DNY59

This article was prepared by Eranda Kalhara, CFA in collaboration with Dilantha De Silva.

At Leads From Gurus, we invested in Carnival Corporation & Plc (NYSE:CCL) in January 2021 and we soon exited our long position mid-last year when Carnival stock surged close to $30. Last May, we published an article highlighting why CCL stock could be an excellent long-term investment for contrarian investors at these depressed prices. With a lot going on in the global economy and many Wall Street analysts downgrading Carnival, we thought it’s important to validate our investment thesis for the company.

Nothing Seems To Be Going Right For Carnival

Carnival Corporation, the world’s leading leisure travel company, has been feeling the wrath of the pandemic for more than two years now. This is not the first time the company has found itself in a tough spot either – Carnival made headlines before the pandemic because of the Costa Concordia disaster in 2012 that killed 32 people and the Carnival Triumph debacle in 2013.

During the current pandemic, the leisure industry initially witnessed a complete halt in operations for around 12 months. Many companies in this sector went bankrupt or leveraged heavily and are now facing cash flow issues amid continuous struggles to revive growth. Almost all leisure-related stocks plummeted in the early days of the pandemic and Carnival stock was no exception. In fact, CCL stock fell by a greater percentage during the pandemic compared to its fall in the 2008/09 financial crisis and the dotcom bubble in 2001. Even though economic recessions have been no stranger to the company nor the leisure industry, a pandemic of this scale, in our opinion, could leave permanent scars.

Carnival stock was not helped by the recent downgrade by Morgan Stanley (MS) where analysts assigned a target price of $7 for the company and a bear-case target price of $0, implying Carnival could go bankrupt and out of business if operating conditions worsen from here. Morgan Stanley analysts are not alone. As illustrated below, the average price target on Wall Street for Carnival has continued to decline ever since the start of the pandemic.

Exhibit 1: CCL stock price vs the average price target on Wall Street

Source: Seeking Alpha

To question the validity of such an alarming projection, investors should first understand the business model of the company including its current financial position, and evaluate whether Carnival has what it takes to withstand the expected global economic slowdown and rising geopolitical tensions.

The Impact of Slowing Economic Growth and Geopolitical Tensions

The global leisure industry that was hammered by the pandemic has to deal with new challenges today. Increasing geopolitical tensions arising from the invasion of Ukraine have already impacted Carnival in many ways. The direct impact of this conflict can be seen through lost revenue as the management has decided to withdraw all activity in Russia which represents 4.6% of capacity for the remainder of the year. Major cruise lines including Carnival have adjusted their itineraries to avoid Russian ports and the Baltic region due to ongoing conflicts. Carnival expects the closed-end nature of the deployment change and its inability to find alternatives for the itineraries to disrupt booking patterns for some time, creating a challenge for the company to offer cruises to the most preferred destinations of some of its loyal customers. This should not be taken lightly as a loss of business today could go on to create long-term growth challenges for the company.

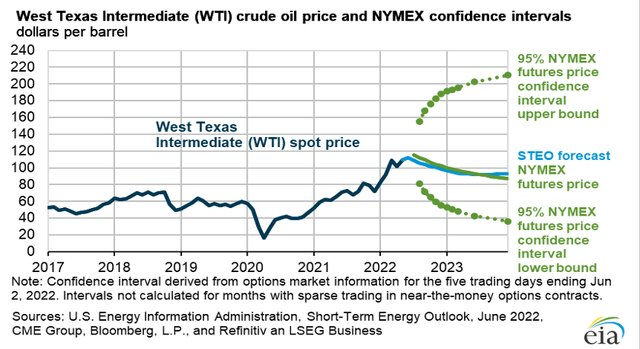

Low oil prices enjoyed by the cruise industry are no more either. The Russian war has been a key factor in the recent surge in oil prices as energy giants including Shell Plc (SHEL), BP plc (BP), and Exxon Mobil Corporation (XOM) have pulled out of Russian energy deals while the U.S. and most of its western allies have announced a ban on importing Russian oil and other petroleum products. Even though OPEC+ has agreed to increase production to boost supply, there is doubt over Saudi Arabia doing as little as possible to maintain its strong ties with both the U.S. and Russia. In addition, American oil producers are taking a slow approach to expand production as they do not want to see a supply increase leading to a sharp decline in oil prices.

Exhibit 2: EIA expectations for oil

Energy Information Administration

Source: Energy Information Administration

The expected recession stands to challenge the industry further as the disposable income of households will contract during a recession, thereby capping the demand for cruise travel. However, it should be noted that Carnival has been recession-resilient in the past. The question, however, is whether the company will be resilient to a recession while recovering from the pandemic. The company management expects a surge in demand driven by the strong labor market in the U.S. and the increased importance placed on travel by Millennials and Generation Z. For the full year 2023, Carnival’s cumulative advanced booking position continues to be at the higher end of the historical range despite higher prices (inclusive of future cruise credits) but we may experience a slowdown in bookings in the second half of this year. A closer look at the booking patterns might be required as the global economic slowdown intensifies to get a clear picture of the demand consistency.

We need to appreciate some of the recent decisions taken by the management to right-size the company including the transfer of the Luminosa in Australia to Carnival as a solution to the complicated European environment triggered by the pandemic and macroeconomic challenges. With the decision to focus on efficiency and not just scale, Carnival is now in a good position to focus on brands that exhibit stronger demand.

The Battle Between Price and Occupancy

The pandemic took a toll on the cruise industry, hurting Carnival’s operations and global bookings. The company’s occupancy and bookings for near-term sailings were negatively impacted by the Omicron variant during the first quarter of 2022 as well. The cruise and leisure industry must follow the guidelines of the CDC and respective health authorities in all regions they operate, which has led to pressure on the pricing front and has also deteriorated the customer experience. Amid these complex and changing regulations, in the last two years, negative consumer confidence was witnessed which led to friction in cross-border travel and itinerary planning. In addition, higher cancellations due to increased positive Covid test results combined with challenges in the availability of timely pre-travel tests added to the downside. However, we expect pre-travel tests and other pandemic-related regulations will be more relaxed during the second half of the year, provided that no severe Covid strains will emerge. Adding to the list of woes, the company believes the pandemic will cause a delay in ship deliveries as shipyards have been impacted, and this will have an impact on the strategized recovery plan and the phased resumption of cruises.

Despite occupancy failing to cross the 70% mark yet again in the fiscal second quarter of 2022, Carnival’s cumulative advanced booking position continues to be encouraging. The Carnival brand is expecting 110% occupancy in the third quarter. Despite the widespread offerings of Carnival, we believe the significant shared capacity among Norwegian Cruise Line Holdings (NCLH) and Royal Caribbean Cruises Ltd. (RCL) will force Carnival to be a price-taker in the short run. Hence, the company will have to face the challenge of balancing occupancy while preserving the prices in the long term.

We must appreciate the marketing efforts of the company as they have been able to see a significant improvement in first-timers. In addition, Carnival has been witnessing ticket price improvements for both its North American and EAA brands, with robust ticket price improvements in its core Caribbean deployment.

Overall, we believe Carnival is heading toward rough seas in the short run not only due to macroeconomic and geopolitical challenges but also because of the difficult decisions the company will be forced to make to strike a balance between occupancy and price in a way that maximizes its long-run earnings.

Not out of the water yet

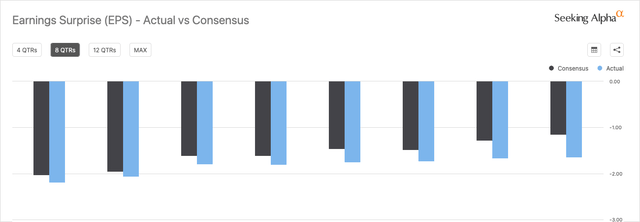

Carnival has witnessed losses during the last two years amid the pandemic and has also found it difficult to meet Wall Street estimates for earnings. At Leads From Gurus, we like to own companies that beat earnings estimates handsomely and Carnival’s recent performance on this front has been lackluster, to say the least.

Exhibit 3: Earnings surprise history (actual vs consensus)

Source: Seeking Alpha

We believe the historically witnessed cost advantages by large-scale cruise operators will no longer hold in the post-pandemic environment. Industry leaders including Carnival historically paid a high-20% level of net cruise costs on SG&A while small operators paid north of 50%. For this to hold, these industry leaders should continue to leverage on their scale. However, in the foreseeable future, we believe Carnival will not enjoy scale as only part of its fleet is in operation as the company executes a staggered return to the sailing of its fleet across its brand portfolio. As of March 22, 75% of Carnival’s capacity was already deployed and the entire fleet was expected to sail by the important summer season but we remain skeptical of Carnival maintaining these deployment levels because of the macro-level challenges the industry is facing. We are yet to see revenue trends and the effectiveness of the cost allocation strategy in the post-pandemic scenario, which is needed to get a better idea of Carnival’s efficiency in this new normal.

Carnival is burning through its cash pile at a rate of around $700 million per month, and we do not believe a swift recovery from this situation is in the cards. The company expects to refinance $3 billion of 2023 maturities in which $1 billion of debt capital was raised at 10.5%. With the Fed on the path to raising rates yet again on the back of record-breaking rate hikes delivered in the last couple of months, we do not believe refinancing will necessarily improve the company’s long-term financial position although we understand the company needs to do whatever it takes to keep its nose above the water in the short run.

In the second half of the year, Carnival expects to generate a higher EBITDA as the fleet’s dry dock schedule returns to historical levels. The adjusted cruise cost without fuel per available lower berth day for the second quarter of 2022 was up 23% versus the second quarter of 2019 due to paused operations and an increased number of dry docks. In addition, Carnival reduced its capacity by disposing of 19 underperforming ships during the pandemic and the company has announced the removal of another three smaller ships from its fleet in 2022.

The company expects 50% of its fleet to comprise of new, more efficient ships with a focus on the LNG propulsion system. The proposed fleet optimization initiative coupled with technology upgrades and continuous R&D investments is likely to help the operating margin profile of the company in the long run given that Carnival navigates short-term troubles successfully. We are looking at a 4% reduction in ship-level unit costs in the future but these expected efficiencies will have no impact on Carnival’s financial position today.

We are, however, not at a stage where we can bet on Carnival stock purely based on these expected efficiency gains as survival itself is becoming a challenging task for the company.

The Thesis Depends on Carnival’s Survival

In our base-case scenario, we believe Carnival will survive short-term challenges and eventually become profitable in fiscal 2023. However, Carnival will have to take bold decisions to remain afloat, including raising funds and refinancing debt. This implies that things will likely get worse before they get better. Even with a long-term perspective, investing in Carnival should be considered by risk-seeking investors who are looking for more bang for the buck at elevated risk levels.

Takeaway

Although we believe Carnival will fight to live another day and eventually benefit from its scale in the next growth phase of the global economy, we believe Morgan Stanley analysts are on point to assign CCL stock a $0 target price in the worst-case scenario. Carnival stock does not currently fit into what we are looking for at Leads From Gurus, but because we are bullish on the company’s long-term prospects, we will keep a close eye on the company and publish another update once Carnival reports fiscal third-quarter earnings.

Be the first to comment