Sitthipong Pengjan/iStock Editorial via Getty Images

The Swiss luxury company Compagnie Financière Richemont (OTCPK:CFRUY) are up 13% in trading as I write. The reason is no surprise. It just released its half-year results. In my last report on CFRUY three weeks ago, I put a Hold rating on the stock based on two concerns. One, its operating margins were significantly lower than those of its peers. And two, China’s zero-COVID-19 policy could continue to hurt it in the foreseeable future. However, its latest numbers assuage both concerns, indicating that we can now expect better results for the company.

YNAP sale boosts margins

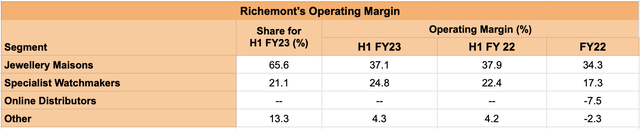

Despite robust revenue and net profit growth in the last financial year (FY22), Cartier owner Richemont was lagging behind peers like LVMH (OTCPK:LVMUY) and Hermes (OTCPK:HESAY) in terms of operating margins. At the present time of high inflation, luxury margins are particularly crucial to consider, since that is precisely what can make them relatively immune to the impact of higher prices. At 17.9%, its operating margin wasn’t bad, but with Hermes at 40% and LVMH at 26.7%, it wasn’t competitive either.

There was room for improvement, however, with the sale of a controlling stake in online retailer Yoox Net-A-Porter [YNAP] to London-based luxury fashion marketplace Farfetch (FTCH). While the exact numbers for YNAP were not available, I had made rough estimates for the drag on its margins based on figures available for its Online Distributors segment. These indicated the possibility of around a 4 percentage point increase in the operating margin after the sale. In its latest update, Richemont has written down its YNAP assets and presented information for continuing operations that reveal a bigger-than-expected jump in operating margin to 28.1% for the first half of the current financial year (April-September, 2022, H1 FY23), with YNAP now represented as discontinued operations. This means, that its margin now only rivals Hermes in the luxury segment, and is actually slightly ahead of that of LVMH.

Source: Compagnie Financière Richemont

There’s, even more, to like about its operating margin. It has risen slightly from the 27.8% level seen in the now available comparative numbers for H1 FY22, as its Specialist Watchmakers and Other (which now includes fashion and accessories, improvements in its watch component manufacturing division, Watchfinder and real estate activities) segments made up for a small decline from its biggest division, Jewellery Maisons (see chart above). Further, compared to FY22, its margins for all three segments have improved. Note that the Other segment isn’t entirely comparable, since Watchfinder was part of Online Distributors earlier, which no longer exists as a category. Its shift to Other has likely contributed to the positive operating margin for the latest half-year in the category, though Richemont does mention strong performance from other brands like the leather goods brand Delvaux and casual sportswear brand Peter Millar.

Improvement in Asia-Pacific sales

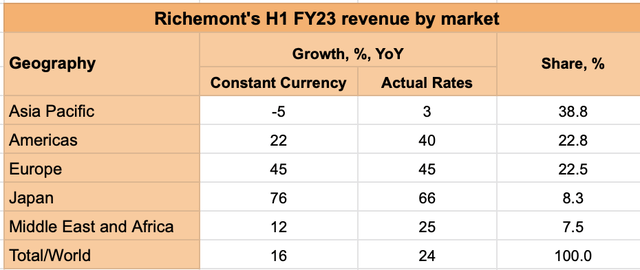

Richemont’s sales figures have also improved since its last update for Q1 FY23 (ending June 30, 2022). At the time, it reported a 20% year-on-year (YoY) revenue increase, which has jumped to 24% for H1 FY23 on a small upward revision to its Q1 figures, but mostly due to improved performance in Q2 as Asia-Pacific sales improved even while the other segments showed a relative slow down from their elevated growth levels in Q1. Its company’s Asia-Pacific revenue has actually grown by 3% following a 16% decrease in Q2. This is partly due to a positive exchange rate effect, though. At constant currency, sales to the region have still declined by 5% but the signs of growth recovery are present with a 6% growth in Q2 at constant exchange rates. The growth rate isn’t ideal but is still good news since the region is its biggest market and the Chinese economy is expected to grow relatively fast next year even as the big economies in Europe and the US slow down.

Source: Compagnie Financière Richemont

Attractive valuations

Richemont’s latest results also provide insight into its earnings from continuing operations, which look promising. It has reported a net loss after the YNAP write-down, but since this is likely the entire amount, the numbers from the next update onwards could look much better. Further, its earnings from continuing operations for H1 FY22 are 11.2% higher than was reported last year, indicating the extent of drag from its YNAP operations. Even considering these higher level of earnings for last year, its profit from continuing operations have jumped by 40% for H1 FY23. Estimating the TTM earnings from continuing operations based on the increase in H1 FY22 earnings after removing the impact of YNAP from H2 FY22 earnings, and its latest H1 FY23 earnings from continuing operations yield a P/E of 20x, down from the 28x before the update came in.

This doesn’t just make CFRUY more attractive compared to earlier, it also makes it more competitive compared to peers like Hermes and LVMH, which have P/Es at 50.3x and 25.3x respectively. Both companies have seen far higher growth in net profits over the past year and have had stronger margins too, which is a partial explanation for this. Moreover, their long-term price performance is better too. Still, I believe there could be some more upside to Richemont in the near term going by the fact that it’s still down almost 26% year-to-date, compared to a 17.1% fall for the S&P 500 (SP500).

What next?

A near-term upside, however, doesn’t translate into a medium-term buy yet. Next year could be challenging for it, and indeed most other companies, considering the impending recession in the US and in Western Europe. Also, as winter progress, we don’t know what will happen next with respect to COVID-19. That said, its performance over the longer term could still improve and valuations look more compelling now. I’m moving from a Hold rating to a Buy on Richemont.

Be the first to comment