THEPALMER/E+ via Getty Images

Because of rising interest rates, inflationary pressures, and weakening consumer sentiment, pretty much any company tied to manufacturing of sorts is being faced with margin compression. But even though this is the case, it doesn’t mean that the company in question does not warrant further upside. One example of this can be seen by looking at REV Group (NYSE:REVG), a producer and seller of specialty vehicles such as ambulances, rescue vehicles, pumpers, lifts, and more. So far this year, sales data provided by the company has been rather mixed and both profits and cash flows have declined. But even so, the stock is trading at a cheap enough level that it has prevented shares from falling materially. Add on top of this the significant amount of backlog on the company’s books, and I do believe that it still warrants a solid ‘buy’ rating at this time.

An interesting ride

Back in late March of this year, I wrote an article that took a bullish stance on REV Group. In that article, I talked about how well the company had performed against the broader market over the prior few months. This came even at a time when the financial performance of the enterprise was showing some signs of weakening. But strong guidance, combined with how cheap shares were, had helped to propel the company higher on a relative basis, and ultimately it led me to keep the ‘buy’ rating I had on the stock prior to that point. Since then, the company has continued to outperform the broader market. While the S&P 500 is down 13.4%, shares of REV Group have seen downside of just 4.8%.

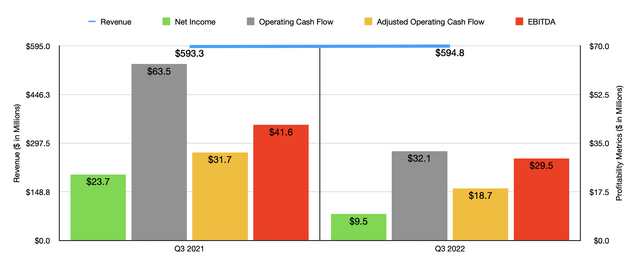

In order to understand where the company stands right now, I do think it’s necessary to touch on its most recent financial performance. This includes the third quarter of the company’s 2022 fiscal year. During that time, sales came in at $594.8 million. That’s marginally higher than the $593.3 million the company reported only one year earlier. This modest increase, management said, was driven largely by an increase in sales within the Recreation segment of the firm. Other parts of the company, by comparison, showed some signs of weakening. Apparently, the improvement in the recreation side of things was because of higher pricing and a favorable product mix. Though it should be said that lower line rates and decreased unit shipments caused by supply chain disruptions and labor constraints proved to be problematic for the enterprise.

Although revenue did increase year over year, profits for the company took a hit, with net income dropping from $23.7 million to $9.5 million. The main culprit here involved a reduction in the company’s gross profit margin from 12.9% to 11.4%, with the aforementioned supply chain disruptions and labor constraints affecting the company. Inflationary pressures were also an issue according to the firm. Naturally, price increases and a favorable product mix did help to offset this some, but it was unable to offset it entirely. Other profitability metrics unfortunately followed suit. Operating cash flow, for instance, dropped from $63.5 million to $32.1 million. But if we adjust for changes in working capital, it would have fallen from $31.7 million to $18.7 million. And over that same window of time, EBITDA also took a hit, dropping from $41.6 million to $29.5 million.

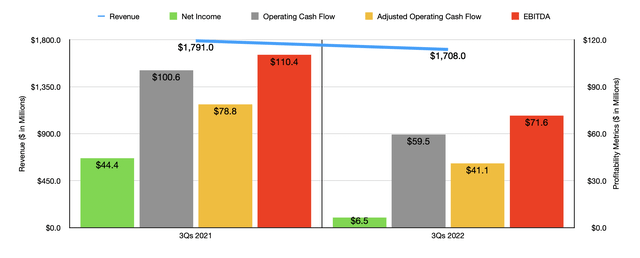

As you can see in the chart above, there are a lot of similarities between the third quarter of this year and the first nine months of the year as a whole. The one big exception would be revenue, which dropped from $1.79 billion last year to $1.71 billion this year. Although the Commercial and Recreation segments for the company performed well, the F&E segment reported a meaningful decline in sales because of decreased unit shipments of fire apparatus and ambulance units that, in turn, was caused by supply chain disruptions and labor constraints. Naturally, profitability followed suit, with net income plunging from $44.4 million to $6.5 million. Operating cash flow nearly halved from $100.6 million to $59.5 million. On an adjusted basis, it dropped from $78.8 million to $41.1 million, while EBITDA text down from $110.4 million to $71.6 million.

For the 2022 fiscal year and its entirety, management has lowered expectations some. Revenue should now come in at between $2.25 billion and $2.35 billion. The only revision there was a $50 million reduction on the top end of the scale. Net income should also be weaker, ranging between $14 million and $25 million. Previously, the higher end of that range was $35 million. A similar $10 million reduction should be seen when it comes to EBITDA, with an expectation of between $100 million and $110 million for the year. No guidance was given when it came to other profitability metrics. But if we assume that adjusted operating cash flow would decline at the same rate that EBITDA should, we should end up with a reading of $72.8 million for the year. It’s also worth mentioning that while sales guidance is weaker, backlog for the company has exploded higher over the past year. As of the end of the latest quarter, backlog totaled $3.94 billion. That compares to the roughly $2.70 billion the company reported for the third quarter of 2021.

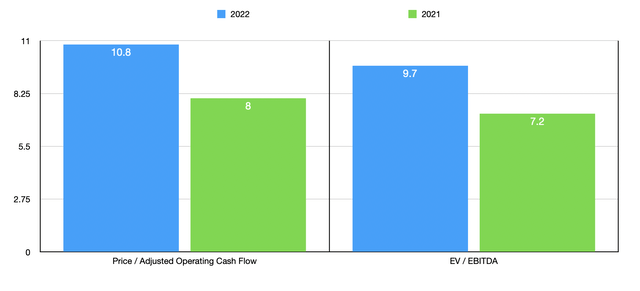

Based on these figures, the company is trading at a forward price to adjusted operating cash flow multiple of 10.8 and at a forward EV to EBITDA multiple of 9.7. By comparison, using the data from 2021, these multiples would be 8 and 7.2, respectively. As part of my analysis, I compared the company to five similar businesses. On a price to operating cash flow basis, these companies ranged from a low of 21.9 to a high of 154. In this case, REV Group was the cheapest of the group. Meanwhile, using the EV to EBITDA approach, the range was from 6.3 to 42.2. In this case, two of the five companies were cheaper than our target.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| REV Group | 10.8 | 9.7 |

| The Shyft Group (SHYF) | 21.9 | 16.6 |

| Douglas Dynamics (PLOW) | 154.0 | 15.1 |

| Astec Industries (ASTE) | 132.6 | 42.2 |

| Manitowoc (MTW) | 44.1 | 6.3 |

| Terex (TEX) | 42.1 | 8.5 |

Takeaway

With what data we have at our disposal today, I must say that I understand why some investors would be concerned about the near term. Margin compression is not fun and sales data has been rather mixed. More likely than not, these will continue to be issues for at least a few additional quarters. At the end of the day though, shares do look cheap and the company has a solid history of growth prior to the pandemic. Absent a material change in backlog moving forward, I do think that shareholders should experience returns that beat the broader market moving forward. And because of that, I have decided to keep the ‘buy’ rating I have on the company for now.

Be the first to comment