filo/E+ via Getty Images

Ring Energy (NYSE:NYSE:REI) recently closed its acquisition of Stronghold Energy II. This transaction nearly doubles its total production and increases its oil production by close to 70%.

Ring’s net debt increased significantly from my earlier projections as a result of the deal, but should be able to reduce its net debt down to around $335 million by the end of 2023. Combined with its increased production levels, Ring’s leverage is projected to end up at around 1.0x by the end of 2023 at current strip.

Ring appears to have decent upside in a long-term (after 2023) $70 WTI oil scenario, with an estimated value of a bit over $4 per share.

Stronghold Acquisition

Ring closed on its Stronghold acquisition for approximately $167.9 million in cash (reduced from $200 million due to purchase price adjustments for cash flow since the June 1 effective date). It also has a $15 million deferred cash payment that is due near the end of February 2023 and assumed $20 million in hedge liabilities. As well, Ring is effectively issuing 63.8 million shares (worth $230 million at the time of the deal announcement). The total consideration was approximately $465 million at the time of the announcement.

Stronghold’s production in June was approximately 9,100 BOEPD (54% oil, 21% NGLs, 25% natural gas). This acquisition will nearly double Ring’s production, but will also reduce its estimated oil percentage from 87% to 70%.

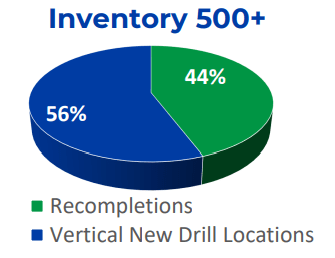

The original $465 million purchase price was approximately 0.65x estimated PD PV-10 ($719 million) or approximately 0.97x PDP PV-10 ($481 million) at late June strip prices. There seems to be a large amount of PDNP reserves (PV-10 of $238 million at late-June strip), reflected by the over 200 recompletions included in Stronghold’s inventory.

Ring’s Inventory (ringenergy.com)

Oil prices have fallen since late June, although the improvement in natural gas prices partially offsets that.

At current (mid-September) strip prices, the original $465 million purchase price may be around 0.72x PD PV-10 or 1.07x PDP PV-10. At June production levels and current strip of low-$80s WTI oil for 2023, the Stronghold assets may generate around $150 million in unhedged EBITDAX in 2023.

The Stronghold acquisition still appears to be a decent deal for Ring despite the subsequent drop in commodity prices. Ring will need to develop (such as through recompletions) the Stronghold assets in a cost-effective manner to get the full benefit of the deal though.

Hedges

Ring added hedges for 2023 in the form of put options with deferred put premiums. This gives it full exposure to any upside in oil prices, but costs Ring approximately $12 million in deferred put premiums for 2023.

| WTI | $60 | $70 | $80 | $90 | $100 |

| 2023 Hedge Value ($ Millions) | $12 | $4 | -$4 | -$11 | -$12 |

Thus if oil averages $100 in 2023, Ring’s hedges would have negative $12 million in value from the deferred put premiums. If oil averages $70 in 2023, Ring’s hedges would have positive $4 million in value, from $16 million in put option value less the $12 million in deferred put premiums.

Ring had around 2,120 barrels per day in 2023 oil hedges as of early August, but could have added more hedges with the closing of its Stronghold acquisition.

Ring also added close to 1,000 barrels per day in 2024 oil hedges, consisting mainly of oil collars, but with some put options with deferred put premiums as well.

Notes On Debt And Valuation

Ring had $268 million in net debt at the end of Q2 2022. The Stronghold acquisition added $203 million in debt based on the final adjusted purchase price, the deferred $15 million cash payment and the assumption of $20 million in hedge liabilities.

Based on current strip prices, I thus estimate that Ring will end 2022 with approximately $450 million in net debt. Ring is expected to provide its initial outlook for 2023 soon, so its capex plans will have a large effect on its projected cash flow. For the time being, I am assuming that Ring aims to average 19,000 BOEPD (71% oil) in 2023, which would result in its estimated net debt at the end of 2023 being around $335 million at low-$80s WTI oil during the year. This would result in its year-end 2023 leverage ending up at around 1.0x EBITDAX without any further acquisitions.

I now estimate Ring’s value at slightly above $4.00 per share in a long-term (after 2023) $70 WTI oil scenario. This also assumes that oil prices remain above $70 until the end of 2023, following current strip of mid-$80s WTI oil for the last four months of 2022 and low-$80s WTI oil in 2023.

Conclusion

Ring Energy’s total production is nearly doubling with its Stronghold acquisition, while its oil production is increasing by close to 70%. Ring has taken on additional debt to pay for the Stronghold acquisition, but may be able to reduce its leverage to around 1.0x by the end of 2023 at current strip prices.

Ring’s shares appear to have decent upside now that they are trading at below $3 per share. In a long-term (after 2023) $70 WTI oil scenario, it may be worth a bit over $4 per share if oil prices follow current strip until the end of 2023 and Ring can develop its Stronghold acreage efficiently.

Be the first to comment