Bet_Noire/iStock via Getty Images

RF Industries (NASDAQ:RFIL) is an assembler of specialized cables from a variety of industries. The company serves different segments through six independent subsidiaries located in the Northeast and Southwest.

The company has not been able to generate consistent operating profits, in my opinion because of low competitive power and lack of SG&A efficiency. In 2021, RFIL made a relatively expensive acquisition, losing most of its cash and increasing debt.

Although I still consider RFIL expensive compared to its earnings generation potential, the latest quarterly data shows that the company is improving efficiencies and growing profits fast on a quarterly basis.

Note: Unless otherwise stated, all information has been obtained from RFIL’s filings with the SEC.

Short recap of the situation

I wrote an article on RFIL in March this year, presenting the company’s operations in detail. In this section, I will only recap the most important aspects.

First, I do not believe RFIL has a substantial competitive advantage or that it is located in a desirable industry. RFIL competes in the cable industry with bigger companies like Amphenol (APH), Belden (BDC) and TE Connectivity (TEL). The company sells undifferentiated and even commoditized products and adds little value to the chain besides owning the assembling operations. Given that an assembler requires facilities and semi-qualified workers (fixed costs), the industry is prone to rivalry and price-destroying competition. Finally, a significant portion of RFIL’s business is non recurring, based on contracts signed for specific projects. This generates a very sticky SG&A structure.

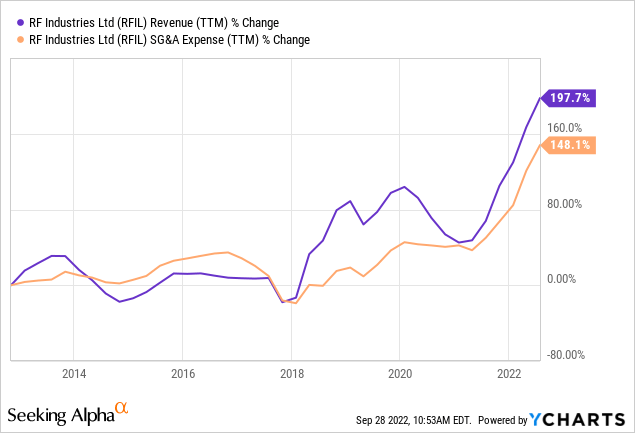

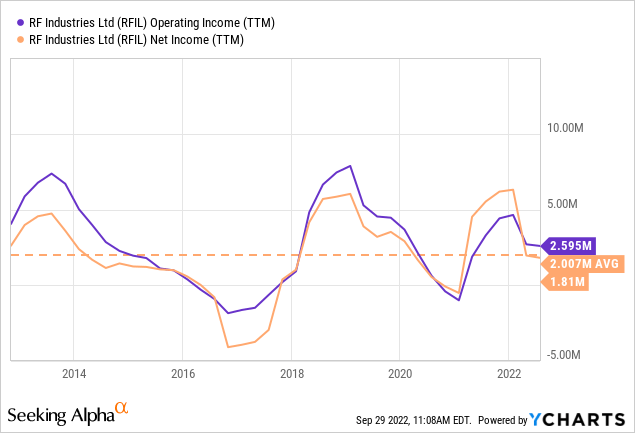

Second, despite the increase in revenue seen after 2018 above, enhanced by the acquisition of Microlab in 2021, RFIL has been unable to grow operating profits or net income, as shown below.

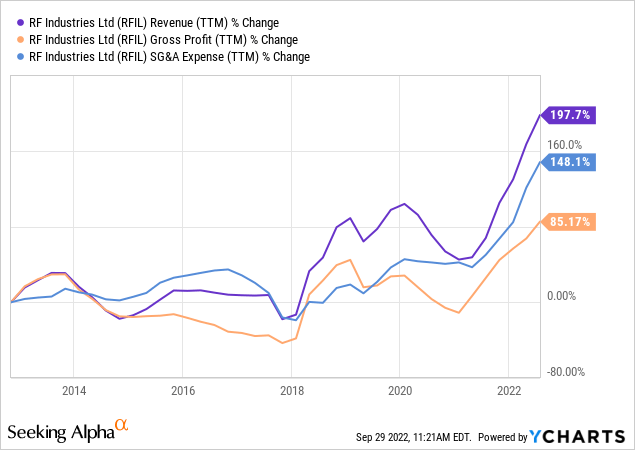

I believe the reason has been loss of gross margin and inefficiencies at the SG&A level, as shown below. In particular, RFIL operates its six subsidiaries as completely independent companies, despite them operating in substantially similar markets. This probably generates significant duplication of responsibilities and inefficiencies.

Finally, I commented that RFIL’s recent acquisition of Microlab, a cable assembler specialized in telecommunications, did not seem accretive. The reasons were decreasing revenues at Microlab for the past three years, and the fact that the company had to take $17 million in debt to pay for the $25 million acquisition. At that time, RFIL had not provided significant financial information on Microlab, only posting its adjusted EBITDA. The company has not yet posted separate financial statements for Microlab.

In that article, readers with more detailed knowledge of the industry commented several interesting points. First, that RFIL’s operations have improved since 2017, coincidentally with the introduction of the new CEO Robert Dawson. Second, that the company still has a lot of room to improve efficiencies, particularly by consolidating its subsidiaries at the operating level. Third, that Microlab was under-invested under its previous owner, and that RFIL would be able to obtain higher returns from the company. Finally, that the upcoming investment in 5G and DAS infrastructure should increase RFIL’s revenues.

RFIL’s latest quarterly data is good but not enough

Since my latest article, RFIL has published financial information for three quarters (January, April, July), and these show promising data.

RFIL has posted three continued quarters of growing revenue that have translated into faster growing operating profits. In particular, and adjusting for one-time costs related to Microlab’s acquisition, the company posted operating profits of $300 thousand in 1Q21, $700 thousand in 2Q22 and $1.3 million in 3Q22.

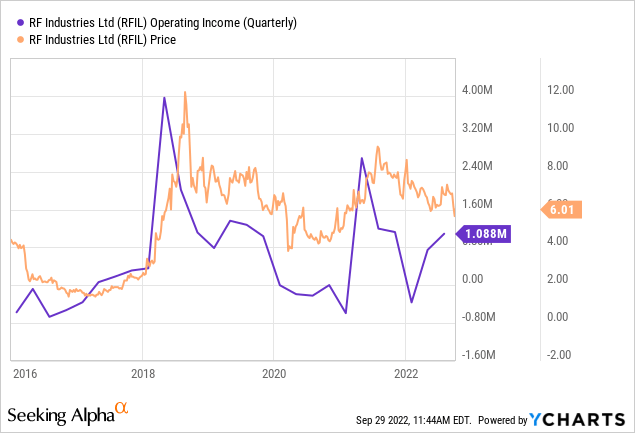

Of course $2.5 million in operating profits is not enough to justify a $57 million market cap, but growth in the bottom line is a good signal. However, the reader should also take into account two aspects that increase RFIL’s volatility. First, the company has non recurring revenues, therefore quarters with significant sales can be followed by quarters with much lower sales. Second, because RFIL’s operating margins are thin, small variations in revenue generate much bigger changes in net income.

Finally, as the chart below shows, RFIL’s operating income is volatile, and its stock price seems to move in line with it, with cycles of boom and bust. Whether we are in the boom or bust stage is more difficult to determine, but trading at a PE of 30, RFIL does not provide a lot of margin of safety.

Finally, in order to pay for the acquisition, RFIL had to draw $17 million from a term loan maturing in May 2027 and paying fixed 3.8%. The resulting $650 thousand in interest should not prove a burden on the company’s financials.

Conclusion

RFIL’s situation has not improved a lot since my latest article. The company is showing growing operating income, but it is not showing significant improvements in terms of efficiency. Given the non recurring nature of RFIL’s business, it is difficult to determine if the recent increases in revenue and operating profits are sustainable or not.

The company’s stock price has not been as affected by the recent bear market, and trades at 15% below its March price. With a market cap of $57 million, it seems overpriced on the basis of historic average net earnings of $2 million, and on the basis of current operating profits of $2.5 million for the first nine months of FY22. The company could definitely continue growing and improving its cost structure, but that it is yet to be proven.

Be the first to comment