marchmeena29/iStock via Getty Images

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on March 14th, 2022.

Hoya Capital High Dividend Yield ETF (NYSEARCA:RIET) had launched in September 2021. I reached out to Alex Pettee for some follow-up questions after taking another look at RIET. When we first reached out to Alex, we received a great response to questions about this new fund. Now, after the fund has been around for around six months, we can look at how the fund has been performing. I also received some additional thoughts on the general outlook of the space.

As a reminder, RIET isn’t Hoya Capital’s first foray into the ETF space. This is a follow-up to their successful Hoya Capital Housing ETF (HOMZ). HOMZ provided a unique exposure in the ETF wrapper that wasn’t available to the market previously. They also offer that exposure while paying a monthly distribution to investors.

With RIET, an even greater focus was put on the income drive of the fund. Income is getting harder and harder to come by; at the same time, there are more and more retirees every day. That’s why their tagline is so fitting; “When investing in real estate for income, just remember “I before E” in RIET because Income Comes First!” This helps explain why their ticker symbol is RIET.

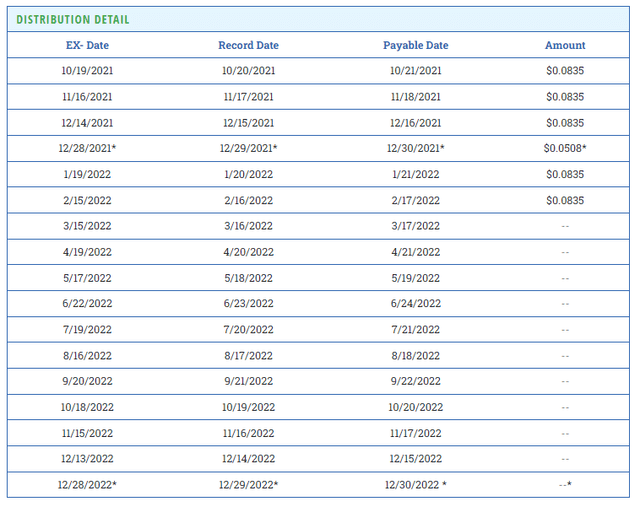

Vanguard Real Estate ETF (VNQ) is undoubtedly a strong ETF in the REIT space, almost certainly one of the REIT funds that first come to mind for investors. However, they currently yield about 2.86%. RIET itself has been paying $0.0835 per month since its launch. This puts the forward yield of this ETF at a strong 6.8%. That should certainly sound more enticing to income-focused investors – especially considering the monthly frequency vs. quarterly payouts.

About The Fund

Several key features of RIET include;

- access to 100 select real estate securities paying high dividend yields

- “smooth” monthly distributions for shareholders

- real estate specialist Hoya Capital Real Estate is behind the fund

- an inflation hedge, which we all know is essential at this time

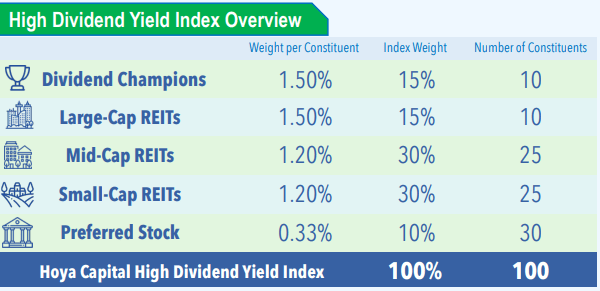

The portfolio construction is similar to other ETFs, they use a rules-based approach, and it’ll be passively invested. They will be rebalancing semi-annually in June and December of each year. That is also fairly standard for passive ETFs. The full process of the index strategy is available in the Fact Sheet.

However, I believe the diversification that the fund provides across the entire REIT space is really noteworthy. That includes industries and asset types. It isn’t just invested in the common stock of equity REITs. It also incorporates preferred holdings and mREITs, across the different market caps as well.

Then there is a tilt towards quality focusing on “dividend champions.” These are selected through “a rules-based process based on market capitalization, dividend yield, and low leverage.” This gives us a broad exposure to the REIT space, focusing on not only higher yields but also making sure that there is exposure to quality.

RIET Index Overview (Hoya Capital)

The objective of the fund “is to track the performance, before fees and expenses of the Hoya Capital High Dividend Yield Index, a rules-based index designed to provide diversified exposure to 100 U.S.-list that’s estate-related securities that collectively provide income through high dividend yields.”

The fund is smaller, with around $22.36 million in total managed assets. That can leave some larger retail investors with a lack of liquidity if someone wants to run out of the exits in a panic. That being said, that’s never suggested anyway, and the fund can grow over time as it gains more popularity.

The fund’s expense ratio comes to 0.50%, but the adviser waived half of this for the first year. Until September 30th, 2022, the net expense ratio will be 0.25%.

Performance And Distribution

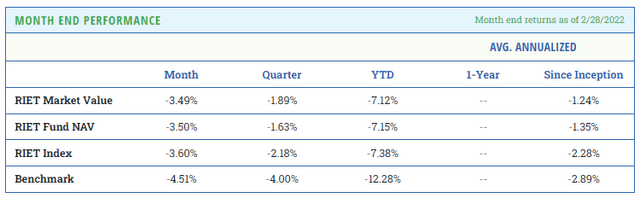

The performance of the fund has been quite solid, considering the environment. I won’t go into too much detail because this is one of the key focuses we discuss in the questions section. However, I’ve used the overall general market weakness to add to my RIET position a couple of times since buying near the IPO.

RIET Performance (Hoya Capital)

The fund launched with a $0.0835 monthly dividend to shareholders. This has been maintained, and the coverage was so strong that investors received a year-end supplemental dividend as well.

As discussed below, REITs are having a historically strong period in terms of coverage and increasing their dividends. That all benefits RIET as it too will have more income coming in. The year-end special indicates that they earned more than enough to cover their regular dividend. Therefore, that extra was needed to meet the required distribution rate for a regulated fund. This is all good news for the sustainability of RIET’s current payout. Which is another important factor when income is such a focus for the fund, that the income can continue at sustainable and stable levels.

RIET Distribution Schedule (Hoya Capital)

RIET’s Top Holdings

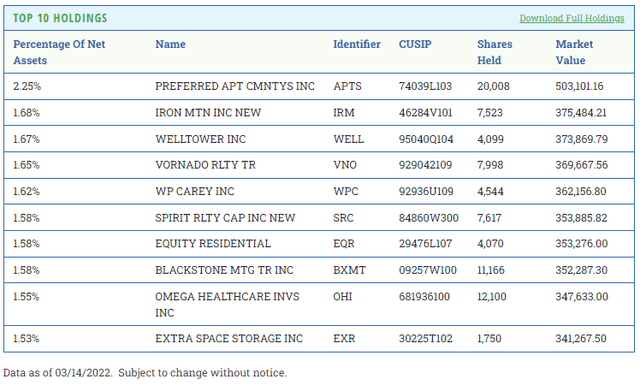

We touched on the outline of the fund’s holdings above. Here we can take a look at the current top ten holdings of the fund. They also provide the full holdings list that is available for download on their website.

The largest holding we have here is a preferred from Preferred Apartment Communities (APTS). This is a position we touch on more below, but one of the reasons this position jumped up so much is because Blackstone’s (BX) Real Estate Income Trust announced it intends to acquire the REIT. However, it has traded above that $25 takeout price as there is a chance someone else might come in and scoop the REIT up for an even higher price.

In this way, this could be seen as a benefit of the passive management of an ETF. Now that this position has shot up based on this takeover deal, the profits will be realized once the fund rebalances. At the same time, the fund will buy into a position that is presumably at a cheaper valuation, relatively speaking.

Another larger position for the fund is Iron Mountain (IRM). This was also a position in the index previously and remained there as one of the higher yielders in the REIT space. This is a specialized REIT that has been in quite a transformation over the years. At one time, they might have been only a paper storage company for businesses, but they have been transforming with the digital world and keeping up with the times. Just as any good company should do, adapt to survive and thrive.

Here is some commentary from the latest IRM earnings call for Q4 2021. It will help shed some light on the digital side of their business.

For the full year, we delivered organic storage rental revenue growth of 2.6%, reflecting continued benefit of pricing combined with positive volume trends. We drove double-digit growth in digital offerings, including data center inside our digital transformation services and secure IT disposition, now referred to as ALM, or asset life cycle management. Our digital services and ALM businesses continue to build momentum, growing over 20% in the fourth quarter and capping off an excellent year of growth.

The dividend hasn’t been growing in recent years, but at least one analyst thinks that is about to change. Considering that IRM is continuing to grow AFFO and have given strong guidance for the year ahead, I would agree.

Questions With Alex Pettee

Alex Pettee of Hoya Capital Real Estate was able to take time to answer some questions about RIET as the fund is finishing up its first six months of trading. For those not familiar, Hoya Capital Real Estate is a successful contributor to the Seeking Alpha community. They specialize in income-producing real estate investments and share their extensive knowledge with investors. They have over 28 thousand followers on the SA platform.

Alex Pettee is President and Director of Research & ETFs for Hoya Capital Real Estate. A passionate Hoya through and through, Alex Pettee founded Hoya Capital Real Estate, a Connecticut-based registered investment advisor that is working to make real estate investing more accessible to all investors. Alex’s commentary on the US residential and commercial real estate markets has been featured in the Wall Street Journal, Bloomberg TV, CNN, and Forbes, and his commentary on the ETF marketplace has been featured in ETF.com, ETF Trends, Benzinga, Zacks, ETF Express, and ETF Strategy. A dual-degree holder and two-sport athlete at Georgetown, Alex played baseball and track for the Hoyas and studied Finance and Real Estate. Alex is a CFA Charterholder and holds a Series 65 license.

For more on the team and about them, visit the Hoya Capital Real Estate website.

1. I think the biggest question and main focus right now is Russia’s invasion of Ukraine. Can you provide any insights into how RIET is positioned now and how this might impact the fund? It seems that a large portion of the holdings, from my initial look, is that they don’t seem to carry a significant amount of exposure outside the U.S. Perhaps that could shelter them from the global uncertainties at this time.

Our hearts go out to everyone in the region and we pray for a peaceful resolution. It goes without saying, but the situation is a human tragedy on many levels, both because of the immediate acute impacts on the Ukrainian people, but also because of the fallout effects to global populations if the conflict continues to escalate from the impact of rising energy and food prices. While global instability and tensions between nuclear powers are not unprecedented, this conflict comes as European and Asian economies, in particular, were already in a vulnerable state following two years of the pandemic, so strong leadership and pragmatic policy actions will be essential to keep all of the pieces together.

At the investor-level, I think the conflict does reinforce just how lucky we are to call North America “home” and to not take for granted the incredible productivity capacity of the U.S. and Canadian economy – particularly in the types of goods and services that are the most “at risk” – oil, gas, and agriculture. So I think the consensus here is absolutely right that U.S. will see notable outperformance and prove to be far more resilient than our European counterparts.

Right there with Utilities as the two most domestic-focused equity sectors, REITs – and by extension the RIET ETF – are extremely well positioned for this type of macro environment. 100% of the RIET ETF is U.S.-listed securities and at the holdings level, more than 98% of the revenues are derived by U.S. properties, which actually is even more heavily domestic-focus than the market-cap weighted index, which includes several large-cap names like American Tower and Equinix that do have significant international operations.

2. As RIET is a steady and level source of income for investors, are you able to give any insight into how the distribution is being covered at this time? There was that special year-end distribution. That would seem to indicate that the fund is earning its payout at this time.

We set the distribution rate on RIET such that we expect the distributions to be fully-covered by the dividends of the holdings. Currently, the Index Dividend Yield is 7.40% gross / 7.15% net of expense ratio, which more-than covers the 6.95% distribution yield, and as you noted, we ended up below our required distribution rate as a registered fund and paid a supplemental special distribution at the end of the year.

That said, as you may know, dividends received from Real Estate Investment Trusts have tax characteristics that include some “non-income” (including ROC, 199A, long-term gains), and the fund generally “passes through” the characteristics as efficiently as allowable. As with most REIT-heavy funds, we do expect some percentage of the distribution to be classified as “return of capital,” but it’s primarily a function of the characteristics of the distributions received. All of it goes on the standard 1099 – not a K1 – so it’s no extra hassle, but just something that investors should note, as there are tax benefits in the passed-through characteristics.

At the holdings-level, we published a report last week that highlighted how REITs are currently have historically strong dividend coverage ratios, and REITs are coming off the strongest year ever of dividend increases with more than 130 U.S. REITs raising their payouts and another 45 so far in early 2022. The holdings in the RIET ETF are broadly consistent with the sector averages in this regard with our average FFO payout ratio below 80% with an average 1-year dividend growth of 9%, so we feel quite good about the current distribution levels.

3. RIET has a rules-based methodology for holdings that make their way in there, so we know positions aren’t being actively picked or traded around. However, was there any comment you could provide on something that might have surprised you? Such as a position that made its way into the fund that you might not have expected? One of the reasons I ask is because Healthcare Trust of America (HTA) was one of the top positions in the index that it is tracking. I noticed that it has now fallen off. It appears as though the position had quite the run, which would have lowered the actual yield it was paying.

Indeed, RIET uses a rules-based methodology designed to select 100 of the highest-yielding REITs through a process that begins with a quality screen to select ten “REIT Dividend Champions” and then classifies the roughly 200 REITs in the universe into a property sector and market capitalization tier, which is used to ensure that the index achieves sufficient diversification across these categories. We rebalance the index twice per year in June and December, and we do also have the ability to conduct a special interim rebalance in certain circumstances if required.

As for what I’ve been surprised by – it’s interesting because I had this same conversation with a colleague and I was saying how surprised I was by the lack of surprises – the first six months have gone quite smoothly for the new fund, and it’s been very well received. As I mentioned in our last discussion, the high-yield space does naturally entail an elevated level of risk, so with that in mind, we dedicated countless hours of research into designing the index specifically to minimize the surprises – and I think this level of diligence would only be possible by a REIT-focused firm that is “in the weeds” of the sector every day for many years.

Specific to HTA, that REIT actually never made it into the live ETF – it was in the index prior to the final adjustment before launch and was just below the threshold. To that point, however, we do own Preferred Apartment (APTS) which has nearly doubled in value since announcing that it will be acquired by Blackstone. That’s been a great “win” for the fund and now APTS is actually the fund’s largest holding as a result at about 2.3%. But of course, with the surge, the dividend yield on APTS has fallen from about 6% to below 3%.

Besides the increase in value, there’s no material impact on the index or fund itself in these cases until the next semi-annual rebalance in which the selection process “starts fresh” and so the lower-yielding names would be swapped-out. Upon acquisition, the weight would be even redistributed to the remaining 99 holdings.

4. The market as a whole has been challenging in 2022 to start off. Real estate hasn’t escaped this pressure. Can you give any general outlook for REITs in the next year or so? How do you see that benefitting RIET?

As we discussed in our State of the REIT Nation report last week, REITs entered 2022 with strong momentum following the best year of total return, dividend growth, and FFO growth for the sector since the 1970. Critically, REIT balance sheets are as strong as they ever have been with record-low leverage levels and as I mentioned before, dividend coverage ratios are also historically high, setting the stage for another year of robust dividend growth – assuming that we can manage to avoid some of the worst-case scenarios of the current geopolitical threats.

We’ve all heard the “Rates Up, REITs Down” adage, and it’s no secret that REIT valuations are sensitive to interest rate expectations since real estate as an asset class exhibit a rather unique blend of “equity-like” and “bond-like” characteristics while also having strong inflation-hedging characteristics as well. So indeed, REITs had been underperforming the major equity indexes over the past few months as the 10-Year Yield has climbed back above 2%, but have caught a bid as a relative “safe haven” over the past few weeks amid the Russia conflict as the consensus macro view has shifted a bit to incorporate a slower growth environment in Europe and Asia, which will likely keep an upside lid on rates here in the U.S.

Importantly, the type of “rates” that matter for REITs on a historical basis are the longer-term rates – specifically the 10-Year and 30-Year Treasury Yields – far more than the Fed Funds rate. And by the time that the Fed will begin tightening this coming week, these longer-term rates have already priced-in quite a bit of the future Fed rate hikes with the 10-Year now closer to its 2018 peak of 3.25% than its 2020 low at 0.52%.

So leaving aside the fundamental strength and momentum behind the REIT sector, I think that a macro environment of U.S.-led growth combined with moderating growth and inflation expectations abroad is quite favorable for REIT outperformance.

5. Along that similar line of thinking, are there any further comments you can give for equity REITs or mortgage REITs regarding how higher interest rates could impact them as the Fed is set to raise rates through 2022? Also, can you share the percentage breakdown of REIT vs. mREIT allocations in the portfolio? That was a stat that I couldn’t find, aside from adding each position up and manually counting.

Good question – while we’re more bullish than many folks on mortgage REITs – particularly in a “rising rate” environment – we designed the index rules specifically to ensure that RIET is, at its core, an equity REIT fund. So currently, we have about a 2:1 ratio on equity to mortgage REITs on the common stock portion of the fund. Apart from the 10% preferred sleeve, equity REITs comprise about 60% of the weight while mortgage REITs are roughly 30%. We think this is an appropriate balance for income-focused investors to capture the yield benefits of mREITs and preferreds with the upside appreciation potential of equity REITs

6. A small “quirk” with the distribution of RIET is that it generally has a payout closer to the middle of the month. This can be great for income seekers and retirees, as many other monthly payers are right near the end of the month or the beginning of the month with their pay dates. Was this by design or something else? I noticed HOMZ also is paying on the same dates.

All of the decisions we make with the REIT Index and at the fund-level are made with the income-focused investor in mind. We heard similar favorable feedback on the benefit of the mid-month distribution on HOMZ, so it made sense to make the schedule and frequency consistent. Beyond that, the core attributes of the dividend policy – a smooth and consistent monthly dividend in the mid-to-high-6% range – has been particularly well-received. Given the need for reliable income in this uncertain environment, we feel very confident that the investment strategy of getting yield through real income producing asset, which is the key value proposition of the RIET ETF.

Be the first to comment