but were anyway due to the circumstances. Like most property owners, REITs have always used debt to finance their purchases.

Heading into the 2007 downturn, leverage ratios of about 45% were consistent with recent norms. With that said, ratios of debt to earnings before interest, taxes, depreciation, and amortization (EBITDA) had risen. Combine that with the perfect storm that erupted, and you have intense problems indeed.”

Keep in mind, I was already hemorrhaging from the mess that my previous business partner had created (also because of excessive leverage), but the Great Recession was like the “nail in the coffin” as everything that I had clawed back from prior to 2007 was swept away.

However, I want to remind you what I said in a recent article…

“The victim mentality feeds on negative thoughts, while the victor mindset is focused on resolution. As a victor, I now have an instinctive appreciation for value that only those who have experience can completely grasp.”

Fortunately, for me and thousands of investors, most REITs also rose to the occasion.

While most did have to cut their dividends – 35 in 2008, 56 in 2009, and another seven in 2010 – they worked hard to reduce their debt leverage by raising equity, selling some properties, forming JVs for others – a trend that developed specifically to handle the depressed conditions – and preserving cash however else they reasonably could.

As a result, REITs were able to rebound sharply in 2009 and 2010, and in fact, by the end of that second year, they were much healthier than their private real estate counterparts.

The sector went on to grow for much of the next decade, including by adding new subsectors, such as prisons, farms, gaming, and even cannabis.

“Adversity is bitter, but its uses may be sweet. Our loss was great, but in the end, we could count great compensations.” – Ben Graham

School in Session

We commenced the Durable Income Portfolio in 2013 and since that time the portfolio has returned 15.2% annually versus:

Learning from lessons of the past, I have developed a serious concern for money, by always adhering to my mantra of “protecting principal at all costs”. I will no longer let my retirement goals slow me down, and in fact, I am still on track to achieve the goal that I set out to accomplish when I got out of college,

“…one day become a large landlord, owning office buildings, warehouses, and shopping centers.”

In fact, I am now a landlord for many other property sectors including cell towers, data centers, apartments, medical office buildings, and even cannabis…

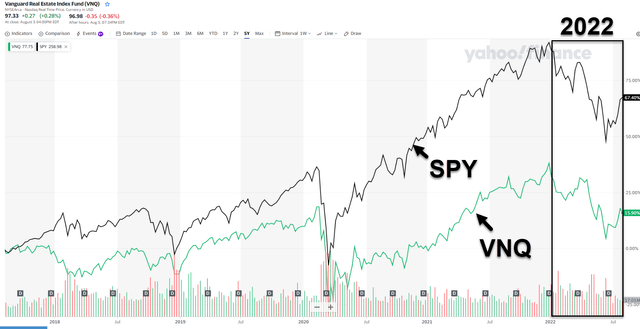

As illustrated below, REITs have under-performed YTD, down by -16.9% versus the S&P 500 (SPY), down by -12.8%.

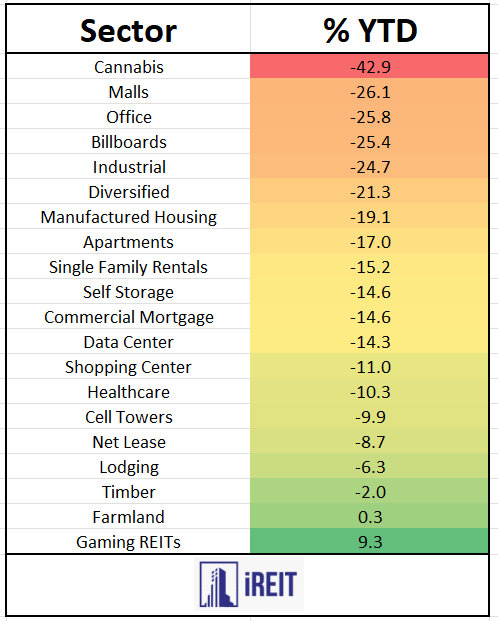

Of course, the REIT proxy I’m using (above) is the Vanguard Real Estate ETF (VNQ) that includes a broad coalition of REITs. As shown below, the REIT universe has generated varied results YTD and several of the top-performing categories include gaming (+9.3%), farmland (.30%), timber (-2.0%), lodging (-6.3%), net lease (-8.7%) and towers (-9.9%).

iREIT

Around a month ago I began building a new income-oriented portfolio for my family and it has performed extremely well, with these notable buys:

Obviously, not all of these are REITs, but the well-balanced income-oriented portfolio is designed to over-weight REITs and I am especially fixated on the companies that are considered high-quality with the widest margin of safety.

I decided that I would add two new REITs to the mix, here’s my reasoning…

Kilroy Realty (KRC)

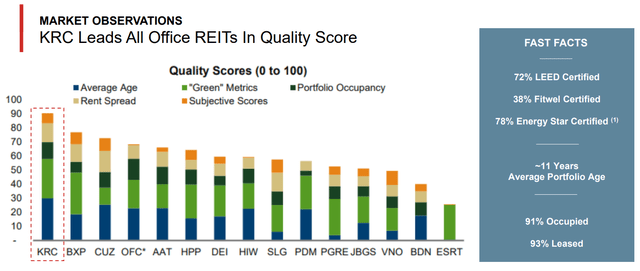

KRC is a true outlier in the office sector, based on the company’s west coast focus and enhanced exposure (~55% of ABR) to “tech” companies that require “collaboration” and cannot “work from home”.

The company invests in submarkets along the West Coast, in markets such as Greater Los Angeles, San Diego County, the San Francisco Bay Area and Greater Seattle.

Austin, TX (KRC Investor Deck)

In Q2-22, the company had a strong earnings results despite concerns of a tech hiring slowdown — a reflection of its high-quality portfolio and minimal 2022 lease expirations (1.6% remaining) but 9.7% expire in 2023. Q2-22 was highlighted by the following:

- FFO/sh of $1.17 (+33.0% y/y) came in above consensus estimate of $1.11.

- Cash SSNOI was up 11.5% (+12.8% in Q1-22)

- Stabilized occupancy increased 10 bps sequentially to 91.4%

KRC increased FY22 FFOps guidance by $0.07/share at midpoint to $4.58 (+17.7% y/y), vs. $4.53 consensus. KRC’s $1.115B under construction portion is now 32% pre-leased with a total pipeline of $1.945B, including $830mm in tenant improvement.

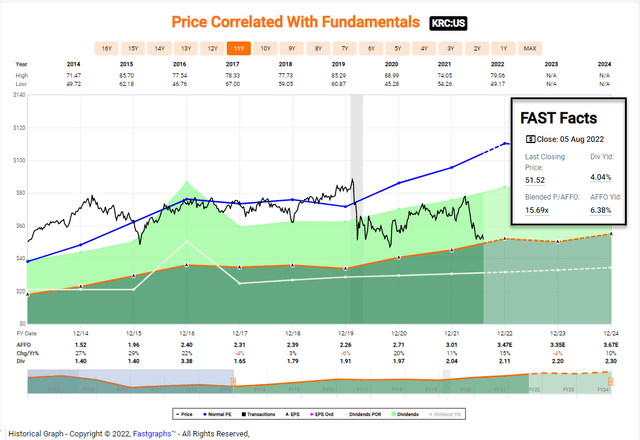

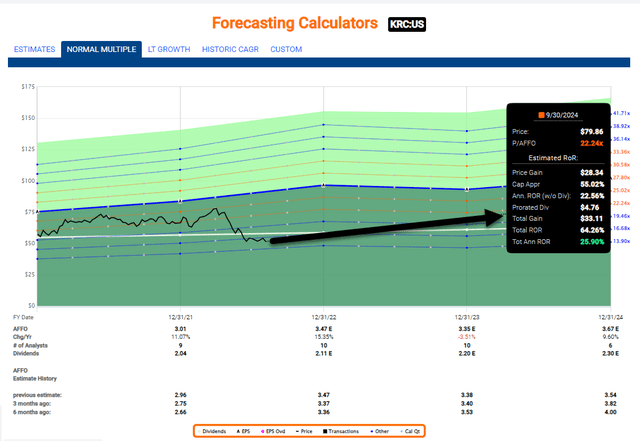

As seen above, KRC is trading at a wide discount, the P/AFFO is 15.7x versus the normal range of 31.8x.

That’s around 50% below normal levels, and while the office sector is certainly beaten down for a reason (major tenants going to hybrid or fully remote work), we view this outlier in a different light.

KRC’s modern, class A office portfolio continues to generate steadily improving metrics (leased occupancy improved 60 bps sequentially to 93.7%), strong mark-to-market rent increases (35.3% GAAP spreads on leases signed in 2Q), and material value creation opportunity. As highlighted above (with FAST Graphs) KRC is forecasted (by analysts) to grow AFFO by share by 15% in 2022.

Meanwhile KRC is yielding 4.0% and well-covered (59% using AFFO) and this capital markets discipline has inspired us to add this position to the family portfolio. Our 12-month Total Return target is 25%.

CTO Realty (CTO)

CTO is another outlier that does not screen on many dedicated REIT investor lists because the company is fairly new to RET-dom.

However, CTO has been around for over a century and has a rich history dating back to 1902 in Jacksonville where it began as Consolidated Naval Stores Company, a timber-based company, specializing in harvesting gum converted into turpentine pitch and rosin from long leaf yellow pine for the maintenance of wooden ships.

CTO later became the largest naval stores factor in the world and initially owned more than one million acres of Florida forest lands. The company pioneered in pine timber conservation by improving turpentine extraction methods. (Source: bizjournals)

Over the years, CTO monetized the value of its land holdings through land sales to redeploy the proceeds into investments in income producing real estate. Many of CTO’s investments were utilized using the like-kind exchange vehicle referred to as the Section 1031 IRS Code.

Previously structured as a C-Corp, CTO converted to a REIT in December 2020 and prior to that the company had spun out 20 net lease properties to form a REIT known as Alpine Income Property Trust (PINE). Interesting enough, CTO still owns a ~$40 million stake in PINE.

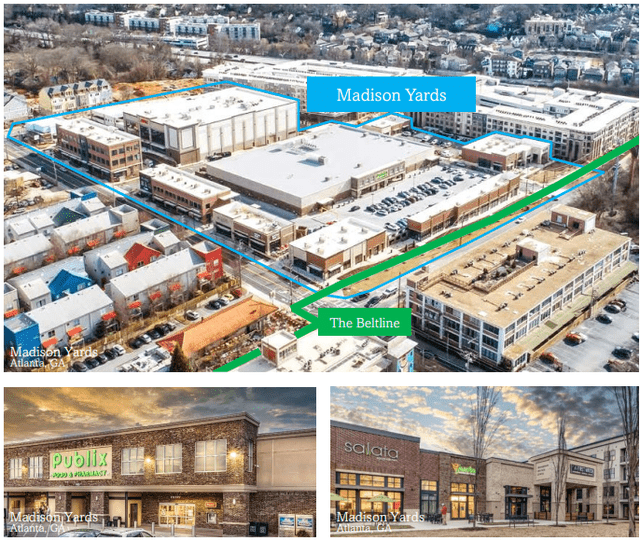

This means that CTO is considered a shopping center REIT that now owns a portfolio of 22 properties (3 million square feet) in faster growing, business friendly markets such as Atlanta, Dallas, Raleigh, Phoenix, Jacksonville, Tampa, Houston, and Salt Lake City, with acquired vacancy and/or repositioning upside.

CTO’s retail-based investment strategy is focused on grocery-anchored, traditional retail and mixed-use properties with value-add or long-term residual value opportunities. The company recently acquired a 162,500 square foot Publix anchored shopping center that has established Atlanta as CTO’s top investment market.

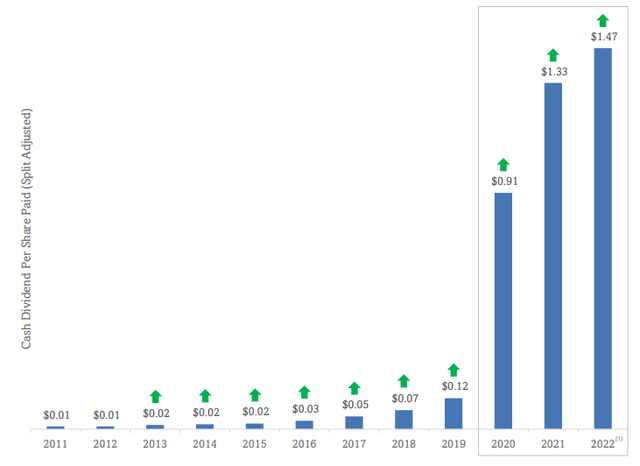

As I said, CTO converted to a REIT in December of 2020, accelerating the required dividend payout ratio, increasing cash flow and earnings have driven a more than 60% increase to CTO’s annualized common stock dividend since 2020.

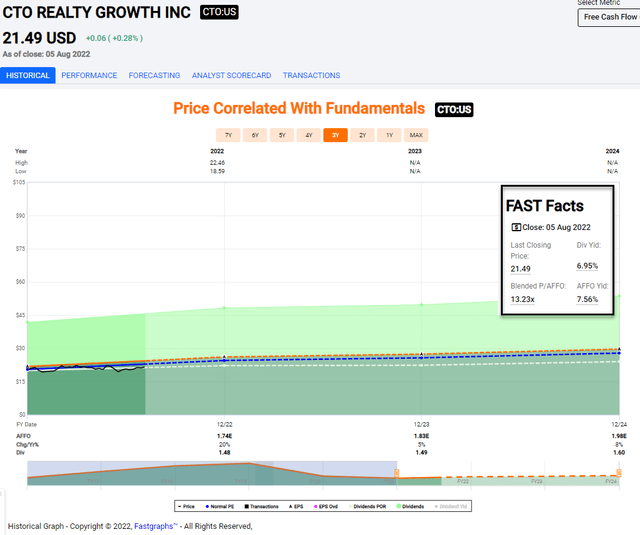

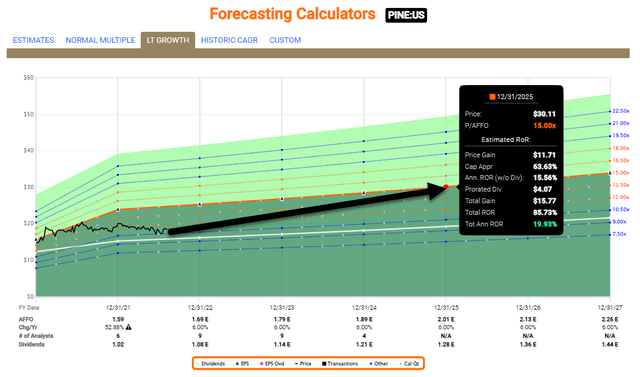

The current midpoint of guidance implies an 86% 2022E AFFO per share dividend payout ratio, and this should continue to drop as the company continues to generate steady earnings growth. CTO has provided guidance indicating as much as 25% year-over-year Core FFO per share growth in 2022, and as viewed below, analysts are forecasting AFFO per share growth of ~20%.

As I mentioned, when you own shares in CTO you also get an ownership slice in PINE, that is also paying out a sweet dividend yield of 5.8%.

However, the big attraction to owning CTO is the juicy 7.0% dividend yield and attractive absolute valuation relative to its retail-focused peer group and recent retail M&A multiples, implying significant valuation upside. Our 12-month total return forecast is 20%.

Lessons Learned…

A few days ago I told a close friend of mine that in some ways I’m glad I lost millions before the Great Recession because it made me much better investor.

Now of course, nobody likes losing money, especially when your family’s wealth is on the line, and I would never want my worst enemy to experience the adversity that I encountered in the past.

However, I can say that I’m much wiser today as a result of my challenges and I thoroughly enjoy writing on Seeking Alpha because it’s a way that I can give back to others.

Think of it like this, you are investing in me by reading this article, and I’m providing you with dividends in the form of articles like these. I want to thank you all for following me and inspiring me to be the most-followed author on Seeking Alpha.

Now let’s go to recess…

“All work and no play makes Jack a dull boy”.

Be the first to comment