MasaoTaira/iStock via Getty Images

Retail Opportunity Investments Corp (NASDAQ:ROIC) is a real estate investment trust (“REIT”) whose operations are geographically concentrated on the West Coast of the United States. Their properties are principally necessity-based community and neighborhood shopping centers, anchored by supermarkets and drugstores.

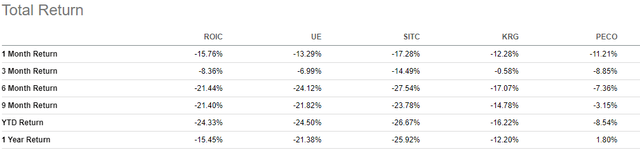

The company has a current market cap of approximately +$2.0B, which is comparable to other retail-related REITS within the sector, such as Urban Edge Properties (UE), SITE Centers Corp. (SITC), and Phillips Edison & Company, Inc (PECO), to name a few.

Over the past year, ROIC has fared better than their peers, though they are still down 15% on the year and about 25% YTD.

Seeking Alpha – Total Returns Of ROIC Compared To Competitors

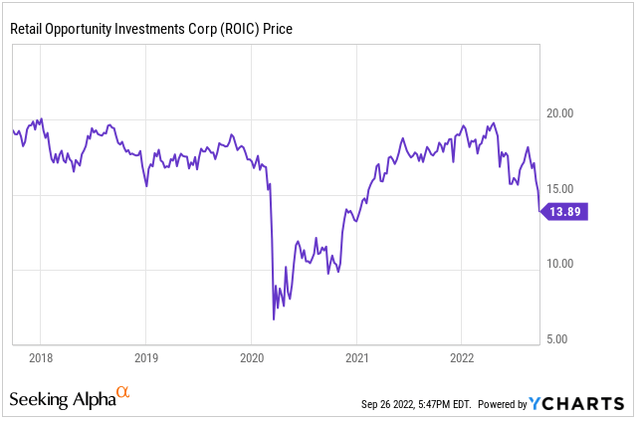

Presently, like many other names, shares are trading at new 52-week lows. While shares have recovered much of their losses incurred in 2020, they still trade at a discount to their pre-pandemic trading levels, at 13x forward funds from operations (“FFO”) versus 16x at the end of 2019. This is despite occupancy levels that are essentially on par with the 2019 benchmark.

YCharts – ROIC Share Price History

Compared to their peers, ROIC does trade at a premium. While their quality portfolio and strong operating presence in a high-barrier-to-entry market may warrant a higher valuation, it may not be compelling enough to court prospective investors seeking to deploy limited capital in an environment with elevated buying opportunities.

A slowing environment for external growth combined with limited organic opportunities may also weigh on future earnings potential. While the stock is a quality hold for existing shareholders, new investors may find it best to hold off on directing new capital into the stock until the release of their next earnings report.

ROIC Has A Portfolio Concentrated Exclusively On The West Coast

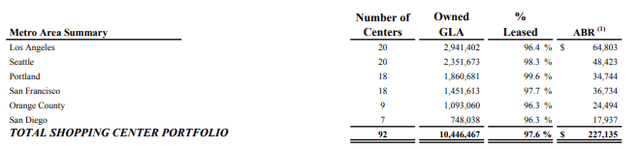

ROIC’s portfolio is comprised of 92 shopping centers exclusively located on the West Coast of the U.S. About 60% of this portfolio is concentrated within four major regions of California, with the remainder located in Seattle, Washington and Portland, Oregon.

Q2FY22 Investor Supplement – Portfolio Concentration By Geographic Segment

A solidified operating presence along the West Coast region provides the company with several competitive advantages, one of which is the barriers to entry in the market, which limits the competition pool. Even when there are new entrants, greater scarcity of supply and complicated regulations constrain their ability to encroach on ROIC’s market share.

Navigation through these difficult-to-enter markets is facilitated by a management team with over 25 years of experience working in the market. This provides an extensive network of relationships with key stakeholders involved in daily business activities.

ROIC’s markets are also characterized by their favorable demographics, which includes densely populated communities with above-average household incomes. This limits volatility through changing business cycles and provides further durability to their tenants’ cash flows, which, as it is, are already inherently protected due to the essential nature of their goods and services.

A Focus On The Essentials

As experienced throughout the COVID-19 pandemic, supermarkets and value retailers providing basic goods and services are always in demand and the least likely to shut down for reasons beyond their control.

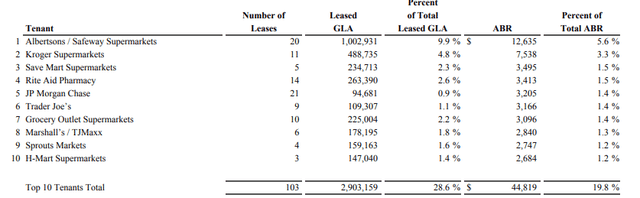

Among their top ten tenants are some of the most stable, necessity-based drug/grocery stores and retailers, including Albertsons (ACI), Kroger (KR), and The TJX Companies (TJX), to name a few. Collectively, their overall top ten accounts for less than 20% of annualized base rents (“ABR”), with ACI the only single tenant representing over 5% of total ABR on its own.

Q2FY22 Investor Supplement – Summary Of Top 10 Tenants

Compared to their peer set, ROIC’s exposure to grocery and/or drug stores is among the highest in the sector, with 97% of their portfolio anchored by one or the other. This level of exposure compensates for the overall size of their portfolio, which lacks scale and geographic diversification outside of the West Coast region.

A Likely Slowdown In Growth Opportunities

Expansion outside of the core operating markets is unlikely. As such, future earnings growth will be dependent upon either organic growth through ongoing leasing and redevelopment activities or additional acquisitions in their current markets. The latter may prove more challenging due to the uncertainties in the current market environment, which is resulting in longer negotiations amid wider bid/ask spreads.

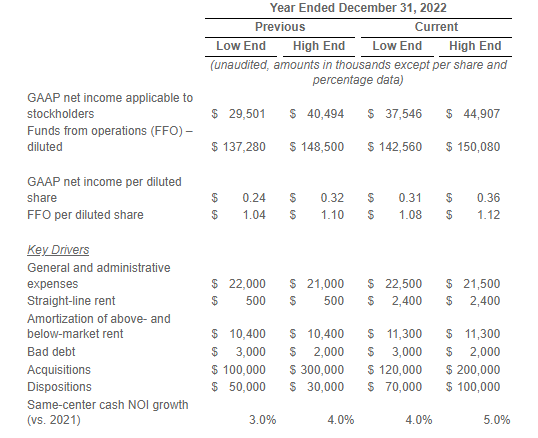

If there is in fact a slowdown in the acquisition environment, ROIC would most likely end the year having completed +$120M in total acquisitions and +$70M in dispositions. This would be on the low end of their target range and would correlate with an annual FFO of $1.08/per diluted share, as reflected on management’s revised guidance range.

If the environment remains robust, on the other hand, ROIC could potentially acquire an additional +$80M of properties. This would drive FFO closer to $1.12/share, which is on the high end of their targeted range. Given additional uncertainties since their release, however, it’s more likely the company will come in on the low end of the spectrum.

Q2FY22 Earnings Release – 2022 Full-Year Guidance

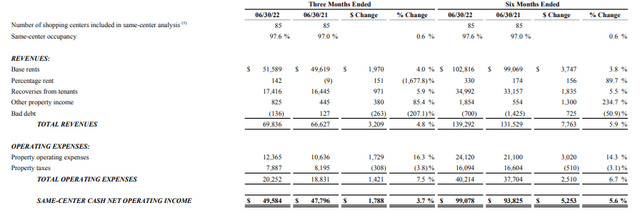

Organically, the portfolio appears to be at a peak, with same-center occupancy now at nearly 98%, which is on par with their record high lease rate achieved prior to the start of the pandemic. Barring external growth, this leaves very little upside in improving upon record occupancy levels.

Q2FY22 Investor Supplement – Same-Center Cash NOI Summary

Additionally, during the most recent quarter ended June 30, 2022, the company leased more space than what was originally set to expire. In total, they leased nearly 300k square feet (“SF”) of space during the quarter and 700k SF through H1, which was more than their previous record last set in 2019.

Furthermore, much of the activity centered on tenant renewals, with many tenants coming to the company earlier than their initially scheduled expiration date. And, moreover, these tenants, in particular the shops, sought terms as high as ten years, which seems odd since their shop tenants have historically signed shorter-term leases with five-year terms on average. One reason may be due to the poor outlook on available supply in the region.

At any rate, ROIC has capitalized on this heightened level of demand by achieving spreads of 10.5% on renewals, which is higher than their historical average. Looking ahead, however, it wouldn’t be unreasonable to forecast a slowdown in rental rate growth. While peak occupancy levels are likely to keep rents higher than historical averages, double-digit spreads are likely to become increasingly harder to come by in subsequent periods.

More Levered Than Peers But Still Financially Sound

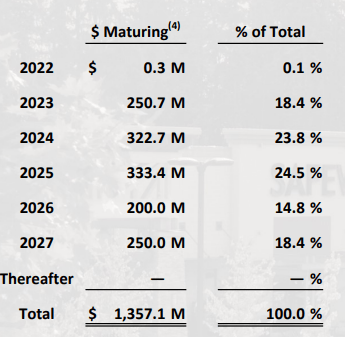

ROIC’s quality portfolio metrics is offset by a debt load that is relatively higher than their peer set. At 6.7x annualized EBITDA, net debt is still within reason to maintain investment grade credit ratings from all three reporting agencies. But it is higher than their peer group, whose multiples generally track below 6.0x.

In addition, the company has a shorter debt ladder, with most of their maturities due prior to 2027. A principally unencumbered portfolio with effectively fully-fixed-rate debt compensates for this by reducing the company’s exposure to volatile interest rate environments. There is also ample availability on the revolving credit facility to meet their reoccurring obligations in the interim to maturity.

Q2FY22 Investor Presentation – Debt Maturity Schedule

Nevertheless, the higher debt burden does limit flexibility and increases the appeal of utilizing the ATM program, which provides an additional source of funding but dilutes future earnings potential at the same time.

ROIC does, however, generate strong cash flows that are backed by tenants with resilient business models. This not only mitigates risks, but it also preserves their quarterly dividend payout, which was recently increased by 15% and now amounts to $0.15/share or 46% of FFO. At these payout levels, there is room for growth back to pre-pandemic levels, which would bring the payout to about 75% and a yield of over 6% at current pricing.

A Quality Holding But Not Compelling Enough For New Investors

ROIC owns a targeted portfolio of high quality, necessity-based shopping centers concentrated exclusively on the West Coast of the U.S. Their solidified presence in this region provides key advantages over their peer set, such as a more affluent customer base residing in densely populated communities. This provides an additional element of stability to tenant cash flows, which are already inherently protected due to the essential nature of their goods and services.

At a composition level of 97% of the portfolio, ROIC’s exposure to these grocery and/or drug anchored stores is the highest among all publicly traded REITs. This level of quality and resilience in their portfolio compensates for weaknesses in other areas, such as a higher debt load and a smaller overall portfolio with minimal geographic diversification.

While the smaller scale and lack of diversification does present an elevated degree of risk, ROIC is positioned with a healthy balance sheet with investment grade credit ratings from all three agencies, a principally unencumbered portfolio, and ample availability on their revolving credit facility. These financial traits would mitigate the worst effects of any downturn, should one occur.

Though a downturn has yet to occur in ROIC’s markets, a slowdown from their record activity levels from past quarters is likely. Already, deal negotiations are taking longer due to rising price uncertainty. This could, consequently, weigh on acquisition activity in the back half of the year.

If the environment for external growth does in fact slow, the company would be left with the challenge of improving upon existing occupancy levels that are at near-peak levels or continuing to build on rents whose best days for growth seem to have passed.

These could prove to be formidable obstacles and could result in the release of earnings that are on the low end of the targeted range. That in-turn could impede any upside movement in the share price. Though a solid hold for existing shareholders, new investors may, thus, find it best to wait for further clarity before initiating a new position on the stock.

Be the first to comment