bjdlzx

Investment thesis

Natural gas and oil inventories remain at multi-year lows, and with winter approaching in Europe and North America, supply disruptions loom. Most of the bullish fundamentals are known, but I believe they are underappreciated by the market:

- The war in Ukraine and the sabotaged pipeline;

- The recent 2 mbpd cut by OPEC, a slap in the face for Biden;

- The last release from the U.S. Strategic Oil Reserves;

- Hurricane season could still threaten gulf supply.

I pointed out here in late August that I believed the perfect storm was coming this fall/winter for oil and gas. TC Energy and DHT Holdings are poised nicely to take advantage of this energy market.

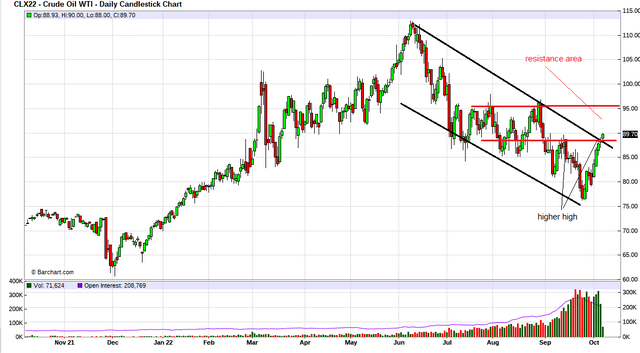

On the oil chart, we are beginning to seem some bullish inklings. Prices have made a slightly higher high and we could be breaking upward from the down trend channel. We really need to see a close at $96 or higher to have a solid new bull move in oil.

Better than a GIC (term deposit)

There is renewed interest in GICs and term deposits at the banks now that interest rates have gone up. A person can get 4% to 5% by locking into a 3 to 5-year terms. Rates vary by type and bank, but that is a good ballpark number. While this is a safe investment, the downside is your money is tied up and there is no chance of getting a higher rate or making a capital gain. A better alternative is:

TC Energy (NYSE:TRP, TSX:TRP) Recent Price – C$55.75

Current Yield 6.5%

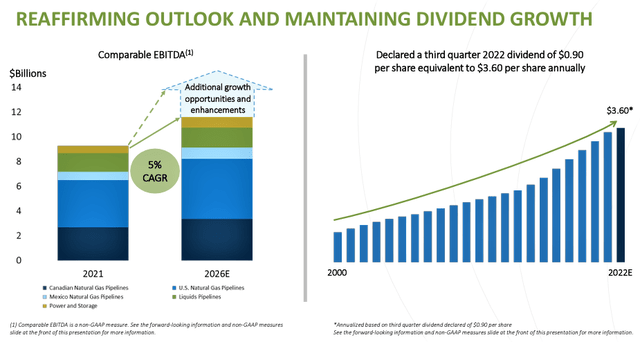

TC Energy offers more potential than GICs, with comparatively small risk. At C$55.75, and an annual payout of C$3.60, TC Energy yields 6.5 per cent. TC Energy owns and operates 93,300 kilometers of natural gas pipelines and 653 billion cubic feet of storage space in Canada, the United States and Mexico. It also has a 4,900 km network of oil pipelines, which supply Alberta crude to the U.S. market. As well, it invests in a number of power-generation facilities, including wind, solar, and nuclear. The current quarterly dividend is C90 cents per share. The company has raised its payout every year since the turn of the century. This graphic is from TC Energy’s presentation.

The company is projecting 5% annual growth, and I see no reason why dividends will not keep increasing. Second-quarter results came in slightly ahead of analysts’ expectations. Net income attributable to shareholders was $889-million (90 cents per share), compared with $975-million ($1 per share) in the same period of 2021. For the first six months of the fiscal year, net income was $1.24-billion ($1.27 a share). In the same period of the prior year, the company reported a loss of $82-million.

TC Energy announced a major expansion into Mexico on August 4th

TC Energy and Mexico’s state-owned electricity producer Comision Federal de Electricidad (“CFE”) announced the launch of a $4.5-billion (U.S.) pipeline that will deliver natural gas from the southwestern U.S. to southern Mexico. TC Energy said the CFE’s decision to take a 15-per-cent share in the project — the 715-kilometre, offshore Southeast Gateway pipeline — is a landmark transaction for the Mexican utility, as its first public-private partnership. The Southeast Gateway pipeline is expected to be operational by 2025, and TC Energy said the project enjoys broad-based support from all levels of government, environmentalists, and regulators. The project will allow the CFE to replace power plants currently fueled by high-sulfur oil with natural-gas-fired facilities that produce half the greenhouse-gas emissions. Over the course of this decade, Mexico’s appetite for natural gas is expected to increase by 50 per cent.

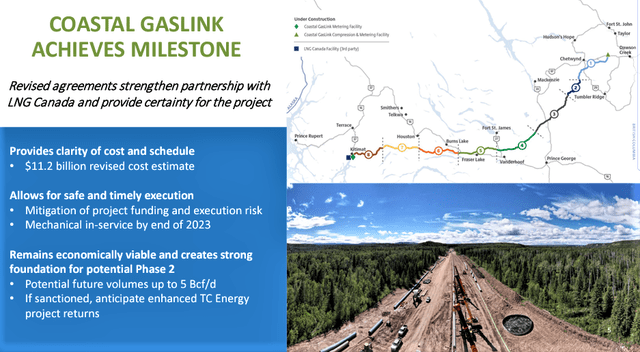

TC Energy is also expanding into what I see as a high-growth market with a strong future, exporting Liquid Natural Gas (“LNG”). Their $40-billion LNG Canada project, will have an export terminal in Kitimat, B.C., at the end of TC Energy’s Coastal GasLink pipeline and aims to be up and running by 2025.

This next graphic is from TC Energy’s presentation that highlights the pipeline.

In March this year, TC Energy announced signing of option agreements to sell a 10 per cent equity interest in the Coastal GasLink Pipeline Limited Partnership to Indigenous communities across the project corridor. The opportunity to become business partners through equity ownership was made available to all 20 Nations holding existing agreements with Coastal GasLink. The formal establishment of these agreements comes from interest expressed by Indigenous groups across the project corridor to become owners in Coastal GasLink alongside Alberta Investment Management Corporation, KKR, and TC Energy. This is an excellent move to avoid native disputes.

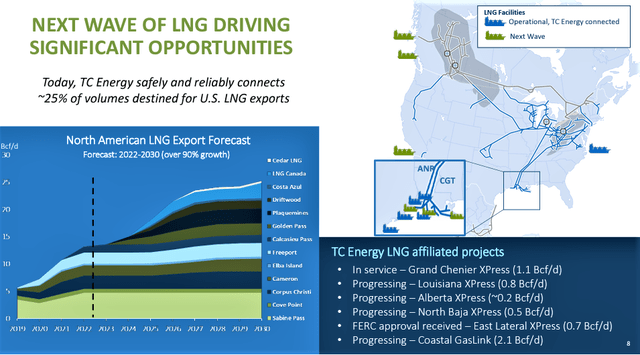

The next graphic from their presentation illustrates that TC Energy is already benefiting from the LNG boom and will continue to do so, and especially with their own Kitimat terminal in 2025.

Conclusion

TC Energy is offering a very good dividend yield and has consistently increased their dividend every one of the past 20 years. The stock has dropped to the lowest level in almost two years, simply correcting too far in sympathy with oil stocks. It does not matter the price of oil and gas. TC Energy is paid to move it at whatever price. The stock is of great value here.

DHT Holdings, Inc. (NYSE:DHT) 164M shares out

DHT is an independent crude oil tanker company with a fleet trading internationally and consists of crude oil tankers in the VLCC segment. At June 30, 2022, DHT had a fleet of 24 VLCCs, with a total dwt of 7,453,519.

A recovery in the VLCC market was expected in 2022 after 2 years of Covid restrictions affecting oil demand. Tankers International reports that the data shows a definite boost. Globally, they count an additional 27 monthly liftings in the VLCC spot market in the first half of this year compared to the 2021 annual average, and we are very close to reaching pre-Covid fixing volumes. 27 additional cargoes per month would employ more than 30 VLCCs full time if they were all traded between the AG and Singapore. Of course, some travel shorter distances and some travel further.

Then add in the Ukraine war and we see more tankers heading to Europe to make up for Russia supply. All things combined has caused tanker rates to soar. On September 12th Tradewinds reported spot tanker rates at $43,600 per day and now they are at $49,000 per day. This is about double from a year ago. This will give a big boost to DHT’s cash flow and earnings late this year and in 2023.

On September 8, 2022, DHT Holdings announced a new dividend policy with 100% of net income being returned to shareholders in the form of quarterly cash dividends. The new policy will be implemented from the third quarter of 2022. Svein Moxnes Harfjeld, President & CEO, stated:

“The key considerations behind the new policy are the strength of our balance sheet and liquidity position in combination with no current plans for significant capital expenditures. The timing of the decision and its implementation reflects our constructive market outlook.”

I expect this will result in a minimum dividend of 50 cents per year and could easily go well over $1.00 if tanker rates stay high. At $7.40 a $0.50 dividend is a 6.8% yield

DHT had a good 2nd quarter

-

In the second quarter of 2022, the Company’s VLCCs achieved an average rate of $24,300 per day.

-

Adjusted EBITDA for the second quarter of 2022 was $32.5 million. Net profit for the quarter was $10.0 million which equates to $0.06 per basic share.

-

In May 2022, the Company entered into agreements to sell DHT Hawk, built 2007, and DHT Falcon, built 2006, for $40 million and $38 million, respectively. The vessels were both delivered during the second quarter of 2022 and the sales generated a combined gain of $12.7 million. The Company repaid the outstanding debt of $13.3 million combined on the two vessels.

-

In June 2022, the Company prepaid $23.1 million under the Nordea Credit Facility. The voluntary prepayment was made under the revolving credit facility tranche and may be re-borrowed.

-

In the second quarter of 2022, the Company purchased 2,826,771 of its own shares in the open market for an aggregate consideration of $15.9 million, at an average price of $5.6256. All shares were retired upon receipt.

-

For the second quarter of 2022, the Company declared a cash dividend of $0.04 per share of outstanding common stock, payable on August 30, 2022, to shareholders of record as of August 23, 2022. This marks the 50th consecutive quarterly cash dividend. The shares will trade ex-dividend from August 22, 2022.

So far in the 3rd quarter of 2022 for DHT, 68% of the available VLCC days have been booked at an average rate of $23,600 per day on a discharge-to-discharge basis (not including any potential profit splits on time charters). This is not much different than Q2 but as time goes on the cheaper rates will drop off and replaced with the higher rates that are currently in the market. For example, in July 2022, the Company entered into a five-year time-charter for DHT Osprey at $37,000 per day, with charterer’s option to extend two additional years, at $40,000 per day and $45,000 per day, respectively. The vessel is expected to deliver into the contract in August.

DHT has a relatively new fleet of ships compared to most tanker companies with only 3 of their 24 VLCCs pre 2011. Those 3 were built in 2007. Newer builds are more efficient, less maintenance and not subject to discount rates that can be applied to older tankers. At the end of 2020, Statista reports that 46% of oil tankers are 15 years old and older.

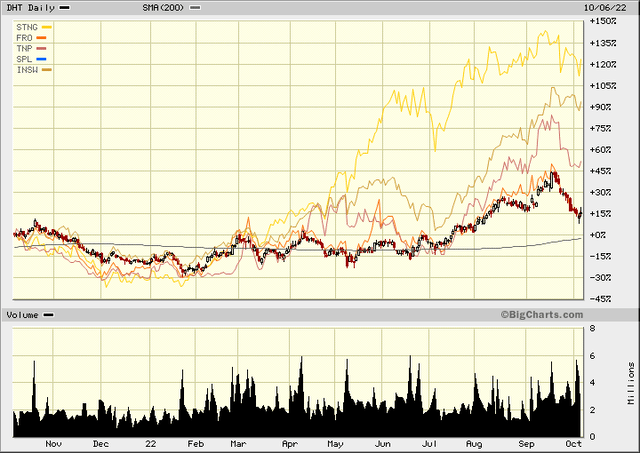

I like DHT because they are well-run and very efficient. The stock has pulled back and is not reflecting their new dividend policy that few if any other tanker companies can afford to do. Most important is the low valuation to peers. Tanker stocks started to rally in April and May and have all pulled back in the past month. However, DHT is at the bottom of the pack with only a +15% gain in the past year. I see no good reason for this and believe the stock can play catch up.

Be the first to comment