Domagoj/iStock Editorial via Getty Images

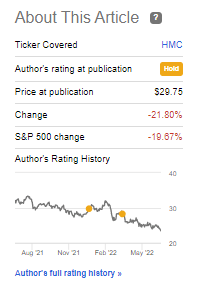

I’ve taken repeated looks at Honda (NYSE:HMC) for the past year, always confirming my “HOLD” stance on the company. Indeed, since I wrote my first piece on this automotive business, it’s hard to argue that this hasn’t been the correct stance to have. Performance in terms of share price has been awful, and the company has underperformed the S&P500 quite significantly.

Honda Performance (Seeking Alpha)

Obviously, there are plenty of different reasons for this development – but I do think that having bought this company at the original valuation at my article, close to $30/share, would have been a massive mistake.

Let’s look at where things stand today.

Honda – An update

The Honda Motor Company is a Japanese multinational conglomerate, active in the research, design, and manufacturing of automobiles, motorcycles, and power equipment. Aside from its appealing automotive business, it’s also the world’s largest motorcycle manufacturer, a position it has had since 1959 with an output of 400 million units by 2019. It also has other business units and divisions, such as airplanes, even private jets.

The company is also the largest engine manufacturer (ICE) in the world, with 14 million engines annually even though this has been dropping quite a bit – but the legacy of Honda is a great thing to behold. It was the first automotive brand to develop its own luxury brand, Acura, back in 1986. This is something that is relatively unique to non-EU markets. In Europe, what the major car companies do, is either keep their luxury models within their brands (such as the Phaeton) or tier sub-brands they’ve acquired according to cost level (such as VW’s tiering of Seat, Skoda, VW, Audi).

Honda still has almost 200,000 employees worldwide, and despite its terrible share price performance, this hasn’t in any way impacted the company’s credit safety, which stands at a A-.

Let me get this out of the way – Honda is actually starting to look interesting here.

Its corporate structure and sales/mix give Honda the business dynamics and cyclicality of an automotive business. That means that large parts of its trends line up with the global production of light automotive vehicles.

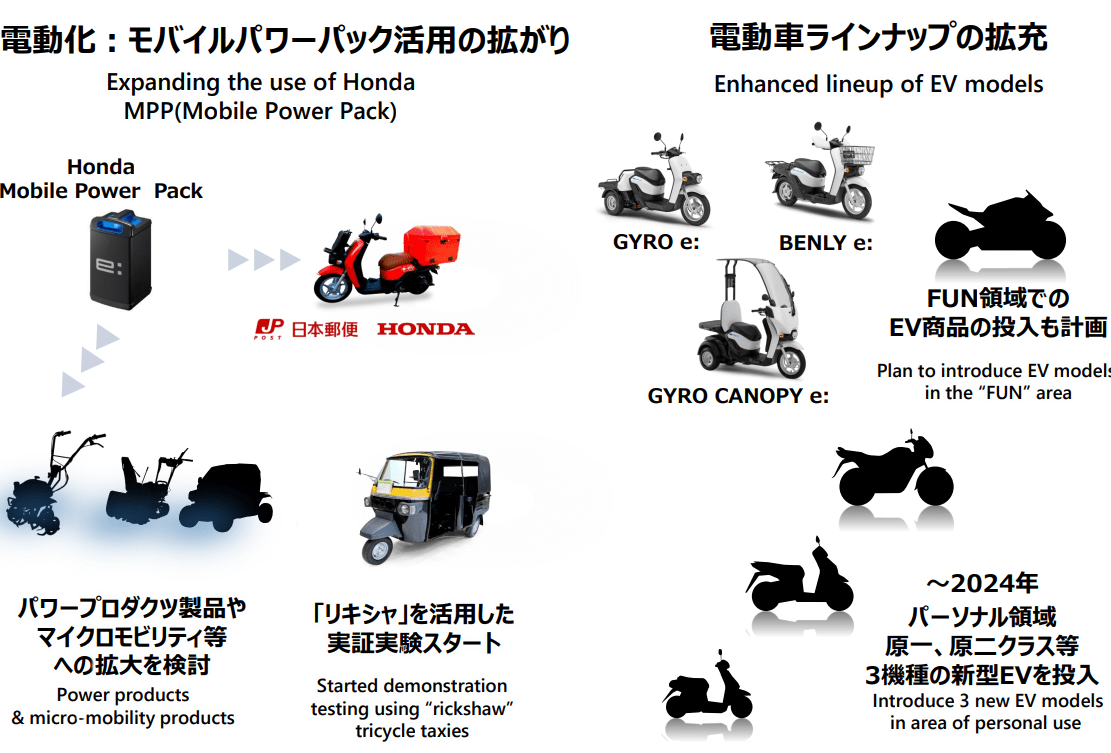

The company has strong electrification targets, including a full share of EV by 2040 in terms of EV/FCV sales ratios, which the company intends to reach through step-by-step increased sales and new models.

Honda is also the largest motorcycle manufacturer on earth, and this will be a significant sales driver for the company moving forward. As I mentioned in my first article, you may think of some things when you think of Honda, but what Honda is actually known for is this.

Honda Portfolio (Honda IR)

Not exactly my old Accord. Outside EU and NA, Motorcycles are a cheaper and often easier (due to road quality) mode of transportation, including in markets such as Vietnam, India, Indonesia, Thailand, Brazil, and so forth. These are the company’s main markets here, and I would call these products “scooters”.

It’s therefore unfortunate that Honda’s Europe sales are so small and at an all-time low. Honda’s market share in the European automotive market is less than 1%. In fact, in 2021, the company almost dipped below 101,000 units in sales. In the USA, these sales are much better, and the company had 8.7% of the market, and also has a large market share of the Asian market.

I spoke about how Honda hasn’t necessarily done all that well the last few years – even the last decade.

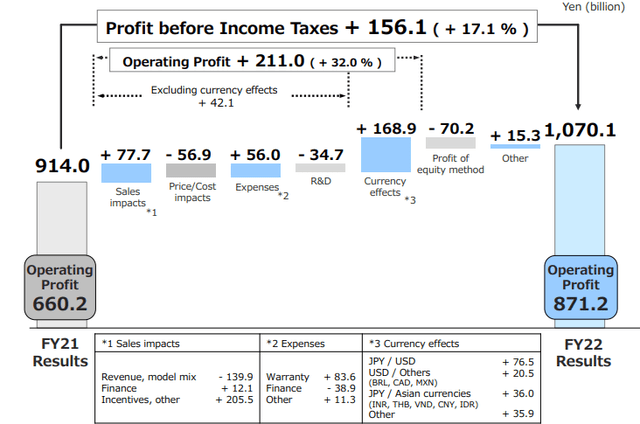

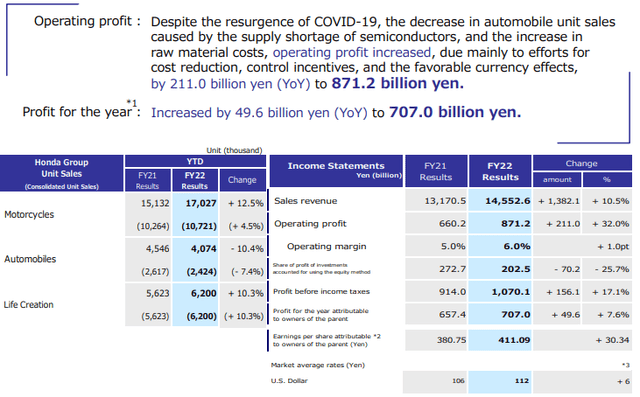

The company reported 2Q22 results, and these saw negative 4% sales declines in motorcycles, almost 27% sales decline in automotive, and growth only in the life creation segment.

This came to an operating profit decline of 30%, more than its YoY sales decline of nearly 7%, due to significant operating margin declines of nearly 2% for the full year. In essence, most relevant numbers, including pre-tax profits, dropped by around 30%.

But as the valuation moves down, and results stay consistent, this company gets more and more attractive from an upside perspective. Recent results are not bad per se. Honda experienced firm overall demand but headwinds continued due to overall semi-challenges.

Honda issued a 2023E profit forecast, and it included further uncertainty on supply and production with further cost increases. The company continues to try to improve its profitability. The main market results were down due to semiconductor impacts, despite high demands. Motorcycles, meanwhile, were negative for the year due to COVID in most main markets, but the recovery is ongoing, even if India’s recovery is expected to take time.

The company actually boosted its dividend slightly but forecasts a flat dividend for the year 2023.

Let’s see how this has impacted overall valuations for the company.

Honda – The valuation

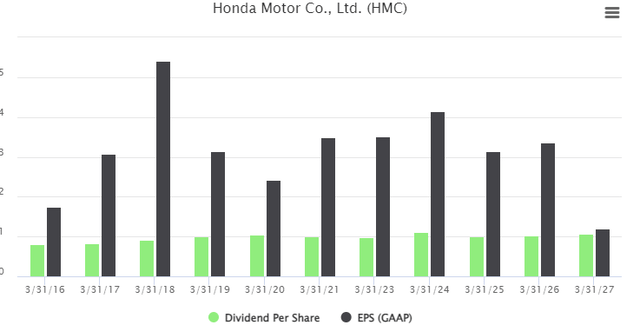

Given the number of headwinds that Honda faces and has faced, the company’s volatility in earnings is really no surprise. Despite a very strong MC market in Asia, the future visibility seems somewhat more opaque at this point, despite good trends and plans for EVs.

The company is absolutely stellar in terms of financing, and overall shares some of the fundamentals which make Japanese companies appealing to invest in – financially conservative approaches. In addition, it should be mentioned that Honda owns a minority stake of 5.7% in GM Cruise, an investment worth $1.14B at this point, and it seems likely to appreciate given current trends.

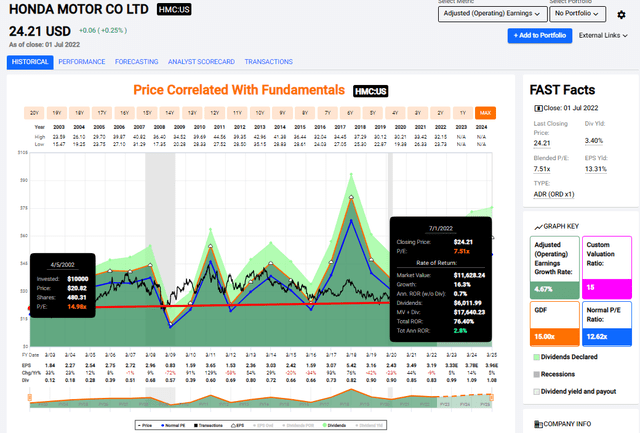

These serve as the positive backdrop for what I’m about to share with you. Honda is trading at an average P/E multiple of around 7.5X. While not as low as some automotive cyclical, this is extremely low for a 3-4% yielding, A-rated Japanese automotive business. It’s also, coincidentally, significantly below the company’s 5-year average of 9-10X P/E.

So, you have both a valuation and a yield upside – because the company is undervalued here from both perspectives.

It doesn’t change much in how poorly the company has performed on a 20-year RoR basis.

But note that this was from how the company performed from a close to 15X investment P/E multiple. What happens if we instead invest at 7.5X or a cheap multiple, as the valuation is today? From an 8.8X multiple back in ’03, the ROR is then more than double that number, at over 130% in close to 20 years. This is nothing amazing, but it’s certainly better than what we’re seeing here.

Based on the 2023E forecast and future expectations, I don’t expect any miracles out of Honda at this juncture either.

Speaking as someone who spends a lot of time looking at the current global supply/demand trends, shortages, inflation, and trade dynamics, I can say with what I feel like is a relatively high level of certainty, that shortages in the semiconductor business and uncertainty in terms of trade aren’t going to be clearing up or becoming less opaque anytime soon.

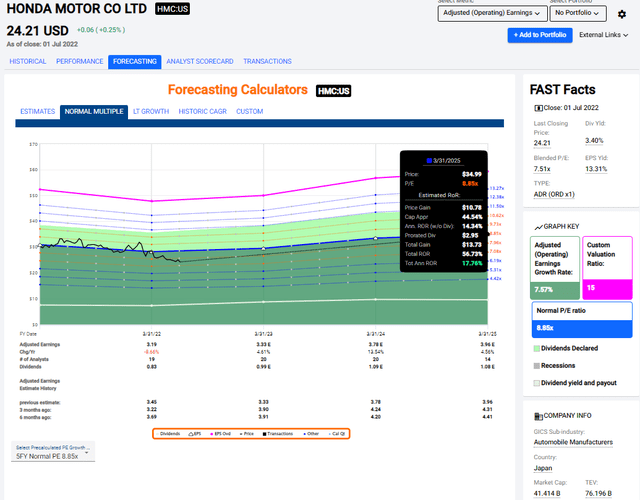

Honda typically warrants a significant discount to fair value, coming in at a 9X 5-year average price/earnings multiple. From this valuation, the company is currently undervalued. Forecasting the company at a 9X P/E forward multiple, we get annualized RoR of close to 18.5% here.

This is a vastly improved situation from what we saw 6 months ago. Is it good enough?

Maybe.

In this environment, I’m always hesitant to move from one stance to another – there’s a lot of uncertainty involved with it, especially as the markets are currently flailing wildly. However, analysts have shifted their targets downward accordingly, and the current average price target for HMC is now close to $31/share, with 3 out of 3 analysts at either a “BUY” or “outperform”.

In short, confidence is now high that from this point onward, the company will improve its results and returns. Analysts are forecasting improved results for the coming years, and for the dividend to remain impressively stable.

Honda Dividends/earnings (S&P Global/TIKR)

However, in the end, this company is one that has proven over time that it is almost chronically unable to deliver significant, consistent earnings growth. Without that, I have a hard time seeing how this company will trade at significantly higher multiples, or more importantly, deliver alpha to the current market performance.

I don’t see that Honda will deliver any sort of significant alpha over the next 1-2 years. It might revert, but that’s about it.

My PT before was $22-$23/share. That’s unchanged.

My stance on Honda remains. I’m at a “HOLD” here.

Thesis

My thesis for Honda remains a troubled one. I don’t view the company as able to offset some of the margin deterioration/cost increases/issues that are coming, because the company’s lack of vertical integration here means it’s (like most automotive) subject to broader market conditions.

This makes the company a poor investment at this time – and one I would avoid even at the current price of below $24/share.

If you’re interested in Honda, I would point to my price target of $22-$23/share at most, which would give you over 3% yield and a good reversion upside, even in the likely case of further EPS pressure. I don’t think you should buy any shares above $23/share.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment