tdub303/E+ via Getty Images

Resolute Forest Products Inc. (NYSE:RFP) is being acquired for $20.50 and a CVR – contingent value right – by Paper Excellence Group’s Domtar. Resolute is currently trading at $21.23, implying the CVR is probably worth something as the spread is negative. The value of the CVR is essential here. The CVR is predicated on refunds on approximately ~$500 million of deposits made by RFP on estimated softwood lumber duties through June 30, 2022. The terms and timing of the resolution of the softwood lumber dispute between Canada and the United States will ultimately determine the value of this thing. The CVR won’t be tradeable after it is issued.

In my previous article on this name, I went over the intricacies of the lumber dispute. Not much has changed there so I don’t want to go over it again entirely but the key points are:

RBC Analyst Paul C. Quinn believes the contingent value right is worth $3+ per share:

There have been no substantive discussions on a potential resolution since the CVD and AD duties were implemented in 2017, so the timing of an eventual resolution is unclear. However, we would value the CVR at over $3/share.

There are two somewhat transactions of softwood deposits that provide a baseline to compare RFP’s softwood deposits. Conifex sold its deposits at 42.5% of face value (back in 2019), and Eacom Timber sold its deposits at 55% to Interfor.

These marks imply a range of between $2.17 and $2.8 per share.

The absolute maximum value should be around $5 per share (full refund of the deposits), which should be discounted for time value lost. The nice thing with a CVR and buying the shares below merger consideration is that you’re effectively not tying up any funds. The timing of any payment is also separate from any market conditions, which is another feature I’m always looking for.

A few things that have happened since my last article that are of importance is that time has progressed(positive), the share price has gone up(negative), Canada is formally challenging the “unwarranted and unfair” U.S. duties on Canadian softwood lumber under the U.S.-Mexico-Canada trade agreement dispute resolution system(positive) and the company has made money(positive).

This is a $1.6 billion market cap company and it generated $163 million in cash from operating activities over the past quarter and invested $31 million of that in fixed assets. Every positive cash flow quarter helps a little bit to mitigate the downside in case of a break.

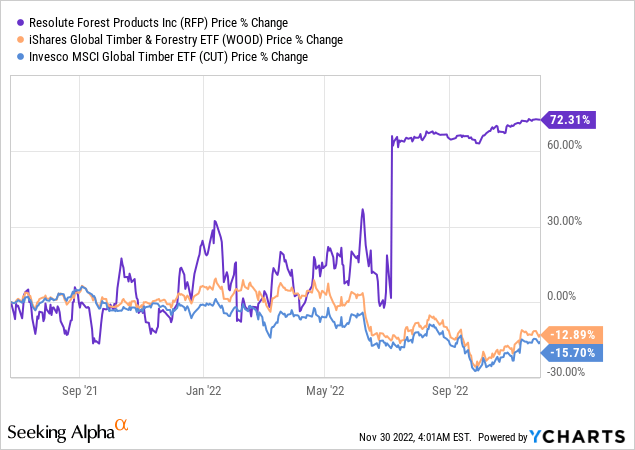

The downside is fairly intimidating here. RFP sold off a lot in June. It went down from about ~$16 to ~$12.30. The bid came at the lows. For good measure, timber ETFs are down from that level (timber prices are bad). It is hard to say where the downside should be pegged. Something like $12-$13 is likely a reasonable bet. There is a 41% loss if RFP drops to $12.

Ultimately, I think this deal is highly likely to close. The CVR could easily be worth something like $2.4 per share.

At the current negative spread, you are essentially paying $0.56 for the CVR, assuming there is virtually no break risk. It is not a riskless deal in my opinion. However, if it breaks, I’m in what’s fundamentally suddenly a highly attractive company. As I mentioned in my prior write-up. Fairfax (run by Prem Watsa) is the key shareholder, but besides them, the Morningstar ownership list (Chou, Dimensional Advisers, Donald Smith, Cambria) shows an unusual number of value-investing-focused firms. T

At the lowest CVR valuation, I get from 3rd parties, there is around 7.5% of upside here. Meanwhile, the deal likely closes in the next 3-4 months. Note that the deal closing will only take most of my risk away. I’ll still have $0.56 tied up here. I won’t receive the CVR payout yet. I do expect that will take quite some time, although it is positive Canada is moving forward with proceedings against the U.S. In the best-case scenario ($5 refund per share), this looks like a ~20% spread). The best-case scenario seems a highly unlikely outcome to me. Besides the worst-case scenario of a deal break resulting in a big fat loss, there’s the chance I’ll have some capital tied up here with nothing to show for it. That outcome seems unlikely to me as well.

At the end of the day, I’m holding on to my position here, notwithstanding the negative spread. I’m not sure if I would buy it here if I didn’t own it already. Theoretically, if I’m willing to own it, it should be a buy… I’m not sure that’s true in practice. It is a close call to me between a buy or a holding call. Things will depend on every individual investor’s return hurdle and what other things you have going on. If I held a lot of cash (I don’t), I’d be more likely to add here.

Be the first to comment