aquaArts studio/iStock via Getty Images

Richardson Electronics, Ltd. (NASDAQ:RELL) is experiencing significant sales growth by selling green energy solutions. Management appears to sell many more components to the wind, solar, and EV industries. In my view, with large existing clients and potential internationalization opportunities, RELL could be worth much more. Under my own estimates, my discounted cash flow model results in a valuation of close to $29 per share. I don’t think that tension with suppliers or competitors in China or other risks seem that serious for RELL.

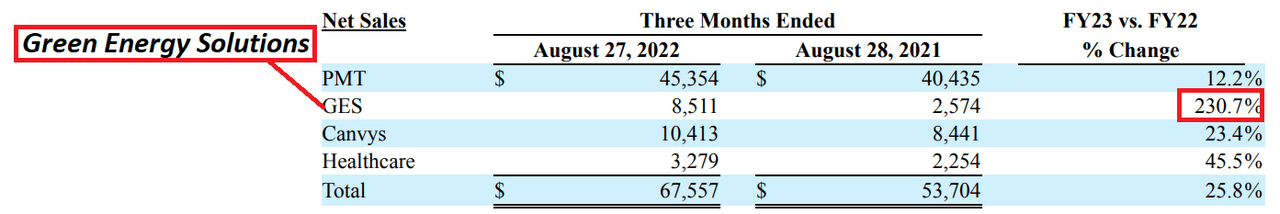

Richardson Electronics: Green Energy Solutions Saw A Triple Digit Sales Growth Thanks To The Wind Turbine Industry

Richardson Electronics, Ltd. is a manufacturer of engineered solutions like power grid and microwave tubes, power conversion, RF and microwave components, and high-value replacement parts for diagnostic imaging equipment.

Richardson reported a 230% increase q/q in green energy solutions. In my view, the investors looking to profit from the increase in the global energy market may be willing to have a look at Richardson’s net sales.

Source: 10-Q

In line with my previous lines, Richardson noted an increase in sales in the Electric Vehicle market and the wind turbine industry. In my view, if these sectors continue to outperform, Richardson shareholders may see significant increase in revenue growth.

The increase was mainly due to growth in our ULTRA3000 and other related product sales into the wind turbine industry and from customers manufacturing synthetic diamonds. We also saw an increase in sales into the Electric Vehicle market. Source: 10-Q

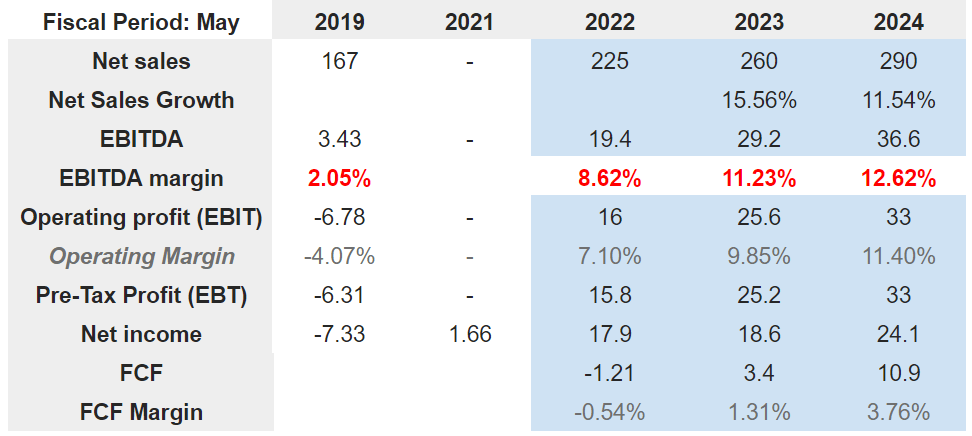

Analysts Expect 15% Sales Growth In 2023 And 11% In 2024

I believe that including the numbers of other analysts would help readers obtain a better picture of Richardson. In my view, the figures delivered by other analysts are very beneficial.

Analysts forecasts for 2024 include net sales of $290 million, in addition to an EBITDA of $36.6 million and an EBITDA margin of 12.62%. The operating profit would stand at $33 million, with an operating margin of 11.40% and a net income of $24.1 million. Analysts also anticipate 2024 FCF of $10.9 million and 2024 FCF margin of 3.76%.

Source: Marketscreener.com

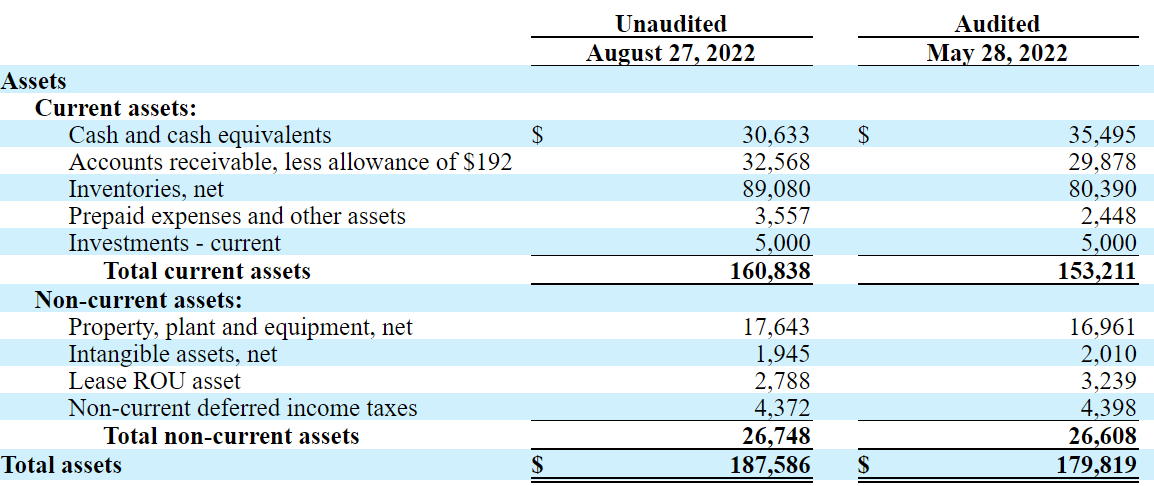

Balance Sheet

As of August 27, 2022, cash and cash equivalents were $30.633 million with accounts receivable of $32.568 million, in addition to inventories worth $89.080 million. With total current assets of $160.838 million and current liabilities of only $44 million, in my view, Richardson does not seem to have to suffer liquidity risks.

Regarding non-current assets, management reported property worth $17.643 million with non-current deferred income tax of $26.748 million. The total assets stand at $187.586 million or 4x the total amount of liabilities. With these figures in mind, I believe that the balance sheet stands in a beneficial position.

Source: 10-Q

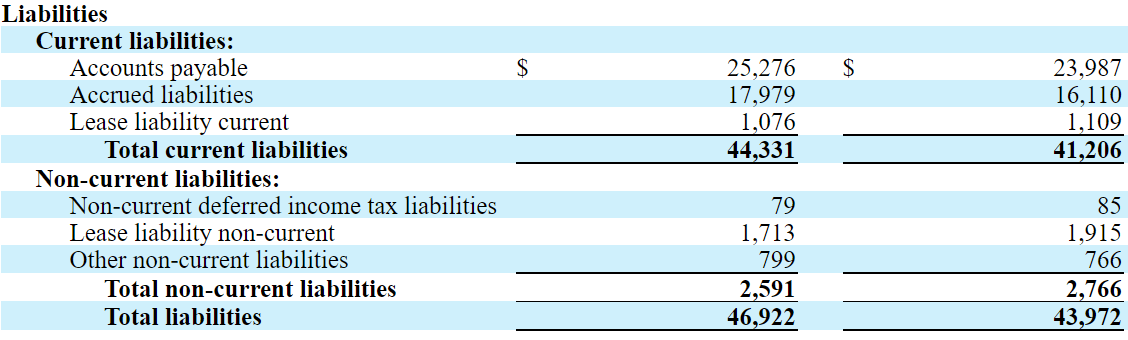

Moving on to the liabilities, Richardson reported accounts payable worth $25.276 million with accrued liabilities of $17.979 million. The non-current liabilities include lease liability of $1.713 million and total liabilities of $46.922 million.

Source: 10-Q

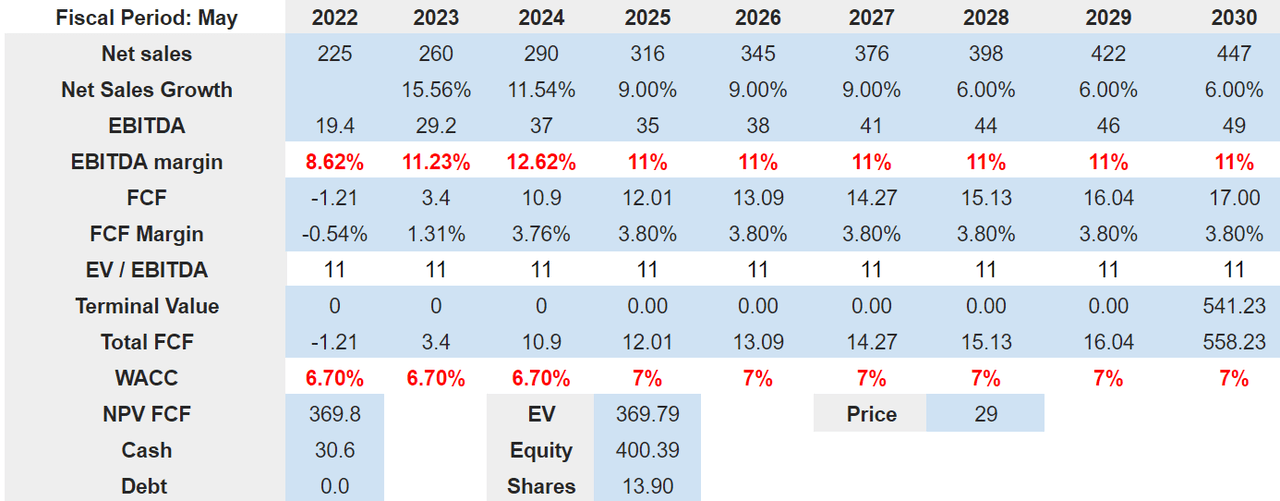

My Conservative Case Scenario Implied A Valuation Of $29 Per Share

Under my base case scenario, I assumed that future sales growth would be a bit better than expected thanks to the green energy applications such as wind, solar, hydrogen, and Electric Vehicles. The company offered certain explanations about new prototypes for these particular sectors in a recent quarterly report.

We provide solutions and add value through design-in support, systems integration, prototype design and manufacturing, testing, logistics and aftermarket technical service and repair-all through our existing global infrastructure. GES’s focus is on products for numerous green energy applications such as wind, solar, hydrogen and Electric Vehicles, and other power management applications that support green solutions such as synthetic diamond manufacturing. Source: 10-Q

With close to 57% of the total amount of sales coming from outside the United States. I think that internationalization could bring significant revenue generation. Let’s note that new clients in the wind, solar, hydrogen, and Electric Vehicles segments may manufacture outside the United States.

During fiscal 2022, we made approximately 57% of our sales outside the United States. We continue to pursue new international sales to further expand our geographic reach. Source: 10-k

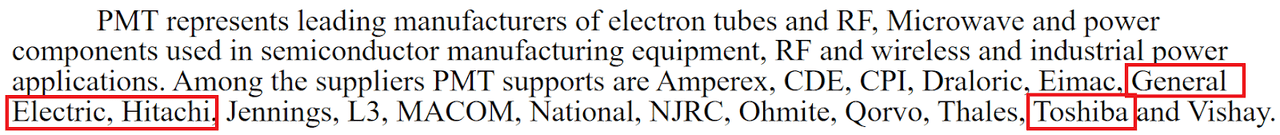

It is also worth noting that Richardson works with an established manufacturer of power components. If the company offers new components, existing clients will most likely consider making orders. In sum, I don’t believe that Richardson may need to make extraordinary efforts to sell to existing clients. Most clients recognize the company’s know-how.

Source: 10-k

For 2030, under this case, I expect net sales of $447 million with EBITDA worth $49 million and an EBITDA margin of 11%. My model also includes a FCF of $17 million with a FCF margin of 3.80%.

If we also include an EV/EBITDA multiple of 11x, the 2030 terminal value would be $541.23 million. Besides, with a WACC of 7%, the discounted sum of free cash flow would be $369.8 million. With cash of $30.6 million and assuming zero debt, the enterprise value would be $369.79 million with the equity of $400.39 million. Finally, the fair price would be $29 per share.

Source: Author’s Work

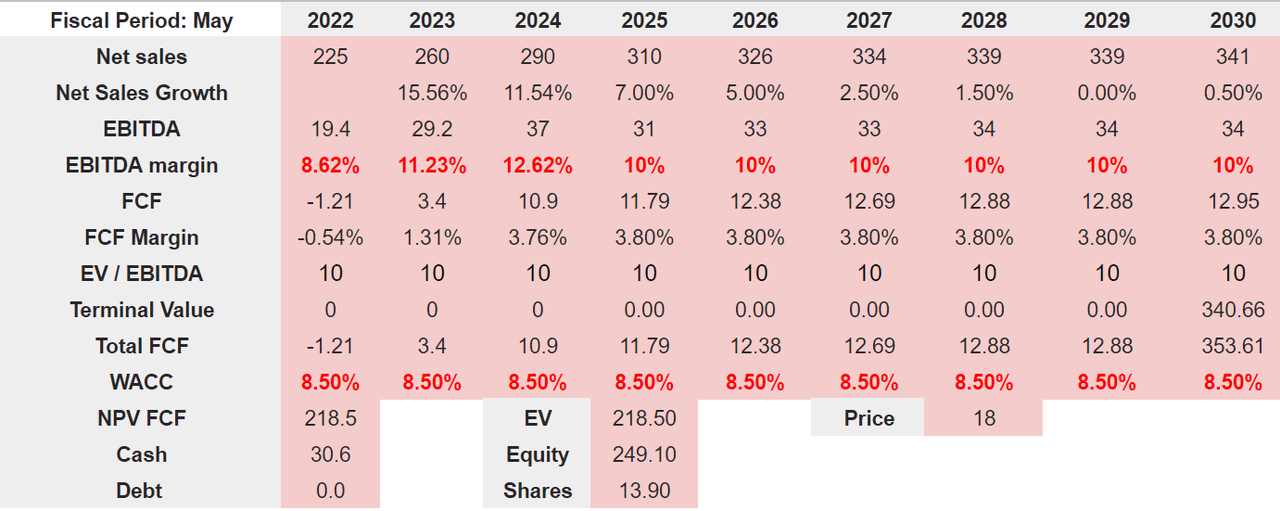

My Worst Case Scenario Resulted In A Valuation Of $18.1 Per Share

Under bearish conditions, Richardson may fail to adapt to new technological changes in the industries in which the company operates. As a result, I believe that management may lose clients, or may have to lower its prices. In sum, we would see a decline in the free cash flow and free cash flow margin.

If we fail to anticipate the changing needs of our customers or we do not accurately forecast customer demand, our customers may not place orders with us, and we may accumulate significant inventories of products that we may be unable to sell or return to our vendors. Source: 10-k

In line with the previous lines, let’s note that there are a number of manufacturers in China that seem to be learning fast. Considering that employees earn a bit less in China, these competitors may produce cheaper goods. If Richardson has to decrease its prices, I believe that the company’s fair value would diminish.

There are also a limited number of Chinese manufacturers whose ability to produce vacuum tubes has progressed over the past several years. Increased competition may result in price reductions, reduced margins or a loss of market share, any of which could materially and adversely affect our business, operating results and financial condition. Source: 10-k

There are certain products that require supplies from a small number of vendors. If the company does not increase the number of suppliers, small vendors may negotiate prices or lower production. Richardson warned about these risks in the last annual report:

The products we supply are currently produced by a relatively small number of manufacturers. One of our suppliers represented 11% of our total cost of sales. Our success depends, in large part, on maintaining current vendor relationships and developing new relationships. Source: 10-k

Richardson noted that 42% of its total cash was located outside the United States. If the company cannot move its total cash in hand to sustain growth in new regions, sales growth may not be as large as expected. Management noted these risks in the annual report.

As of May 28, 2022, $15.0 million, or approximately 42% of our cash and cash equivalents was held by our foreign subsidiaries. While we intend to use some of the cash held outside the United States to fund our international operations and growth, when we encounter a significant need for liquidity domestically or at a particular location that we cannot fulfill through other internal or external sources, our liquidity requirements could necessitate transfers of existing cash balances between our subsidiaries or to the United States. Source: 10-k

Under the previous assumptions, I included 2030 net sales of $341 million and net sales growth of 0.50%, along with an EBITDA of $34 million and an EBITDA margin of 10%. I believe that free cash flow of $12.95 million and FCF margin of 3.80% would make sense.

With an EV/EBITDA multiple of 10x, my terminal value would be $340.66 million, and the NPV of future FCF would be $218.5 million. If we also add the cash in hand of $30.6 million, the equity valuation would stand at $249.10 million. Finally, the fair price would be $18.1 per share.

Source: Author’s Work

Conclusion

Richardson delivered significant sales growth related to green energy solutions. The sale of components to the wind, solar, and EV industry appears to grow fast. In my view, with large and existing clients, management will likely not have issues with offering new components. Besides, internationalization could become a beneficial revenue catalyst. In sum, in my opinion, future free cash flow would be sufficient to obtain a fair valuation close to $29 per share. Even considering risks from tension with suppliers or competitors in China, Richardson appears quite undervalued.

Be the first to comment