MicroStockHub

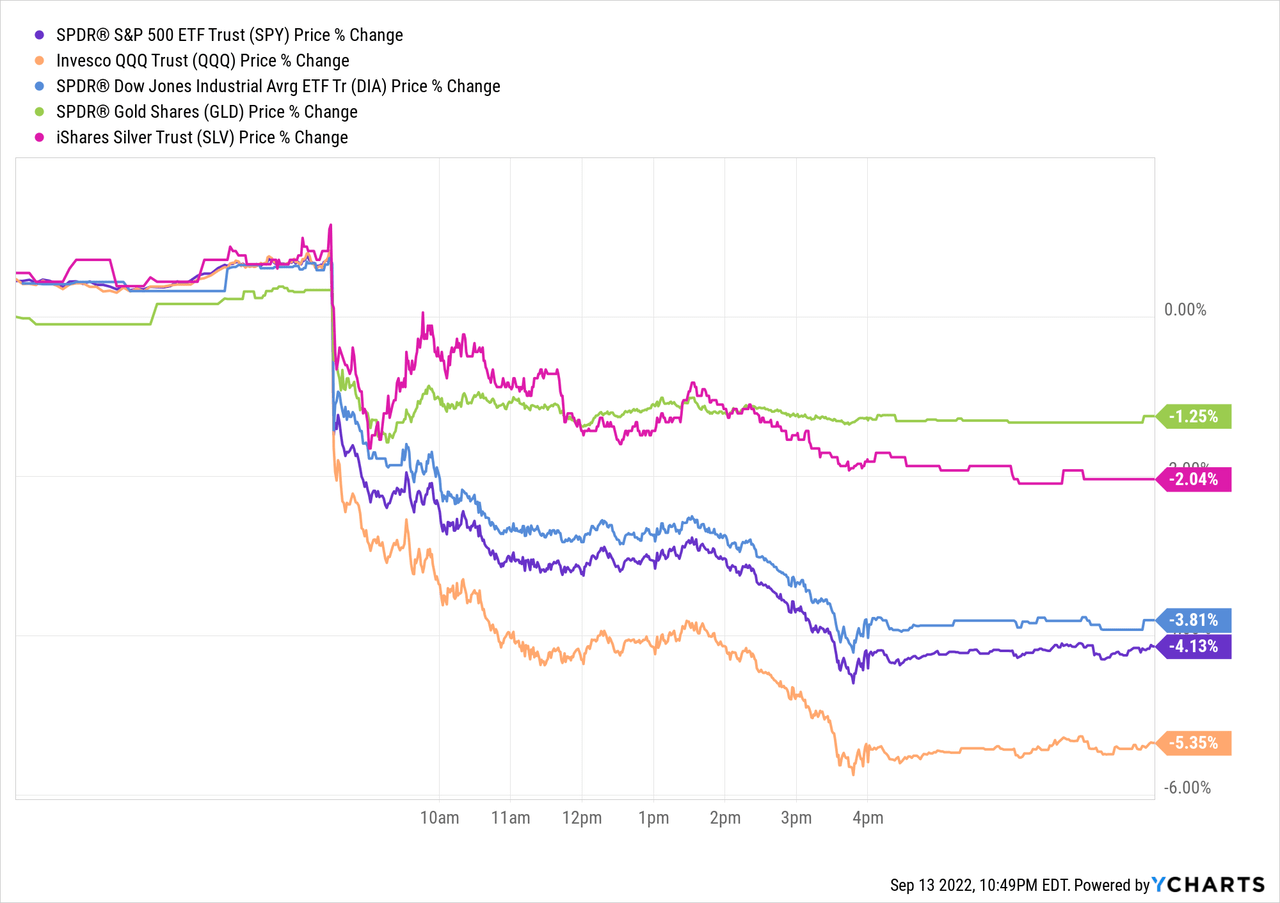

Today the stock market got hammered in response to the latest CPI data, with major indexes (SPY) (QQQ) (DIA) down along with gold (GLD) and silver (SLV):

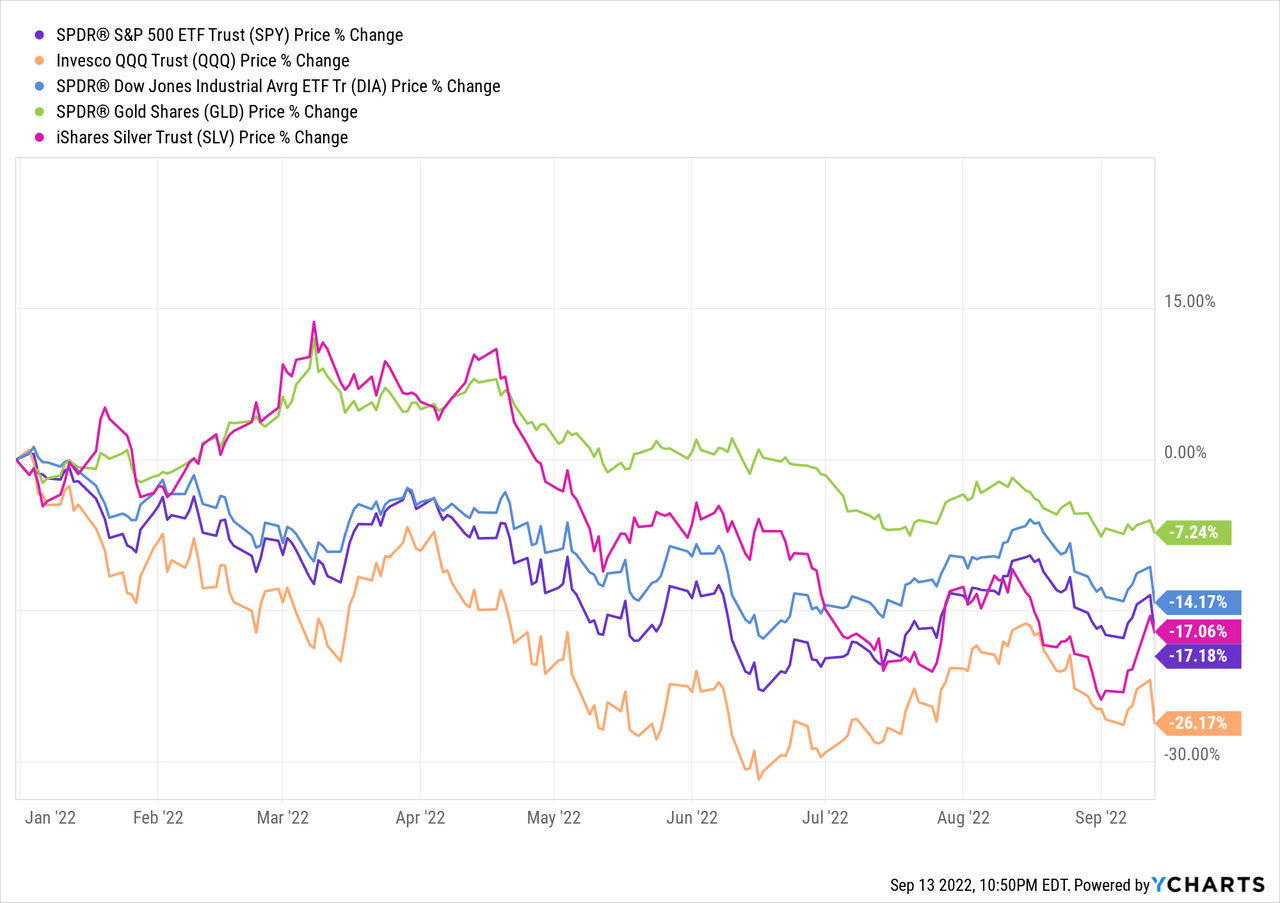

This continues what has been a bearish year overall for the markets:

While some investors are heading for the hills in a panic, the reality is that for long-term investors who are focused on building a passive income stream rather than short-term volatility, this is an excellent buying opportunity. Sure, there could be (or might not be) further losses for the stock market in the near future. However, now is a great opportunity to bolster your passive income stream to retire earlier because as stock prices fall, dividend yields move higher. As a result, investors can buy equity in high quality income investments at meaningfully higher yields than they would be able to otherwise. In this article, we share three attractively priced high yield SWANS.

#1. Blackstone (BX)

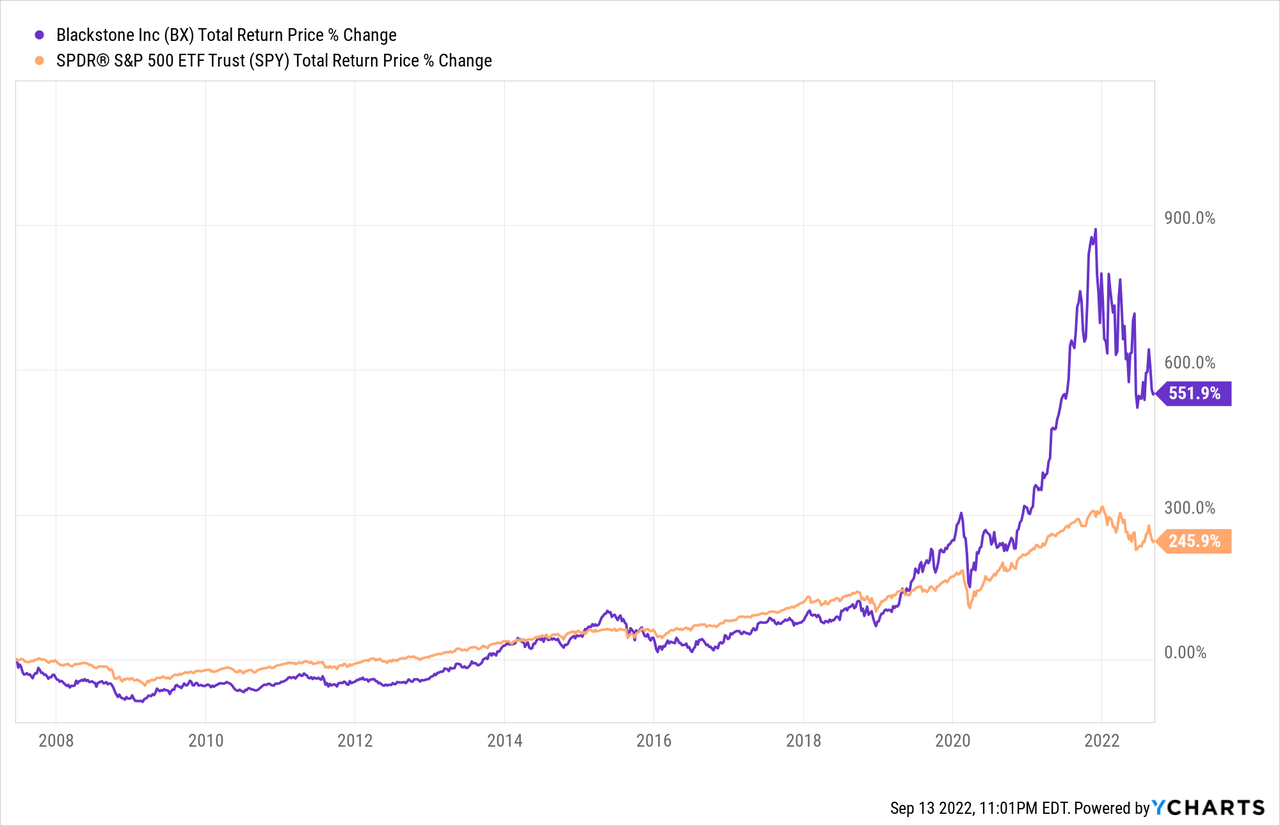

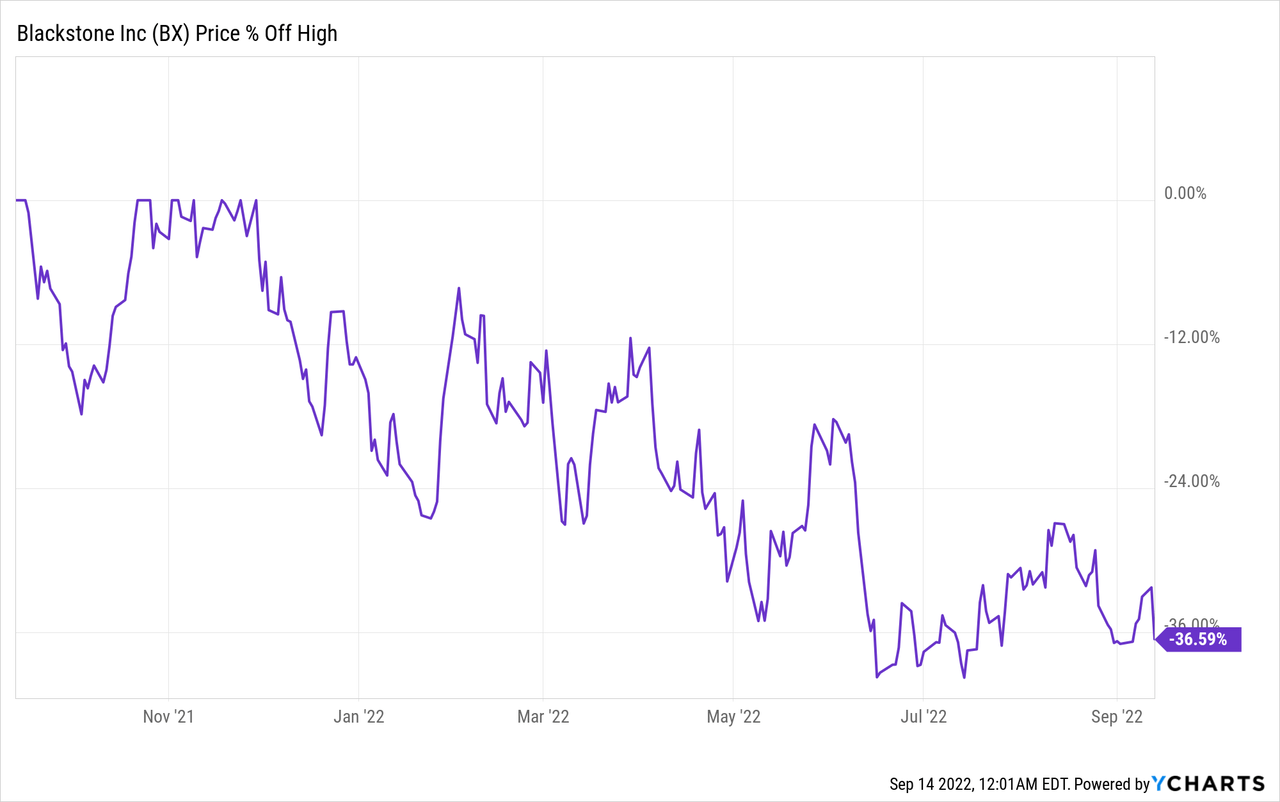

Blackstone plunged 6.4% today in response to the CPI data and is now down by 25.48% year-to-date. As a result of this vicious pullback in the share price, its trailing twelve month dividend yield is now north of 5%, which implies that it is quite attractively priced considering that it has generated very impressive growth over time on top of its generous dividend policy.

While it does pay out dividends according to an 85% distributable earnings payout ratio rule – and distributable earnings are expected to decline during a recession due to declining realized incentive fees in its managed funds – 52% of its fee-earnings assets under management are permanent capital and it generates a high percentage of its distributable earnings from base management fees. As a result, it should be able to continue paying out a solid dividend yield even during an economic downturn.

On top of that, it has nearly $1 trillion in assets under management, giving it the number one ranking among alternative asset managers and with it considerable competitive advantages. These include business network and deal flow, name brand, and economic/industry data that enable it to invest in more attractive deals with greater understanding of the risks and catalysts involved. As a result, BX is able to generate alpha for its clients, driving stronger fundraising for the business and performance incentive fees for shareholders.

Given the major global infrastructure deficit and BX’s A+ credit rating, it is well positioned to continue thriving during an economic downturn and will likely be able to make many investments on very attractive terms, leading to continued long-term outperformance for clients and shareholders alike. As far as the quality of management goes, one need merely look at the following chart:

With the stock down ~37% from its recent highs seen in late 2021, now is not a bad time to initiate a long-term position in this proven income and wealth creation machine.

#2. Enterprise Products Partners (EPD)

While BX is a more exciting and cyclical dividend powerhouse, EPD is a slow-and-steady, defensive distribution growth machine. Between its BBB+ credit rating, two decade long weighted average term to debt maturity, and heavy insider alignment (about one-third of the partnership is owned by insiders), investors can sleep well at night knowing their investment is in good hands.

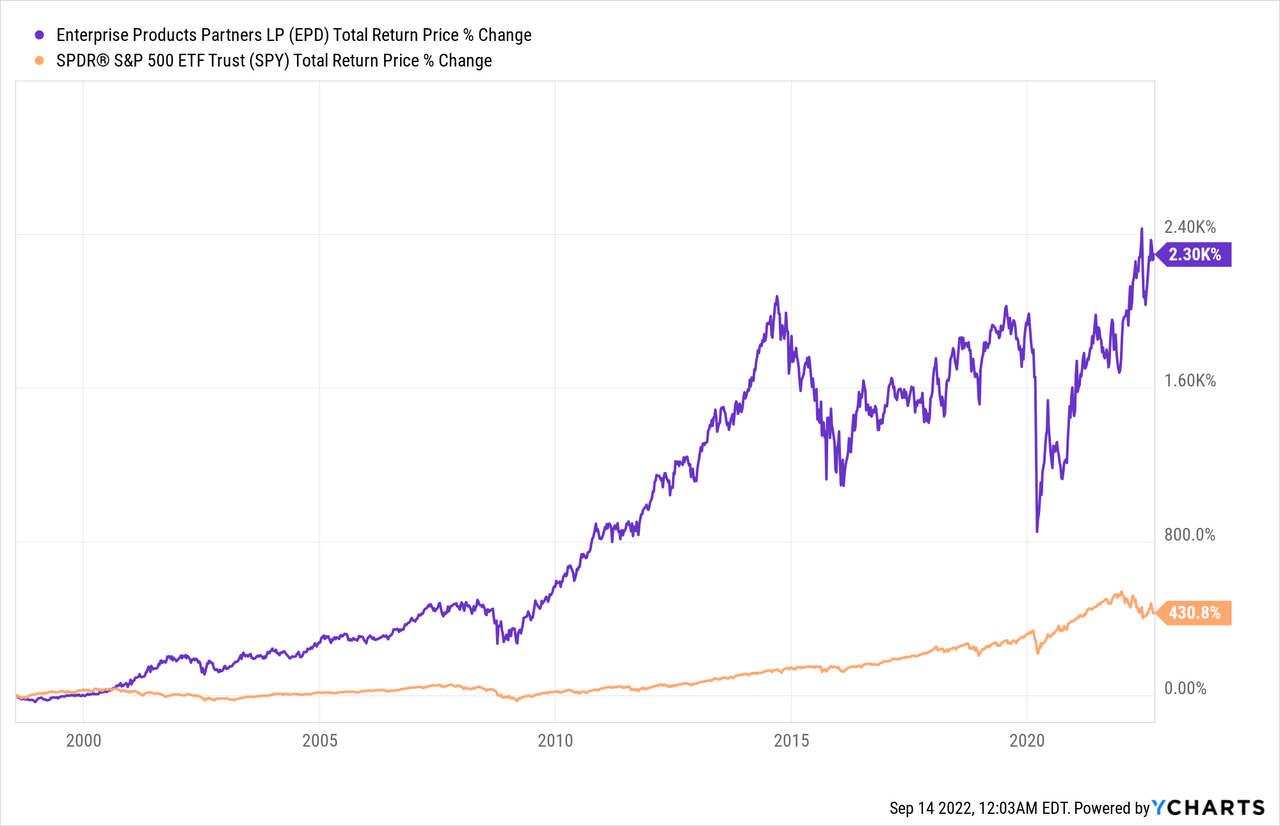

Over the long-term, EPD has crushed the SPY and the broader midstream sector (AMLP):

while also generating very consistent distribution growth (24 year distribution growth streak). Moving forward, EPD is poised to continue delivering distribution growth as its leverage ratio is at a very conservative level (3.1x, which is below the low end of its conservative long-term target range of 3.25x-3.75x), its distribution coverage ratio is 1.83x, and the partnership is pursuing several high return growth projects.

Given that EPD’s cash flows have proven to be quite resistant to energy commodity price and macroeconomic swings and are mostly indexed to inflation, it is a great place to invest when the market is facing severe headwinds. The valuation is also very attractive, trading at a steep discount to its five year averages on an EV/EBITDA, P/DCF, and distribution yield basis. Between the 7.2% current yield, mid-single digit annualized DCF per unit CAGR outlook we have over the next several years, and the potential for valuation multiple expansion, EPD should generate extremely attractive risk-adjusted returns for investors at current prices.

#3. Barrick Gold (GOLD)

GOLD – with its pristine balance sheet, portfolio of world class assets, and substantial free cash flow – is an excellent blue chip investment into gold and copper on a value basis. On top of that, you paid a 5.1% dividend yield while you wait for the long-term thesis to play out.

GOLD is currently primarily a gold miner, but its copper production is increasing rapidly. In Q2, its copper production soared by 25% year-over-year to 120 million pounds, helping to drive earnings per share higher by 17.4%. Moving forward, GOLD expects copper production to continue to ramp until it becomes a much larger percentage of the company’s total revenues. For example, it is currently investing in bringing the massive 40+ year production life Reko Diq Project online later this decade with a projected 31 billion pounds of copper and 25 million ounces of gold.

GOLD looks dirt cheap here thanks to the combination of its attractive dividend yield, long-term attractive growth profile (particularly fueled by it rapidly growing copper exposure), and suppressed share price. Given gold’s unique features and illustrious history as a store of value in the face of inflation, recessions, and geopolitical turmoil and copper’s very bullish long-term outlook, now appears to be a great time to add shares of GOLD.

Investor Takeaway

With inflation continuing to rage out of control, the Federal Reserve intent on continuing to raise interest rates aggressively, and recession warnings flashing left and right, these are scary times for investors who are focused on the scoreboard.

While it is never fun to see our portfolio filled with red and the market value of our securities declining sharply, it is simply part of investing in the stock market. Instead of fretting about short-term performance, we keep our focus on the passive income that our portfolio is generating in the short-term as well as a five-year time horizon for total return generation.

With this mindset, we are able to sleep soundly at night, stay calm during the day, think rationally, take advantage of bargains that the market indiscriminately throws at us, and ultimately build our passive income stream. Over the long-term, we look forward to the outperformance that will be generated by our investments made today that we purchased from others who are panic selling. As Warren Buffett once said:

Games are won by players who focus on the field, not the ones looking at the scoreboard.

Instead of focusing on the stock prices being thrown at us each day, let’s keep our focus on the true intrinsic value that our businesses are compounding for us. With BX, EPD, and GOLD, investors can buy rock-solid businesses with attractive long-term prospects on a value basis and collect very attractive income yields while they wait for capital appreciation to materialize.

Be the first to comment