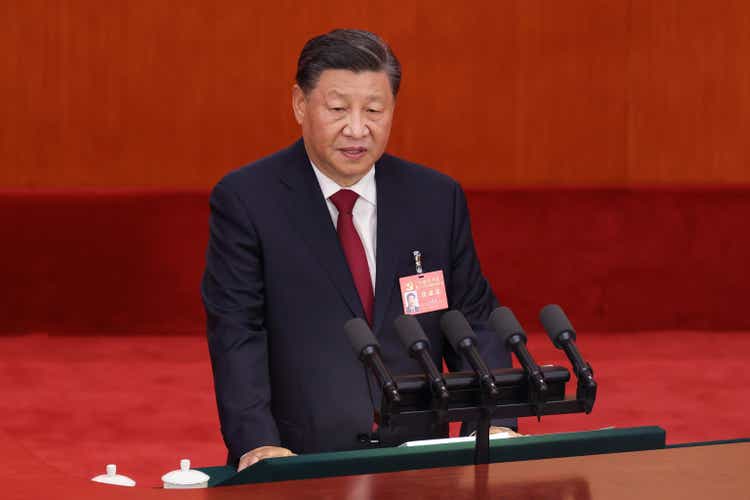

Lintao Zhang/Getty Images News

About a year ago, we did a deep dive into why China’s “common prosperity” mandate is synonymous with erasing any hopes for Alibaba (NYSE:BABA, BABAF) on returning to its former glory days. And, over the past weekend, President Xi’s successful renewal of a precedent-breaking third term in power solidifies such a bleak fate for the once high-flying Chinese tech stock.

While President Xi Jinping has doubled down on China’s aspirations to become technologically “self-sufficient” amidst intensifying geopolitical tensions with the U.S. and the west, the mandate does not necessarily translate into opportunities for non-state-owned, yet sprawling, enterprises that risk consolidation of power and wealth within the private sector – namely, Alibaba, amongst other private Chinese big tech names that count Tencent (OTCPK: TCEHY), Meituan (OTCPK: MPNGF / OTCPK:MPNGY), and ByteDance (PRIVATE: BDNCE).

The lack in momentum in the last week’s rally observed across some of China’s darling industries – such as electric vehicle stocks – on the back of President Xi’s supportive rhetoric for home-grown technology advancements also underscores investors’ lack of confidence in the country’s growth outlook. As much as President Xi hopes for his third term to represent an era of self-reliance, and strong fundamentals for China over the longer-term, the immediate reality is that his reign has only cast a darker shadow of angst and doubt among investors who are becoming increasingly worried about a backtracking economy to the days under Mao Zedong’s “chaotic rule.”

Our view is that with President Xi’s advocation for “common prosperity” now more deeply rooted into the country’s mandate than ever before under his “unquestioned grip over the ruling [Communist Party],” Alibaba’s fate is dire. The only respite we see in the near-term for the Alibaba stock is if China abandons the stringent COVID Zero policies that have been a drag on the country’s economy – but even then, any related momentum for Alibaba will likely be brief, as the reality of its controlled growth under President Xi’s assertion over reining-in private big tech sets in.

Key Takeaways from the Twice-A-Decade Communist Party Congress

President Xi kicked off the Communist Party congress last Sunday with a historical speech that laid out the key mandates for China ahead of his third ruling term. These included a further acceleration of China’s appeal as an influential economic and geopolitical power on the world stage against a “growing challenge from the U.S.”; ensuring China’s national security amid the pursuit of economic development and growth; and pledging “innovation in areas vital to technology self-reliance.”

From a foreign policy perspective, it means the outlook of fraying U.S.-China relations will only become more fraught, especially as President Xi name-drops Taiwan as part of aspirations for “China’s reunification and the rejuvenation of the Chinese nation.” Geopolitical tensions between China and the West have only intensified since President Xi and President Biden’s “candid” exchange in July, with hostility between the two major global economies escalating following U.S. House Speaker Nancy Pelosi’s highly-controversial visit to Taiwan in August, and more recently, the Biden administration’s enforcement of new curbs on the export of advanced semiconductor technology to China. This has, in turn, caused President Xi to suggest prioritizing “national security” over China’s “economy” in the years ahead, with the build-out of a self-sufficient technological playground being key to achieving such mandate.

A week later, the twice-a-decade Communist Party congress wrapped up with President Xi safely securing his precedent-breaking third term, alongside the appointment of six “loyalists” as part of the brand new seven-member Politburo Standing Committee (which includes President Xi). This has only solidified President Xi’s power over the Communist Party and China’s future, reverting to a similar ruling structure adopted under the Mao Zedong era and abolishing the “collective leadership model that underpinned the nation’s rise to become the world’s second-biggest economy.”

While President Xi’s third term was largely expected, market participants seem to have only just realized the Chinese leader’s ambition to lead the country with an “unquestioned grip.” This has sent jitters across the global markets, as observed through the violent selloff in Chinese equities across all major bourses spanning the Hong Kong Exchange to the NYSE / Nasdaq, despite the release of stronger-than-expected economic data for the three months through September. Investors have become particularly fearful that there will no longer be voices challenging President Xi’s ambitions – including growth-stifling policies spanning COVID Zero in the immediate term, to the sporadic yet unforgiving regulatory crackdown on the private sector over the longer-term – which spells further uncertainties ahead.

Implications on Common Prosperity

President Xi’s unwavering commitment to restoring common prosperity was a key theme in his broader ambitions to strengthen China’s influence from both a geopolitical and economic perspective on the global stage. During his kick-off speech, he vowed to “improve the system of income distribution…,ensure more pay for more work and encourage people to achieve prosperity through hard work…, promote equality of opportunity, increase the income of low income earnings, and expand the size of the middle income group.” And more specifically, President Xi called to “keep income distribution and the means of accumulating wealth well regulated.”

This, again, opens a pandora box of uncertainties for Alibaba from a regulatory perspective – all in the name of common prosperity.

As discussed in our analysis last year, the rhetoric likely means a potential eradication of Alibaba’s leadership in e-commerce and cloud-computing, as any indications of “inequality” would not meet the requirements of common prosperity:

Although there may be a myriad of valid reasons to initiate a long position on the Alibaba stock right now, China’s reintroduction of common prosperity alone should be enough of a reason to stay away. Thinking Alibaba could return to its former glory at the $300-level would be akin to a wild bet given what lies ahead in the name of common prosperity remains a big question mark. It is also likely that the national move towards restoring common prosperity will eradicate the widening “rich-poor polarization”, and Alibaba will no longer stand out as the industry leader once the sector becomes levelled.

Source: “Alibaba: Why ‘Common Prosperity’ is Enough to Invalidate Every Bullish Call on the Stock.”

Fast-forward to a year later, the risks have only escalated – common prosperity has now officially made it into the Communist Party’s charter.

Lets See What it Means for Alibaba

While the regulatory and geopolitical risks surrounding Chinese equities have now become more acknowledged amongst the investing community today compared to a year ago, the top bullish narratives over the Alibaba stock have largely remained unchanged. To gauge what President Xi’s third ruling term and official inclusion of the common prosperity mandate into the Communist Party’s charter would mean for Alibaba, we have revisited the same bullish narratives last analyzed:

1. Strong Fundamentals

Alibaba’s fundamental performance has deteriorated significantly since our analysis’ prequel last September – and so has China’s economy. The company’s fundamental cracks first shone through its weak December-quarter results last year, when Taobao’s blockbuster annual “Singles Day” shopping event in November grew at the slowest pace on record. The lackluster results underscored the toll of China’s stringent COVID restrictions as well as an ongoing property slump at the time.

Things got worse during the June-quarter when Shanghai was subject to a monthslong lockdown to stem the spread of COVID, which paralyzed economic activity across the country and essentially threw China’s official growth target of 5.5% for the year out the window. Meanwhile, the country’s real estate crisis has only gotten worse with a growing volume of defaults on developers’ debt and mortgage boycotts by homebuyers. Fading consumer confidence alongside COVID disruptions to business eventually took Alibaba to its first quarterly revenue decline since becoming a public company during the three months through June. The outcome of Beijing’s crackdown on antitrust behavior – which required Alibaba to eradicate the use of exclusive arrangements that limited vendors from selling on rival platforms such as JD.com (JD) – also took a toll on the company’s fundamentals, adding to the regulatory turmoil priced into its beaten-down valuation multiple.

Yet, Alibaba remains the unmatched market leader in e-commerce and cloud-computing in China – so from the grander scale of things, its fundamentals are still strong, with the business remaining viable and profitable. Although retail sales growth of 2.5% in September fell short of consensus estimate for 3.3% and was “less than half the 5.4% pace in August,” it was still a positive contribution that represented recovery from declines observed in the preceding quarters – a welcomed tailwind for Alibaba. Although preliminary data showed consumer spending had weakened during the weeklong National Day holiday earlier this month, discount shopping on Alibaba’s core commerce platform, Taobao, during the same festive period seemed strong, with live shopping vendors logging significant traffic. The fast-approaching 11-11 Singles Day shopping event is expected to bring a seasonality boost to Alibaba’s core commerce sales for the December-quarter, though the pace of sales growth could potentially decelerate further from the prior year given additional tightening of COVID curbs this time around.

But given the meltdown in Chinese equities observed today (October 24), investors are focused on a bigger problem at hand – namely, greater uncertainties over China’s economic outlook. And Alibaba’s still seemingly strong fundamental performance is insufficient to take such uncertainties away. In fact, the confirmation of President Xi’s third term in power might have even put Alibaba’s still-strong fundamentals today at greater risk. Specifically, Alibaba has been double-downing on its cloud-computing business and international expansion efforts for e-commerce this year as part of a new strategy to diversify its growth reliance beyond the slowing / maturing domestic market. Yet, President Xi’s third term in power stands to thwart such growth plans in two ways, spelling greater fundamental uncertainties ahead for Alibaba:

- Intensifying geopolitical tensions with the U.S. – As discussed in the earlier section, President Xi’s aspirations to strengthen China’s fight against the U.S. means more geopolitical turmoil to come. This is further corroborated by the recent curbs imposed by the U.S. government on exports of advanced semiconductor technologies to China, which will limit Alibaba’s aspirations of growing its global cloud-computing market share. Last year, Alibaba introduced a new in-house-developed server processor based on 5nm processing technology, which marked a “milestone in China’s pursuit of semiconductor self-sufficiency.” The company had planned to integrate the in-house developed silicon into its data centers, and potentially commercializing it in the future. However, the only foundries capable of producing chips with the advanced 5nm process today are Taiwan Semiconductor (TSM) and Samsung Electronics (OTCPK:SSNLF / OTCPK:SSNNF) – both of which have been restricted from providing chip manufacturing expertise that is anything more advanced than 16nm technology to China in order to stay compliant with the U.S.’ new rules. This likely means a big part of Alibaba’s growth goals in cloud-computing have been held back.

- Common Prosperity – Common prosperity essentially aims at “reducing inequality” across wealth and opportunities, amongst other things. While Alibaba hopes to take its core commerce operations overseas to maintain a longer-term growth trajectory, common prosperity could potentially say otherwise as the mandate aims at levelling out “market leadership.” The opaqueness of China’s regulatory agenda means any rule changes could happen swiftly and brutally (cue the edtech sector that went from everything to nothing overnight). Beijing could easily cite national security concerns as a mean to stop Alibaba short from its aggressive overseas expansion efforts, the same way it restricted overseas securities issuances on Chinese companies, levied harsh penalties against findings of antitrust violations, and released an “unspoken order” for big tech to unravel their sprawling influence through divestments.

2. Valuation is Cheap

Like we had acknowledged last time – yes, Alibaba’s valuation is cheap, with its multiples plunging toward record lows and diverging further away from American equivalents like Amazon (AMZN) by wide margins. Yet, there also isn’t anything compelling to convince investors – namely, market-influencing institutional investors with stringent risk mandates – that the stock’s significant discount relative to peers can compensate for the myriad of risks hanging over its prospects.

Alibaba’s valuation discount to its American counterparts is essentially a quantified representation of the downside risks stemming from regulatory and geopolitical uncertainties facing the stock. With common prosperity now officially inked into the Communist Party’s charter and official ruling mandate, regulatory and geopolitical uncertainties facing Alibaba’s future – especially given its market leadership still while being a private entity – have only become ever more elevated, representing a substantial downside risk that its American equivalents do not have as much of an exposure to.

3. China Will Not Let the People’s Favorite Fail

Yes…and no.

To stem instability from the unravelling property sector, the PBOC has recently increased the roll-out of accommodative policy packages to shore up the country’s housing slump. Regulators have also “increased lending to developers so they can complete unfinished housing projects” as part of efforts to assuage mortgage boycotters. But these accommodative policies are likely not going to sustain now that President Xi has secured his third term in power. Beijing will likely revert back to its original mandate – a commitment to cracking down on over leverage within the real estate sector, which spells more economic pain ahead, though needed to be done to prevent a bigger collapse in the future.

The same goes for big tech companies in the private sector like Alibaba. On one hand, China’s sprawling regulatory overhaul over every corner of the private sector in recent years is needed to prevent inequitable growth within its economy – similar to antitrust regulations implemented across major economies to ensure fair competition and eradicate monopolies. But, on the other hand, the measures risk stymying even the good kind of growth that has long been beneficial to the development of China’s economy in past decades.

Leading up to the Communist Party congress over the past week, Chinese officials have repeatedly vowed that the sweeping regulatory crackdowns levied on the private sector are nearing an end, with a promise to ensure markets are kept stable against further valuation deterioration as part of efforts to shutter market qualms. Yet, Chinese equities faced continued volatility as investors saw little structural evidence of such promises being materialized, casting a shadow of uncertainty for the cohort’s valuation prospects.

But now, with President Xi’s third term double downing on common prosperity, and Alibaba still boasting a market leadership that has not yet been levelled out, the company could potentially face more severe regulatory changes and penalties over antitrust, and a more costly social responsibility burden. This continues to point to the fact that China will only not let the people’s favorite fail if and only if it is in the central government’s political interest – and unfortunately, Alibaba might not fit the bill.

Conclusion

While the last time around we had likened a bullish call on the Alibaba stock to a wild bet, today we see greater clarity on the company’s valuation prospects. President Xi’s third term in power, alongside a newly appointed close-knit Politburo Standing Committee that implies little questioning over anything the party’s leader says, has effectively turned the regulatory and geopolitical “uncertainties” observed over the past two years into now an “official objective” within China’s political mandate over the next five years. Although what lies ahead for Alibaba in the name of common prosperity is still a big question mark, one thing is for certain – the challenges will not end until Alibaba is stripped of its influence over the Chinese population (and their wealth, data, time, etc.).

Taking a step back, we do not think that China’s common prosperity mandate is a complete bust, as it does promote the growth of others looking to capitalize on the country’s growing economy when it does recover (perhaps, the eradication of COVID Zero would be a good start). But it is likely not something that Alibaba – and its big tech peers in the private sector – will benefit from. These companies come from a better place and position that now needs to be brought down and reined in to create growth opportunities that can pull others that were previously behind, up. And given Alibaba’s market leadership today in China’s e-commerce and cloud-computing segments, there is likely still more room to go in the downward valuation adjustment, and little room left for a structural valuation recovery within the foreseeable future.

Be the first to comment