Dilok Klaisataporn/iStock via Getty Images

Bacterial Contamination

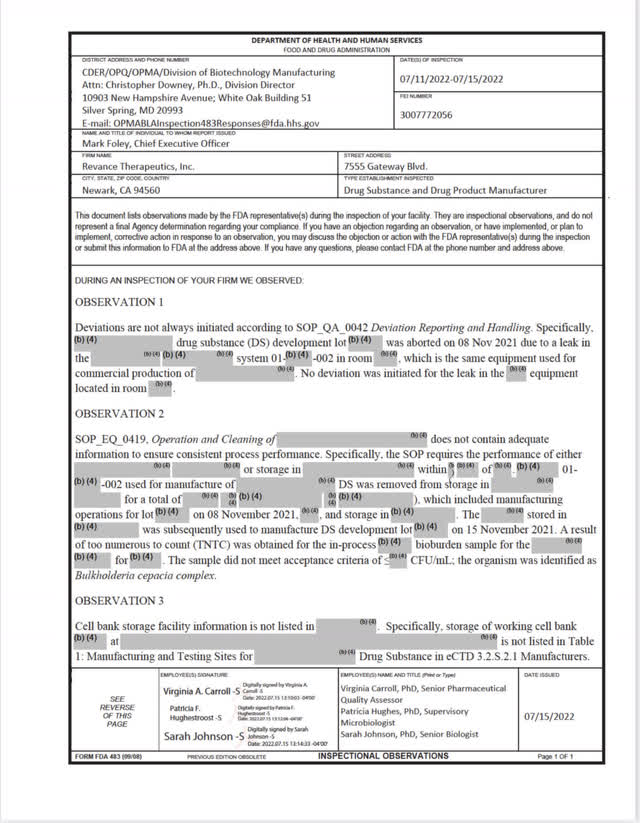

Even though Revance Therapeutics (NASDAQ:RVNC) tried being transparent about its manufacturing issues in their Q2 Earnings Release, the company paraphrased FDA Observation 2 and investors may not get the full picture of the FDA findings. Importantly, the FDA noted at the end of the Observation that “too numerous to count” Burkholderia cepacia complex was found during in-process bioburden testing.

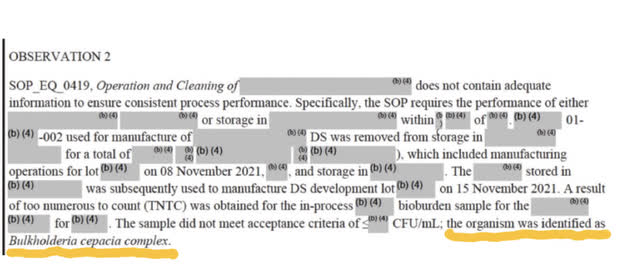

RVNC version:

RVNC Press Release

FDA Version:

FDA

Burkholderia cepacia complex has been responsible for a number of product recalls, and the FDA issued a warning last year to manufacturers about contamination risk. Even though this warning was issued to non-sterile manufacturers, in the case of RVNC, the bug found its way into the sterile manufacturing process.

RVNC paraphrased this observation to summarize that the “development lot failed to follow the existing SOP.” In my opinion, the issue with this observation is the first part of the FDA statement. The FDA noted at the top of Observation 2 that the RVNC Standard Operating Procedure “does not contain enough information, to ensure consistent process.” This means 1) RVNC has to rewrite the SOP and 2) potentially show more information to the FDA to ensure that their process can be reproduced consistently to avoid bacterial contamination. Since actual bacterial contamination was found during the process, this SOP is clearly important and not a “throw away.”

Development Lots

While it’s true that Observations 1 and 2 referred to development lots, the issues raised affect commercial production as well:

In Observation 1, the FDA points out that it was Commercial equipment that sprang a big enough leak that the lot had to be aborted, and “no deviation was initiated,” which means an investigation into what caused the commercial equipment to malfunction wasn’t undertaken. Naturally, this equipment needs to function correctly after approval.

In Observation 2, the bacterial contamination was due to a sterility SOP being deficient; the same SOP is used in the production of commercial product. Therefore, it will have to be modified as discussed above.

Inspection Close-Out

While these observations are addressable, I believe there is risk whether it can be done in time for the September 8 PDUFA. It can take several weeks for the FDA to close out an inspection, even when the issues are self-limiting, such as Observation 3. However, if the FDA needs to review additional data and documents, the process can take more time.

When an inspection is closed out, the FDA compiles an Establishment Inspection Report (EIR); it is sent to the manufacturer and quickly becomes public record. In this case the EIR is not available yet. There is a chance that we are in the window between the company receiving it and the document becoming public record, but it could also mean that the FDA hasn’t closed out the inspection yet.

Conclusion

In 2018, ADMA received a CRL on their Bivigam PAS in a similiar situation, where the FDA had questions about red-lined versions of SOPs and Development Lots made NOT on commercial equipment.

I think the risk of RVNC receiving a CRL is greater than investors think, because of the tight timeframe between the FDA inspection and the PDUFA. The FDA decision in this case will be somewhat subjective and they are certainly able to give the company the benefit of the doubt and approve without reviewing any data. On the other hand, finding Burkholderia cepacia complex in a sterile process for a cosmetic product may cause the FDA to dot all the i’s.

Since the issues in this 483 are straightforward to address, the only question is whether RVNC receives approval this year or next. If they receive a CRL, I believe the stock will trade down to the $16-17 level because it will be dead money for the rest of the year. If they are approved, stock should be around $25 and investors will focus on commercial execution.

Full Form 483:

FDA

Be the first to comment